< Key Hightlight >

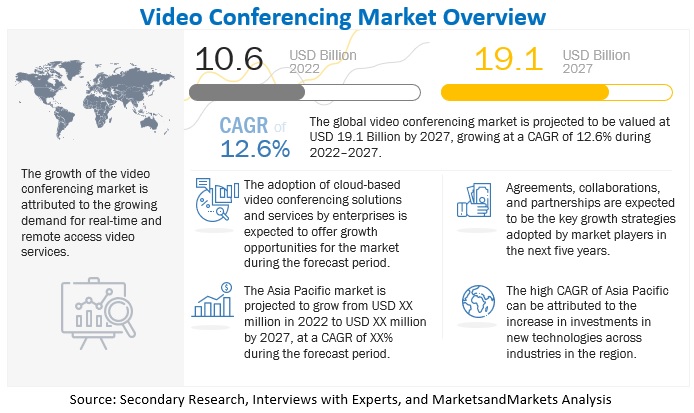

[242 Pages Report] The global video conferencing market size is expected to grow from USD 9.2 billion in 2021 to USD 22.5 billion by 2026, at a Compound Annual Growth Rate (CAGR) of 19.7% during the forecast period. With COVID-19, the entire workforce has experienced a transition toward remote working, paving a way for video conferencing solution and hardware products. The reduced travel time and cost, the importance of involving employees in determining strategic goals, and the rising need for virtual meeting rooms have overall increased the spending of companies on video conferencing solutions.

To know about the assumptions considered for the study, Request for Free Sample Report

The COVID-19 pandemic has affected every segment of society, including individuals and businesses. During the COVID-19 pandemic, the telecom sector is playing a vital role across the globe to support the digital infrastructure of countries. Every individual and government, irrespective of federal, state, central, local, and provinces, has been in constant touch with one other in the society to provide and get real-time information on COVID-19. Currently, healthcare, telecommunication, media and entertainment, utilities, and government institutes are functioning day and night to stabilize the condition and facilitate prerequisite services via video conferencing solutions to every individual.

COVID-19 cases are growing day-by-day, as several infected cases have been on the rise. In line with individuals, COVID-19 has a massive impact on large enterprises and SMEs. Core industries, such as manufacturing, automotive, textile, transportation and logistics, travel and hospitality, and consumer goods, have been closed due to country-level lockdown across the globe. This would have a substantial impact on the global economy in terms of the decline in GDP. Since ages, SMEs are acting as the backbone of the economy. In the current situation, SMEs are the most affected due to the COVID-19 pandemic.

Market Dynamics

Driver: Transformed global workforce

With COVID-19, the entire workforce has experienced a transition toward remote working, paving a way for video conferencing Solution and hardware products. Applications such as Microsoft Teams, an in-built application of Office 365, already in use by most enterprises for end-to-end productivity with email and storage capabilities, experienced a terrific growth post-pandemic. Zoom meeting solution is also experiencing growth due to its feasibility and ease of usage. Moreover, companies such as Huawei, Cisco, and Poly are rolling out hardware’s compatible for better video conferencing solution.

Restraint: Issues of privacy and security

The security and privacy of the video content shared across various platforms can pose major concerns for enterprises. Moreover, organizations are also concerned about copyright and Digital Rights Management (DRM) due to the possibilities of misuse, information leakages, and data breaches. The healthcare, finance, manufacturing, information, and public sectors witnessed the highest number of data breach incidents in 2019. To counter such restraints, enterprises need to restructure their strategies in employing video conferencing offerings before deploying these solution. In the absence of policies and procedures for the proper management of video content, video conferencing Solution may witness a sluggish adoption rate. Furthermore, vendors need to offer interoperable and easy-to-use enterprise-grade video communication Solution that have in-built security features.

Opportunity: 5G paving the way for video conferencing

5G networks deliver an enhanced broadband experience of up to 1 Gbps and <10ms and provide the platform for cloud and AI-based video services. Various data-intensive applications, both individual as well as Business 2 Business (B2B), are emerging, such as AR, VR, and video applications. Industries, such as IT and telecom, retail, healthcare, automotive, media and entertainment, BFSI, and agriculture, have different types of video conferencing requirements, including high bandwidth, low power, ultra-low latency, and high speed. To cope with the increasing demand for video conferencing, the network capacity needs to be increased by using a new spectrum, which would lead to the wide adoption of the 5G core to deploy 5G technology for enhanced mobile broadband services.

Challenge: Internet bandwidth and technical glitch issues.

The lack of strong communication tools significantly limits employee productivity. Noise during video or low-quality video can create misunderstandings or consume more time of employees. Low quality of video streaming and disturbances during video conferences can significantly limit effective communication among workers, especially in the COVID-19 situation. Many people are frustrated due to the bad quality of video and other disturbances that occur during video conferences.

Healthcare and Life Science’s vertical is expected to grow at a higher rate during the forecast period

The healthcare and life sciences vertical deals with diverse clinical, administrative, and financial content on a daily basis. This results in the requirement for channelized content insights and accurate clinical information that can be consolidated through video conferencing Solution. The collaborations enable healthcare providers in telemedicine and patient care, medical education, and healthcare administration applications to offer enhanced patient care by providing them with improved communication options. The solution enable face-to-face interactions between patients, healthcare teams, and family members to discuss various treatment options, located anywhere in the world. Video conferencing technology also helps with patient monitoring, consulting, and counseling. Currently, the video conferencing market is witnessing increased growth opportunities in the healthcare and life sciences vertical. This growth can be attributed to the increasing requirement for video Solution to enhance clinical collaborations, staff training, medical education, and healthcare communication.

To know about the assumptions considered for the study, download the pdf brochure

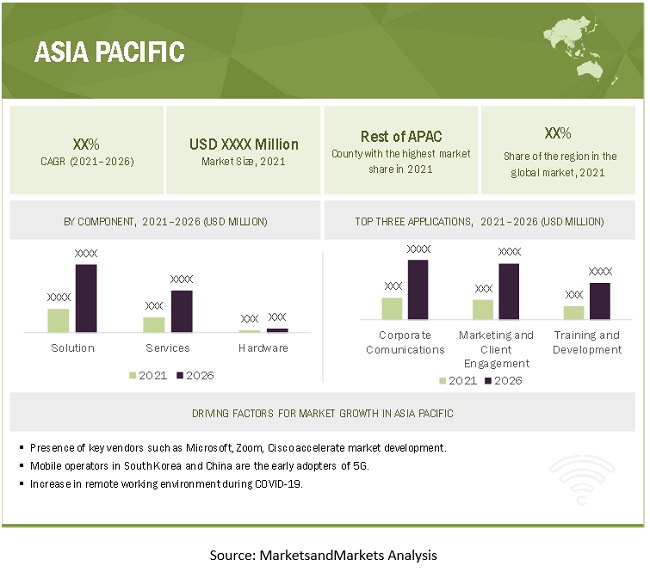

APAC to account for the largest market growth during the forecast period

APAC is estimated to hold the largest market share in 2020. The region is transforming dynamically with respect to the adoption of new technologies across various sectors. The infrastructural growth in APAC, especially in Japan, South Korea, Australia, Singapore, China, and India, and the increasing deployment of 4G and 5G networks present huge opportunities for the implementation of the video conferencing.

The video conferencing market in the APAC region is growing at a significant rate during the COVID-19 pandemic. The usage of technologies, such as cloud computing, AI, and IoT, is increasing in the region to effectively operate connected devices in hospitals, medical facilities, and other healthcare organizations. To maintain business continuity, organizations in this region are adopting the remote working approach for their employees. As a result, there is a significant demand for video conferencing solution across industries in the region.

Market Players

The report covers the competitive landscape and profiles major market players, such as Microsoft Corporation (Microsoft), Zoom Video Communications, Inc. (Zoom), Cisco Systems, Inc. (Cisco), Adobe Systems Incorporated (Adobe), Huawei Technologies Co. Ltd (Huawei), Avaya, Inc. (Avaya), Amazon Web Services, Inc. (AWS), Google, LLC (Google), Plantronics, Inc. (Poly), LogMeIn, Inc. (LogMeIn), Enghouse Systems Limited (Enghouse Systems), Pexip, AS (Pexip), Qumu Corporation (Qumu), Sonic Foundry Inc. (Sonic Foundry), Lifesize, Inc. (Lifesize), Kaltura Inc. (Kaltura), BlueJeans Network (BlueJeans Network), Kollective Technology, Inc. (Kollective), StarLeaf Inc. (StarLeaf), HighFive Inc. (HighFive), Logitech International SA (Logitech), Barco NV (Barco), Fuze Inc. (Fuze), Haivision Inc. (Haivision), and Premium Global Services Inc. (PGi).

The study includes an in-depth competitive analysis of these key players in the video conferencing market with their company profiles, recent developments, and key market strategies.

Scope of Report

Report Metric | Details |

Market size available for years | 2020-2026 |

Base year considered | 2020 |

Forecast period | 2022-2026 |

Forecast units | Value (USD Million) |

Segments covered | Component, vertical, deployment mode, application, and region. |

Regions covered | North America, Europe, APAC, Middle East and Latin America |

Companies covered | Microsoft (US), Zoom(US), Cisco(US), Adobe(US), Huawei(China), Google(US), Avaya(US), AWS(US), Poly(US), LogMeIn(US), Enghouse Systems (Canada), Pexip (Norway), Qumu (US), Sonic Foundry (US), Lifesize (US), Kaltura (US), BlueJeans Network (US), Kollective Technology (US), StarLeaf(UK), HighFive (US), Logitech(Switzerland), Barco(Belgium), Fuze (US), Haivision (Canada)and Premium Global Services (US). |

This research report categorizes the Video Conferencing to forecast revenue and analyze trends in each of the following submarkets:

Based on component:

Based on Hardware:

- Multi point Control Unit

- Hard Codec

- Peripheral Devices

Based on Deployment mode:

Based on Application:

- Corporate Communications

- Training and Development

- Marketing and client engagement

Based on regions:

- North America

- Europe

- APAC

- Middle East and Africa

- Latin America

Recent Developments:

- In January 2021, Microsoft partnered with SAP’s intelligent suite of Solution, building new integrations between Microsoft Teams and SAP Solution, such as SAP S/4HANA, SAP SuccessFactors, and SAP Customer Experience

- In September 2020, Zoom Video Communications partnered with Lumen to enable Lumen to offer Zoom as part of its Unified Communications and Collaboration Suite. This will enhance the user experience for the Unified Communications and Collaboration Suite and will provide enhanced customer reach for Zoom

- In September 2020, Avaya partnered with Telarus, the international distributor of business cloud infrastructure and contact center services. According to the partnership, Telarus would begin offering the new ACO by RingCentral UCaaS solution to its extensive partner network in the UK. The Telarus United Kingdom joined the Avaya Master Agent program to deliver a new all-in-one, call-meet-message app.

- In August 2020, Google acquired StratoZone, a US-based cloud assessment company, to help partners and customers plan and automate data center migrations to Google Cloud Platform.