< Key Hightlight >

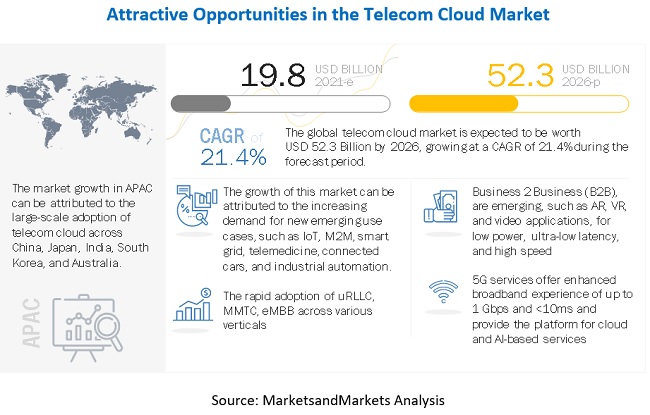

[361 Pages Report] The global telecom cloud market size is expected to grow from USD 19.8 billion in 2021 to USD 52.3 billion by 2026, at a Compound Annual Growth Rate (CAGR) of 21.4% during the forecast period. With COVID-19, the entire workforce has experienced a transition toward remote working, paving a way for telecom cloud solution and hardware products. The reduced Capex and Opex, the importance of accessing the data from anywhere anytime, and the rising need for virtual environments have overall increased the spending of companies on telecom cloud solutions.

To know about the assumptions considered for the study, Request for Free Sample Report

The COVID-19 pandemic has affected every segment of society, including individuals and businesses. During the COVID-19 pandemic, the telecom sector is playing a vital role across the globe to support the digital infrastructure of countries. Every individual and government, irrespective of federal, state, central, local, and provinces, has been in constant touch with one other in the society to provide and get real-time information on COVID-19. Currently, healthcare, telecommunication, media and entertainment, utilities, and government institutes are functioning day and night to stabilize the condition and facilitate prerequisite services via telecom cloud solutions to every individual.

COVID-19 cases are growing day by day, as several infected cases have been on the rise. In line with individuals, COVID-19 has a massive impact on large enterprises and SMEs. Core industries, such as manufacturing, automotive, textile, transportation and logistics, travel and hospitality, and consumer goods, have been closed due to country-level lockdown across the globe. This would have a substantial impact on the global economy in terms of the decline in GDP. For ages, SMEs are acting as the backbone of the economy. In the current situation, SMEs are the most affected due to the COVID-19 pandemic.

Market Dynamics

Driver: Growth witnessed by cloud native environment

The transition to the cloud for many telecom companies has been made easy by the digital transformation and the workflows for the new business. Enterprises are adopting cloud technologies and trying to have a competitive advantage and differentiation in the market. Cloud infrastructure and Business Intelligence (BI) are expected to see increased spending in the coming years. The increase in the number of cloud technology being adopted, cloud awareness, and the reduction in cost have led companies to enter the cloud environment and actuate the telecom cloud market.

Restraint: Portability and interoperability issues

Cloud is an emerging technology, but portability has been an issue that needs to be addressed when considering telecom cloud. Every cloud provider has a different set of products and services to offer. When it is easy to move the cloud to various providers, it becomes easy. The major issue is when the cloud is enabled in PaaS. It has three components: platform, infrastructure, and management. There are many layers that constitute the PaaS. When an organization uses the PaaS, they are not aware of the physical properties that are used in their usage which acts as a hinderance.

Opportunity: Demand for Open RAN and private 5G network.

Open Radio Access Network (RAN) enables interoperability for the RAN elements for different vendors. The use of open RAN can prevent the company’s from being stuck to one vendor’s hardware or software. The demand for a private 5G network is also continuously increasing nowadays. This has resulted in increased efficiency and also provided flexibility to the network and has paved way for telecom cloud market.

Challenge: Risk of information loss

The latest digital era has seen a buzzing technology called the cloud, but the cloud develops some serious concerns. The risk of data loss is always there when users do not have the information saved in their private systems. The risk of data loss exists when the data is unintentionally deleted by the user, thinking that it would be saved somewhere else or when the system gets corrupted. Overwriting of data is also one of the serious concerns of the clients. This has become has challenge in the telecom cloud market.

Banking, financial services and insurance vertical is expected to have a larger market size during the forecast period

The banking, financial services and insurance vertical deals with the need to reduce non-core functions and has started outsourcing them. Outsourcing helps banks minimize costs and maximize efficiency. This results in the requirement for channelized content insights and accurate banking information that can be consolidated through telecom cloud Solution. The collaborations enable banking and financial service providers to offer enhanced facilities by providing them with improved communication options. The solution enables face-to-face interactions between customer and employees to discuss various banking options, located anywhere in the world. Telecom cloud technology also helps with customer experience enhancement. Currently, the telecom cloud market is witnessing increased growth opportunities in the banking, financial services and insurance vertical. This growth can be attributed to the increasing requirement for telecom cloud to enhance staff training, banking education, and customer communication.

To know about the assumptions considered for the study, download the pdf brochure

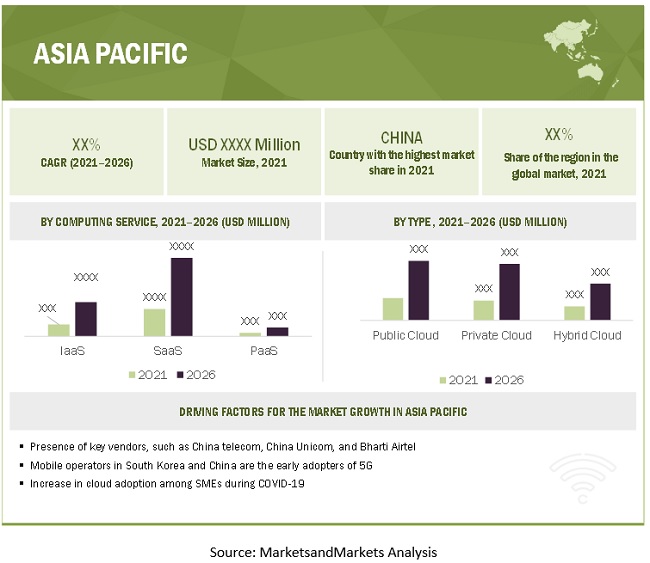

APAC to account for the largest market growth during the forecast period

APAC is estimated to hold the higher CAGR during the forecast period. The region is transforming dynamically with respect to the adoption of new technologies across various sectors. The infrastructural growth in APAC, especially in Japan, South Korea, Australia, Singapore, China, and India, and the increasing deployment of 5G networks present huge opportunities for the implementation of the telecom cloud.

The telecom cloud market in the APAC region is growing at a significant rate during the COVID-19 pandemic. The usage of technologies, such as cloud computing, AI, and IoT, is increasing in the region to effectively operate connected devices in hospitals, medical facilities, and other healthcare organizations. To maintain business continuity, organizations in this region are adopting the remote working approach for their employees. As a result, there is a significant demand for telecom cloud solutions across industries in the region.

Market Players

The report covers the competitive landscape and profiles major market players, such as AT&T Inc. (AT&T), BT Group PLC (BT Group), Verizon Communications Inc. (Verizon), Vodafone Group PLC (Vodafone), China Telecom, Lumen Technologies Inc. (Lumen), Singapore Telecommunications Ltd. (Singapore Telecommunications), Nippon Telegraph and Telephone Corporation (NTT), Orange Business Services, Telefonica S.A (Telefonica), Deutsche Telekom A.G (Deutsche Telekom), Telstra Corporation Limited (Telstra), SK Telecom Co. Ltd (SK Telecom), Saudi Telecom Company (STC), Rogers Communications Inc.(Rogers), and Emirate Tele Group Company PJSC (Etisalat).

Amazon Web Services Inc. (Aws), Microsoft Corporation (Microsoft), International Business Machines Corporation (IBM), Oracle Corporation (Oracle), Alphabet Inc. (Google), Alibaba Group (Alibaba Cloud), Dell and Red Hat Inc. (Red Hat) are considered as partners in the study.The study includes an in-depth competitive analysis of these key players in the telecom cloud market with their company profiles, recent developments, and key market strategies.

Scope of Report

Report Metric | Details |

Market size available for years | 2016-2026 |

Base year considered | 2020 |

Forecast period | 2021-2026 |

Forecast units | Value (USD Million) |

Segments covered | Type, service, application, cloud computing services, organizations size, end users, region |

Regions covered | North America, Europe, APAC, MEA and Latin America |

Companies covered | AT&T Inc. (AT&T), BT Group PLC (BT Group), Verizon Communications Inc. (Verizon), Vodafone Group PLC (Vodafone), China Telecom, Lumen Technologies Inc. (Lumen), Singapore Telecommunications Ltd. (Singapore Telecommunications), Nippon Telegraph and Telephone Corporation (NTT), Orange Business Services, Telefonica S.A (Telefonica), Deutsche Telekom A.G (Deutsche Telekom), Telstra Corporation Limited (Telstra), SK Telecom Co. Ltd (SK Telecom), Saudi Telecom Company (STC), Rogers Communications Inc.(Rogers), and Emirate Tele Group Company PJSC (Etisalat).

The cloud partners considered in the study includes Amazon Web Services Inc. (Aws), Microsoft Corporation (Microsoft), International Business Machines Corporation (IBM), Oracle Corporation (Oracle), Alphabet Inc. (Google), Alibaba Group (Alibaba Cloud), Dell and Red Hat Inc. (Red Hat) in the study.

This research report also studies the strategic alliances and lucrative acquisitions among various global and local players in the telecom cloud ecosystem. |

This research report categorizes the Telecom cloud to forecast revenue and analyze trends in each of the following submarkets:

Based on type:

- Public Cloud

- Private Cloud

- Hybrid Cloud

Based on cloud computing services:

Based on application:

- Data Storage

- Achieving

- Computing

- Enterprise Application

- Cloud delievery model

- Communication and collaboration

- Network cloud migration

- Over-The-Top

- Other Applications

Based on service:

- Colocation Services

- Network Services

- Management Service

- Content Management

- Supply Chain Management

- Business Support system(BSS)

Based on organization size:

Based on end user:

- BFSI

- Retail and Consumer Goods

- Healthcare and Life Sciences

- Media and Entertainment

- Government

- Automotive

- Energy and Utilities

- Other End Users

Based on regions:

- North America

- Europe

- APAC

- MEA

- Latin America

Recent Developments:

- In December 2020, SK Telecom launched SKT 5GX Edge, a 5G edge cloud service. It provides users with ultra-low latency for data-intensive services by connecting to AWS Wavelength Zones installed in SK Telecom's telecommunications offices in South Korea.

- In June 2020, Google launched a cloud region in Spain that will leverage Telefonica's Madrid region infrastructure. This partnership also aimed at the country's economic recovery post-COVID-19 by boosting the digitalization of companies and supporting Spain's public administration.

- In September 2020, AT&T and Microsoft entered into a multi-year partnership, making Microsoft AT&T’s preferred cloud provider for non-network applications. AT&T, in its public statement, confirmed it would move most of its non-network workloads to Azure by 2024.

- In October 2020, Oracle entered the multi-cloud and hybrid management and monitoring fray. The company launched the Oracle cloud observability and management platform, a suite of management, diagnostic, and analytics tools to manage multiple clouds and on-premises environments.

Key Benefits of Buying the Report

The report would provide the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall telecom cloud market and its subsegments. It would help stakeholders understand the competitive landscape and gain more insights better to position their business and plan suitable go-to-market strategies. It also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.