< Key Hightlight >

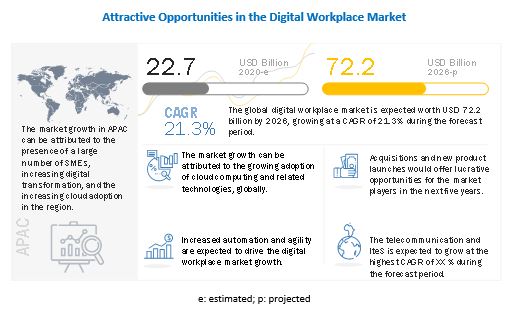

The global digital workplace market size is expected to grow from USD 22.7 billion in 2020 to USD 72.2 billion by 2026, at a Compound Annual Growth Rate (CAGR) of 21.3% during the forecast period. Key factors that are expected to drive the growth of the market availability of new technologies and tools, employees demand greater flexibility in terms of work-life balance. Organizations are adopting digital workplace market solutions to enhance employee experience through a simpler and more flexible work style. It helps organizations to attract new employees and retain more experienced and expert workers. However, lack of training and required education among the workforce expected to limit the market growth.

To know about the assumptions considered for the study, download the pdf brochure

COVID-19 impact analysis on the global digital workplace market

The impact of the COVID-19 pandemic on the market has been covered throughout the report. The pandemic has had a positive impact on the digital workplace market growth. The major reason for the positive impact on the market is a rise in the demand for cloud-based business continuity tools and rise in adoption of business continuity tools and workplace solutions due to COVID-19. However, reduced industry spending due to COVID-19 is expected to impact the adoption of digital workplace solutions and services.

Market Dynamics

Driver: Demand for greater flexibility and improved employee experience

A digital workplace will help attract, retain, engage, and motivate employees. Mature digital workplace policies allow employees to choose their own devices and facilitate a variety of work styles. With the use of persona-based models, instead of single services, end users receive a fit-for-purpose workplace bundle customized to their requirements. Employee content and data is securely embedded in collaboration tools, corporate drop boxes, and cloud storage so that employees can access data from any device, in any location and time as seamlessly, whether they are a physical office or working remotely. Access to this data increases efficiency and drives the level of productivity and organizational agility. Digital workplace solutions give employees the support they need to improve their communication, collaboration, and connections with each other. Implemented efficiently and effectively, these solutions allow organizations to mitigate common risks, adhere to their regulatory compliances, and ultimately realize enhanced business value, thereby being able to provide a better experience to employees. Providing the right digital workplace tools for organizations will help increase the agility and flexibility of employees. Easy-to-use digital workplace solutions both inside and outside the firewall will also heighten staff satisfaction and increase their productivity, along with enhancing the efficiency of operations in an organization. Given below are the findings from 2019 annual survey from FlexJobs, a job portal site. The findings clearly state how flexible job options and work-life balance are top priorities along with salary when candidates are evaluating job prospects. The same survey listed that employees opt for flexible jobs for improved work-life balance, spending time with family, time savings, and to tackle commute stress. Thus, these demands from employees are expected to fuel the adoption of digital workplace solutions

Restraint: Lack of training and required education among the workforce

As the adoption of IT infrastructure supporting workplace transformation is increasing, it is becoming crucial for organizations to train and educate their workforce to use these solutions efficiently and bring out the best of their performances. Thus, organizations have to ensure that their employees have access to training that allows them to harness the digital workplace solutions to their advantage. In addition to technical training, employees need policy training on the type of information they should or should not share in the digital workplace. For this, organizations are required to communicate about policies on how to handle personal and company’s devices and data to avoid security and compliance concerns. For instance, a team manager equipped with a new resource performance tracker should be provided with all the guidelines and training to use the solution.

Thus, training programs are ongoing processes that need to be implemented by organizations before adopting digital workplace solutions and services to improve and evolve with the workplace transformation strategy. This, in turn, is a restraining factor for the adoption of digital workplace transformation strategies, as they require ongoing training efforts from organizations’ end.

Opportunity: Increasing adoption of workplace transformation services among SMEs

SMEs adopting digital workplace solutions gain a competitive advantage in the industry through increased productivity, cost savings, a more mobile and agile workforce, increased flexibility, and adaptability in the marketplace. It is crucial for Small and Medium-sized Enterprises (SMEs) to focus on their business operations and growth, and improve their strength in their domain of business. As stated in an article by Kissflow, the SMEs familiarity with digital transformation has doubled over the years, with just 33% in 2017 to 57% in 2019. The article also states that by implementing a digital workplace, organizations have been able to see an increase of 43% in revenue, 53% in employee engagement, and 67% in productivity. SMEs are under continuous pressure to adopt more robust and efficient IT infrastructures to take their products and services to the market as fast as their counterparts. However, they typically lack the internal skills to manage the IT infrastructure. To overcome these challenges, SMEs need managed services that are cost-effective and enable digital workplace transformation. Thus, the SMEs across all industries adopt digital workplace services to sustain and remain competitive in the market.

Challenge: Lack of thought leadership in organizations

Digital transformation is prevalent everywhere. It is powering the growth of organizations, smart cities, and promoting advancements in healthcare. However, there are certain fundamental risks with people in the organizations, most notably, skills getting outdated faster than ever before. This presents modern business leaders with a very acute set of challenges. To overcome these, organizations will need a new style of leadership and a new structure for their organizations, which would help them drive the right behavior in employees. As technology has continued to evolve, leaders have to continue adapting to it.

The big task for management is to create a culture and leadership style to support autonomy, empowerment, and active management. It is not enough to merely invest in innovative technologies to drive digital transformation. The “people first” motive is now more valid than ever before. This means that a change in leadership style and organizational structures is required to enable more motivational and creative work environments.

Professional services segment to hold a larger market size during the forecast period

Professional services help organizations align their digital workplace processes efficiently with required digitalization. Moreover, professional services help organizations maintain a competitive edge in the market and offer various benefits, such as faster time-to-market, stable operating environments, and reduced governance and compliance risks. Professional services include consulting services, training support and maintenance, and integration and implementation services. All these services deliver cost-effective support for technical queries and prevent any downtime caused while implementing digital workplace solutions. Vendors offering training support and maintenance services focus on improving network performance, reducing the CAPEX and Operational Expenditure (OPEX), and providing end-to-end delivery and multivendor support.

Cloud deployment to hold a larger market size in 2020

SMEs are majorly moving toward the adoption of the cloud deployment due to its major benefits, such as lower costs, no requirement of manpower for hardware maintenance, faster and efficient results, and complete flexibility and scalability, which result in reduced OPEX and CAPEX. Seamless flexibility and scalability enable customers to store and retrieve actionable insights anytime and anywhere easily. The cloud-based deployment enables users to run analytics on data from remote locations in real time. Cloud-based digital workplace and services provide cost-saving benefits, which improve enterprises’ operational efficiency and reduce operational costs. Lower maintenance costs and less workforce are expected to drive the adoption of cloud-based digital workplace solutions and services across verticals.

Large enterprises to hold a majority of the market share during the forecast period

The trend of digitalization has been increasing extensively among large enterprises. The growing connectivity of bandwidths and mobility trends can be seen more among large enterprises, due to the presence of a huge workforce. Large enterprises have a large corporate network and many revenue streams. These organizations are also keen to invest in new and latest technologies to effectively run their business. The digital workplace market has a stronghold in large enterprises, as the IT infrastructure becomes more complex in large enterprises as compared to SMEs. The increasing demand for employees to access computing resources and applications from a mobile location and at any time has made it complex for enterprises to store their data properly, maintain and manage their data centers, and focus on their core business operations.

Manufacturing industry vertical to hold a significant market share during the forecast period

The digital workplace idea is a key element of the Fourth Industrial Revolution (Industry 4.0). Automated systems and robotics in manufacturing are enabling employees to focus their skill sets on more value-added and evolved tasks by taking up some of the more repetitive processes. Data-enabled and data-driven methods will continue to play a major role with a particular focus on remote, collaborative, virtual, mobile, and augmented ways of working. A digital workforce using the latest technologies can help manufacturers thrive and survive many of the workplace challenges they currently face. Technology will drive all aspects of manufacturing transformation, from improvements in processes to supply chain efficiency and digital workplace environments.

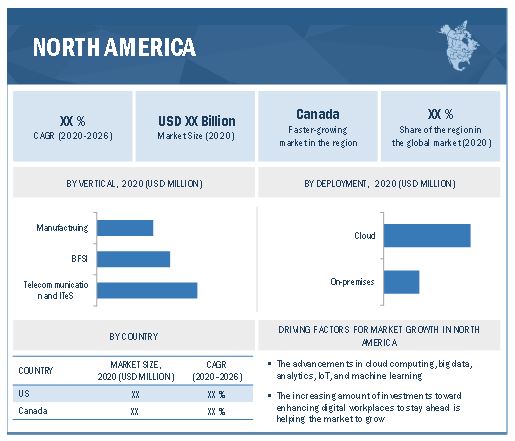

North America to account for the largest market size during the forecast period

The global digital workplace market by region covers five major geographic regions, namely, North America, Asia Pacific (APAC), Europe, Middle East & Africa (MEA), and Latin America. North America is expected to be the most promising region for major verticals, such as telecommunication and ITes, BFSI, and manufacturing. North America is the most mature market in terms of adopting digital workplace solutions and services. Considering the fact that the region is home to a huge number of enterprises and has the abundant technical expertise, it adopts digital workplace solutions and services to help enterprises have advanced IT infrastructures. The region is a hub for the number of small enterprises, startups, medium and large enterprises. The movement toward securing the Internet of Things (IoT) gateway communications, adoption of technologies, such as Artificial Intelligence (AI), Augmented Reality (AR), and Robotic Process Automation (RPA), and the rise of social collaboration outside the enterprise is anticipated to fuel market growth in the region.

Key Market Players

The digital workplace vendors have implemented various types of organic as well as inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions, to strengthen their offerings in the market. The major vendors offering digital workplace solutions and services globally are Atos (France), Cognizant (US), IBM (US), Zensar (India), Wipro (India), Infosys (India), Accenture (Ireland), Fujitsu (Japan), HCL Technology (India), DXC Technology (US), NTT Data (Japan), Unisys (US), HPE (US), TCS (India), Sonda (Chile), KissFlow (India), Capgemini (France), and others.

The study includes an in-depth competitive analysis of key players in the digital workplace market with their company profiles, recent developments, COVID-19 developments, and key market strategies.

Scope of the report

Report Metric | Details |

Market size available for years | 2020–2026 |

Base year considered | 2020 |

Forecast period | 2021–2026 |

Forecast units | Billion (USD) |

Segments covered | Component, Deployment, Organization Size, Vertical, and Region |

Geographies covered | North America, APAC, Europe, MEA, and Latin America |

Companies covered | Atos (France), Cognizant (US), IBM (US), Wipro (India), Infosys (India), Zensar (India), Accenture (Ireland), Fujitsu (Japan), HCL Technology (India), DXC Technology (US), NTT Data (Japan), Unisys (US), HPE (US), TCS (India), Sonda (Chile), KissFlow (India), Capgemini (France), and others. |

This research report categorizes the digital workplace market based on components, deployment, organization size, vertical, and region.

Based on the component:

- Solutions

- Unified communication and collaboration

- Unified endpoint management

- Enterprise mobility and management

- Services

- Professional services

- Managed services

Based on the deployment:

Based on the organization size:

Based on the vertical

- BFSI

- Consumer goods and retail

- Telecommunication and ITes

- Manufacturing

- Healthcare and pharmaceuticals

- Government and public sector

- Media and entertainment

- Others

Based on the region:

- North America

- Europe

- UK

- Germany

- France

- Rest of Europe

- APAC

- China

- Japan

- ANZ

- Rest of APAC

- MEA

- KSA

- UAE

- South Africa

- Rest of MEA

- Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In February 2021, Accenture announced the acquisition of Imaginea, a provider of a cloud-based platform. The acquisition will enable Accenture to enhance offerings of cloud-based services for digital services and solutions.

- In December 2020, Atos joined forces with Vodafone Spain to launch a new digital workplace offering for Vodafone Business customers in Spain.

- In June 2020, Wipro launched a digital inspection solution to improve workplace safety and experience. The solution will be available to clients both in perpetual or subscription-based license models, with no additional cost for mobility.

- In February 2020, Infosys partnered with GE Appliances. The partnership aims toward enabling digital and workplace transformation. Infosys will help GE Appliances in modernizing its IT infrastructure and run IT in managed services mode through this partnership.

- In November 2019, Atos introduced Workplace as a Service | Google Edition, as a part of its Atos Digital Workplace solutions, to provide enterprise customers with a way of enhancing the employee workplace experience through greater choice for users and a boost to productivity. As part of its partnership with Google Cloud, Atos is offering a unique, integrated, and secure package, including the supply and support of Chromebooks with Atos’ Circuit s