< Key Hightlight >

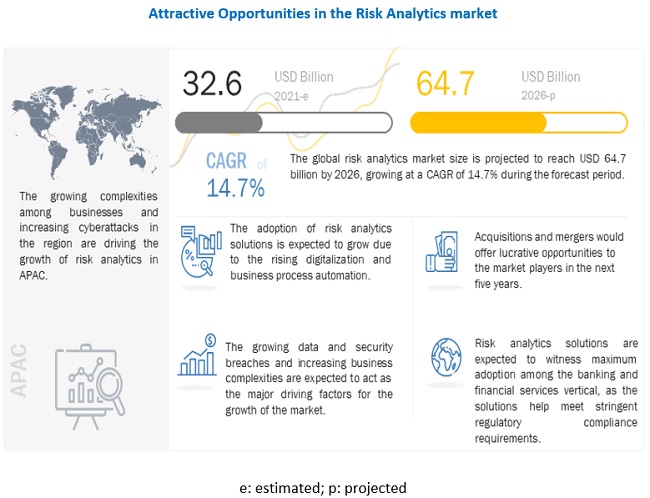

[261 Pages Report] The global risk analytics market size to grow from USD 32.6 billion in 2021 to USD 64.7 billion by 2026, at a Compound Annual Growth Rate (CAGR) of 14.7% during the forecast period. Various factors such as compliance with stringent industry regulations, increasing complexities across business processes, rising digitalization and BPA, and growing data and security breaches are expected to drive the adoption of risk analytics solutions and services.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on the global Risk Analytics market

COVID-19 pandemic has made an adverse impact on credit portfolios. There has been an unprecedented rise in unemployment and disruption in economic activity, which are putting a strain on the solvency of customers and companies. Central banks have taken a proactive approach by injecting liquidity into the market by lowering interest rates and asset purchase programs. As per an article by Genpact, Mortgage forbearance increased sharply, showing a nearly 3,000% increase from March 2020 to May 2020. To prepare for such extreme shocks and uncertainty, large US banks increased their loss provisions by ~3–4 times for Q1 2020 compared to Q4 2019, based on their expectations of impending defaults and charge-offs. Regulators are focusing on implementing various measures to get financial institutions back on the path of recovery. Basel Committee on Banking Supervision (BCBS), along with the International Organization of Securities Commission (IOSCO), has decided to postpone implementing the final two phases of margin requirement by one year. Increased volatility in the market has caused high trading losses, affected earnings, and capital preservations, and have led to breaches of limit/thresholds. Higher volatility, price movements, and counterparty risks have directly impacted risk-weighted assets. Hence, the COVID-19 pandemic has disrupted the global financial markets and has created panic, uncertainty, and distraction in the operations of global corporations.

Market Dynamics

Driver: Increasing complexities across business processes

Increasing business complexities are challenging for organizations to manage a large number of data and identify potential risks. The major factors of rising business complexity include growing innovations, changing nature of complexities, lack of information management, intricate regulation, and government oversight. In the aftermath of the financial crisis that broke out in 2008, organizations became more careful regarding risk management and have started investing a significant amount in adopting new techniques that can help in managing risk across the organization. Moreover, due to growing technological innovation and the proliferation of new technologies, such as AI, ML, IoT, and edge computing, data has been generated in a massive amount. The increase in data has led to increased business complexity, and decision-making has become more intricate. Most organizations have started implementing analytical solutions that simplify data gathering and analysis processes. The analytical solutions also help in gaining insights from the data and reducing complexity.

Restraint: Intricate nature of regulatory compliance

Regulatory compliances are varied in nature across the globe. Therefore, it becomes difficult for organizations to mitigate compliance risk and comply with various regulatory policies that are different from country to country and business to business. This is considered one of the restraining factors for the growth of the risk analytics market, as there is no clear standard that needs to be followed. These factors are also making it difficult for risk analytics solution providers to cater to the various end-user requirements. In some of the regions where there is no regulatory structure and standard imposed by governing bodies, organizations focus on executing in-house regulatory guidelines and policies.

Opportunity: Rising innovations in the FinTech industry

The FinTech industry constitutes financial and technological solutions providing companies. This is the most data-sensitive industry that is vulnerable to various types of risks, such as market compliance risk, cyberattacks, and fraud detection. Hence, organizations, both large enterprises and SMEs, are focusing on the FinTech industry to invest in technology solutions, such as RPA and digitalization, and introduce innovations in the market. The risk analytics market is being digitalized and innovated in various aspects, such as the launch of new comprehensive tech-enabled tools and the implementation of new business models for risk management. Tech-enabled tools assist in investment research, compliance, and risk management. These innovations are helping FinTech vendors offer effective risk management solutions and add more value to their customers.

Challenge: Integration of data from data silos

Extracting value from data has become a key requirement for companies to successfully mitigate risks, target valuable customers, and evaluate business performance. In addition, monetizing these data assets requires the availability of a sufficient amount of data. However, data consolidation from distinct data sources into meaningful information can incite various challenges for organizations, especially centralized business enterprises. Data exchange and data ecosystem deliver tools to analyze the collected data at a centralized location and help extract and cross-check business-critical components. The development of data exchanges and data ecosystem varies based on the assumptions made in the value of the data for each customer segment. Many risk analytics providers offer unified data aggregation and data analytics platforms that help users in successfully aggregating and analyzing data from disparate data sources. Furthermore, data exchange is a major concern for industries, such as banking and financial services and healthcare, which deal with individual’s confidential data. As the need for data exchange increases, it needs to be balanced with risk mitigation capabilities. With companies adopting risk analytics software integrated with data security capabilities, data exchange is not expected to be a major issue in the near future.

The services segment is expected to grow at a higher CAGR during the forecast period

The services segment has been further divided into professional and managed services. These services play a vital role in the functioning of risk analytics solutions, as well as ensure faster and smoother implementation that maximizes the value of the enterprise investments. The growing adoption of risk analytics software is expected to boost the adoption of professional and managed services.

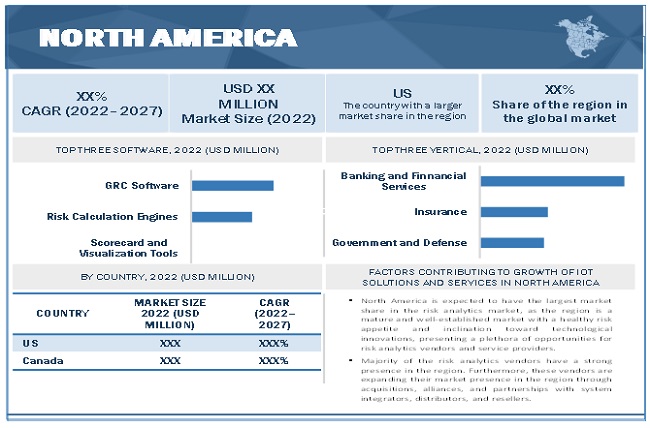

North America to account for largest market size during the forecast period

North America is expected to have the largest market share in the risk analytics market, as the region is a mature and well-established market with a healthy risk appetite and inclination toward technological innovations, thereby presenting a plethora of opportunities for risk analytics vendors and service providers. The majority of the risk analytics vendors have a strong presence in the region leading to the higher adoption of risk analytics solutions in the region.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The Risk analytics vendors have implemented various types of organic and inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. The major vendors in the global Risk Analytics market include IBM (US), Oracle (US), SAP (Germany), SAS Institute (US), FIS (US), Moody’s Analytics (US), Verisk Analytics (US), AxiomSL, (US), Gurucul (US), Provenir (US), Risk Edge Solutions (India), BRIDGEi2i (India), Recorded Future (US), DataFactZ (US), Alteryx (US), AcadiaSoft (US), Qlik (US), CubeLogic (UK), Equarius Risk Analytics (US), Quantifi (US), Actify Data Labs (India), Amlgo Labs (India), Zesty.ai (US), Artivatic (India), Attestiv (US), RiskVille (Ireland), Quantexa (UK), Spin Analytics (UK), Kyvos Insights (US), and Imply (US). The study includes an in-depth competitive analysis of these key players in the Risk Analytics market with their company profiles, recent developments, and key market strategies.

Scope of the Report

Report Metric | Details |

Market size available for years | 2015–2026 |

Base year considered | 2020 |

Forecast period | 2021–2026 |

Forecast units | USD Million |

Segments covered | Component, Deployment Mode, Organization Size, Risk type, Vertical, And Region |

Geographies covered | North America, Europe, APAC, Latin America and MEA |

Companies covered | IBM (US), Oracle (US), SAP (Germany), SAS Institute (US), FIS (US), Moody’s Analytics (US), Verisk Analytics (US), AxiomSL, (US), Gurucul (US), Provenir (US), Risk Edge Solutions (India), BRIDGEi2i (India), Recorded Future (US), DataFactZ (US), Alteryx (US), AcadiaSoft (US), Qlik (US), CubeLogic (UK), Equarius Risk Analytics (US), Quantifi (US), Actify Data Labs (India), Amlgo Labs (India), Zesty.ai (US), Artivatic (India), Attestiv (US), RiskVille (Ireland), Quantexa (UK), Spin Analytics (UK), Kyvos Insights (US), and Imply (US) |

This research report categorizes the risk analytics market based on components, deployment mode, organization size, risk type, vertical, and regions.

By Component:

- Solution

- Software

- Extract, Transform, and Load (ETL) tools

- Risk calculation engines

- Scorecard and visualization tools

- Dashboard analytics and risk reporting tools

- GRC software

- Others (operational risk management, human resource risk management, and project risk management)

- Services

- Professional Services

- Managed Services

By Deployment Mode:

By Organization Size:

- Large enterprises

- Small and medium-sized enterprises (SMEs)

By Risk Types

- Strategic Risk

- Operational Risk

- Financial Risk

- Others (Reputational Risk, Environmental Risk, Third-Party Risk, And Economic Risk)

By Vertical:

- Banking and Financial Services

- Insurance

- Manufacturing

- Transportation and Logistics

- Retail and Consumer Goods

- IT and Telecom

- Government and Defense

- Healthcare and Life Sciences

- Energy and Utilities

- Others [Travel And Hospitality, Academia And Research, and Media And Entertainment)

By Region:

- North America

- Europe

- UK

- Germany

- France

- Rest of Europe

- APAC

- China

- Japan

- India

- Rest of APAC

- MEA

- Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In January 2021, Moody’s Analytics announced the launch of Moody’s DataHub, a new cloud-based analytical platform that integrates data from across Moody’s Analytics, including its affiliates. Moody’s DataHub enables financial and risk decision-makers to explore, analyze, and consume a wide range of relevant information seamlessly and efficiently.

- In September 2020, IBM Security announced a new risk-based service. It will help organizations apply analytics for traditional business decisions to cybersecurity spending priorities. It will help clients identify, prioritize, and quantify security risk as they weigh decisions, such as deploying new technologies, making investments in their business, and changing processes.

- In June 2020, SAP launched the German government’s Corona Warn App. The application was developed in collaboration between SAP and Deutsche Telekom as well as other partners. It was developed in an open-source mode, and the program code was continuously visible to the public on the development platform, GitHub. The Corona Warn app commissioned by the German government would be one of the first European apps based on the current specifications of the Exposure Notification Framework provided by Apple and Google.

- In April 2020, SAS Institute released online learning offerings to respond to COVID-19. These free offerings included SAS Academy for Data Science, SAS Learning Subscription, and customer intelligence resources. The offerings would fulfill the needs of learners and professionals during the current pandemic.

- In April 2020, Moody's Analytics launched SolvencyWatch Solution for Insurers’ Capital Monitoring. It provides a fast valuation of an insurer’s assets and liabilities.

- In June 2018, IBM enhanced the portfolio offering of RegTech by adding new solutions, including next-gen GRC, financial crimes, and financial risks. These solutions would help IBM comply with regulations, which are required for IBM’s businesses.