< Key Hightlight >

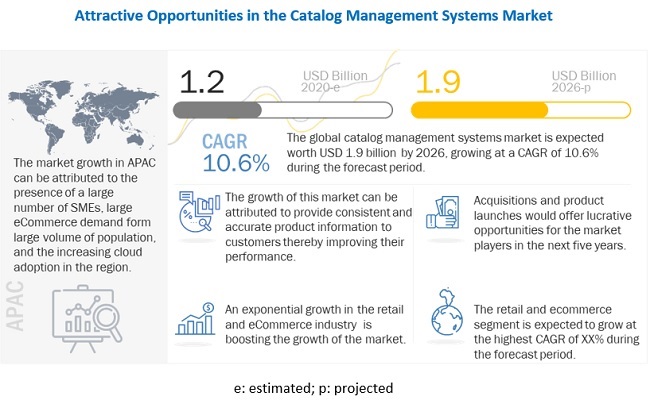

[251 Pages Report] The global catalog management systems market size is expected to grow at a Compound Annual Growth Rate (CAGR) of 10.6% during the forecast period, to reach USD 1.9 billion by 2026 from USD 1.2 billion in 2020. Key factors that are expected to drive the growth of the market are the rising consumer demand for products, growing internet access, and rising penetration of smartphones demand which is acting as a catalyst for catalog management solutions from the e-commerce industries. The catalog management systems market is fragmented as there is presence of large number players across market. The major factors that are expected to drive the adoption of catalog management software among enterprises as well as SMEs across several verticals, including retail and e-commerce, media and entertainment, telecom, IT, and travel and hospitality are increasing adoption of cloud and digital transformation is significantly increasing. Developing countries across APAC and MEA are expected to offer more opportunities for vendors in the market. In current times, the market is profitable for catalog management software vendors as several companies from diverse verticals are progressively adopting digital transformation across their businesses. During the COVID, the catalog management systems market is profitable for catalog management software vendors as such software and solution help organizations in categorizing and consolidating product or service data into a single digital point of location for organizations and their end customers, i.e., buyers. The systems maintain and store product and service information for organizations which save time and reduce manual work.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact analysis on the global catalog management systems market

The impact of the COVID-19 pandemic on the market is covered throughout the report. The pandemic has had a positive impact on the catalog management systems market. COVID-19 has led to digital transformation across multiple industries, including retail and eCommerce, telecom, and media and entertainment. These solutions provide a quick snapshot of products in a channel, and capture and upload data and map it to customer needs. They also help in validating, enriching, and augmenting the data in real-time and automate the creation of catalog information using data from multiple sources to improve product assortment and achieve faster syndication of product data across channels.

Market Dynamics

Driver: Rising demand for catalog management solutions from the eCommerce industry

The eCommerce industry has been growing at a tremendous pace, owing to the rising consumer demand for products, growing internet access, and rising penetration of smartphones. Worldwide online sales have increased. In countries such as the Philippines, Mexico, India, and China, the eCommerce industry is growing rapidly. Catalog management helps reduce the cost of service delivery, improve the customer experience, enhance employee efficiency, and boost the overall functioning of businesses. Catalog management system solutions deliver a better shopping experience to customers by offering detailed information on any product. These benefits help businesses to reduce time and offer automation to update product information on eCommerce platforms.

Restraint: Misapprehensions related to data security and privacy risks

Catalog management involves data collection and transmission from one channel to another. The synchronization and publishing of data across channels are also involved with catalog management systems. Due to the lack of proper knowledge about security frameworks and their implementation, many companies have the perception that catalog management solutions might lead to data breaches in their highly abstracted data sets.

Apprehensions about data security are the prime reasons for hindering the adoption of catalog management solutions. Users concisely refrain from using these solutions, fearing losing their crucial master data and reference data due to data errors occurring during compilation or upgradation. Users are under the impression that the privacy of their data is at risk, and there would be no accountability for their data losses or thefts or any mitigation would not be provided. Moreover, users fear losing the authenticity of their data. Therefore, companies prefer vendors who can customize their existing systems to manage their product information and withstand competition.

Opportunity: Incorporation of AI and ML capabilities to improve information management and customer experience

Organizations across industries such as healthcare, retail, and BFSI have been investing and adopting new technologies, such as AI and ML, to grow and stay ahead of their competitors. AI-powered catalog management offers the automatic classification of products, anomaly detection, enrichment processes through the selection of data from trusted sources, scoring of products, and contextual recommendations. AI-powered catalog management solutions can generate automated insights about data issues and create an integrated view of the data present across multiple systems for helping customers understand their products better. Furthermore, AI-embedded chatbots can also improve customer experience and satisfaction, resulting in enhanced revenues and profits. ML-enabled catalog management solutions help organizations in managing compliance, driving data-based digital transformation, and achieving better operational efficiency by sensing upcoming data quality issues and suggesting appropriate solutions to improve data matching and avoid data inconsistencies. Companies such as IBM have started offering ML-enabled catalog management solutions. It is expected that the demand for such solutions can increase, which would encourage new developments in catalog management solutions.

Challenge: Absence of the standardized catalog format among enterprises

Catalog requirements differ for each enterprise based on products or services offered. There is no standardized format that is followed by enterprises. Despite the cleansing, consolidation, and enrichment benefits of catalog management solutions, companies are required to establish a proper governance policy that ensures consistency across product catalogs for achieving standardized data. Similarly, for better integrations with existing systems, the data coming from systems containing poor information or data inconsistencies must also be taken into consideration while formulating such policies.

Services segment to hold a larger market size during the forecast period

The services segment for catalog management systems is expected to grow at a higher CAGR due to the need of professional and managed services for ensuring smooth functioning of product information and manage data in a single repository. Enterprises across various regions requires active support from skilled professionals to minimize their downtime during the pre-and post-installation of catalog management solutions. These services provide the necessary support to uphold the efficiency of business processes, increase enterprise growth, and reduce unwanted operational expenses.

Cloud deployment type to hold a larger market size in 2021

The cloud segment is expected to hold a higher share of the catalog management systems market as organizations across various regions are adopting cloud for digital transformation rapidly. The on-premises model is adopted specifically by large enterprises as the budget allocation generally is high for installing catalog management software products and services in companies’ equipment compared with SMEs.

Small enterprises to hold a majority of the market share during the forecast period

SMEs are defined as organizations with an employee strength ranging from 1 to 1,000. SMEs have a low marketing budget and often lack the resources and capabilities for effective marketing orchestration. These enterprises face greater challenges of limited budget as compared to large enterprises and require better methods to resolve complexities for improving the cost optimization of their business processes. However, the SMEs segment is expected to grow at a higher CAGR during the forecast period, due to rising adoption of cloud-based catalog management systems. Cloud-based software and services offers benefits such as reliability, scalability, user-friendly capabilities, easy integration, increased agility, and improved efficiency which are expected to encourage SMEs to adopt cloud-based catalog management system solutions and services at a rapid pace.

Retail and eCommerce industry vertical to grow at the highest CAGR during the forecast period

Retail and e-commerce is one of the fastest-growing verticals with respect to the adoption of advanced technologies and services due to the enormous volume of product data. Digital transformation initiatives have led to the boom in the retail and eCommerce vertical to meet customers’ dynamic requirements. Today, customers demand rich and consistent product information; therefore, catalog manager ensures the quality of product data across all the sales channels. It includes how merchants organize, standardize, and publish their product data using each sales channel. Whether the product data is created in-house or is from third parties such as suppliers, organizations need to manage its accuracy.

To know about the assumptions considered for the study, download the pdf brochure

Asia Pacific (APAC) to grow at the highest CAGR during the forecast period

Asia Pacific has witnessed the advanced and dynamic adoption of new technologies and is projected to record the highest CAGR during the forecast period. In addition, the IT spending across organizations in the region is gradually increasing, which is projected to lead to a surge in the adoption of catalog management software solutions. China, India, Japan, and Australia and New Zealand (ANZ) are the leading countries in terms of the adoption of catalog management software solutions and services in the region. While the expenditure on technology solutions in APAC has increased, a setback is witnessed due to the recent COVID-19 pandemic. The COVID-19 pandemic makes it more urgent for business leaders across APAC to increase their rate of cloud adoption and digital transformation, thereby embracing great market opportunities for catalog management system vendors across the region. However, the current pandemic has forced the retail vertical across APAC to shift toward digital innovation and eCommerce, thereby driving huge market opportunities for catalog management system vendors.

Key Market Players

The catalog management system vendors have implemented various types of organic as well as inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions, to strengthen their offerings in the market. The major vendors offering catalog management systems solutions and services globally are IBM (US), SAP (Germany), Oracle (US), Salsify (US), Coupa Software (US), ServiceNow (US), Proactis (England), Broadcom (US), Fujitsu (Japan), Comarch (Poland), Zycus (US), GEP (US), Ericsson (Sweden), Amdocs (US), Episerver (US), Hansen Technologies (Australia), Vinculum (India), Claritum (UK), eJeeva (US), SunTec (India), Plytix (Denmark), Mirakl (France), Sellercloud (US), Vroozi (US), CatBase (UK), Akeneo (France), nChannel (US), Contalog (India), and Sales Layer (Spain).

The study includes an in-depth competitive analysis of key players in the catalog management systems market with their company profiles, recent developments, COVID-19 developments, and key market strategies.

Scope of the report

Report Metric | Details |

Market size available for years | 2016–2026 |

Base year considered | 2021 |

Forecast period | 2021–2026 |

Forecast units | Million (USD) |

Segments covered | Type (Product Catalogs and Service Catalogs), Component (Solutions and Services), Deployment Type, Organization Size, Vertical, and Region |

Geographies covered | North America, APAC, Europe, MEA, and Latin America |

Companies covered | IBM (US), SAP (Germany), Oracle (US), Salsify (US), Coupa Software (US), ServiceNow (US), Proactis (England), Broadcom (US), Fujitsu (Japan), Comarch (Poland), Zycus (US), GEP (US), Ericsson (Sweden), Amdocs (US), Episerver (US), Hansen Technologies (Australia), Vinculum (India), Claritum (UK), eJeeva (US), SunTec (India), Plytix (Denmark), Mirakl (France), Sellercloud (US), Vroozi (US), CatBase (UK), Akeneo (France), nChannel (US), Contalog (India), and Sales Layer (Spain). |

This research report categorizes the catalog management systems market based on type, component, deployment type, organization size, vertical, and region.

Based on the type:

- Product Catalogs

- Service Catalogs

Based on the component:

- Solutions

- Services

- Managed Services

- Professional Services

Based on the deployment type:

Based on the organization size:

Based on the vertical

- BFSI

- Retail and eCommerce

- Telecom

- IT

- Media and Entertainment

- Travel and Hospitality

- Others

Based on the region:

- North America

- Europe

- UK

- Germany

- France

- Rest of Europe

- APAC

- China

- Japan

- India

- Rest of APAC

- MEA

- UAE

- South Africa

- Rest of MEA

- Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In November 2020, Salsify formed a partnership with e-Comas, an Amazon consulting, account management, and content optimization firm. The aim behind the partnership is to provide Amazon digital shelf excellence to brand manufacturers in Europe, Middle East, and Africa (EMEA) by using Salsify’s solutions.

- In June 2020, Oracle released the implementation guide for Oracle Product Information Management version 12.1. This new version allows users to efficiently define responsibilities, users, suppliers, customers, setting up item catalogs and categories, item templates, manage item statuses, change policies for item catalogs, define new item requests, manage display formats, and define report templates.

- In July 2019, SAP launched its Product Content Hub, which is a cloud-based PIM solution. Its capabilities include product data management, product catalog management, product data model management, users and workflows, and data feed management. This new product offers master product data for customer-facing systems, including the SAP Commerce Cloud Solution, and its user interface allows business users to effectively create and manage high quality product data across marketing channels.

- In March 2019, Salsify introduced PXM platform for automated content submission. The new features specific to Amazon include automated content submission, creation, and publishing of content across the entire product catalog and automated inventory alerts.