< Key Hightlight >

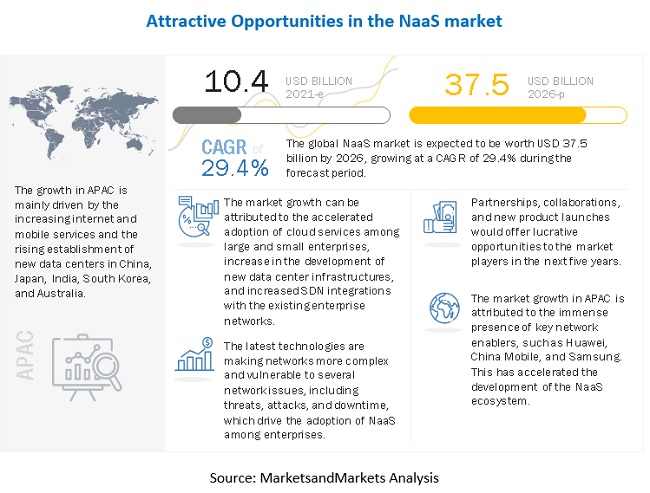

The global NaaS market size is expected to grow from USD 10.4 billion in 2021 to USD 37.5 billion by 2026, at a Compound Annual Growth Rate (CAGR) of 29.4% during the forecast period.

Due to the speed, massive capacity, and super low latency of the 5G network, 5G is expected to be the strongest enabler in the expansion of the IoT. The 5G network has the capability to support a massive number of static and mobile IoT devices, having a diverse range of speed, bandwidth, and quality of service requirements. The unprecedented speed, large bandwidth, low latency, massive scalability, and high reliability of the 5G network suit applications, such as consumer VR/AR, AI, and autonomous vehicles, with high data density and rapid response requirements, thus enabling faster adoption of these technologies. Countries expected to launch 5G services at the earliest include the US, China, South Korea, Japan, the UK, and Germany. Countries with a strong 4G infrastructure are expected to be the early deployers Countries with agile connectivity platforms in IoT are also expected to quickly transform their services into 5G, probably by 2020 Q1.

To know about the assumptions considered for the study, Request for Free Sample Report

The COVID-19 pandemic has affected every segment of society, including individuals and businesses. During the COVID-19 pandemic, the telecom sector is playing a vital role across the globe to support the digital infrastructure of countries. Every individual and government, irrespective of federal, state, central, local, and provinces, has been in constant touch with one other in the society to provide and get real-time information on COVID-19. Currently, healthcare, telecommunication, media and entertainment, utilities, and government institutes are functioning day and night to stabilize the condition and facilitate prerequisite services to every individual. During the pandemic, many organizations have implemented a remote workplace approach. This has resulted in network enhancements in firewall and VPN usage. Network security solutions are required for ease of use and convenience in network management.

COVID-19 cases are growing day by day, as several infected cases have been on the rise. In line with individuals, COVID-19 has a massive impact on large enterprises and SMEs. Core industries, such as manufacturing, automotive, textile, transportation and logistics, travel and hospitality, and consumer goods, have been closed due to country-level lockdown across the globe. This would have a substantial impact on the global economy in terms of the decline in GDP. Since ages, SMEs are acting as the backbone of the economy. In the current situation, SMEs are the most affected due to the COVID-19 pandemic.

Market Dynamics

Driver: Accelerated adoption of cloud services among large and small enterprises

Nowadays, Small and Medium-sized Enterprises (SMEs) and large enterprises are progressively adopting cloud-based services, as they are more cost-effective than maintaining an on-premises data center and expensive IT resource to manage the organizations’ entire network. Moreover, enterprises are looking for a network that provides ease of access to their infrastructures, applications, and other IT resources on-demand. Thus, these rising needs have accelerated the adoption of the virtual resource-sharing environment. NaaS components make it possible to convert physical networking elements into sharable virtual resources, which are used by the enterprises for data center connectivity requirements. Most of the enterprises are working toward centralizing their business activities and consolidating data from multiple locations in multi-tenant facilities. Thus, enterprises are moving toward cloud-based environments for carrying their business activities. Furthermore, with the advent of Software-defined Wide Area Network (SD-WAN) and NFV- based solutions, third-party vendors can provide faster, simpler, and flexible/programmable networks that cater to the best needs of their clients. These services are available on a subscription basis and per-user license basis.

Restraint: Lack of standardization in NaaS Market

The major issue faced in this market is the difficulty in ensuring proper regulatory compliances, while offering NaaS services to clients. Appropriate security and regulatory policies are to be practiced by the market vendors, which are vital for enterprises to achieve their business goals. With specific requirements such as increased security, business reorganizations, mergers, and consolidations, cloud providers have to meet stringent scalability specifications for storage, computing, and network resource sharing to encourage the growth of NaaS solutions. The vendors, at some point, may find it difficult to maintain and secure their technologies, and adhere to certain standards and laws. The non-compliance of regulations and standards by the vendors can directly affect the services they offer to clients, leading to major financial and business risks to the clients and their business processes. NaaS service vendors offer full transparency to their customers. They emphasize and offer programs and services by adhering to set standards and following the best service-delivery practices. As technologies evolve, it becomes difficult for vendors to keep up with the constantly changing technology and government regulations. This is a major challenge for both the vendors and clients in this market.

Opportunity: Demand for SDN and NFV-based cloud-native solutions to replace traditional networking model

Evolving network infrastructures have been gaining traction in the past few years. The advent of the technologies, such as SDN and NFV, has revolutionized network infrastructures by using virtualizations and cloud computing. Until the last decade, the existing technologies and traditional network infrastructure were major challenges for managing the data from multiple locations. Moreover, the traditional model consumes enormous efforts and higher investment to build custom silicon and purpose-built hardware that delivers limited functionality and does not fulfill clients’ needs. Thus, the advent of SDN and NFV has revolutionized the network infrastructure and management system; these technologies have simplified network management by replacing hardware with software solutions. This would deliver a major blow to the existing technology vendors, even though several such vendors have started partnering with various SDN and NFV solutions and service providers to upgrade the existing NaaS systems and make them compatible with virtualization techniques. SDN-based solutions directly decouple the data plane from the control plane while making networks programmable and software-driven. Even though there is a compelling technological rationale to adopt SDN solutions resistance from the networking enterprise fraternity may restrain the SDN adoption. This is critical to thriving in this virtual environment from an industrial standpoint.

Challenge: Data security and privacy concerns

One of the major challenges of the NaaS market is security concerns for cloud-based network connectivity that is holding back the adoption of NaaS solutions among various industry verticals. Security is one of the main criteria considered by enterprises while choosing cloud-based and on-premises solutions. NaaS solutions are facing synchronization issues, due to network complexities and complex applications. Hence, the outsourcing of network connectivity can generate issues in organizational security. Organizations usually assume that NaaS-based connectivity can expose their sensitive data and would cause them to lose control over their network infrastructure. Therefore, companies are uncertain about the adoption of cloud-based networking solutions.

Among organization size type, small and medium sized enterprises segment to grow at the higher CAGR during the forecast period

Organizations with less than 999 employees are considered under the SMEs segment. These organizations struggle with a low network infrastructure budget, despite advancements in technologies. However, with the availability of low-cost cloud services and the as-a-service model, SMEs have shifted their focus on digital transformation to benefit from emerging technologies such as cloud, analytics, IoT, and SDN. Small businesses all over the globe are no exception when it comes to access to wired and wireless infrastructure. Every organization, irrespective of size, has adopted the mobile-first strategy to cope with the growing technology world and garner new business opportunities. The NaaS model has benefitted most SMEs. This model offloads the burden of managing the entire network infrastructure at a lower cost for network operation teams. In this way, business stakeholders can emphasize on their daily business activities by accessing continuous internet connectivity. Like global organizations, SMEs in emerging countries are moving toward the subscription-based model from the ownership model. Within the subscription or NaaS model, enterprises can opt to purchase any software or hardware device costing more than the as-a-service model.

Among end user, the BFSI segment is expected to dominate the market during the forecast period

Based on end user, the BFSIsegment of the NaaS market is projected to hold a larger market size during the forecast period. BFSI stakeholders comprise banks, financial institutes, and insurance firms. With technological advancements, the digital economy is flourishing across all the developed and developing countries owing to the emergence of internet and mobile banking. The increasing tech-savvy consumers have forced BFSI institutes to become more technologically advanced and deliver on-the-go financial services to consumers. The banking sector focuses on safeguarding financial data. Therefore, CIOs are opting for secure wireless connectivity to improve data security, enhance user experience, and offer new services to customers. The adoption of the NaaS model has started growing in the BFSI end-user segment as most of the vendors are offering highly secure SD-WAN and Wi-Fi services to customers. Traditionally, this end-user segment used to install its network infrastructure on its premises due to the need for higher security. However, technology advancements have helped NaaS vendors to deliver AI-enabled and secure network infrastructure to the BFSI end-user segment. These vendors also offer additional services, such as analytics, real-time monitoring of network traffic, location-based services, guest Wi-Fi services, and marketing solutions. Therefore, the NaaS model is gaining significant traction across the globe due to the low cost of deployment and 24*7 support services.

To know about the assumptions considered for the study, download the pdf brochure

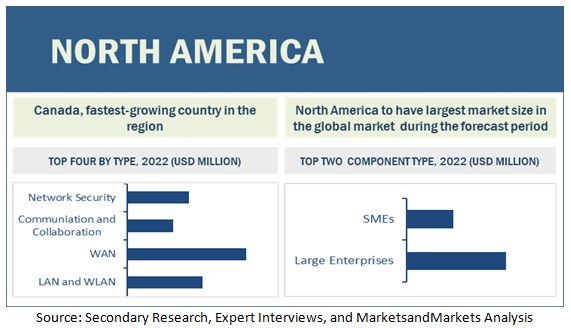

North America to account for the largest market size during the forecast period

North America is estimated to hold the largest market share in 2021. The region is transforming dynamically with respect to the adoption of new technologies across various sectors. Enterprises in the region have been the early adopters of NaaS solutions, including LAN, WAN, and Wi-Fi. The region has sustainable and well-established economies, which enable them to strongly invest in R&D activities, thereby contributing to the development of innovative technologies in the era of network service providers. The region has also witnessed increased adoption of NaaS solutions by SMEs. The presence of several key market players in the region is expected to be a major driving factor for the NaaS market in North America.

North America has been an extremely open market toward Wi-Fi-as-a-service, LAN-as-a-service, and SD-WAN as these solutions have gained corporate alignment, increased significant business benefits, and pervasive adoption among enterprises. The indispensable need to minimize TCO, followed by the ongoing government initiatives of smart infrastructure and smart city projects, has categorically driven the adoption of WLAN in North America. Presently, North America is the largest revenue contributor to the NaaS market as compared to other regions

Market Players

The report includes the study of key players offering NaaS. It profiles major vendors in the global NaaS market. The major vendors include AT&T (US), Verizon (US), Telefonica (Spain), NTT Communications(Japan), Orange Business Services(France), Vodafone (UK), BT Group(London), Tata Communications(India), Lumen(US), Masergy(US), Servsys(US), TELUS(Canada), PCCW Global(China), KDDI(Japan), Cloudflare(US), ARYAKA NETWORKS(US), China Telecom(China), China Mobile(China), Singtel(Singapore), GTT Communications(US), Telia(Sweden), Telstra(Australia), Deutsche Telekom(Germany), Colt Technology Services(UK), HGC(China), TenFour(US),PacketFabric(US), OnX Canada(Canada), Megaport(Australia), Wipro(India), Epsilon(Singapore), Axians(France), IPC Tech(US), and Microland(India).These players have adopted various strategies to grow in the global NaaS market.

The study includes an in-depth competitive analysis of these key players in the NaaS market with their company profiles, recent developments, and key market strategies.

Scope of Report

Report Metric | Details |

Market size available for years | 2020-2026 |

Base year considered | 2020 |

Forecast period | 2021-2026 |

Forecast units | Value (USD Million) |

Segments covered | Type(LAN and WLAN, WAN, Communication and Collaboration, Network Security), Organization Size, Application, end user, and regions |

Regions covered | North America, Europe, APAC, MEA, and Latin America |

Companies covered | AT&T (US), Verizon (US), Telefonica (Spain), NTT Communications(Japan), Orange Business Services(France), Vodafone (UK), BT Group(London), Tata Communications(India), Lumen(US), Masergy(US), Servsys(US), TELUS(Canada), PCCW Global(China), KDDI(Japan), Cloudflare(US), ARYAKA NETWORKS(US), China Telecom(China), China Mobile(China), Singtel(Singapore), GTT Communications(US), Telia(Sweden), Telstra(Australia), Deutsche Telekom(Germany), Colt Technology Services(UK), HGC(China), TenFour(US),PacketFabric(US), OnX Canada(Canada), Megaport(Australia), Wipro(India), Epsilon(Singapore), Axians(France), IPC Tech(US), and Microland(India). |

This research report categorizes the NaaS market to forecast revenue and analyze trends in each of the following submarkets:

Based on Type

- Local Area Network And Wireless Local Area Network

- Wide Area Network

- Communication and Collaboration

- Network Security

Based on Organization Size

- Large Enterprises

- Small and Medium-Sized enterprises

Based on End User:

- Banking, Financial Services, and Insurance

- Manufacturing

- Retail And Ecommerce

- Software And Technology

- Media and Entertainment

- Healthcare

- Education

- Government

- Others End Users (Transportation and Logistics, Energy and Utilities, and Hospitality)

Based on Application:

- Ucaas/Video Conferencing

- Virtual Private Network

- Cloud And SaaS Connectivity

- Bandwidth On Demand

- Multi-Brach Connectivity

- Wan Optimization

- Secure Web Gateway

- Network Access Control

- Other Applications (Secure DDI and Firewall)

Based on regions:

- North America

- Europe

- APAC

- MEA

- Latin America

Recent Developments:

- In March 2021, Verizon launched a new SDN and NFV service that enables enterprises to transition to a virtual infrastructure model, providing greater agility and on-demand resources.

- In February 2021, Verizon extended its strategic partnership with Cisco by adding three new SD-WAN managed service offerings.

- In January 2021, Orange Business Services was selected by BNP Paribas to deploy an SD-WAN solution in its more than 1,800 branches across France.

- In November 2020, AT&T offered networking capabilities and other advanced technologies to National Oceanic Atmospheric Administration (NOAA) to help federal agencies modernize their technology infrastructure.

- In October 2020, NTT Communications launched the Mobile Workplace Connect solution for increasing enterprise productivity and security. This solution offers immediate, secure, and global cellular connectivity to employees for end-point devices: laptops, tablets, smartphones, or any other device with a 3G/4G modem.

- In January 2020, Telefonica was selected by Arlanxeo, to deliver NaaS solutions as per a five-year contract. With this contract, Telefonica aims at delivering SD-WAN, LAN, Wi-Fi, IP-Telephony, and embedded managed security services to 11 countries in four continents.

Key Benefits of Buying the Report

The report would provide the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall NaaS market and its subsegments. It would help stakeholders understand the competitive landscape and gain more insights better to position their business and plan suitable go-to-market strategies. It also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.