< Key Hightlight >

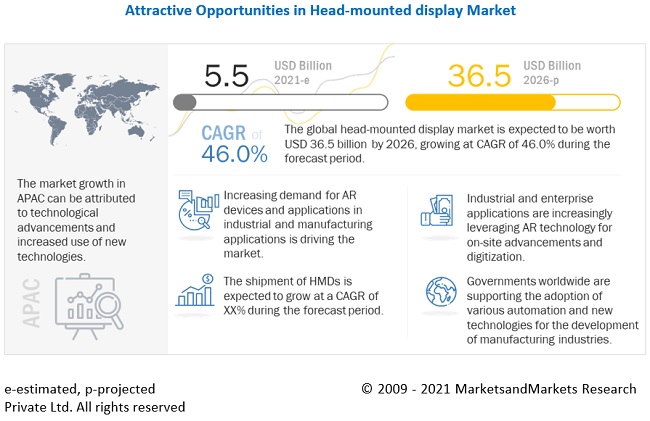

[234 Pages Report] The head-mounted display market is expected to grow from USD 5.5 billion in 2021 to USD 36.5 billion by 2026, at a CAGR of 46.0%. Surge in investments by major players in development of HMDs, increased adoption of AR and VR technologies due to COVID-19, availability of low-cost HMDs, and technological advancements and growing digitalization—are the key factors driving the head-mounted display market.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Head-mounted display Market

The head-mounted display market includes major Tier I and II suppliers such as Sony (Japan), Google (US), Microsoft (US), Oculus (US), HTC (Taiwan), Seiko Epson (Japan), Samsung (South Korea), Lenovo (China), Magic Leap (US), and Vuzix (US) and so on. These suppliers have their manufacturing facilities spread across various countries across Americas, Europe, APAC, and RoW. COVID-19 has impacted their businesses as well. The HMD market witnessed a significant decline in the first 2 quarters of 2020 owing to the spread of COVID-19. The outbreak had adversely impacted the HMD market’s supply chain, as some of the prominent players are based in China, the epicenter of the pandemic. Moreover, considering the current situation, key market players are presently focusing on maintaining and generating operating revenue, which has reduced the number of developments in the market in 2020 and 2021. Many scheduled product launches and related developments have been postponed due to COVID-19. However, the impact of COVID-19 is expected to decline during the forecast period.

Market Dynamics of Head-mounted display

Driver: Surge in investments by major players in development of HMDs

There has been a significant increase in the investments toward the development of HMDs, and in the use of such devices in various applications worldwide. The investments in the HMD market have been huge, and investors have been keen to invest in companies that have proved the worth of their technologies and products in the last few years.

Companies such as Facebook Corporation, Intel Corporation, Qualcomm, Inc., Alphabet, Inc., Comcast Ventures, and Samsung Group are investing heavily in the HMD market. Also, several research institutes are carrying out research in the AR application market for various products and applications. Research institutes are being funded by private firms and venture capitalists or governments. Industries such as consumer electronics, aerospace & defense, healthcare, retail, and advertising are embracing AR due to its benefits.

Boeing announced a new setup named HorizonX in 2017. It would be investing in some companies to start with, including Upskill, a major company in enterprise software for industrial AR devices, and Zunum Aero. In April 2019, Magic Leap raised USD 280 million from NTT DoCoMo, the Japan-based cellphone service provider. The objective of the partnership is to combine NTT’s 5G infrastructure with Magic Leap’s AR platform. In January 2019, Niantic raised USD 245 million from a venture capital company named IVP. The funding’s objective is to support the company behind Pokémon Go to innovate and develop innovative AR solutions and expand its gaming offerings.

Restraint: Lack of standardization for HMD design

Many manufacturers of HMDs and eyeglasses are focusing on enhancing the user experience and making products more informative. The lack of standardization causes compatibility issues between products from different sellers, as different products have different specifications and quality, which affects user experience. To enable widespread enterprise and consumer adoption of HMDs, VR and AR HMDs require similar universal standards that allow developers to make applications that are open and interoperable across different headsets.

For mobile virtual reality, where different smartphones from different manufacturers are used, it becomes more complicated, as users have different operating systems, screen standards, and other parameters. As a result, it becomes difficult for developers to create VR apps, which limits the growth of the market. Therefore, the lack of standardization restrains the growth of the market.

Opportunity: Growing use of HMDs for video games

HMDs have a high penetration rate in video games, as they enhance the gaming experience. PlayStation (PS) PlayStation has made HMDs more popular. HMDs project digital images, allowing a 3D view to enhance the user experience by projecting images and game screens like real-world images, which increases the quality of gaming. The spending on the video game industry has witnessed a huge surge due to the COVID-19 pandemic. Top-tier gaming companies are launching many AR and VR games. The gaming industry has undergone a technological evolution with the emergence of VR and 3D technologies. Therefore, the growing gaming sector would drive the market for HMDs.

Challenge: Adverse impact of lockdowns due to COVID-19 on commercial trade

The imposition of lockdowns and social distancing measures has severely affected the manufacturing sector, as a large chunk of consumer spending is discretionary. Hence, it is being postponed or canceled due to quarantine and social distancing. Some companies had to completely halt their manufacturing operations, which disrupted their supply chains. For instance, key automobile companies such as Volkswagen, Ford, and General Motors had shut down all their production units worldwide during the first wave of COVID-19 in the first half of 2020. The second wave in 2021 has also caused partial lockdowns in various countries and hampered the HMD market again. The third and fourth quarters of 2021 are expected to drive the growth of the HMD market, as COVID-19 cases are expected to reduce with the vaccinations being done on a large scale. All these factors, along with the potential third wave of COVID-19, are expected to significantly impact the growth of the HMD market until mid-2022.

Displays to account for the largest share of components in the head-mounted display market in 2020

Display is one of the basic components in HMDs, and its decreasing cost is expected to boost the market for HMDs. Displays are used in many AR devices, owing to which a high growth in the demand for displays in the HMD market can be witnessed. Most AR displays are still in the R&D phase, and companies are trying to make them more compact and add many features.

Wired connectivity held the largest share of head-mounted display market in 2020

On the basis of connectivity, market has been segmented as wired and wireless. Wired connectivity headsets are also called tethered headsets. Tethered headsets are connected to PCs or gaming consoles using cables. Some of the wired headsets that are physically connected to PCs are Oculus Rift, HTC Vive, and PlayStation VR. Tethered headsets are large and expensive. They also often work in combination with external cameras to track the user’s head with better accuracy.

Eyewear products to account for the largest share in the head-mounted display market in 2020

On the basis of product type, the HMD market has been segmented into head-mounted and eyewear. The market for eyewear products is expected to grow at a higher CAGR owing to the increasing demand for AR applications. Increasing use of eyewear in various applications, such as industry and enterprise, healthcare, and research and design, is expected to increase the market for eyewear HMDs. Eyewear products are also expected to be used in the consumer application with the growing adoption of advanced technologies. Such products give information about the surroundings without disturbing the wearer’s normal field of view and allow the wearer to get driving directions, e-mails, and other notifications.

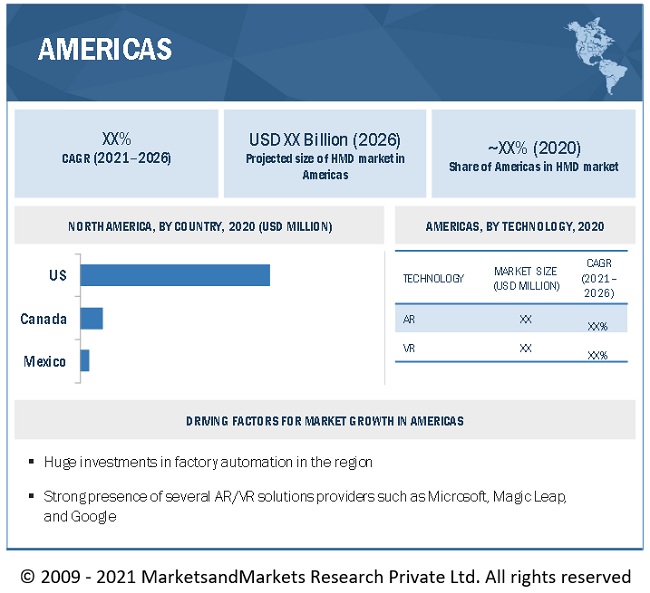

Americas is leading the market for head-mounted display in 2020

In the Americas, North America is the leading region for HMDs. Investments made by the major players in the US have led the market growth in this region. Adoption of new technologies and presence of major companies are also among the drivers for the North American market’s growth. In North America, many companies are investing in HMDs. The spread of COVID-19 in the Americas has led to fatalities and loss of lives and livelihood. Countries in the region faced serious disruptions in automotive, transportation, retail, agriculture, and construction sectors, leading to a complete or partial shutdown of manufacturing units, except for essential commodities. The HMD market in North America has also been affected by the pandemic, resulting in a significant loss for the HMD market.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Major players in the head-mounted display market include Sony (Japan), Oculus VR (Facebook) (US), Microsoft (US), HTC (Taiwan), Google (US), and so on.

Scope of the Report

Report Metric | Details |

Base year considered | 2020 |

Forecast period | 2021–2026 |

Forecast units | Value (USD Million) |

Segments covered | Type, Technology, Product Type, Component, Connectivity, Application, and Region |

Geographies covered | Americas, Europe, APAC, and RoW |

Companies covered | Sony (Japan), Google (US), Microsoft (US), Oculus (US), HTC (Taiwan), Seiko Epson (Japan), Samsung (South Korea), Lenovo (China), Magic Leap (US), Vuzix (US), and so on.

(Total 25 major players covered) |

In this research report, the head-mounted display market has been segmented on the basis of technology, offering, device type, application, and geography.

Head-mounted display Market, by Type

- Slide-on HMD

- Integrated HMD

- Discrete HMD

Head-mounted display Market, by Technology

- AR Technology

- VR Technology

Head-mounted display Market, by Component

- Processors and Memory

- Displays

- Lenses

- Sensors

- Controllers

- Cameras

- Cases and Connectors

- Others

Head-mounted display Market, by Product Type

Head-mounted display Market, by Connectivity

Head-mounted display Market, by Application

- Consumer

- Commercial

- Enterprise & Industry

- Engineering & Design

- Healthcare

- Aerospace & Defense

- Education

- Others

Geographic Analysis

Recent Developments

- In April 2021, Microsoft has won a USD 22 billion contract for manufacturing Augmented Reality Gear from the US Army. It would start manufacturing Integrated Augmentation Systems under the contract, which is for over a timeline of 10 years.

- In March 2021, Sony has unveiled its new VR controllers that would be different from the ball-on-a-stick controllers used in PS4. Sony has also stated that the controllers will come with adaptive triggers, haptic feedback, and finger touch detection features, among others.

- In January 2021, Magic Leap has entered into a multi-phased, multi-year strategic partnership agreement with Google (US) for Google Cloud to deliver spatial computing solutions to businesses and Google Cloud customers.