< Key Hightlight >

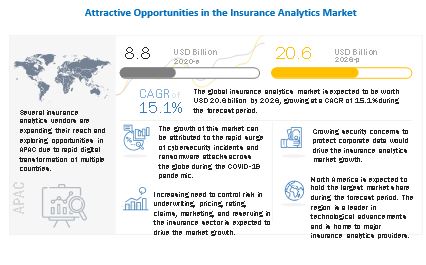

The global insurance analytics market size is expected to grow from USD 8.8 billion in 2020 to USD 20.6 billion by 2026, at a Compound Annual Growth Rate (CAGR) of 15.1% during the forecast period. Increasing focus on enhancing customer experience and the growing trend of digitalization would drive the market growth. However, rising cyberattacks and its threats is expected to restrain the market growth. Factors such as, need for cloud-based digital solutions by the insurer and COVID-19 accelerated organizations to new customer engagement through digital experiences would create opportunities.

To know about the assumptions considered for the study, download the pdf brochure

COVID-19 impact on the global insurance analytics market

Several insurance providers are accelerating investments in digitization and closing gaps in business continuity models. The integration of third-party data to mitigate risk is increasing in urgency. Throughout this time, customers are reminded of how significant the role of insurance is in their lives. For example, health coverage assists with drug and treatment plans for the ill, employment insurance helps those impacted by the economic turmoil, and business interruption coverage supports businesses unable to operate. Companies must continue investing and enabling access for customers while ensuring underwriters are well-informed of upcoming risks. Emergencies, such as COVID-19, highlight the need for insurers to seamlessly integrate reliable data sources, actionable insights, and responsive control measures to help navigate the uncertain landscape. By leveraging data and investing in digitization and analytics, insurers can navigate this challenging period and move the industry forward.

Market Dynamics

Drivers: Rising need for big data and predictive modeling capability during the COVID-19 pandemic drives the adoption of insurance analytics tools

Data is one of the most valuable assets an insurer can have, and predictive analytics has been helping businesses make the most of that data. The COVID-19 crisis has shown insurers that the ability to predict change is invaluable, and predictive modeling is a great tool for carriers that know they need to make changes but want to ensure they are doing it accurately. The capability of predictive modeling in insurance software can help define and deliver rate changes and new products more efficiently. Predictive analytics and big data together enable insurers with valuable insights such as forecasting customer behavior and supporting underwriting processes.

Predictive analytics tools can collect data from a variety of sources from both internal and external, to better understand and predict the behavior of insureds. Property and Casualty (P&C) insurance companies are collecting data from telematics, agent interactions, customer interactions, smart homes, and even social media to better understand and manage their relationships, claims, and underwriting. Insurers can quickly and accurately consolidate data and generate new insights that paint a complete picture of a customer. What are their buying habits? What is their risk profile? How apt are they to buy new or expanded coverage? Before predictive analytics, insurers could estimate or take guesses at these questions, but now they are able to accurately and effectively service customers, which ultimately results in happier customers and increased revenues. This helps insurers provide a personalized experience to consumers.

Restraint: Rising cyberattacks and their threats

P&C insurance companies are always battling various instances of frauds and often are not as successful as they expect. As other sectors, such as banking, become more secure, hackers are turning their attention toward more vulnerable target insurance companies. Insurers maintain a huge database of Personally Identifiable Information (PII) related to policyholders that make an appealing target for identity thieves, including names, birthdates, social security numbers, street, and email addresses, health data, and employment data, such as income. Information related to policyholders’ personal property, including homes and cars, can also be a target.

Over the years, various insurers have invested in security tools that offer a false sense of security. In reality, attackers are advancing faster than traditional cybersecurity tools such as firewalls and antivirus software and are now leveraging encryption and other advanced attack techniques that can evade detection. In fact, according to the KPMG Global CEO Outlook survey, only 43% of insurance executives said their organization was prepared for a cyberattack on their insurance company. This is a dangerous risk as attacks on insurance firms can result in significant financial damages such as fines and lawsuits, as well as reputational damage and loss of trust, a factor that will negatively impact an insurer’s brand and market value.

Opportunity: COVID-19 accelerated organizations to new customer engagement through digital experiences

Digital channel usage has seen a spike during the pandemic. Corporate investments in digital experiences will need to mirror new ways of living and working. As customers continue to ‘go’ and ‘stay’ digital, post-crisis expectations for digital experience will continue to rise. Organizations are witnessing stunning shifts in customer interaction volumes, types, and transactions. The timeline for developing relationships with customers is now significantly compressed. During their prolonged time at home, consumers have become more willing and are able to use digital methods of engagement. Already digital-savvy consumers are increasing their use, while individuals who once resisted digital interactions such as eCommerce, mobile finance, and video calls are emerging as digitally engaged customers. The emergence of new digital customer profiles is expected to continue and will require ongoing analysis to maintain the right customer sales and service channel mix.

Both during and post-COVID-19 situations, companies should focus customer engagement on reassurance- and confidence-building to continuously reinforce the value of products, services, and the organization itself. Data and feedback collected from social media, smart devices, and interactions between claims specialists and customers are straight from the source. Data that is not harvested through outside channels (such as the typical demographic material used in the past, including criminal records and credit history) is more direct and can provide valuable insights for P&C insurers. The innovation demonstrates that digital capabilities created during the pandemic can become a permanent engagement strategy. As a result, the foundation has been set for organizations to think more holistically related to the flexibility of their workforce across customer engagement touchpoints. This, in turn, will drive significant changes in customer sales and support operating models as well as the workforce skills required to succeed.

Challenge: Data security and privacy concerns

Security threats are projected to grow even further in the future. In the past four years, the financial impact of cybercrimes increased by nearly 78%, and the time it takes to resolve cyberattacks has increasingly doubled. The increase in data from various sources is becoming cumbersome for several IT teams. The inefficiency of managing exabytes and petabytes of data has led to an increase in the chances of security breaches and data loss. It may seem as if insurance analytics is a threat to data privacy. However, the actual threat is poorly managed data. Before buying data, organizations should do their research and ensure they are receiving data from a reputable provider that offers accurate data. As data consists of customer demographic information, organizations may develop algorithms that penalize individuals based on their age, gender, or ethnicity. Organizations should always have a detailed and precise representation of customers, account for biases, and offer fairness above analytics.

Data privacy concerns related to how critical enterprise data or personal information to be used or misused is a barrier to the adoption of cyber insurance. The global spread of COVID-19 has generated a lot of questions related to data protection, privacy, security, and compliance. Owing to COVID-19, companies, and organizations are reviewing their existing privacy policies to ensure the appropriate disclosure of Personally Identifiable Information (PII) to government agencies and cyber insurers to ensure the privacy of data. Some enterprises hesitate in revealing reliable information related to risk exposures in their environment, making it burdensome for insurers to provide guidance on an effective cyber insurance policy. Insureds are reluctant to share information with insurers due to the fear of disclosure risks. Enterprises are wary when it comes to revealing cyber incident data as they feel that the exposed data could further intensify attacks and expose it to regulatory fines or legal fees.

Tools segment to constitute a larger market size during the forecast period

Insurance analytics tools are widely adopted by various end users, such as insurance companies, third-party administrators, agents, and brokers, to gain a competitive advantage over others by using data as a strategic asset. The growing emphasis on compliance as well as government regulations across the insurance sector has also fueled the adoption of insurance analytics solutions, especially in highly regulated regions such as North America and Europe. The emerging regulations, such as GDPR, are expected to further propel the demand for insurance analytics solutions during the forecast period. In addition to the strict governance and compliance policies, insurance analytics solutions also help enterprises avert risks through fraud and risk management applications and optimize their daily operations, leading to a reduced operational cost.

Risk management segment to hold the largest market size during the forecast period

Insurers are widely using analytics solutions to understand the potential risks and deploy countermeasures to mitigate losses, or at least screen, pre-empt, and assess the cost of risks in the underwriting process. Risk management involves the identification, assessment, and management of potential risks, incorporating analytics to support decision-making by clearly stating business goals and objectives, and facilitating precise information management with a better understanding of the trade-offs between risks and rewards. Risk management provides insurers with the risk capacity to maintain specific credit ratings, manage capital, and reduce earnings volatility across insurance companies.

Cloud deployment model to grow at a higher CAGR during the forecast period

The cloud deployment model is expected to grow at a higher CAGR during the forecast period. Cloud-based solutions are gaining a firm hold in the market due to various benefits, such as cost control, resource pooling, and less implementation time. Cloud deployment offers flexibility, scalability, and cost-effectiveness benefits. It also enables an enterprise to have more control over the server, infrastructure, and systems that can be configured as per the business requirements

APAC region to grow at the highest CAGR during the forecast period

The global insurance analytics market by region covers five major geographic regions: North America, Asia Pacific (APAC), Europe, Middle East & Africa (MEA), and Latin America. APAC is expected to grow at the highest CAGR during the forecast period. APAC constitutes major countries, such as China, Japan, South Korea, Australia, and the rest of APAC, which are increasingly contributing toward the development of data analytics solutions in the insurance analytics market. Various end users such as insurance companies and government agencies are leading the race in terms of cloud adoption in the APAC region.

Key Market Players

The insurance analytics market comprises major solution providers, such as IBM(US), Salesforce(US), Oracle(US), Microsoft(US), Sapiens (Israel), OpenText (Canada), SAP (Germany), Verisk Analytics (US), SAS Institute (US), Vertafore (US), TIBCO (US), Qlik (US), Board International (Switzerland), BRIDGEi2i (US), MicroStrategy (US), Guidewire Software (US), LexisNexis Risk Solutions (US), WNS (India), Hexaware Technologies (India), Pegasystems (US), Applied Systems (US), InsuredMine (US), ReFocus AI (US), RiskVille (Ireland), Pentation Analytics (US), Habit Analytics (US), Artivatic.ai (India), CyberCube (US), and Arceo.ai (US). The study includes an in-depth competitive analysis of these key players in the insurance analytics market with their company profiles, recent developments, and key market strategies.

Scope of the report

Report Metric | Details |

Market Size Available for years | 2016-2026 |

Base year considered | 2019 |

Forecast Period | 2020-2026 |

Forecast units | Value (USD Billion) |

Segments covered | Application, Component, Organization Size, Deployment Mode, End User, and Region |

Geographies covered | North America, APAC, Europe, MEA, and Latin America |

Companies covered | The major market players include IBM(US), Salesforce(US), Oracle(US), Microsoft(US), Sapiens (Israel), OpenText (Canada), SAP (Germany), Verisk Analytics (US), SAS Institute (US), Vertafore (US), TIBCO (US), Qlik (US), Board International (Switzerland), BRIDGEi2i (US), MicroStrategy (US), Guidewire Software (US), LexisNexis Risk Solutions (US), WNS (India), Hexaware Technologies (India), Pegasystems (US), Applied Systems (US), InsuredMine (US), ReFocus AI (US), RiskVille (Ireland), Pentation Analytics (US), Habit Analytics (US), Artivatic.ai (India), CyberCube (US), and Arceo.ai (US). |

The study categorizes the insurance analytics market based on component, deployment mode, organization size, application, end user are at the regional and global level.

On the basis of component, the insurance analytics market has been segmented as follows:

On the basis of application, the market has been segmented as follows:

- Claims Management

- Risk Management

- Customer Management and Personalization

- Process Optimization

- Others (workforce management and fraud detection)

On the basis of organization size, the insurance analytics market has been segmented as follows:

On the basis of deployment modes, the market has been segmented as follows:

On the basis of end user, the insurance analytics market has been segmented as follows:

- Insurance Companies

- Government Agencies

- Third-party Administrators, Brokers and Consultancies

On the basis of regions, the market has been segmented as follows:

- North America

- Europe

- Germany

- UK

- France

- Rest of Europe

- APAC

- Japan

- China

- Australia

- South Korea

- Rest of APAC

- MEA

- Kingdom of Saudi Arabia (KSA)

- United Arab Emirates (UAE)

- South Africa

- Rest of MEA

- Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In September 2020, IBM launched a new risk-based service IBM Risk Analytics. IBM Risk Analytics is designed to help organizations apply the same analytics used for traditional business decisions to cybersecurity spending priorities.

- In August 2020, WNS launched EXPIRIUS, AI, and analytics-driven customer experience solution.

- In June 2020, Microsoft announced a new global skills initiative required for the COVID-19 scenario. The objective of the initiative is to provide extensive access to digital skills in improving economic recovery, particularly for the people hardest hit by job losses.

- In March 2020, Board International released the latest version of its leading Board decision-making platform – Board 11.2. Already making business reporting, planning, and forecasting more effective with its unified approach, the Board platform is now even faster and more flexible. One of the most significant enhancements in the new version is the DeepLocker function, which enables users to lock data values at the cell or aggregate level along any hierarchy and across any dimension.

- In February 2020, Oracle and Microsoft expanded their cloud collaboration with a new cloud interconnect location in Amsterdam, Netherlands. The new interconnect will enable these businesses to share data across applications running in Microsoft Azure and Oracle Cloud.