< Key Hightlight >

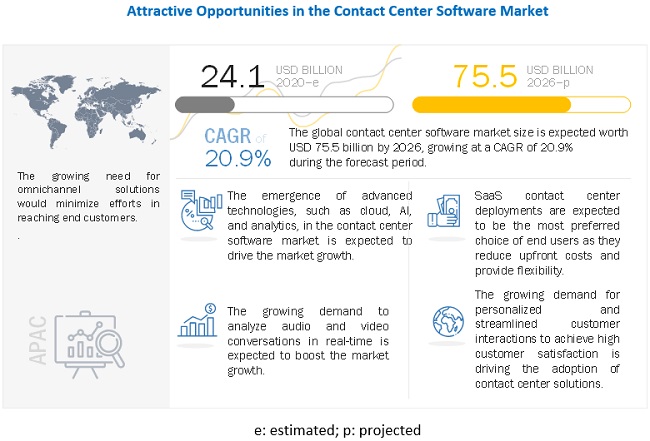

The global Contact center software market size is expected to grow from USD 24.1 billion in 2020 to USD 75.5 billion by 2026, at a Compound Annual Growth Rate (CAGR) of 20.9% during the forecast period. Major factors that are expected to drive the growth of the contact center software market include the rising adoption of advanced contact center technologies, need for handling contact center attrition and absenteeism, emerging role of social media in contact center operations, increasing adoption of virtual and cloud-based contact center solutions during and post-COVID-19 to achieve better business continuity, growing need for omnichannel solutions to minimize efforts in reaching end customers, continuous transitions to cloud-based contact centers, and rising demand for personalized and streamlined customer interactions to achieve high customer satisfaction. However, inadequate network bandwidth in the emerging economies minimizes the adoption of VoIP and cloud-based telephony, high costs and long-term contracts associated with PRI phone services, and the impact of IVR frauds and cyber attacks on business operations are major restraining factors hindering the growth of the contact center software market.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact analysis on the global contact center software market

According to pre-COVID-19 growth data, the market’s CAGR should have been ~25.0%. However, considering optimistic and pessimistic growth scenarios due to the cumulative growth obtained from the impact of market dynamics (drivers, opportunities, restraints, and challenges), and inputs from industry experts and multiple companies associated with the ecosystem, the growth rate is 25.8% in 2020 for the overall market estimation.

Market Dynamics

Driver: Rising adoption of advanced contact center technologies

As both contact centers’ home working agents and office agents manage in-bound, outbound, and blended calls, emails, web inquiries, and chats, organizations infuse their contact centers with robust software-based telephony technologies, such as ACDs, CTI, dialer APIs, and Voice over Internet Protocol (VoIP) softphones; and advanced analytics technologies, such as speech analytics and data analytics; and mobile technologies, such as smartphones, mobile screening, and mobile apps. These technologies enable organizations to improve their responsiveness by quickly adapting to dynamic customer preferences and helps deliver consistent experiences. Whereas software-based telephony technologies provide contact centers the freedom to contact customers through their desktops, without the need for a hardware-based telephone system, the infusion of analytics to monitor and analyze interactions for providing customized responses and video enablement to engage in face-to-face video calls, add to the benefits of modern-age contact centers. According to Cisco Contact Center Global Survey 2020, over 80% of the respondents are considering data analytics, bots, and AI robotic automation to be an important function of contact centers.

Furthermore, smartphone access provides global accessibility to the customer and further provides contact center agents with appropriate real-time information irrespective of their location. This further adds to the growing demand for mobile-enabled, analytics-powered, advanced contact center solutions. According to the 2017 State of Global Customer Service Report by Microsoft, 43% of the surveyed young age professionals use mobile phones or tablets to start a customer service interaction. Similarly, according to the October 2016 State of the Connected Customer Report by Salesforce, 60% of the business buyers and 43% of the consumers stated that it was very important to receive in-app mobile support from companies they do business with.

Restraint: Impact of IVR frauds and cyber attacks on business operations

As more contact centers are moving toward adopting self-service channels, IVRs, and webchats for minimizing the call volumes at the agents’ end, fraud attacks and associated losses are on the rise, especially after a surge in the number of calls due to the outbreak of COVID-19. Many fraudsters have developed certain algorithms to autodial IVRs, bypass PIN securities, and crack the last digits of Social Security Numbers and CVVs of credit and debit cards to perform account takeovers and extract money from people’s bank accounts, despite the absence of a payment IVR in place.

- According to the 2021 Voice Intelligence and Security Report, 66% of surveyed professionals have witnessed new types of frauds in the contact centers, and over 57% witnessing the misuse of IVR by fraudsters for account mining or reconnaissance during COVID-19.

- Also, according to the 2019 State of Call Center Authentication survey, 51% of respondents working in the banking and financial services segment consider the phone channel as the top threat for account takeover attacks, while call centers were identified as the primary channel of attack by 23% of non-financial organizations.

Furthermore, cyberattacks for stealing potential customer information from other online contact channels, such as the web, social media, and SMS have also increased. Recently, SANS Institute released a new cloud security report based on a survey of several hundred companies across the US, Asia, Europe, and Canada. According to the survey, 19% of respondents suffered from cloud cyberattacks and are concerned about storing information in the cloud. Contact centers are a rich source of critical customer information, as they continuously interact with customers and process large volumes of information that attracts cybercriminals to target these contact centers. The growing number of security challenges force contact centers to stick to the traditional methods of customer interactions, thereby affecting the adoption of new contact center methods or technologies. This, in turn, maximizes the unattended call and call-waiting-in-queue rates and consequently decreases the customer satisfaction scores and brand value.

Opportunity: Dynamic customer demands for robust self-service interactions

Although customers demand live interactions with contact center agents to get solutions for their queries, the growing contact center turnover rate and involved waiting and hold time in connecting to an agent, result in a negative customer experience. As customer experience plays an important role in maintaining customer relationships as well as improves products and services based on customer feedback, the need for improving customer satisfaction levels becomes important to organizations. The incorporation of robust self-service bots and cutting-edge technologies such as AI, ML, and analytics enables organizations to connect with their customers for delivering enhanced customer experiences, especially after the influx in calls during and post the COVID-19 crisis.

- IBM witnessed a 40% increase in their traffic to Watson Assistant from February to April 2020.

- According to 2021 Voice Intelligence and Security Report by Pindrop, contact center call volumes jumped over 800% from normal levels in the second quarter of 2020. Also, in the last quarter of 2020, call durations were up 14% when compared to the pre-COVID-19 levels.

Owing to this, various contact center solution providers launched self-service AI chatbots and IVRs, to automate call handling and reduce call answering and query resolution time to serve influx in contact center calls and webchat interactions.

Challenge: Data privacy and security aspects

Contact centers are always at risk as they store a huge amount of crucial customer data. In 2019, the number of fraud attempts against call centers increased, and companies are responding with sophisticated tools to identify suspicious calls. According to the 2019 State of Call Center Authentication survey, 54% of respondents wanted to complete the authentication before answering the calls. The validation of calls before they are picked up by IVR or call center agents eliminates the need to authenticate customers on the phone. Longer calls increase the operating costs of call centers. They also frustrate customers, which can damage the customer experience and overall customer satisfaction. However, the introduction of intelligent IVRs, also known as IVAs, has added different levels of security to authenticate users. Also, with options of choosing privacy-compliant and reliable contact center solution providers, the privacy and security challenges are expected to decline in coming years.

Solutions segment to hold a larger market size during the forecast period

The growing agent attrition and increasing need for improving customer satisfaction and agent performance as per contact center KPIs and metrics are boosting the demand for robust WFO, omnichannel contact centers, and customer engagement solutions. Contact center solutions help manage contact center operations as per contact center metrics, such as AHT, TAT, FCR, ACW, NPS, CSAT, and CES, to monitor, assess, and improve agent performance as well as customer satisfaction. The demand for contact center solutions is also rising with the growing business continuity challenges, work from home trends, and resource wastage on manual tasks. Vendors in the market offer contact center solutions either in the form of an integrated platform with all key contact center capabilities or best-of-breed contact center solutions. The emerging technologies such as AI, ML, NLP, and advanced analytics and the integration capabilities of contact center solutions with various business platforms, including CRM, and out-of-the-box applications have facilitated the streamlining of contact center processes and better management of contact center agent performance. Some of the major vendors offering contact center solutions across regions are Genesys, Cisco, NICE, Avaya, Five9, Vonage, AWS, 8x8, Talkdesk, and Atos.

On-premises deployment type to hold a larger market size in 2020

The on-premises deployment model is the most traditional approach for implementing contact center solutions. In this deployment model, the deployment of software takes place at client’s premises. The on-premises deployment involves investments in on-premises-based telephony systems and ACDs, in-house servers, networks, storage, hardware, software licenses, and other infrastructure requirements along with the IT personnel necessary to administrate and support on-premises systems. Therefore, it is mostly preferred by large organizations or data-sensitive organizations with a large number of contact center agents and the demand for greater control over the security of their data and systems.

The on-premises deployment model of contact center solutions provides organizations with robust contact center management benefits, along with the ownership of their consumer/customer data. The on-premises deployment model also helps manage risks, business processes, and organization’s internal policies. Moreover, it enables adherence to external compliance requirements, as and when required. The flexibility to customize solutions as per requirements and integrate with existing business applications, such as finance, CRM, HR, and SCM platforms; voice, video, and messaging APIs; and out-of-the-box applications, adds to on-premises deployments in the contact center software market.

Large enterprises to hold a majority of the market share during the forecast period

Organizations with more than 1,000 employees are categorized as large enterprises. These enterprises constantly adopt new and emerging technologies for automating mundane tasks and increasing the overall productivity and efficiency of their contact centers. The adoption of contact center solutions in large enterprises is higher as compared to SMEs. This is mainly attributed to sufficient budgets; the presence of a large number of contact center agents, high call volumes, and customer agent interactions; and affordability due to economies of scale that enables organizations to leverage contact center solutions. The contact center solutions carry the extreme potential for large enterprises as low uptime, high number of unanswered calls, high wait and hold time, non-availability of agents to respond to customer requests, and low customer satisfaction scores may cost them with the loss of customers, ultimately affecting their brand image.

Telecommunications industry vertical to hold a significant market share during the forecast period

Telecom companies are thriving to be innovative and maximize their revenues by implementing the right tools at the right place to improve the uptime of their customer service and harness massive customer data for utilizing actionable insights. These companies are also managing terabytes of data regarding customer interests, their requests, and complaints stored in silos and scattered across the organization. Thus, for faster and easier processing of useful data as well as interactions with agents, telecom companies are searching for a data-driven advanced automated solution to achieve accurate real-time insights through data mining and analytics. This has increased the number of partnerships of telecom companies with OTT platform providers, such as Netflix, Amazon Prime Video, HBO Now, and Hulu.

With its large size, the industry exhibits complex contracts, interdependency of services, disparate spends, and minimal resources and time. Contact center solutions help telcos to overcome such challenges through advanced data analytics and workflow automation capabilities. The solutions significantly help companies in identifying potential threats by collecting data from various data channels, including phone, social media, email, and web, thereby helping them in forming better customer relationships. Furthermore, these solutions provide telecom companies control over their diversified and mixed workforce consisting of in-house sales employees and remote working employees.

To know about the assumptions considered for the study, download the pdf brochure

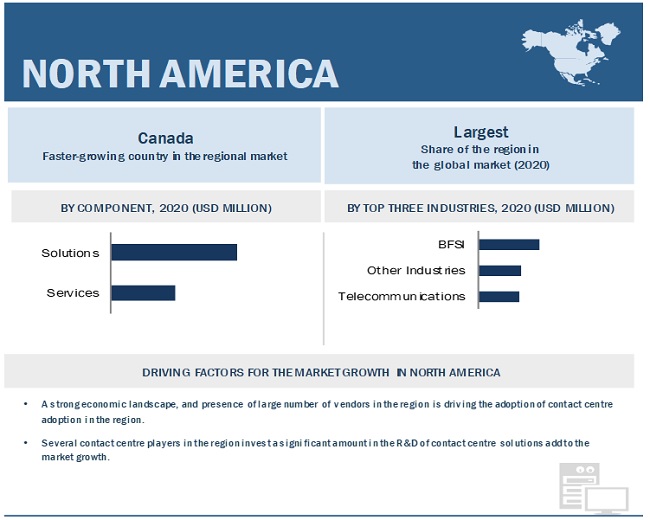

North America to account for the largest market size during the forecast period

The global contact center software market by region covers five major geographic regions, namely, North America, Asia Pacific (APAC), Europe, Middle East & Africa (MEA), and Latin America. North America is expected to be the most promising region for major verticals, such as IT, BFSI, and telecommunications. As per CallMiner, a software company, the US companies lose USD 136.8 billion per year due to consumer switching. Hence, to increase revenue and avoid loss, more and more North American companies are moving toward contact center solutions for catering to the growing customer requests, resolving customer complaints, and improving on feedback coming from all digital and non-digital channels.

The adoption of contact center solutions, especially during and post-COVID-19, to cater to the upsurge in call volumes is expected to drive the market growth in 2021. For instance, the US government and public sector call centers across the US, including Hudson Valley Region 211, Harris County, Marion County, Integral Care, LA County 211, and 211 San Diego, have adopted contact center solutions from renowned vendors to ensure citizen safety and convenience. The rising adoption has added to the growth of the contact center software market in North America.

Key Market Players

The contact center software vendors have implemented various types of organic as well as inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions, to strengthen their offerings in the market. The major vendors offering contact center software solutions and services globally are NICE (Israel), Genesys (US), Cisco (US), Avaya (US), Five9 (US), Talkdesk (US), Vonage (US), 8x8 (US), AWS (US), Atos (France), Alcatel-Lucolent Enterprise (France), SAP (Sweden), Oracle (US), RingCentral (US), IBM (US), Lifesize (US), Content Guru (UK), Aspect Software (US), Enghouse Interactive (US), 3CLogic (US), Ameyo (India), Verizon (US), Intrado (US), AT&T (US), BT (UK), Twilio (US), Vocalcom (France), NEC (Japan), Evolve IP (US), Mitel (Canada), and ZTE (China).

The study includes an in-depth competitive analysis of key players in the contact center software market with their company profiles, recent developments, COVID-19 developments, and key market strategies.

Scope of the report

Report Metric | Details |

Market size available for years | 2016–2026 |

Base year considered | 2019 |

Forecast period | 2021–2026 |

Forecast units | Million (USD) |

Segments covered | Component (Solutions & Services), Deployment Model, Organization Size, Industry, and Region |

Geographies covered | North America, APAC, Europe, MEA, and Latin America |

Companies covered | NICE (Israel), Genesys (US), Cisco (US), Avaya (US), Five9 (US), Talkdesk (US), Vonage (US), 8x8 (US), AWS (US), Atos (France), Alcatel-Lucolent Enterprise (France), SAP (Sweden), Oracle (US), RingCentral (US), IBM (US), Lifesize (US), Content Guru (UK), Aspect Software (US), Enghouse Interactive (US), 3CLogic (US), Ameyo (India), Verizon (US), Intrado (US), AT&T (US), BT (UK), Twilio (US), Vocalcom (France), NEC (Japan), Evolve IP (US), Mitel (Canada), and ZTE (China). |

This research report categorizes the contact center software market based on component, deployment type, organization size, vertical, and region.

Based on the component:

- Solutions

- Omnichannel Routing

- Workforce Engagement Management

- Reporting And Analytics

- Customer Engagement Management

- Others (CTI, Messaging, Compliance, and Data Integration)

- Services

- Consulting

- Implementation and Integration

- Training, Support, and Maintenance

Based on the deployment model:

Based on the organization size:

Based on the industry

- BFSI

- Telecommunications

- Retail and Consumer Goods

- Manufacturing

- IT and ITeS

- Government and Public Sector

- Energy and Utilities

- Others

Based on the region:

- North America

- Europe

- APAC

- MEA

- Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In December 2020, Five9 partnered with Conn3ct, a CX, unified communications, and network services communication provider, to utilize the latter’s suite of communication channels for enhancing customer experiences and strengthening its foothold in EMEA.

- In October 2020, Cisco acquired BabbleLabs, a noise removal technology provider, to improve its platform’s video meeting capabilities with BabbleLabs competencies in noise removal and speech enhancements.

- In July 2020, NICE launched an interaction guidance solution, Real-Time Interaction Guidance, powered by its AI platform— ENLIGHTEN. Based on predictive behavioral models, the solution is aimed at determining and scoring agent behaviors for improving sales opportunity identification and increasing customer satisfaction.