< Key Hightlight >

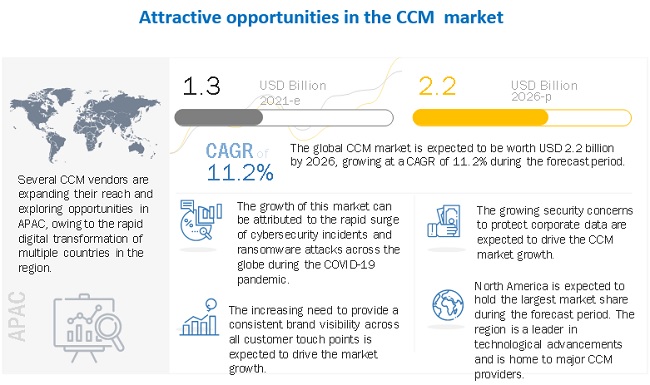

The global CCM market size is projected to grow from USD 1.3 billion in 2021 to USD 2.2 billion by 2026, at a Compound Annual Growth Rate (CAGR) of 11.2% during the forecast period. The major growth drivers for the market include increasing adoption of CCM solutions and services in various verticals such as IT and telecom, retail and eCommerce, healthcare, BFSI, travel and hospitality, government, utilities, and other verticals.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact Analysis on CCM Market

The COVID-19 pandemic has affected every segment of society, including individuals and businesses. Businesses and NGOs around the world are quickly working to develop communication management plans to respond to the COVID-19 impact, which is spreading around the world. Investment in CCM platforms, augmented by AI and the cloud, to scale crisis communications has been impacted by IT’s retracted spending as a result of COVID-19 priorities. Because of lockdowns and social-distancing measures, customers have come to rely upon online, digital brands during the COVID-19 crisis. CCM solutions combined with transaction data hold the key to personalization. CCM solutions enable companies to offer customers with personalized service experience, speedy response and resolution to their inquiries and a positive connection with a brand 24 hours a day, 365 days a year.

Market Dynamics

Driver: The rapid CCM solutions help in keeping customer engagement through omnichannel

One of the major factors driving the growth in the CCM market is the increasing need to keep customers engaged through communication over various channels. Organizations need to constantly deliver relevant documents and promotional offers to their customers in order to maintain a healthy customer relationship. Customers in today’s technology-driven world expect to interact with companies through channels of their choice, such as voice, email, web, mobile, Short Message Service (SMS), and social media, at their convenience. To remain competitive, companies are facilitating customer interactions across these various channels. But what still hampers delivering seamless CX is that these multiple channels exist in silos and, thus, restrict an organization from delivering an omnichannel experience to customers. Customers get the freedom to switch between different channels without any hassles, such as loss of information or the need to repeat existing information. It is expected that more companies will switch to omnichannel in 2021 and move away from a siloed approach.

Restraint: Data synchronization and complexities

Businesses collect an enormous amount of data through a variety of channels to gain a better understanding of customer preferences, needs, purchasing patterns, and so on. With the proliferation of digital technologies and mobile devices, organizations are flooded with data gathered from internal and external sources. In such a case, better data synchronization plays a crucial role in designing and analyzing customers’ journeys. Traditionally, enterprises have relied on batch-oriented file synchronization. However, in this method, the organizations might face declining profits with eroding customer loyalty. The customers raising queries to the call center would witness resistance from call center workers and see outdated transaction information on self-service websites. Enterprises need to improve the speed of integration with consistent growth and complexity of touchpoints in the customer feedback process. The data is collected from different touchpoints, which differ from one another, and businesses have to categorize the data based on customer needs and expectations. One touchpoint data is not similar to the other; so, businesses cannot combine them since they have to structure them in different ways. A large amount of structured and unstructured databases requires significant resources, such as money, time, and employees to analyze.

Opportunity: Integration of CCM technology with the cloud to provide major business opportunities

The cloud-based platform is constantly evolving, which provides the deployment of software applications without the complexity and cost of managing and acquiring the underlying software and hardware layers. SMEs are laying emphasis on enhanced customer interactions in order to add value to their offerings. CCM software platform is expected to evolve in a cloud-based environment to cater to large enterprises as well as SMEs. As a result of this, enterprises are expected to switch to a cloud environment in order to inculcate flexibility in a communication system.

Challenge: Increased focus on data privacy and security

In today’s competitive marketplace, the marketing team requires real-time and secure data to deliver efficient CX. Such data, which is used in support and communications, may include a variety of data types, such as public information, big data, and small data collected from the customers. This data can include permissions, individual preferences, and updated contact information on products, services, and communication platforms. Thus, the vendors need to ensure high-level data security to maintain customer trust. Cyber-attacks have increased significantly and have become sophisticated. For instance, in recent times, cybercriminals have widespread tools to obtain anything from passwords to secret questions and token-generated passwords. In such situations, marketing and IT teams need to work concurrently, providing each other with insights into when and how the data is gathered, processed, and used in operations. In 2021, it is expected that companies will implement tighter privacy and cloud security practices and communicate this to their customers. It is also expected that companies will offer more ways for customers to have agency over which data they share. Companies that are serious about privacy and respect with data attract more customers, particularly privacy-conscious ones.

IT and telecom vertical to grow at the highest CAGR during the forecast period

CCM market is segmented into IT and telecom, retail and eCommerce, BFSI, travel and hospitality, healthcare, government, utilities, and other verticals. CCM solutions help simplify IT infrastructure through a single, comprehensive solution for batch automation and interactive communications generation. In this way, companies can utilize data while creating documents. This enables them to create valuable content and contribute directly to objectives of their customer experience strategy. Therefore, telecommunications and IT companies have started investing in CCM solutions that would help them deliver high-quality services to their customers.

To know about the assumptions considered for the study, download the pdf brochure

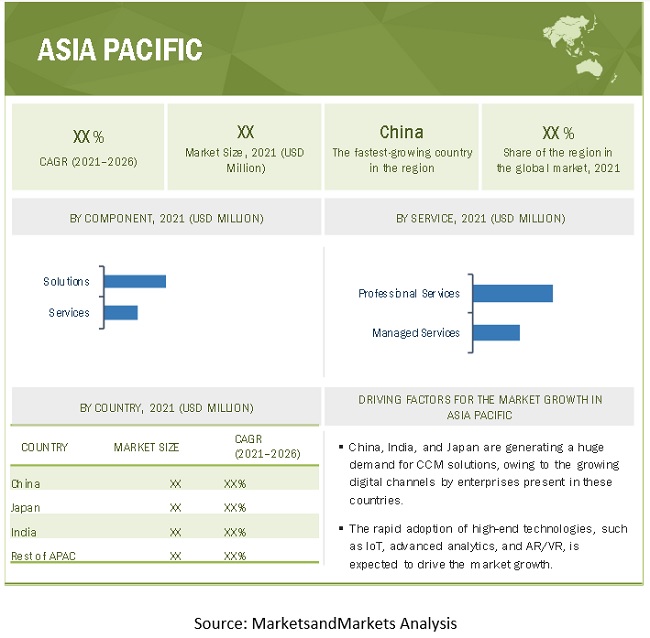

APAC to account for the highest CAGR during the forecast period

APAC countries are increasingly investing in CCM projects. The CCM market in APAC has been sub-segmented into China, Japan, India, and the rest of APAC. These countries act as a major driver for the growth of the market in the region. The increasing internet penetration and per user online consumption have led organizations to enhance their offerings in the CCM market. This rapid growth is because of its growing technology adoption rate. The growth of SMEs in the region has increased their spending on advanced technologies, such as AI, ML, and data analytics, to compete in the market and capture more opportunities. The implementation of CCM solutions has become more plausible for these businesses. Cloud computing is adopted on a large scale by organizations in the region’s developed economies, such as Japan, ANZ, and Singapore. As the cloud technology is used as a repository of data for further analysis, its increased adoption is expected to drive the growth of the CCM market.

This research study outlines the market potential, market dynamics, and key and innovative vendors in the CCM market include Adobe(US), Oracle(US), OpenText(US), Zendesk(US), Newgen Software(India), Capgemini(France), Quadient(France), Smart Communications(England), Sefas(France), CEDAR CX Technologies(US), Messagepoint(Canada), Doxim(Canada), Topdown(US), Napersoft(US), Ecrion(US), Doxee(Italy), Papyrus Software(Austria), Hyland(US), Bitrix24(US), Braze(US), HelpCrunch(US), AdventSys(India), Front(US), Trengo(Netherlands), Podium(US), Pitney Bowes(US).

The study includes an in-depth competitive analysis of these key players in the CCM market with their company profiles, recent developments, and key market strategies.

Scope of the Report

Report Metric | Details |

Market size available for years | 2016–2026 |

Base year considered | 2021 |

Forecast period | 2021–2026 |

Forecast units | Value (USD) |

Segments covered | Component (Solutions and Services), Deployment Mode, Organization Size, Verticals and Region |

Geographies covered | North America, Europe, APAC, MEA, and Latin America |

Companies covered | Adobe(US), Oracle(US), OpenText(US), Zendesk(US), Newgen Software(India), Capgemini(France), Quadient(France), Smart Communications(England), Sefas(France), CEDAR CX Technologies(US), Messagepoint(Canada), Doxim(Canada), Topdown(US), Napersoft(US), Ecrion(US), Doxee(Italy), Papyrus Software(Austria), Hyland(US), Bitrix24(US), Braze(US), HelpCrunch(US), AdventSys(India), Front(US), Trengo(Netherlands), Podium(US), Pitney Bowes(US). |

This research report categorizes the CCM market to forecast revenues and analyze trends in each of the following subsegments:

Based on Component:

Based on Deployment Mode:

Based on Organization Size:

Based on Verticals:

- IT and Telecom

- Retail and eCommerce

- BFSI

- Healthcare

- Travel and Hospitality

- Government

- Utilities

- Other Verticals (Media and Entertainment, and Education)

Based on Region:

- North America

- Europe

- United Kingdom (UK)

- Germany

- France

- Rest of Europe

- APAC

- China

- Japan

- India

- Rest of APAC

- MEA

- KSA

- UAE

- South Africa

- Rest of MEA

- Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In 2021 February, Capgemini and OVHCloud announced a global alliance partnership agreement intended to address the cloud transformation needs of public and private organizations.

- In 2020 December, Newgen Software launched OmniOMS 9.0, an upgraded version of its customer communication management system. The latest version of the software provides a robust and unified communications platform linking a variety of information types, information sources, and distribution channels. The embedded functionalities would enable users with easy customer communication creation, design composition change management, distribution, and control.

- In 2020 December, Capgemini extended its Digital Cloud Platform for SAP solutions with AWS to reduce costs and remove the complexity for customers running their SAP implementations, enabling them to focus on their core business.

- In 2020 October, Adobe launched new features in Advertising Cloud DSP. The legacy help was replaced with updated pages, available from the Help link in the DSP main menu. The previous Campaigns Beta views are now the default Campaigns views for quicker insights, simplified workflows, and customized views.

- In 2020 July, Oracle announced Oracle Dedicated Region Cloud@Customer. Driven by strong customer demand, Oracle announced Oracle Dedicated Region Cloud@Customer, the first fully managed cloud region introduced in the industry that brings all of Oracle’s second-generation cloud services, such as Autonomous Database and Oracle Cloud applications, to customer data centers.

- In 2020 June, Oracle announced Oracle Documaker 12.6.4. This document introduced Documaker 12.6.4 and described its new features and enhancements incorporated into Document Factory, Documaker Interactive, Documaker Server, Documaker Desktop, Documaker Studio, and the various utilities.