< Key Hightlight >

The post-COVID 19 global DDI market size is expected to grow from USD 400 million in 2021 to USD 836 million by 2026, at a Compound Annual Growth Rate (CAGR) of 15.9% during the forecast period.

The major factors fueling the DDI market include the rise of IoT platforms, increasing BYOD trend at workplaces, expansion of existing DDI solutions and adjacent network services, and significant adoption of virtualization by organizations. Moreover, increasing need for IPAM and advent of IPv6 would provide lucrative opportunities for DDI vendors.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID 19 IMPACT

The ecosystem of connected devices witnessed a surge due to the COVID-19 pandemic, and DDI demonstrated its added value in this increasingly connected market. Almost all entities are working from home needed networks to be more resilient for functioning properly, fueling the need for efficient DDI solutions and services. Hence, the rise of IoT platforms acted as a driver for the DDI market. WFH made almost everyone work and operate from home, including large organizations, educational institutes, and lawmakers. Organizations are especially accelerating their digital transformation initiatives for fulfilling the needs of their employees, such as connecting to an enterprise network, accessing resources and apps from anywhere, etc. Hence, in order to provide secure access to every remote enterprise user as well as maintaining the security of accessed resources, the adoption of DDI witnessed an increase. With the second wave of COVID-19 in countries such as the UK, Brazil, and India, WFH is expected to continue, which would further necessitate the demand for DDI solutions and services. The outbreak of COVID-19 fueled the trend of online digital education. This trend resulted in an increased number of laptops, tablets, and mobile devices connected to a network, making DDI a necessity for them. Even though the COVID-19 outbreak slowed down the process of 5G rollout, 5G was still on track to roll out extensively in 2020 and 2021. In fact, the pandemic has grown the importance of 5G, especially with most people of a country that are working remotely, necessitating data speeds and increased network support for people to do their jobs.

MARKET DYNAMICS

Driver: Rise of IoT Platforms

Internet of Things (IoT) enables the communication between physical devices embedded with electronics and software to collect data. The framework on which this is done is called the IoT platform. Today, a majority of companies are adopting IoT to facilitate their operations and process. The implementation of IoT platforms requires a large number of devices, frameworks, and IP services at a large scale. IoT platforms at this scale and degree require a dynamic and robust DDI solution. Thus, the increasing need for IoT platforms is likely to propel the demand for commercial DDI solutions. Clients undertaking IoT initiatives with a central framework require DDI to manage large-scale IP addresses. Using DDI based on IoT platforms provides efficient operational benefits for vendors that are deploying internally managed IoT platforms, automated DNS, or diversified IPv6. Furthermore, vendors such as EfficientIP, Nixu Software, and Men & Mice provide cost-effective DDI options in the market and serve small-scale IoT environments.

Restraint: Limited mainstream adoption of SDN

Software-Defined Networking (SDN) is a method to manage and monitor computer networks via open interfaces and software tools. SDN infrastructure is the mechanism or platform by which network application services achieve their objective. SDN gives a new perspective to plan, design, build, and execute networks that support abstraction, virtualization, and authenticity to the server infrastructure. SDN also provides new ways to implement mobile devices and manage DDI services on them. However, a few of the DDI vendors are not adopting SDN architectures to deploy their commercial DDI software. Some of the reasons why organizations do not implement SDN include the improper definition of SDN use cases and the requirement for an environment with OpenFlow support in the switches for the adoption of real-time SDN infrastructure. However, many companies are currently developing network applications for SDN, giving network virtualization a new value by influencing the infrastructure dynamically on behalf of the hosted application or their users. Hybrid network services automation, rapid time-to-service, and cloud integration are some of the reasons that would propel the implementation of SDN in the coming years.

Opportunity: Increasing need for IPAM

IP addresses are a significant part of a network, and dealing with them becomes complex as they increase in number. Most of the enterprise applications require internet protocol for communication, and more IPs are used for databases, services, and more. Managing all of the necessary IP addresses becomes very important as it gives devices the ability to communicate. IP Address Management (IPAM) is the way in which enterprises track and manage the IP address on the network. Usually, IPAM integrates DHCP and DNS, which allows real-time automatic updating of changes. With all of the new mobile devices and services in need of IP addresses today, maintaining and monitoring all of them on the network without an organized plan is difficult, which is why organizations must have an IPAM strategy in place. IPAM also provides enterprises with security as its data includes information such as the IP addresses in use, what and which devices each IP is assigned to, and the timestamps. IPAM helps in compliance with internal policies, which can be enforced using NAC systems and IPAM data.

Challenge: Integration of DDI in complex networks is time consuming

The network of any organization is completely dependent upon IP addresses and forms an important part of a network. The number of IP addresses used on the network increases as the company starts to expand its operations. Most of the network applications require IPs to be allocated as the enterprise grows. In the growing stage, an organization needs to abandon the manual administration of IP, DHCP, DNS and needs to properly manage IP. The organization’s network becomes complex and cluttered by implementing BYOD, other mobile devices, and network endpoints. Most of the businesses also use virtualization to diversify resources for their business strategy execution but end up doubling their IP in doing so. Integrating DDI solutions in an existing complex network becomes a time-consuming task as the implementation counts in migrating and managing the current network infrastructure to a new optimized and organized network structure.

SMEs segment to grow at a higher CAGR during the forecast period

Rather than investing in on-premises networking solutions, SMEs prefer cloud-based solutions, which are more flexible and fall within the budget. The adoption of the pay-as-you-go model by SMEs to flexibly manage the IT infrastructure as per their requirements is projected to drive the adoption of DDI. Also, the need for efficient customer data protection and cost-cutting, as well as attaining a competitive advantage, enables quick response and timely decisions that are projected to drive the growth of the DDI market in SMEs. Also, factors such as the need for efficient customer data protection, cost-cutting, getting a competitive advantage, and quick response and timely decisions are projected to drive the growth of the DDI market in SMEs.

Telecom and IT vertical to hold the largest market size during the forecast period

Telecom and IT companies deal with complex networks that need to be upgraded on a regular basis to meet the fast-changing technological demands of the industry, necessitating the deployment of efficient DDI solutions and services. Protecting DNS servers from malicious attacks, high resiliency, and centralized management and monitoring of networks are major aspects of the telecom and IT industry that contribute to the major share of the DDI market. The proliferation of mobile devices and the advent of IPv6 are putting growing pressure on telecom and IT companies to effectively create provision and manage vast numbers of IP addresses, thus aiding the adoption of DDI solutions and services in the telecom and IT vertical.

To know about the assumptions considered for the study, download the pdf brochure

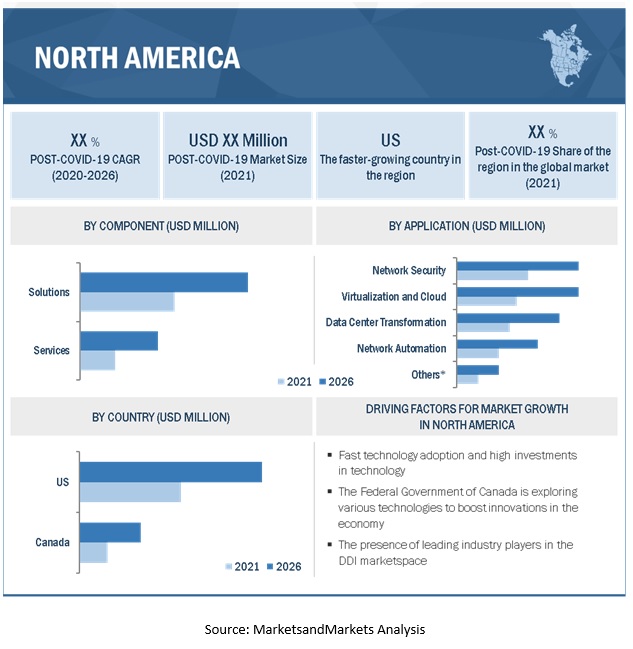

North America to hold the largest market size during the forecast period

DDI has demonstrated its capabilities to maintain network dynamics securely and smoothly, which has helped organizations to reduce their maintenance and operational expenses. North America accounts for the major chunk of the global DDI solutions and services market, and it is considered as one of the most advanced regions in technology adoption and infrastructure. Furthermore, the various verticals operating in the region, such as IT & Telecom, have been increasingly adopting new ways to monitor network security and IPAM. In the past, verticals relied on traditional methods such as maintaining documents and spreadsheets to record IP address allocations. North America held the largest share in terms of revenue generated from DDI due to the presence of large telecom and IT, government and defense, and education organizations in the region. The presence of leading industry players in the DDI space such as Infoblox, BlueCat Networks, and in the region as well as potential untapped opportunities in countries such as Canada, are also expected to fuel the adoption of DDI in the region. The growing technological adoption and high investments in technology are key factors contributing to the DDI market in the region.

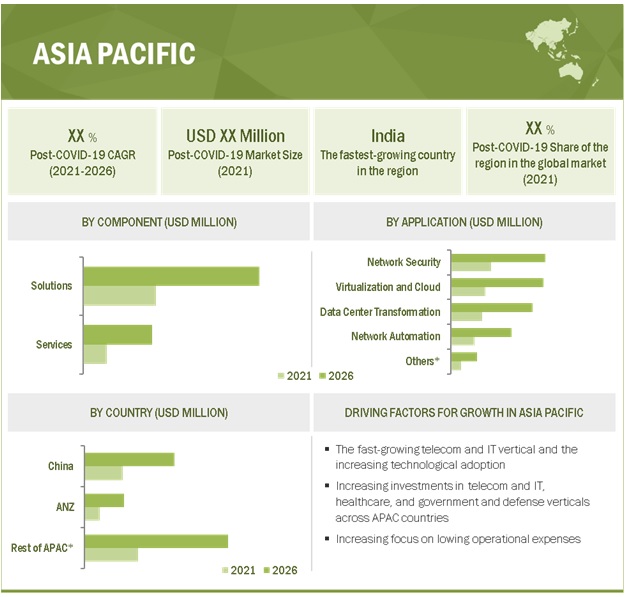

Asia Pacific to grow at the highest CAGR during the forecast period

The Asia-Pacific (APAC) region is emerging as the world’s growing economy, due to the increasing spending on improving performance, security, and economic stability. The APAC region comprises major economies, such as China, India, Japan, Singapore, Malaysia, and Australia. The APAC region is witnessing a surge in the deployment of DDI solutions. China, the world’s top manufacturing country, is leveraging real-time machine monitoring systems to increase manufacturing companies’ operational efficiency and production. The manufacturers are considering network management as a strategic business function and plan to lower their OPEX. DDI solutions enable the companies to streamline their security and maintenance by efficient DHCP, DNS, and IPAM implementation. Furthermore, the DDI solutions will allow vendors operating on the APAC region to achieve high efficiency. APAC is an emerging market with significant growth in the telecom and IT vertical in the emerging economies. Similarly, the demand for DDI solutions and services is expected to increase in the APAC region due to the advent of IPv6 and the increasing number of mobile devices.

Key Market Players

Major vendors in the global DDI market include Nokia Corporation (France), BlueCat Networks (Canada), Infoblox(US), Men and Mice(Iceland), and EfficientIP(US).

Founded in 1990 and headquartered in Kopavogur, Iceland, Men&Mice is a renowned provider of various solutions, including cloud solutions, virtualization, network security, APIs, replace excel spreadsheets, advance from homegrown solutions, and migration from alternative DDI vendors. Moreover, the company has a comprehensive DDI product portfolio consisting of Men & Mice DDI suite, DHCP management, DNS management, and IP address management. Men & Mice caters to a diverse set of clients spread across the globe through its extensive reseller network. The company has implemented its business functions as a software overlay solution that can support Microsoft DNS, Azure DNS, and Amazon Web Services. This allows the company to integrate and serve the customers requiring overlay DDI solutions easily. Men & Mice provides support for DNS (Microsoft and Unbound) and DHCP (Microsoft and Cisco routers). The company’s solutions are scalable and provide tools for efficient administration and control. Its simplified deployment is the key advantage to its solution and allows easy integration with Microsoft Active Directory simplifying network management. Men & Mice might face challenges serving enterprises and service providers, as it is a small company with specific and limited resources. The company offers solutions for various industry verticals including IT, manufacturing and production, education, and healthcare. Men & Mice has business operations in the US and Europe and caters to a diverse client base through its extensive reseller network spread across the globe.

Scope of the Report

Report Metric | Details |

Market size available for years | 2015–2026 |

Base year considered | 2020 |

Forecast period | 2021–2026 |

Forecast units | Value (USD) |

Segments covered | Component (Solutions and Services), application, deployment mode, organization size, vertical, and Region |

Geographies covered | North America, Europe, APAC, MEA, and Latin America |

Companies covered | Nokia Corporation (France), BlueCat Networks (Canada), Microsoft Corporation (US), Infoblox (US), Cisco Systems (US), Men & Mice (Iceland), EfficientIP (US), BT Diamond IP (US), FusionLayer (Finland), PC Network (US), TCPwave (US), Apteriks (Netherlands), ApplianSys (UK), NCC Group (UK), Solarwinds Network (US), NS1 (US), Empowered Networks (Canada), Datacomm (Indonesia), INVETICO (Australia). |

This research report categorizes the DDI market to forecast revenues and analyze trends in each of the following subsegments:

Based on Component:

Based on Application:

- Network Automation

- Virtualization and Cloud

- Data Center Transformation

- Network Security

- Others (Transition to IPv6)

Based on Deployment Mode:

Based on Organization Size:

Based on Verticals:

- Telecom and IT

- BFSI

- Government and Defense

- Healthcare and Life Sciences

- Education

- Retail

- Manufacturing

- Others (Media and Entertainment, Energy, and Hospitality)

Based on Region:

- North America

- Europe

- United Kingdom (UK)

- Germany

- Rest of Europe

- APAC

- MEA

- Latin America

- Mexico

- Rest of Latin America

Recent Developments

- In January 2020, Men&Mice Suite 9.3 was released with support for Akamai Fast DNS, strengthened enterprise features, improved High Availability, and various user experience enhancements

- In July 2018, new Men&Mice Suite version 9.1 for cloud-ready DDI was introduced viz a powerful and simplified web-based management application that optimized cloud support and virtual appliance upgrades, reinforcing commitment to visibility and functionality across hybrid and multi-cloud DNS networks.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst