< Key Hightlight >

[360 Pages Report] The global eGRC market size is projected to grow from USD 1.3 billion in 2021 to USD 2.2 billion by 2026, at a Compound Annual Growth Rate (CAGR) of 10.9% during the forecast period. The major factors fueling the eGRC market growth include the growing need to meet stringent compliance mandates and get a holistic view of the increasing need to get a comprehensive view of policy, compliance, risk-related data, and increasing data and security breaches. Moreover, the growing integration of Artificial Intelligence (AI) and blockchain technologies with Governance Risk Compliance (GRC) solutions would provide opportunities for eGRC vendors.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID 19 IMPACT

Due to the recent outbreak of COVID-19, risk managers and compliance officers are struggling to tackle this pandemic. In this situation, the risk management optimization has quickly emerged as one of the best defenses an organization can have to ensure business continuity. Businesses are utilizing the capabilities of their risk teams through smart investments into risk technology. Even though being proactive is the best option towards risk management under normal circumstances, since the pandemic is a risk that has already been actualized, there has been a focus on approaches that can react quickly to the latest developments. Also, Compliance managers across the globe are ensuring compliance with the rules and regulations set up by state governments to contain the virus.

Market Dynamics

Driver: Increase in stringent compliance mandates

The increasingly complex regulatory environment and need to comply with various regulations imposed by the governing bodies are expected to create a demand for eGRC solutions. Staying compliant with the regulations, such as Control Objectives for Information and Related Technologies (COBIT),), Sarbanes-Oxley Act (SOX), The Federal Financial Institutions Examination Council (FFIEC), The General Data Protection Regulation (GDPR), The Payment Card Industry Data Security Standard (PCI DSS), The Gramm-Leach-Bliley Act (GLBA), Health Insurance Portability and Accountability Act (HIPAA), The Federal Information Security Management Act (FISMA), The National Institute of Standards and Technology (NIST), and other federal and state mandates are becoming critical for organizations to avoid any further loss. Failure to meet the compliance requirements and regulations can result in huge business loss, usually in the form of penalties.

Restraint: Varying structure of regulatory policies

Structure of regulatory policies changes from country to country and business to business. Various countries do not have an assigned body to govern these policies; these need to be regulated and executed by considering multiple factors, such as micro-economic risk factors along with the business requirements. This factor, i.e., no clear standard that needs to be followed, is considered as one of the restraining factors for the growth of the eGRC market. These factors are also making it difficult for eGRC solution providers to cater to the various end-user requirements. In some of the regions, where there is no regulatory structure and standard imposed by governing bodies, organizations focus on executing in-house regulatory guidelines and policies.

Opportunity: Integration of AI and blockchain technologies into eGRC solutions

The growing volume of data offers a wide range of opportunities for business professionals, such as audit, risk, and compliance, to enhance the way they perform their tasks. Also, the increasing need to analyze the data silos for identifying risk, as well as to present it to the stakeholders at the right time, has become crucial. Therefore, to help organizations meet these requirements, various companies have started providing AI-powered solutions to help enterprises meet different regulatory and compliance requirements. AI-powered solutions and platforms integrated with analytical tools and business intelligence help enterprises extract insights from large volumes of data and thereby make informed decisions. Moreover, AI technology can automate various tasks that deal with risk management. On the other hand, blockchain technology can help organizations accelerate the process of GRC data management and sharing.

Challenge: Providing a comprehensive eGRC solution

Most of the organizations primarily focus on delivering services to a wide range of industries, such as Banking, Financial Services, and Insurance (BFSI), healthcare, legal, retail and eCommerce, and others. Hence, organizations focus on developing solutions that can meet the requirements of these industry sectors, which creates the demand for multiple solutions designed to fulfill the requirement of each business segment. The major challenge that may impact the growth of the market is delivering an integrated eGRC solution that can meet various business requirements of BFSI, healthcare, and various other industries. The solution should include risk management, mandates, and compliance for each industry vertical and help them manage the complexity of changing business requirements. To develop such a solution is another complex task, as each industry has different regulatory and compliance requirements, which need to be followed. But with the technological advancements and increasing business focus toward developing innovative solutions, vendors are expected to focus on developing an integrated solution to cater to the customer requirements in the eGRC market.

Among software, risk management segment to grow at the highest cagr during the forecast period

With the increasing business complexities, risk management software solutions are becoming crucial for the proper functioning of various businesses, as these solutions enable organizations to understand their risk exposure and manage it cost-effectively. The increasing cyber-attacks and growing need to analyze organizational silos are creating the demand for risk management software solutions.

BFSI end user to hold the largest market size during the forecast period.

Based on end user, the eGRC market has been segmented into BFSI, telecommunication, energy and utility, government, healthcare, manufacturing, mining and natural resources, retail & consumer goods, Information technology (IT), and transportation and logistics, and others. BFSI is the largest revenue contributor to the global eGRC market. The BFSI industry faces increasing pressure to enhance its overall performance and deliver a seamless experience to its customers. Hence, the BFSI vertical is looking for a framework that can help organizations meet various regulatory and compliance-related requirements.

To know about the assumptions considered for the study, download the pdf brochure

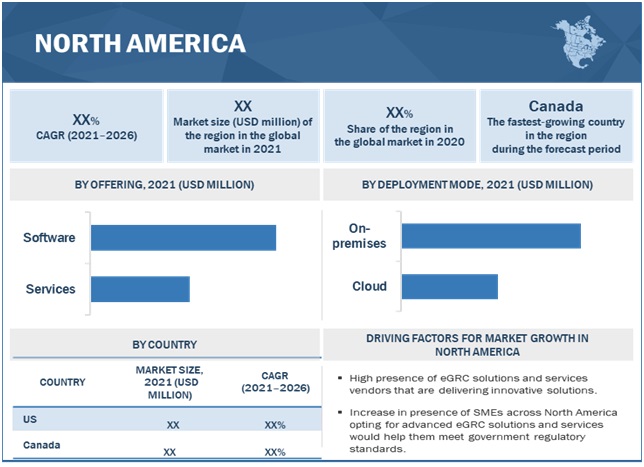

North America to hold the largest market size during the forecast period

North America is expected to hold the largest market size in the global eGRC market. This region houses major vendors that adopt various organic and inorganic strategies to maintain their competitive position in the market. While the growth rate of the APAC region is projected to be the highest during the forecast period, its growth is attributed to the various eGRC vendors that are expanding their reach in the region to cater to the changing customer requirements.

Key market players

Major vendors in the global eGRC market are IBM (US), Microsoft (US), Oracle (US), SAP(Germany), SAS Institute (US), ServiceNow (US), Thomson Reuters (Canada), Wolters Kluwer (Netherlands), Dell EMC (US), FIS (US), Software AG (Germany), RSA Security (US), MEGA International (France), Ideagen (UK), Mphasis (India), MetricStream (US), Protiviti (US), SAI Global (US), ProcessGene (Israel), LogicManager (US), Quantivate (US), Riskonnect (US), NAVEX Global (US), Alyne(Germany), and Lexcomply (India), StandardFusion (Canada).

The study includes an in-depth competitive analysis of these key players in the eGRC market with their company profiles, recent developments, and key market strategies.

Scope of the report

Report Metrics | Details |

Market size available for years | 2015–2026 |

Base year considered | 2021 |

Forecast period | 2021–2026 |

Forecast units | Billion (USD) |

Segments covered | Offering, Software, Deployment Mode, Organization Size, Business Function, End User, and Region |

Geographies covered | North America, Europe, APAC, MEA, and Latin America |

Companies covered | IBM (US), Microsoft (US), Oracle (US), SAP (Germany), SAS Institute (US), ServiceNow (US), Thomson Reuters (Canada), Wolters Kluwer (Netherlands), Dell EMC (US), FIS (US), Software AG (Germany), RSA Security (US), MEGA International (France), Ideagen (UK), Mphasis (India), MetricStream (US), Protiviti (US), SAI Global (US), ProcessGene (Israel), LogicManager (US), Quantivate (US), Riskonnect (US), NAVEX Global (US), Alyne(Germany), and Lexcomply (India), StandardFusion (Canada). |

This research report categorizes the eGRC market to forecast revenues and analyze trends in each of the following subsegments:

Based on Offering:

Based on Software:

- Usage

- Type

- Policy Management

- Compliance Management

- Audit Management

- Incident Management

- Risk Management

- Others (business continuity management, financial controls management, and issue management)

- Services

- Training and Consulting

- Integration

- Support

Based on Deployment Mode:

Based on Organization Size:

Based on Business Function:

Based on End User:

- BFSI

- Telecommunication

- Energy and Utility

- Government

- Healthcare

- Manufacturing

- Mining and Natural Resources

- Retail and Consumer Goods

- IT

- Transportation and Logistics

- Others (Construction and Engineering, Academia, Media and Entertainment, Oil and Gas, and Tourism and Hospitality)

Based on regions:

- North America

- Europe

- Germany

- United Kingdom

- France

- Rest of Europe

- APAC

- China

- Japan

- India

- Rest of APAC

- MEA

- Latin America

- Brazil

- Rest of Latin America

Recent Developments

- In April 2021, Oracle partnered with CherryRoad Technologies (CherryRoad). CherryRoad has highly regarded expertise in configuring and implementing tailored and innovative solutions with the Oracle Governance, Risk and Compliance (GRC) suite of applications.

- In March 2021, IBM announced the release of IBM OpenPages Data Privacy Management, a new module in the OpenPages platform that enables organizations to meet new data privacy challenges head-on. This module will give users a unified view of all of the private data assets being stored across their organization, and it will enable users to run privacy assessments on them.

- In March 2021, ServiceNow released Now Platform Quebec. This latest version of the Now Platform features expanded native AI capabilities and new low-code app development tools, empowering customers to innovate quickly, realize the fast time to value, improve productivity and deliver great experiences.

- In February 2021, Microsoft partnered with PwC to address the need for transformed risk practices buoyed by advanced artificial intelligence (AI) and analytics. PwC's new Risk Command suite of products embraces a traditional GRC workflow tool at the center of the solution and wraps connectors and best-in-breed solutions around it to create an enhanced armor of functionality around a core platform.

- In December 202, Wolters Kluwer GRC acquired eOriginal. The acquisition helps GRC Compliance Solutions’ to attain a leading position in the US mortgage and loan document generation and analytics into the fast-growing digital loan closing and storage adjacency.