< Key Hightlight >

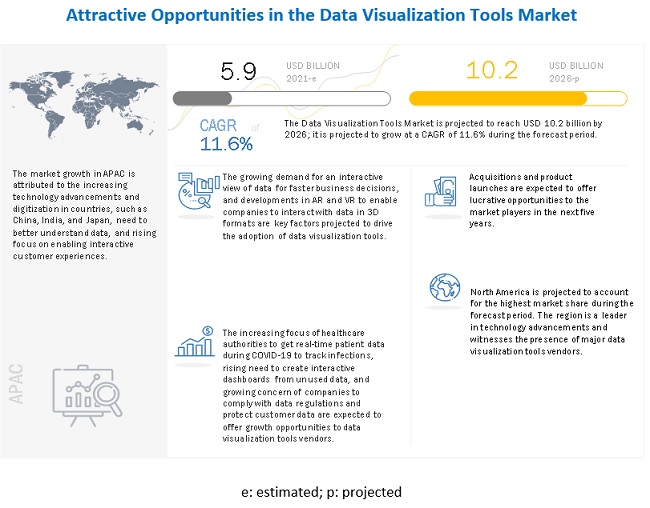

The global data visualization tools market size to grow from USD 5.9 billion in 2021 to USD 10.2 billion by 2026, at a Compound Annual Growth Rate (CAGR) of 11.6% during the forecast period. Various factors such as the growing demand for an interactive view of data for faster business decisions and increasing developments in Augmented Reality (AR) and Virtual Reality (VR) to enable the interaction of companies with data in 3D formats, are expected to drive the demand for data visualization tools.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on Global Data Visualization Tools Market

The data visualization tools market has witnessed several advancements in terms of tools offered by the industry players. Verticals such as manufacturing, retail, and energy and utilities have witnessed a moderate slowdown, whereas BFSI, government, and healthcare and life sciences verticals have witnessed a minimal impact. The COVID-19 pandemic has given rise to increased use of line charts, bar charts, and choropleth maps in the news. Simple data visualizations have become the key to communicating vital information about the coronavirus pandemic to the public. While these terms might not be familiar to all, the visualizations themselves certainly are. One of the most interesting developments due to the current COVID-19 crisis is that organizations that excel at the developments of dashboards centralize analytics and decision-making approaches and scale them exponentially across all connected channels.

Market Dynamics

Driver: Growing demand for an interactive view of data for faster business decisions

Today, most organizations are adopting a simplified process that consists of identifying, collecting, maintaining, and sharing a large amount of data. Data visualization tools are used for having a fast and simplified business decision-making process. The data should be provided with a standard visualization ability, which is used to identify customer preferences and tendencies, extract strategic insights, and help maintain a balance between the demand and supply of new and existing products. Companies across verticals adopt data visualization tools to understand data in an easy manner and derive actionable business insights. Data visualization tools in the cloud enable organizations to have a cost-effective and scalable way for data analysis. The data visualization capability helps companies identify business drivers and Key Performance Indicators (KPIs) through BI. Data visualization tools help companies eliminate unnecessary data to discover patterns, insights, trends, and usage strategies, which help leverage its growth in the market.

Restraint: Variation in data formats

Without data, there is no objective way to measure the success of efforts. Data is one of the most important elements of a business, which helps users in generating meaningful business insights. There is always variation in data, whether the data measures something as simple as the daily temperature or as complex as the success of a surgical procedure. Companies fail to analyze their data due to insufficient understanding. Employees may not know what data is, its storage, processing, importance, and sources. Data professionals may know what is going on, but others may not have a clear picture. As data has spread throughout society, one of the elements that have become evident is that there is a huge variation in the levels of understanding. This could even be in a high-powered business setting, where people who are used to seeing basic excel graphs do not understand anything more complex. The idea of interactivity within visualized data is not something they would ever feel necessary. However, there are others who would benefit from more complex visualizations, where they can see as much as possible in as smaller space as they can, through interactive design or just more complex features. It is, therefore, difficult for those designing visualizations to match up to the wide-ranging understanding of data and data visualizations.

Opportunity: Rising need to create interactive dashboards from unused data

Data is being generated on a large scale, be it Fitbit, Google, or Facebook, the use of data has evolved and is considered an integral part of the digital transformation of any business. The use of IoT continues to increase and the generation of insights from all incoming data is the need of the day. In today’s business environment, organizations use BI to make faster and more critical decisions. Through the internet, social media companies gather a large volume of data. It becomes difficult for them to distinguish whether a source of information is real or not. Most of the unstructured data obtained from various sources is not used. Unstructured data such as email correspondences account information, and old versions of related documents are not used to create value to help in making business decisions. Companies invest a lot in data collection to optimally use it. For instance, banks can pay heed to how online customers landed on the applications page, which would help to find measures on how to attract customers. The utilization of unused data can help companies gain valuable insights and drive their business. Data visualization tools come up with solutions to use all unused data. Hence, the increasing need for generating insights from unused data is expected to create an opportunity for the growth of the data visualization tools market.

Challenge: Lack of skilled professional workforce

Organizations often fail to identify where they need to allocate their resources, which results in deriving the full potential of data visualization. Most organizations still cannot harness the complete benefits of data visualization tools in the cloud due to the lack of awareness and professional expertise to utilize cloud-based data visualization tools optimally. Due to key factors, such as the shortage of skilled workforce or the complexity of data visualization tools, these organizations report problems in analyzing insights from a large volume of data. With the increasing demand for emerging technologies such as AI, ML, analytics, and IoT, businesses are looking for data scientists to be skilled with new-age technologies rather than older programming languages such as R, Ada, C, and Haskell. Currently, companies are looking for newer skills such as data visualization, ML, and AI, in order to make a more informed decision in this competitive landscape.

Among verticals, the healthcare and life science segment to grow at a the highest CAGR during the forecast period

The data visualization tools market is segmented on verticals into BFSI, government, healthcare and life sciences, retail and eCommerce, manufacturing, telecommunications and IT, transportation and logistics, and other verticals (education, media and entertainment, travel and hospitality, and energy and utilities). The BFSI vertical is expected to account for the largest market size during the forecast period. Moreover, the healthcare and life sciences vertical is expected to grow at the highest CAGR during the forecast period. To gain access to unstructured data such as output from medical devices, image reports, and lab reports is not useful to improve patient health. Healthcare providers are adopting data visualization tools that help them to gather real-time data insights to improve patient health.

The marketing and sales segment is expected to hold the larger market size during the forecast period

The data visualization tools market is segmented on the basis of business function into marketing and sales, human resources, operations, and finance. The marketing and sales business function segment is expected to account for the largest market size during forecast period. The growth can be attributed as data visualization tools enable sales managers to monitor sales performance against quarterly goals for revenue, the percentage of closed deals, and status of the deal stages in the sales funnel. Data visualization tools also help them in planning marketing strategies.

The on-premises segments is expected to hold the larger market size during the forecast period

The data visualization tools market by deployment mode has been segmented into on-premises and cloud. The cloud segment is expected to grow at a rapid pace during the forecast period. T The high CAGR of the cloud segment can be attributed to the availability of easy deployment options and minimal requirements of capital and time. These factors are supporting the current lockdown scenario of COVID-19 as social distancing, and online purchasing of goods hit the industry and are expected to drive the adoption of cloud-based data visualization tools. Highly secure data encryption and complete data visibility and enhanced control over data in terms of location and the real-time availability of data for extracting insights are responsible for the higher adoption of on-premises-based data visualization tools.

North America to hold the largest market size during the forecast period

North America is expected to hold the largest market size in the global data visualization tools market, while Asia Pacific (APAC) is expected to grow at the highest CAGR during the forecast period. The growing awareness for companies to uncover patterns from data silos in key countries, such as China, India, and Japan, is expected to fuel the adoption of data visualization tools. The commercialization of the AI and ML technology, giving rise to generate real-time data, and the need for further advancements to leverage its benefits to the maximum are expected to drive the adoption of data visualization tools in the region.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The data visualization tools vendors have implemented various types of organic as well as inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. The major vendors in the global data visualization tools market Salesforce (US), SAP (Germany), Microsoft (US), Oracle (US), IBM (US), AWS (US), Sisense (US), Alteryx (US), SAS Institute (US), Alibaba Cloud (China), Dundas (Canada), TIBCO Software (US), Qlik (US), GoodData (US), Domo (US), Klipfolio (Canada), Datafay (US), Zegami (England), Live Earth (US), Reeport (France), Cluvio (Germany), Whatagraph (The Netherlands), Databox (US), Datapine (Germany), Toucan Toco (France), and Chord (US). The study includes an in-depth competitive analysis of these key players in the data visualization tools market with their company profiles, recent developments, and key market strategies.

Scope of the Report

Report Metric | Details |

Market size available for years | 2015–2026 |

Base year considered | 2020 |

Forecast period | 2021–2026 |

Forecast units | USD Million |

Segments covered | Tool, organization size, deployment mode, business function, vertical, and region |

Geographies covered | North America, Europe, APAC, Latin America, and MEA |

Companies covered | Salesforce (US), SAP (Germany), Microsoft (US), Oracle (US), IBM (US), AWS (US), Sisense (US), Alteryx (US), SAS Institute (US), Alibaba Cloud (China), Dundas (Canada), TIBCO Software (US), Qlik (US), GoodData (US), Domo (US), Klipfolio (Canada), Datafay (US), Zegami (England), Live Earth (US), Reeport (France), Cluvio (Germany), Whatagraph (The Netherlands), Databox (US), Datapine (Germany), Toucan Toco (France), and Chord (US) |

This research report categorizes the data visualization tools market based on tool, deployment mode, organization size, business function, application, vertical, and region.

By tool:

By organization size:

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

By deployment mode:

By business function:

- Marketing and Sales

- Human Resources

- Operations

- Finance

By vertical:

- BFSI

- Government

- Healthcare and Life Sciences

- Retail and eCommerce

- Manufacturing

- Transportation and Logistics

- Telecommunications and IT

- Other Verticals (Media and Entertainment, Travel and Hospitality, Energy and Utilities, and Education)

By region:

- North America

- Europe

- UK

- Germany

- France

- Rest of Europe

- APAC

- China

- Japan

- India

- Rest of APAC

- MEA

- KSA

- UAE

- South Africa

- Rest of MEA

- Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In March 2021, Alteryx partnered with Tech Data, an APA company that automates analytics, data science, and processes to accelerate business outcomes. The partnership aims at providing Tech Data and its partners access to the Alteryx unified platform that simplifies analytics, data science, and process automation to accelerate digital transformation for customers.

- In March 2021, Tableau launched a new dedicated region in London, UK, to harvest data insights using its fully hosted SaaS offering, Tableau Online. This region would be dedicated to offer Tableau’s customers enhanced performance and more choice in data locality. The SaaS offering would be hosted by AWS’ infrastructure in London. Tableau Online enables its fast-growing European customer base to instantly access, analyze, and share data through visualization.

- In January 2021, Salesforce launched Vaccine Cloud that would help government agencies, healthcare organizations, businesses, nonprofits, and educational institutions rapidly, safely, and efficiently deploy and manage their vaccine programs. It helps governments, healthcare organizations, businesses, and non-profit organizations to manage and deploy vaccine programs for delivering vaccines through the Salesforce Customer 360 platform, including mobility solutions, bots, analytics, and integration capabilities.

- In November 2019, Microsoft announced the launch of Azure Synapse Analytics, a new Azure solution for enterprises. The company describes the solution as the next evolution of Azure SQL Data Warehouse. It highlights the solution’s integration with Power BI, an easy-to-use BI and reporting tool, as well as Azure Machine Learning for building models. It aims at providing core capabilities for customers to collect and analyze data by breaking down data into silos for better understanding.

- In September 2019, Oracle launched Oracle Analytics for Fusion ERP, designed to provide line-of-business users and decision-makers with personalized analytics and improved cross-line-of-business analytics capabilities. It would include dashboards and visualizations via Oracle Analytics Cloud that would connect the entire enterprise and unify KPIs across functions for a holistic view of enterprise performance.

- In August 2019, Salesforce acquired Tableau Software. With this acquisition, Salesforce aims at competing with Microsoft in the area of Power BI and data visualization space. As a part of Salesforce, Tableau would be positioned to accelerate and extend its mission to help people see and understand data. Tableau would operate independently under the Tableau brand, driving forward its mission, customers, and community.

- In July 2019, IBM released a new, updated version of IBM Cognos Analytics on Cloud. It is equipped with a host of new ease-of-use features and a low price point. It is designed to extend the enterprise-grade business analytics suite to SMEs. IBM Cognos Analytics on Cloud 11.1.3 is offered in three distinct tiers: USD 15/user per month for Standard Edition, USD 35/user per month for Plus Edition, and USD 70/ user per month for Premium Edition.

- In March 2019, SAP announced enhancements to the SAP Analytics Cloud solution, which includes augmented analytics, BI, enterprise planning workflows, and data integration capabilities. With this update, SAP aims at building a stronger unified solution. Designed for business users, the solution is intuitive and powerful with an end-to-end data and analytics approach, enabling confident, data-driven decisions and intelligent processes that power better business outcomes.

Frequently Asked Questions (FAQ):