< Key Hightlight >

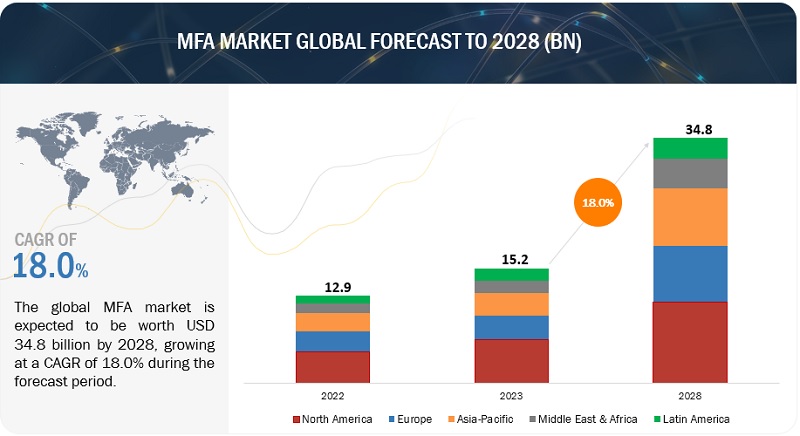

The global MFA market size is projected to grow from USD 11.1 billion in 2021 to USD 23.5 billion by 2026, at a Compound Annual Growth Rate (CAGR) of 16.2% during the forecast period. Major driving factors for the MFA market include rise in security breaches, fraud, and data identity thefts, surge in use of BYOD/ IoT devices, high demand for cloud-based MFA solutions and services, high volume of online transactions, and stringent government regulations.

MFA can be described as authenticating a person to carry out certain transaction based on factors provided by the same person. The factors can be classified into three broad categories: “Something you have,” “Something you know,” and “Something you are.” These three factors can be hardware tokens, Personal Identification Number (PIN), passwords, biological traits, and so on. Another type of authenticating factor is an OTP, which is gaining popularity in Europe and the Americas. MFA provides a high degree of security, which ensures the confidentiality of personal information.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact Analysis on MFA Market

The COVID-19 pandemic has affected every segment of society, including individuals and businesses. The internet ecosystem has been playing a pivotal role all over the globe. Due to the COVID-19 pandemic, the dependency on online businesses has increased significantly. BFSI, healthcare and life sciences, manufacturing, automotive, retail, transport, and logistics, among others, are leveraging the internet to provide necessary services to consumers. Vendors have experienced decreased demand for MFA solutions. With the widespread use of mobile devices and internet penetration across the globe, individuals are progressively inclined towards the use of digital technologies such as MFA. Additionally, restrictions imposed by governments in response to the COVID-19 pandemic have encouraged employees to work from home, and even ‘stay at home’. As a consequence, technology has become even more important across working and personal lives. Despite this rising of technology needs, it is noticeable that many organizations still do not provide a ’cyber-safe’ remote-working environment. Where business meetings were traditionally held in-person, most now take place virtually. While the COVID-19 outbreak continues to drive cybersecurity trends as a whole, it has also inspired new attacks that capitalize on the desire of citizens for news, assistance, or guidelines that could help keep them safe. The growing number of cyberattacks across enterprises is expected to drive the MFA market.

Market Dynamics

Driver: Stringent government regulations to increase the adoption of MFA solutions

The constantly changing threat landscape has given rise to a large number of government regulations, such as the General Data Protection Regulation (GDPR), Payment Services Directive 2 (PSD2), and Anti-Money Laundering Directive 5 (AMLD5). These regulations have made it mandatory for every business to have sound identity authentication checks integrated into their system to put a halt on frauds, such as money laundering, identity theft, and terrorist financing. The increasing instances of cyberattacks, such as identity-related attacks, have increased the instances of frauds across almost all the verticals around the globe, especially the BFSI and healthcare verticals. Compliances such as PSD2, GDPR, and CCPA are making sure that enterprises have proper security practices in place to eliminate the chances of frauds, data leaks, and identity thefts. Due to the huge penalties levied for non-compliance with regulatory mandates, the presence of stringent compliances and regulations has become a major driver for the rapid adoption of MFA solutions among enterprises.

Restraint: Increasing response time in higher order authentication models

The average time required to handle a single query for two-factor authentication systems is less, as compared to that of three-, four-, and five-factor authentication. An authentication system has to be simple and perfect, to implement it successfully. Authentication systems with multiple factors are being designed and prototyped with the advancement of technology, but this would increase the time required to handle a single query as it would involve multiple processes for the authentication of data or user. As a result, this would result in long queues and increase service/response time. The impact of this restraint is currently high but will reduce in the future because of the ease in access techniques.

Opportunity: High volume of online transactions

The increasing volume of online transactions with high adoption of digital banking by customers is expected to propel demand for MFA. The spurt in eCommerce and use of internet banking, and mandatory laws by central banks are urging large corporations to authenticate users with strong authentication measures. The growing use of mobile banking for online transactions is set to surge demand for OTP authenticators (both hardware and software). MFA is used for secure transaction and to protect customers from phishing attacks and fraudulent transactions. Moreover, the integration of these systems for payment by sectors of healthcare, retail, and BFSI is a wide opportunity for the growth of MFA authentication market.

Challenge: Lack of awareness related to MFA among enterprises

The major limitation to the growth of the MFA market is the lack of awareness about the correct use of MFA solutions. The growing threat to on-premises and cloud data has increased the overall IT spending for on-premises and cloud security. The inability of in-house enterprise security teams to safeguard on-premises data has forced enterprises to move their data to the cloud. Lack of adequate MFA knowledge may lead to errors, resulting in a huge loss for enterprises. Chief information security officers play an important role to ensure that enterprises are well-equipped with the best-in-class MFA solutions, and employees do not fall prey to adversaries, such as malware, phishing, spoof, ransomware, and APT. With changes in the business environment, the security requirements are also evolving with the rise in zero-day threats and phishing attacks. This lack of awareness about advanced security threats has put businesses at risk and is hindering the growth of the MFA market.

Based on end user, the Banking, Financial Services, and Insurance (BFSI) industry vertical accounts for the largest market size in the MFA market

The BFSI industry vertical is expected to hold the highest market share in the MFA market. BFSI is the most targeted industry vertical as it deals with large volumes of sensitive and private financial data. The COVID-19 outbreak has impacted every possible vertical across the globe, especially high-profile and high-value data verticals such as BFSI, healthcare, and government. With the increasing cyber threat landscape and risk surface, the demand for MFA solutions is also rising. MFA takes a holistic approach to create a layer of defense and make it difficult for an unauthorized person to gain access. The BFSI vertical is an early adopter of cutting-edge MFA solutions as they possess highly sensitive financial data. Financial institutions increasingly understand the value of technological advancements to improve the customer experience and protect themselves and their customers against the consequences of security breaches. These institutions also have a deep understanding of how MFA solutions could be used to combat threats posed by fraud and identity theft. Moreover, the BFSI industry vertical is the most regulated as it has to comply with many security requirements. There are strong data security requirements for BFSI industries due to the sensitive and private data they deal with. Various government mandates, such as PSD2 and PCI-DSS, necessitate financial institutions to meet the terms and standards related to the privacy of customer data. MFA solutions and services also help the BFSI industry vertical deliver robust security, secure identities, and manage regulatory compliances.

To know about the assumptions considered for the study, download the pdf brochure

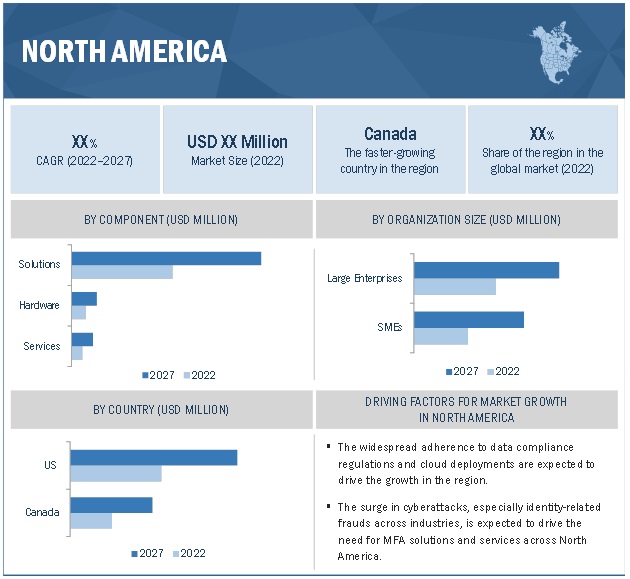

North America is expected to hold the largest market size during the forecast period

North America is estimated to account for the highest market share in the MFA market. Early adoption of MFA and the presence of several vendors that provide MFA solutions are expected to drive market growth in the region. Businesses in this region are increasingly implementing MFA solution for enabling data security; prevent cyber-attacks, identity thefts, and commercial espionage; and ensure security and privacy of data to facilitate business continuity. The growth of the market in North America can primarily be attributed to the presence of key MFA market vendors, investments and innovations, strict regulatory environment, and high technology adoption rates.

This research study outlines the market potential, market dynamics, and key and innovative vendors in the MFA market include Micro Focus (UK), Broadcom (US), Microsoft (US), OneSpan (US), Okta (US), Thales (France), RSA Security (US), Duo Security (US), Ping Identity (US), HID Global (US), ESET (Slovakia), ForgeRock (US), CyberArk (US), OneLogin (US), SecureAuth (US), Oracle (US), Salesforce (US), Secret Double Octopus (Israel), Silverfort (Israel), Trusona (US), FusionAuth (US), HYPR (US), Keyless (US), and Luxchain (Hong Kong).

The study includes an in-depth competitive analysis of these key players in the MFA market with their company profiles, recent developments, and key market strategies.

Scope of the Report

Report Metric | Details |

Market size available for years | 2015–2026 |

Base year considered | 2020 |

Forecast period | 2021–2026 |

Forecast units | Value (USD) |

Segments covered | Component, Authentication Type, Model Type, Organization Size, End-user, and Regions. |

Geographies covered | North America, Europe, APAC, Middle East and Africa (MEA), and Latin America. |

Major companies covered | Micro Focus (UK), Broadcom (US), Microsoft (US), OneSpan (US), Okta (US), Thales (France), RSA Security (US), Duo Security (US), Ping Identity (US), HID Global (US), ESET (Slovakia), ForgeRock (US), CyberArk (US), OneLogin (US), SecureAuth (US), Oracle (US), Salesforce (US), Secret Double Octopus (Israel), Silverfort (Israel), Trusona (US), FusionAuth (US), HYPR (US), Keyless (US), and Luxchain (Hong Kong). |

This research report categorizes the MFA to forecast revenues and analyze trends in each of the following submarkets:

Based on authentication type:

- Password authentication

- Passwordless authentication

Based on model type:

- Two-factor authentication

- Smart card with pin

- Smart card with biometric technology

- Biometric technology with pin

- Two-factor biometric technology

- One time password with pin

- Multi-factor with three-factor authentication

- Smart card with pin and biometric technology

- Smart card with two-factor biometric technology

- Pin with two-factor biometric technologies

- Three-factor biometric technology

- Multi-factor with four-factor authentication

- Multi-factor with five-factor authentication

Based on component:

- Solutions

- Hardware

- Services

Based on organization size:

Based on the end user:

- BFSI

- Government

- Travel and Immigration

- Military and Defense

- Commercial Security

- IT

- Telecommunication

- Healthcare

- Media and Entertainment

- Other verticals (education, and retail and eCommerce)

Based on the region:

- North America

- Europe

- United Kingdom (UK)

- Germany

- France

- Italy

- Rest of Europe (Sweden, Switzerland, Finland, the Netherlands, Belgium, among others)

- APAC

- Australia

- India

- China

- Japan

- South Korea

- Rest of APAC (Taiwan, Singapore, Thailand, Indonesia, Malaysia, among others)

- Middle East and Africa (MEA)

- United Arab Emirates (UAE)

- The Kingdom of Saudi Arabia (KSA)

- Rest of MEA (Africa, Israel, Qatar, Turkey, among others)

- Latin America

- Brazil

- Rest of Latin America (Mexico, Argentina, Chile, among others)

Recent Developments:

- In March 2021, Okta entered into a definitive agreement to acquire Auth0 for USD 6.5 billion. Okta, which has focused on serving businesses with products for IAM, SSO, MFA, cloud directory services, and more will be strengthened by Auth0 acquisition, which focuses more on serving customer identity and access markets. The acquisition is expected to close in July 2021.

- In September 2020, OneSpan partnered with ForgeRock. The strategic partnership has resulted in the integration of OneSpan technologies into the ForgeRock Identity Platform for identity authentication and risk analytics. The combined solution leverages OneSpan’s integration with ForgeRock Intelligent Access to simplify authentication, as well as risk management. The solution is mainly used by financial institutions to secure their customers from fraud.

- In April 2020, Okta unveiled Okta FastPass that provides users with a secure and passwordless login experience across devices, applications, and various OS.

- In February 2020, Thales launched Fast Identity Online 2.0 (FIDO2) that provides passwordless access to Microsoft Azure AD cloud apps, domains, and all connected devices and services. This will ultimately help businesses and organizations move securely to the cloud.

- In December 2020, Micro Focus released NetIQ Universal Policy Administrator (UPA) to deliver centralized security management streamlined with unified authorization and authentication. This next-generation policy platform equips IT security administrators with a centralized policy management solution that improves operational efficiencies and strengthens cyber resilience.

- In December 2019, RSA partnered with Yubico, to jointly offer enterprises modern FIDO-based authentication. FIDO2-enabled “YubiKey for RSA SecurID Access” delivers secure authentication and identity assurance for the modern workforce. The solution, YubiKey for RSA SecurID Access, combines a FIDO2-enabled hardware device by Yubico supported with enterprise-grade security and risk-based authentication delivered by RSA SecurID Access.