< Key Hightlight >

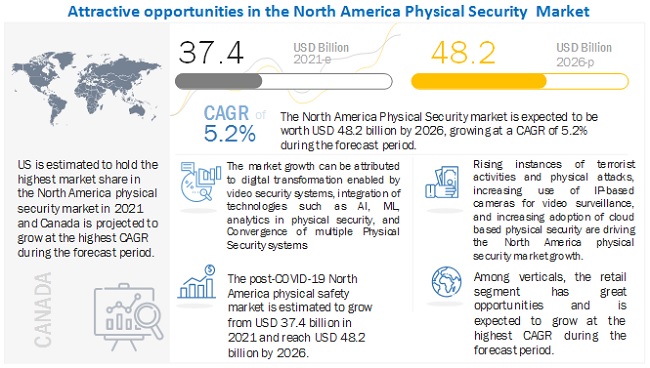

[243 Pages Report] The global North America physical security market size is projected to grow from USD 37.4 billion in 2021 to USD 48.2 billion by 2026, at a Compound Annual Growth Rate (CAGR) of 5.2% during the forecast period. Major driving factors for the North America physical security market include rise in security breaches, fraud, and data identity thefts, surge in use of BYOD/ IoT devices, high demand for cloud-based physical security solutions and services, high volume of online transactions, increasing use of IP-based video surveillance camera systems, and stringent government regulations.

Protecting important data, confidential information, networks, software, equipment, facilities, company’s assets, and personnel is what physical security is about. There are two factors by which security can be affected. First attack by nature like a flood, fire, power fluctuation, etc. Though the information will not be misused, it is very hard to retrieve it and may cause permanent loss of data. The second is an attack by the malicious party, which includes terrorism, vandalism, and theft.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact Analysis on North America Physical Security Market

The COVID-19 pandemic has affected every segment of society, including individuals and businesses. The internet ecosystem has been playing a pivotal role all over the globe. Due to the COVID-19 pandemic, the dependency on online businesses has increased significantly. BFSI, government, manufacturing, retail, education, and healthcare, among others, are leveraging the internet to provide necessary services to consumers. Vendors have experienced an increased demand for physical security solutions and services in North America. With the widespread use of mobile devices and internet penetration across the globe, individuals are progressively inclined towards the use of digital technologies. Additionally, restrictions imposed by governments in response to the COVID-19 pandemic have encouraged employees to work from home, and even ‘stay at home’. As a consequence, technology has become of paramount importance across working and personal lives. Despite these rising technology needs, it is noticeable that many organizations still do not provide a ’cyber-safe’ remote-working environment. Where business meetings were traditionally held in-person, most now take place virtually. While the COVID-19 outbreak continues to drive cybersecurity and physical security trends as a whole, it has also inspired new attacks that capitalize on the desire of citizens for news, assistance, or guidelines that could help keep them safe. The growing number of cyberattacks across enterprises in North America is expected to drive the physical security market growth in the region.

Market Dynamics

Driver: Increasing use of IP-based cameras for video surveillance

One of the best ways to prevent crimes such as thefts and vandalism in residential and commercial areas is by utilizing advanced North America Physical Security techniques, such as video surveillance. Initially, CCTV cameras were being used to monitor various business assets. With technological advancements in internet and camera hardware, IP cameras and IP network systems are rapidly replacing CCTV cameras. IP cameras offer flexibility, remote access, and better scalability as compared to traditional analog camera-based monitoring systems. IP-based cameras provide a more efficient and flexible North America Physical Security system because of controllable bandwidth, which gives a high resolution. Moreover, the hard drive space can be shared across many systems for recording.

Organizations today are mostly looking for digital solutions in their workplaces because of the various distinctive and unique features that the IP systems provide. There are several reasons contributing for the scenario, ranging from budgetary to technological issues and also distinctive features that have been offered by IP-based systems, such as image resolution, scalability, easy installation procedures, and also the ability to adapt to any future upgrades, such as the integration of video analytics. Moreover, the deployment of IP-based systems is easier than analog systems, due to hardware support, plug in and plug out features, and easy cabling, provided by device manufacturers.

Restraint: Violation of privacy

Any surveillance system in places such as highways, parking lots, parks, transportation modes, retail stores, financial institutions, and offices is often viewed as a violation of privacy and is opposed by various civil liberties groups and activists. There have been concerns about who watches the video and how the video might be used or misused, as people expect their personal information to be used only for legitimate and specific purposes. Governments and private sector organizations should take necessary steps to lower the impact of video surveillance systems on the privacy of people by issuing guidelines. For example, the deployment of California Consumer Protection Act (CCPA) takes violation of privacy very seriously and parties involved are subjected to heavy penalties. With the introduction of such laws regarding privacy, any public or private organization using CCTV to monitor public accessible areas must adhere to the regulatory requirements. The citizens of various North American countries are protesting to the use of video surveillance and facial recognition due to the threat of misuse of their identity. This is working as a restraint for the North America Physical Security market since possible misuse of data can lead to privacy violation.

Opportunity: Integration of technologies such as AI, ML, analytics in Physical Security

Combining AI, ML, and analytics with surveillance offer a wave of unrealized possibilities ranging from predictive crime to real-time identification of an ongoing crime or attack. The security team blends AI-based analytics with surveillance to watch for many possible scenarios. The moment AI identifies any dangerous scenario, it alerts the on-site monitor, the person investigates it, and acts as per the situation. The monitoring operator may issue an audio warning, contact the point person for the business, or call for emergency response. What makes video analytics more powerful than other security solutions is that it's proactive and does help to deter crime and avert damage. For example, IC Realtime launched a product named Ella that combines AI and surveillance. Ella uses AI to analyze what is happening in video feeds, enable the users to search footage to find clips showing specific objects or particulars. Integration of AI, ML and analytics is boosting the surveillance process by analyzing live video without the need for human intervention.

Challenge: Increasing cyber threats to physical security systems

The North America Physical Security equipment that provides safety and security to people and assets are perceived to have a high-level of risk of cyber-attack. Especially video surveillance has been identified as the weakest link in North America Physical Security. According to experts, physical systems from industries such as biomanufacturing, healthcare, agriculture, and food systems throughout the region is facing increasing risks. These cyberattacks on these systems are expected to be exploited to the detriment of national security, economic competitiveness, and societal wellbeing. To prevent such cyber threats to physical systems, steps are being taken towards strengthening the physical systems to eliminate the risks of cyberattacks.

Based on end-user, the retail segment is estimated to grow at the highest CAGR during the forecast period

The COVID-19 outbreak has impacted every possible vertical across the globe, especially high-profile and high-value data verticals such as BFSI, healthcare, retail, and government. With the increasing cyber threat landscape and risk surface, the demand for physical security solutions is also rising in North America. The retail vertical is an early adopter of cutting-edge physical security solutions as they possess highly sensitive personal user data. Retail store outlets are ever-increasingly heading toward the adoption of physical security solutions and services in North America. The retail vertical is largely prone to cyberattacks due to the use of different payment methods, such as MasterCard or Visa. These payment methods capture users’ personal and confidential details, which may consist of phone numbers, email addresses, credit card information, and complete addresses, along with their online behaviors. Regulatory compliances such as PCI-DSS compel retail trade owners to adopt strong physical security measures. Non-compliance with these regulations could lead companies to pay heavy penalties of approximately USD 100,000 every month or USD 500,000 per security incident. Physical security solutions and services also help the retail industry vertical deliver robust security, secure identities, and manage regulatory compliances.

To know about the assumptions considered for the study, download the pdf brochure

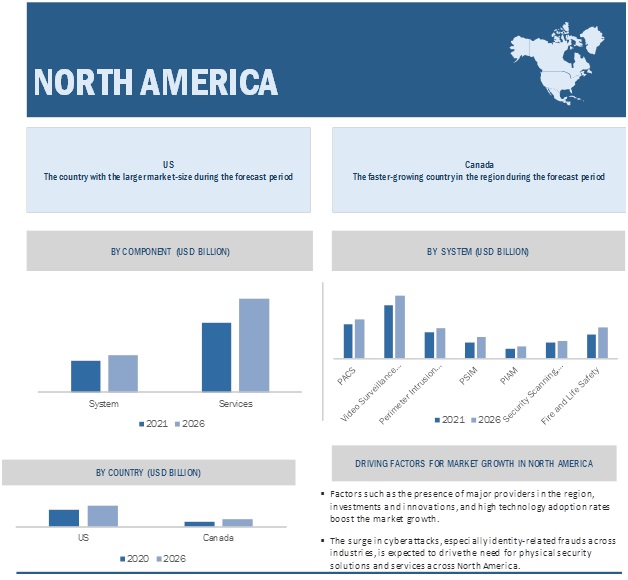

The US is expected to hold the largest market size during the forecast period

The US is estimated to account for the higher market share in the North America physical security market. Early adoption of physical security solutions and the presence of several vendors that provide physical security systems and services is expected to drive market growth in the country. Businesses in this country are increasingly implementing physical security solutions to prevent cyber-attacks, identity thefts, and commercial espionage; and ensure security and privacy of data to facilitate business continuity. The growth of the market in the US can primarily be attributed to the presence of key physical security market vendors, investments and innovations, strict regulatory environment, and high technology adoption rates in the country.

This research study outlines the market potential, market dynamics, and key and innovative vendors in the North America physical security market include ADT (US), Cisco (US), Honeywell (US), Johnson Controls (Ireland), TELUS (Canada), Anixter [WESCO] (US), Genetec (Canada), Bosch Building Technologies (Germany), STANLEY Security (US), GardaWorld (Canada), Convergint Technologies (US), Bell Canada (Canada), Paladin Security (Canada), DSC (US), DMP (US), Telsco (Canada), Axis Communication (Sweden), Hanwha Techwin America (US), FLIR Systems (US), Qolsys (US), Chubb Fire & Security (UK), Alarm.com (US), Avigilon (Canada), Tyco (Ireland), ICT (New Zealand), AMAG Technology (US), PTI Security Systems (US), Kantech (US), Feenics (Canada), Brivo (Canada), Exacq Technologies (US), SightLogix (US), Kairos (US), Immix (US), IOTAS (US), Verkada (US), Openpath (US), SmartCone Technologies (Canada), Cloudastructure (US), and Qognify (US).

The study includes an in-depth competitive analysis of these key players in the North America physical security market with their company profiles, recent developments, and key market strategies.

Scope of the Report

Report Metrics | Details |

Market size available for years | 2015–2026 |

Base year considered | 2020 |

Forecast period | 2021–2026 |

Forecast units | Value (USD) |

Segments covered | Component, Systems, Services, Organization Size, Vertical, and Country. |

Geographies covered | US and Canada |

Major companies covered | ADT (US), Cisco (US), Honeywell (US), Johnson Controls (Ireland), TELUS (Canada), Anixter [WESCO] (US), Genetec (Canada), Bosch Building Technologies (Germany), STANLEY Security (US), GardaWorld (Canada), Convergint Technologies (US), Bell Canada (Canada), Paladin Security (Canada), DSC (US), DMP (US), Telsco (Canada), Axis Communication (Sweden), Hanwha Techwin America (US), FLIR Systems (US), Qolsys (US), Chubb Fire & Security (UK), Alarm.com (US), Avigilon (Canada), Tyco (Ireland), ICT (New Zealand), AMAG Technology (US), PTI Security Systems (US), Kantech (US), Feenics (Canada), Brivo (Canada), Exacq Technologies (US), SightLogix (US), Kairos (US), Immix (US), IOTAS (US), Verkada (US), Openpath (US), SmartCone Technologies (Canada), Cloudastructure (US), and Qognify (US). |

This research report categorizes the North America Physical Security to forecast revenues and analyze trends in each of the following submarkets:

Based on Component:

Based on Systems:

- PACS

- Video Surveillance System

- Perimeter Intrusion Detection and Prevention

- PSIM

- PIAM

- Security Scanning, Imaging, and Metal Detection

- Fire and Life Safety

Based on Services:

- Managed Service

- Professional Service

Based on Organization Size:

Based on the Vertical:

- BFSI

- Government

- Retail

- Transportation

- Residential

- Telecom

- IT and ITES

- Other verticals

Based on the region:

- North America

- United States (US)

- Canada

Recent Developments:

- In February 2021, Honeywell enhanced the capabilities of its MAXPRO Cloud portfolio with the launch of MPA1 and MPA2 access control panels that offer cloud, web-based, or on-premises hosting options to support the needs for SMEs. MPA1 and MPA2 control panels strengthen Honeywell’s MAXPRO Cloud offering by providing users with inexpensive access control functionality and real-time security information.

- In February 2021, Cisco partnered with Openpath, one of the leaders in touchless, modern access control and workplace safety automation. Onepath announced new Video Management System (VMS) partnership integration with Cisco Meraki. Openpath’s access control capabilities will be paired with Cisco Meraki’s industry-leading cloud-based technology, including smart camera intelligence that delivers data and analytics, and provides insights to help users make smarter business decisions.

- In November 2020, Johnson Controls unveiled its Smart Connected Fire Sprinkler Monitoring solution. As a part of Johnson Controls OpenBlue suite of digital solutions, the fire sprinkler monitoring solution will enable preventative maintenance and real-time insights into the health and functioning of the fire sprinkler system.

- In January 2020, ADT introduced ‘Blue by ADT’ DIY Home Security Platform. Blue by ADT is an extensible DIY system that allows customers to customize their smart home security systems with ease. The platform offers several devices with advanced compatibility features, including self-monitoring and 24/7 professional monitoring.

- In October 2019, TELUS acquired ADT Security Services Canada, prominent providers of security and automation solutions in Canada, for approximately CAD 700 million (USD 575 million). The acquisition strengthens TELUS’ capabilities in wireless networks, connected home solutions, security, IoT, smart buildings, smart cities, and smart healthcare services for its Canadian customers.

Key Benefits of Buying the Report

The report would provide the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall NORTH AMERICA PHYSICAL SECURITY market and its sub-segments. It would help stakeholders understand the competitive landscape and gain more insights to position their business and plan suitable go-to-market strategies. It also helps stakeholders understand the market's pulse and provides them with information on key market drivers, restraints, challenges, and opportunities.