< Key Hightlight >

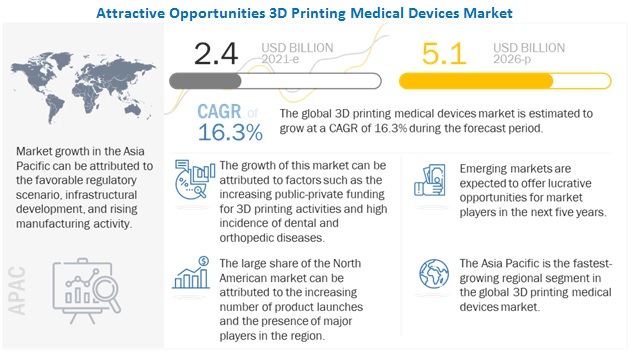

The 3D Printing Medical Devices market is projected to reach USD 5.1 billion by 2026 from USD 2.4 billion in 2021, at a CAGR of 16.3% during the forecast period. Increasing public-private funding for 3D printing activities, high incidence of dental and orthopedic diseases, easy development of customized medical products using 3D printing, growing applications of 3D printing in the healthcare industry, availability of advanced 3D printing materials for dental and medical applications, and the increasing demand for 3D-printed products in the cosmetics and pharmaceutical industries, are the key factors supporting the growth of the market.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the global 3D Printing Medical Devices market

As a result of the pandemic, during March 2020 and throughout the second quarter of 2020, access to customers to sell and implement the 3D Printing Medical Devices diminished as hospitals became primarily focused on the COVID-19 pandemic. The pandemic has led to a significant increase in the demand for ventilators. The closure of manufacturing facilities due to lockdowns and disrupted supply chains slightly impacted the growth of the 3D Printing Medical Devices market at the regional level in 2020. Established vendors such as Stratasys Ltd supported the increased demand and mitigated key shortages of nasopharyngeal swabs and face shields. The company manufactured field-ready, individually packaged, sterile 3D-printed nasopharyngeal swabs and face shields.

3D Printing Medical Devices Market Dynamics

Driver: Increasing public-private funding for 3D printing activities

In recent years, there has been a significant increase in public-private funding to support various initiatives in the 3D printing industry. Such research and funding activities are expected to boost the development of 3D printing products and technologies, thereby driving the growth of the 3D printing medical devices market.

Listed below are recent development in recent years:

- In September 2020, nTopology (US) raised funding of USD 40 million for the development of the nTop software platform for additive manufacturing processes.

- In March 2019, the University of Huddersfield (UK) raised funding of USD 2.6 million (EUR 2.25 million) from Innovate UK for the development of a new generation of the electron-beam additive manufacturing (EBAM) printer.

Restraint: Shortage of a skilled workforce due to limited specialized training in additive manufacturing

One of the prominent barriers to the adoption of additive manufacturing or 3D printing is the lack of a skilled workforce. There is a very limited resource pool available for staff that is well-versed with 3D printing processes, which is further worsened by the rapid pace of evolution of the 3D printing medical devices market in terms of technology and materials.

There is a dearth of training programs available for additive manufacturing, and there exists a wide gap between academia and practical applications in the industry that is difficult to bridge. The lack of a workforce with a full understanding of the design process and production cycle in additive manufacturing affects the final quality of the product. The lack of such a workforce would restrain the overall adoption of 3D printing in the medical devices industry.

Opportunity: Direct digital manufacturing

The digitization of dentistry and medical procedures has advanced immensely over the years, with the intention of improving the clinical workflow through the incorporation of technology. The industry is experiencing a shift from traditional to digital dentistry and surgeries. Direct digital manufacturing involves the application of computer-controlled processes for developing a physical object directly from a digital design. With advancements in 3D printing, direct digital manufacturing is becoming a widely used technology as compared to traditional manufacturing techniques. It offers a unique set of advantages as it eliminates the investment in tooling, reduces the lag time between designing and production, and increases production.

Challenge:High capital investment and operating costs

Small and medium-sized end users may find it unfeasible to establish 3D printing facilities due to financial constraints. This is a key challenge in the market. The cost of a high-resolution 3D printer is around USD 40,000–100,000, while the cost of a 3D printer used for printing craniomaxillofacial implants is approximately USD 3,500–4,000; ROI for these devices can only be met after 1–2 years. This also makes it difficult for healthcare facilities dependent on federal funding (for whom securing funds in itself is a time-consuming process) to install and use such equipment. Due to this financial aspect, many smaller dental and orthopedic clinics may choose to outsource production to service bureaus or laboratories.

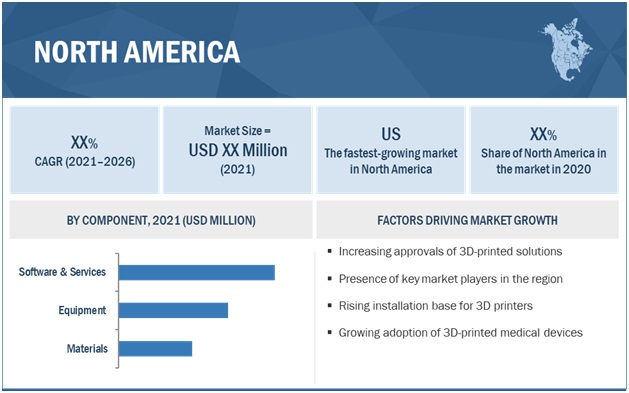

By component, the Software and Services segment dominated the global 3D Printing Medical Devices market

Based on the component, the 3D Printing Medical Devices market is segmented into equipment, materials, and software & services. The software & services dominated the 3D Printing Medical Devices market in 2020. The cost-effectiveness, utility, uniformity, and accuracy offered by services for medical device 3D printing, is expected to fuels the growth of this segment during the forecast period.

By application, the custom prosthetics and implants segment dominated the global 3D Printing Medical Devices market

Based on the application, the 3D Printing Medical Devices market is segmented into surgical guides, surgical instruments, standard prosthetics and implants, custom prosthetics and implants, tissue-engineered products, hearing aids, wearable medical devices/implantable medical devices, and other medical devices. The custom prosthetics and implants segment accounted for a larger share in the market in 2020. 3D printing is used on a large scale in manufacturing highly customizable prosthetics and implants out of a variety of materials, including biological materials (such as skin and bones), plastics, ceramics, and metals. 3D printing of custom implants—are attracting many medical device companies and new investors to purchase 3D printer is expected to drive the growth of this market segment in the coming years.

By Technology, the laser beam melting segment accounted for the largest share of the 3D Printing Medical Devices market in 2020

Based on technology, the 3D Printing Medical Devices market has been segmented into electron beam melting (EBM), laser beam melting (LBM), photopolymerization, droplet deposition or extrusion-based technologies, three-dimensional printing (3DP) or adhesion bonding, and other technologies. Among these, the laser beam melting (LBM) segment accounted for the largest share of the market in 2020. The large share of this segment is attributed to the increasing application of this technology in the dental industry and for manufacturing implants for minimally invasive surgery.

By End User, the Standard power supply segment accounted for the largest share of the 3D Printing Medical Devices market in 2020

Based on End User, the 3D Printing Medical Devices market has been segmented into the hospitals & surgical centers, dental & orthopedic clinics, academic institutions & research laboratories, pharma-biotech & medical device companies, and clinical research organizations. Among these, the hospitals & surgical centers segment accounted for the largest share of the market in 2020. The large share of this segment can be attributed to the expansion of existing 3D printing laboratories, growing affordability of 3D printing services, and the rapid adoption of advanced technologies by hospitals.

To know about the assumptions considered for the study, download the pdf brochure

North America is expected to command the largest share of the 3D Printing Medical Devices market in 2020

The report covers the 3D Printing Medical Devices market across five major geographies, namely, Europe, North America, Asia Pacific, Latin America, and MEA. North America commanded the largest share of the 3D Printing Medical Devices market in 2020. Market growth is mainly attributed to the strong base of healthcare facilities, especially hospitals and diagnostic imaging centers, and the growing installation base for 3D printer in healthcare facilities.

Key Market Players

The major players in the 3D Printing Medical Devices market are Stratasys Ltd. (US & Israel), 3D Systems Corporation (US), GE Additive (US), Materialise NV (Belgium), Renishaw plc (UK), SLM Solutions Group AG (Germany), Desktop Metal, Inc. (US), Prodways Group (France), Carbon, Inc. (US), CELLINK (Sweden), Organovo Holdings, Inc. (US), EOS (Electro Optical Systems) GmbH (Germany), Biomedical Modeling, Inc. (US), Formlabs, Inc. (US), 3T Additive Manufacturing Ltd. (UK), DENTSPLY Sirona, Inc. (US), DWS Systems SRL (Italy), Roland DG (Japan), HP, Inc. (US), and regenHU (Switzerland) among others.

Stratasys Ltd. held the leading position in the global 3D printing medical devices market in 2020. The company’s 3D printing product portfolio includes a wide range of 3D printing systems and consumables through which it caters to the demand of various industries, including automotive, consumer electronics, aerospace, dental, defense, education, commercial products, architecture, and medical. The company also offers services associated with its 3D printing products. It primarily focuses on product innovation and new product launches as its key business strategy to sustain its leadership position in the global market. Additionally, in order to ensure its future growth, the company adopted strategies such as partnerships, agreements, and mergers and acquisitions to strengthen its product portfolio and customer base and expand its presence across various regions.

Scope of the report

Report Metric | Details |

Market size available for years | 2019–2026 |

Base year considered | 2020 |

Forecast period | 2021–2026 |

Forecast units | Value (USD Billion) |

Segments covered | Component, Application, Technology, End User, and Region |

Geographies covered | Europe, North America, the Asia Pacific, Latin America, and Middle East and Africa |

Companies covered | Stratasys Ltd. (US & Israel), 3D Systems Corporation (US), GE Additive (US), Materialise NV (Belgium), Renishaw plc (UK), SLM Solutions Group AG (Germany), Desktop Metal, Inc. (US), Prodways Group (France), Carbon, Inc. (US), CELLINK (Sweden), Organovo Holdings, Inc. (US), EOS (Electro Optical Systems) GmbH (Germany), Biomedical Modeling, Inc. (US), Formlabs, Inc. (US), 3T Additive Manufacturing Ltd. (UK), DENTSPLY Sirona, Inc. (US), DWS Systems SRL (Italy), Roland DG (Japan), HP, Inc. (US), and regenHU (Switzerland) |

This report has segmented the global 3D Printing Medical Devices market based on component, application, technology, end user, and region.

Global 3D Printing Medical Devices Market, by Component

- Equipment

- 3D Printers

- 3D Bioprinters

- Materials

- Plastics

- Thermoplastics

- Photopolymers

- Metals and Metal Alloys

- Biomaterials

- Ceramics

- Paper

- Wax

- Other Materials

- Services & Software

Global 3D Printing Medical Devices Market, by Application

- Surgical Guides

- Dental Guides

- Craniomaxillofacial Guides

- Orthopedic Guides

- Spinal Guides

- Surgical Instruments

- Surgical Fasteners

- Scalpels

- Retractors

- Standard Prosthetics & Implants

- Custom Prosthetics & Implants

- Orthopedic Implants

- Dental Prosthetics & Implants

- Craniomaxillofacial Implants

- Tissue-engineered Products

- Bone & Cartilage Scaffolds

- Ligament & Tendon Scaffolds

- Hearing Aids

- Wearable Medical Devices

- Other Applications

Global 3D Printing Medical Devices Market, by Technology

- Laser Beam Melting

- Direct Metal Laser Sintering

- Selective Laser Sintering

- Selective Laser Melting

- LaserCUSING

- Photopolymerization

- Digital Light Processing

- Stereolithography

- Two-photon Polymerization

- PolyJet 3D Printing

- Droplet Deposition/Extrusion-based Technologies

- Fused Deposition Modeling

- Multiphase Jet Solidification

- Low-temperature Deposition Manufacturing

- Microextrusion Bioprinting

- Electron Beam Melting

- Three-dimensional Printing/Adhesion Bonding/Binder Jetting

- Other Technologies

Global 3D Printing Medical Devices Market, by End User

- Hospitals & Surgical Centers

- Dental & Orthopedic Clinics

- Academic Institutions & Research Laboratories

- Pharma-Biotech & Medical Device Companies

- Clinical Research Organizations

Global 3D Printing Medical Devices Market, by Region

- North America

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe (RoE)

- Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- RoAPAC

- Latin America

- Middle East & Africa

Recent Developments

- In April 2021, 3D Systems (US) introduced launched titanium- and nylon-made patient-specific VSP Hybrid Guides for maxillofacial procedures

- In March 2021, Stratasys Ltd. (US) Introduced the J5 DentaJet 3D Printer PolyJet printer for dental laboratories

- In February 2021, Desktop Metal, Inc. (US) acquired EnvisionTEC (Germany). This acquisition will strengthen the company’s existing client base of 3D Printing Medical Devices