< Key Hightlight >

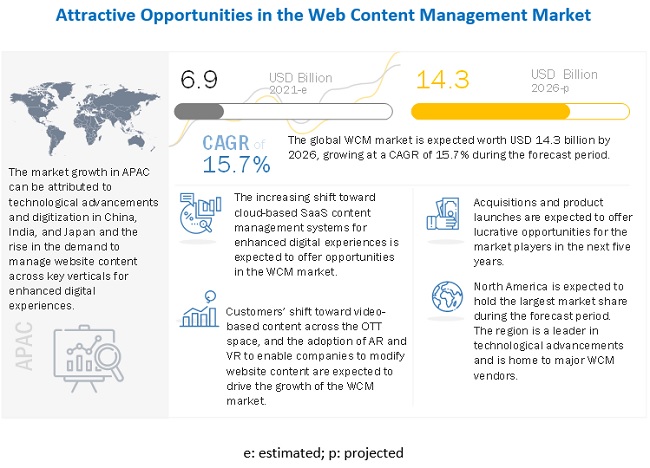

[316 Pages Report] The global web content management (WCM) market size to grow from USD 6.9 billion in 2021to USD 14.3 billion by 2026, at a Compound Annual Growth Rate (CAGR) of 15.7% during the forecast period. Factors such as customers’ shift toward video-based content across the OTT space and the adoption of AR and VR to enable companies to modify website content drive the growth of the WCM market across the globe. Moreover, the increasing shift toward cloud-based SaaS content management systems for enhancing digital experiences is expected to create opportunities for WCM vendors.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on Global web content management Market

In a short time, the COVID-19 outbreak has affected markets and customer behaviors. It has had a substantial impact on economies and societies. COVID-19 impacts are foreseen to shift consumer demand to online channels. This may irreversibly change customer behavior as once people get into the habit of shopping online, it becomes a routine, and it is hard to get away from it easily, forcing companies to escalate their online presence. There was an immediate and widespread impact of COVID-19 on customer behavior across all industries. For instance, the education industry has been one of the most affected industries, especially when it comes to publishing and distributing content to students, and staff, and faculty members. The ability to sustain has become the new normal for enterprises as they are shifting their focus from growth opportunities and concentrating on implementing drastic measures to mitigate the impact of the COVID-19 pandemic. The competition among major WCM companies is expected to be furious as most upcoming projects are on hold due to the pandemic. Hence, several companies would fight to gain a single project. Businesses have already started their efforts to return back to normal and are facing multiple challenges on the customer as well as the operational side.

Market Dynamics

Driver: Customers’ shift toward video-based content across the OTT space

Media consumption across the globe is increasingly happening in digital formats. The increase in the number of devices capable of supporting digital media along with increasing internet access speed has provided consumers with an option to access the media content of their choice, be it information, entertainment, or social activity anytime, anywhere. Media consumption in the US has shown a tremendous increase and has seen a significant jump from traditional media to new (digital) media. The rise of digital media players, such as Netflix, Hulu, Amazon, Apple TV, Roku, and Boxee, is challenging the traditionally maintained supremacy of television as the main entertainment hub. The increasing popularity of digital media has provided for a paradigm shift in global advertising content spends. According to Deloitte, spending on digital media as a percentage of total advertising content spend is expected to increase from 21% in 2010 to 28% in 2015 and is further expected to reach 36% by 2020. Therefore, they are moving toward the influencer marketing technique that enables them to target potential buyers. According to the analysis from Twitter and Annalect, 40% of Twitter users make purchase decisions with the help of tweets.

Restraint: Interoperability issue due to data integration

Interoperability refers to the ability of software to easily integrate with other systems in terms of sharing functionality and data. The interoperable software enables users to easily communicate with external systems by standardizing interactions and reducing compatibility challenges. An interoperable content management system can not only pull data and content from a range of external systems but can also deliver content and experiences to a multitude of frontend applications. Another crucial aspect of interoperability is the data itself. If a platform cannot easily exchange data — both to and from — another system, then it is not truly interoperable. This means it is often not enough to simply connect with other systems, but the software needs to utilize common standards for the information itself. Building WCM is crucial to remaining digitally adaptable as technologies and customer demands change. Implementing a highly interconnected and seamless WCM, however, is often a costly endeavor. Documents come in many layouts, from simple, structured forms to freeform text on a page. If web manager only processes structured forms in standardized formats, they get a percentage of the benefit of automation, but not the full potential. Processing unstructured, freeform document layouts require costly manual processing, which is prone to error and is expensive. Thus, it is very crucial for a content management system to lay the foundation for integrating with critical internal and external systems.

Opportunity: Increasing shift toward cloud-based SaaS content management system

Thousands of businesses, however, still use on-premise WCM that encumbrance their IT staff, content creators, and marketing experts. These systems demand so much attention and draw from so many company resources that they can quickly become liabilities instead of the efficiency tools they are intended to be. With these limitations in mind, many companies are considering switching from an on-premise legacy content management system to a cloud-based platform. A cloud content management system has the same functionality as a traditional content management system, enabling authors to create, update, and delete the content as needed. Most enterprises are becoming familiar with the SaaS and cloud-based offerings across a number of applications. WCM software solutions are increasingly differentiating themselves on a scale of how well their solution can help a customer deliver a personalized web experience to the client’s consumers through multiple channels, such as web, mobile and social. Companies such as Sitecore and Adobe have started offering cloud-based SaaS WCM software to deliver market-beating time-to-value, flexibility, integration, and security. According to Bloomberg, public cloud platforms, business services, and SaaS applications will all grow at a 9% CAGR between 2020 and 2023 and worth USD 60.36 billion.

Challenge: Language transformation and localization of content

Translating content in the local language is not enough. It has to be tailored for particular regions. The local audience should be able to connect with the content displayed for a high level of interaction. Certain cultures may consider some images as inappropriate or certain icons may not have inter-culture or cross-cultural meanings. Some languages are read right to left, which only can be done if the WCM supports bi-directional text. An organization can look for a Universal Coded Character Set (Unicode) standard support within the WCM system, enabling the incorporation of text in most writing styles around the globe.

Virtually every website nowadays uses a tracking or analytics tool, such as Google Analytics, Woopra, and GoSquared. These tools provide users with informative data and show where their visitors mainly come from within the geographic data section. The tools also help companies to identify state which languages they use to browse the website. The data collected from websites can clearly indicate new languages users need to support to best meet their visitors’ needs and expectations. According to the German industry service, 81% of users would not return to a website if they have negative experiences. Localization adapts a website to cultural backgrounds and local languages, making it easier for users to browse content and find what they are actually looking for.

Among verticals, media and entertainment vertical segment is expected to hold the largest market size during the forecast period

The WCM market is segmented into the various verticals, particularly BFSI, IT and telecom, retail and eCommerce, healthcare and life sciences, government, travel and hospitality, media and entertainment, education, and others (transportation and logistics, energy and utilities, and manufacturing). The increasing challenge of media and entertainment companies to maintain the volume and velocity of content to boost WCM adoption across the globe. WCM solutions help the vertical provide secured authoring, transformation into different formats, aggregation management, templating, publishing, segmentation and personalization, optimization, and social media integrations. They also assist companies in acquiring new customers and improving customer experiences.

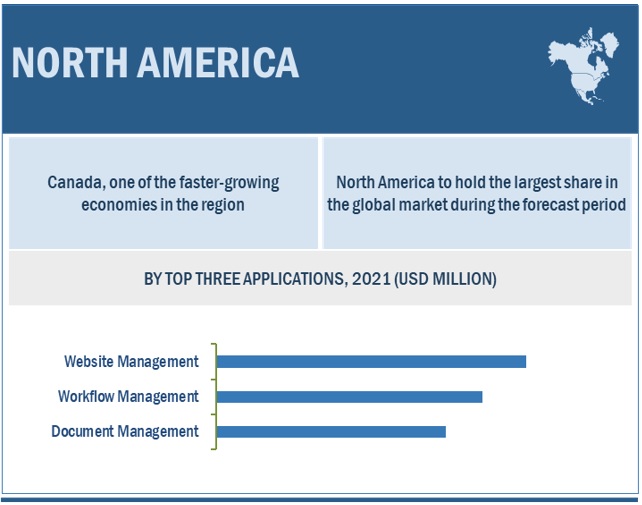

APAC to grow at the highest CAGR and North America to hold the largest market size during the forecast period

The WCM market has been segmented into five regions: North America, Europe, APAC, MEA, and Latin America. Among these regions, North America is projected to hold the largest market size during the forecast period. Key factors favoring the growth of the North American market include the increase in technological advancements and the rise in the number of key players associated with the market. APAC is expected to grow at the highest CAGR during the forecast period. Countries in APAC are technology-driven and present major opportunities in terms of investments and revenue. These countries include China, Singapore, Japan, and India. Factors such as flexible economic conditions, industrialization- and globalization-motivated policies of governments, and digitalization are expected to support the growth of the WCM market in APAC.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The WCM vendors have implemented various types of organic as well as inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. Some of the key players operating in the WCM market include Adobe (US), Microsoft (US), Oracle (US), OpenText (Canada), Progress (US), IBM (US), Upland Software (US), RWS (UK), HubSpot (US), HCL (India), e-Spirit (US), Sitecore (US), Kentico (Czech Republic), Frankly Media (US), Duda (US), Agility (Canada), GX Software (Netherlands), Solodev (US), Siteglide (UK), Amplience (England), Contentful (Germany), Contentstack (US), Storyblok (Austria), Brandcast (US), Webflow (US), Bynder (Netherlands), Docsie (Canada), GraphCMS (Germany) Pantheon (US), and Strapi (France). The study includes an in-depth competitive analysis of these key players in the WCM market with their company profiles, recent developments, and key market strategies.

Scope of the Report

Report Metric | Details |

Market size available for years | 2016–2026 |

Base year considered | 2020 |

Forecast period | 2021–2026 |

Forecast units | USD Million |

Segments covered | Component, solution, service, application, deployment mode, organization size, vertical, and Region |

Geographies covered | North America, Europe, APAC, Latin America, and MEA |

Companies covered | Adobe (US), Microsoft (US), Oracle (US), OpenText (Canada), Progress (US), IBM (US), Upland Software (US), RWS (UK), HubSpot (US), HCL (India), e-Spirit (US), Sitecore (US), Kentico (Czech Republic), Frankly Media (US), Duda (US), Agility (Canada), GX Software (Netherlands), Solodev (US), Siteglide (UK), Amplience (England), Contentful (Germany), Contentstack (US), Storyblok (Austria), Brandcast (US), Webflow (US), Bynder (Netherlands), Docsie (Canada), GraphCMS (Germany) Pantheon (US), and Strapi (France). |

This research report categorizes the WCM market based on component, solution, application, deployment mode, organization size, vertical, and region.

By component:

- Solutions

- Services

- Managed Services

- Professional Services

- Consulting

- System Integration and Implementation

- Training, Support, and Maintenance

By deployment mode:

By organization size:

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

By application:

- Website Management

- Document Management

- Workflow Management

- Social Media Management

- Content Scheduling/ Deployment

- Access Control

- Workforce Optimization

- Others (customer engagement, content syndication, multi-site management, and content virtualization)

By vertical:

- BFSI

- IT and Telecom

- Retail and eCommerce

- Healthcare and Life Sciences

- Government

- Travel and Hospitality

- Media and Entertainment

- Education

- Others (Transportation and Logistics, Energy and Utilities, and Manufacturing)

By region:

- North America

- Europe

- UK

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- Japan

- Rest of APAC

- MEA

- KSA

- UAE

- South Africa

- Rest of MEA

- Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In April 2021, OpenText launched OpenText Core Content and OpenText Core Case Management, the new content services platform from the global leader in information management. Both the solutions are multi-tenant cloud offerings that are quick and easy to deploy and can be tailored to address unique lines of business, departmental, and industry needs.

- In January 2021, SAP and Microsoft expanded their partnership for integrating Microsoft Teams with SAP’s intelligent suite of solutions. Under the partnership, the companies aim at accelerating the adoption of SAP S/4HANA on Microsoft Azure. This adoption would enable both companies to simplify and streamline customers’ journey to the cloud.

- In October 2020, Adobe, Microsoft, and C3 AI partnered to enable companies to take advantage of their real-time customer profiles for cross-channel journey orchestration. The partnership will offer an integrated ecosystem that empowers customers to take advantage of leading CRM capabilities along with an integrated ecosystem with Azure, Microsoft 365, and the Microsoft Power Platform.

- In July 2020, RWS launched the next generation of its intelligent content platform, SDL Tridion. The platform is designed to assist organizations with their digital transformation by addressing the full spectrum of single-source content for employees, partners, and customers, substantially increasing automation and bridging content silos.

- In April 2020, HubSpot launched CMS Hub, a content management system that offers speed, security, and scalability to rapidly growing businesses. CMS Hub comprises two tiers, enterprise and professional, giving companies the freedom to choose a CMS offering best suited to their stage of growth.

- In May 2019, Progress announced the latest release of its digital experience management platform, Progress Sitefinity 12. With this release, Progress brought Sitefinity to the cloud and provided new productivity, efficiency, and faster time-to-market. Sitefinity Cloud empowers organizational scale, eliminates the need for infrastructure management, and deeply integrates Microsoft Azure services enabling organizations to focus on their core business.

- In May 2019, Upland Software acquired Kapost, a leading content operations platform provider for sales and marketing. Kapost’s cloud-based content operations platform unites revenue teams to speak in one voice across the customer journey by streamlining the content development process at scale. The platform’s open architecture, robust set of APIs, and deep collaboration capabilities help organizations better orchestrate all stages of content planning, production, and distribution.