< Key Hightlight >

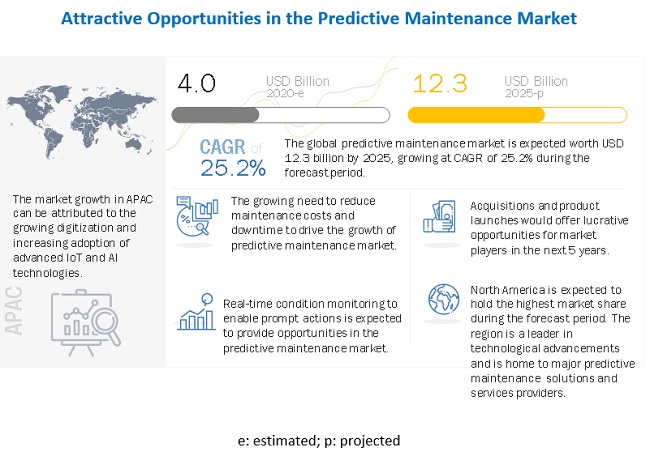

The global predictive maintenance market size is expected to grow from USD 4.0 billion in 2020 to USD 12.3 billion by 2025, at a Compound Annual Growth Rate (CAGR) of 25.2% during the forecast period. The major growth drivers of the market include the increasing use of emerging technologies to gain valuable insights, and the growing need to reduce maintenance cost and downtime.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on Global Predictive Maintenance Market

COVID-19 would have an impact on all the elements of the technology sector. Global ICT spending is estimated to decline by 4%–5% by the end of 2020. The hardware business is predicted to have the most impact on the IT industry. Due to the slowdown of hardware supply and reduced manufacturing capacity, the IT infrastructure growth has slowed down. Businesses providing solutions and services are also expected to slow down for a short span of time. However, the adoption of collaborative applications, analytics, security solutions, and AI is set to increase in the remaining part of the year.

In a short time, the COVID-19 outbreak has affected markets and customers' behavior and has a substantial impact on economies and societies. With offices, educational institutions, and manufacturing facilities shutting down for an indefinite period; major sports and events being postponed; and work-from-home and social distancing policies in effect, businesses are increasingly looking for technologies to assist them through these difficult times. Analytics professionals, business intelligence professionals, and professionals providing expertise in more advanced analytics such as AI and ML have been called for their expertise to help executives make business decisions on how to respond to the new business challenges caused by the COVID-19 outbreak.

Market Dynamics

Driver: Growing need to reduce maintenance cost and downtime

Companies are leveraging AI and ML technologies to achieve incredible precision, accuracy, and speed over traditional business intelligence tools to analyze IoT data. With the advent of predictive maintenance, enterprises can make operational predictions up to 20 times faster and with greater accuracy than threshold-based monitoring systems. In various verticals, such as industrial manufacturing or offshore oil and gas, unplanned downtime arising from equipment breakdown can cost money. AI-based IoT solutions offer enterprises predictive maintenance applications to predict equipment failure ahead of time. As industrial customers become increasingly aware of the growing maintenance costs and downtime caused by unexpected machinery failures, predictive maintenance solutions are gaining even more traction. Predictive maintenance-based solutions help enterprises identify patterns in constant streams of data to predict equipment failure.

Restraint: Lack of skilled workforce

Trained workers are required to handle the latest software systems to deploy AI-based IoT technologies and skillsets. Hence, the existing workers are required to be trained on how to operate new and upgraded systems. Moreover, industries are dynamic toward adopting new technologies; however, they are facing a shortage of highly skilled workforce and proficient workers. As most of the global vendors are organizing predictive maintenance projects, the demand for a highly skilled workforce is increasing. Companies need to acquire expertise in areas, such as cybersecurity, networking, and applications. Moreover, they seek to use IoT data for predicting outcomes, preventing failures, optimizing operations, developing new products, providing advanced analytics competency, which includes AI and ML, these technologies would play a critical role in the overall reduction of operational cost. Moreover, with enterprises integrating AI in IoT, there would be a growing need for operational intelligence-oriented data analyst teams to handle huge amounts of data generated from IoT devices.

Opportunity: Real-time condition monitoring to assist in taking prompt actions

Improved asset management is increasingly needed across almost every vertical. Solution providers equipped with AI and ML can collect and turn the vast amount of customer-related data into meaningful insights, as IoT generates a huge amount of data from connected devices. AI can also be integrated with the IoT devices to optimize various aspects of service delivery, such as predictive maintenance and quality assessment, without the need for any human intervention. The real-time inputs from sensors, actuators, and other control parameters would not only predict embryonic asset failures, but also help companies monitor in real-time and take prompt actions.

Challenge: Companies’ concern over data security and privacy issues

The predictive maintenance market has huge growth potential; however, maintaining data security and privacy is a key challenge that market players may face in the coming years. Data generated by these devices is also expected to increase in volumes, as the number of connected devices is growing. Companies can misuse the data to determine their rivals' business strategies and production schedules automatically and to hack and take control of machines. The reason for the upsurge in security and privacy issues is the unavailability of resources to implement AI techniques on IoT devices. The security challenges in IoT include insufficient authentication and authorization, uncertain network services, lack of transport encryption, poor security configuration problems, and weak physical security

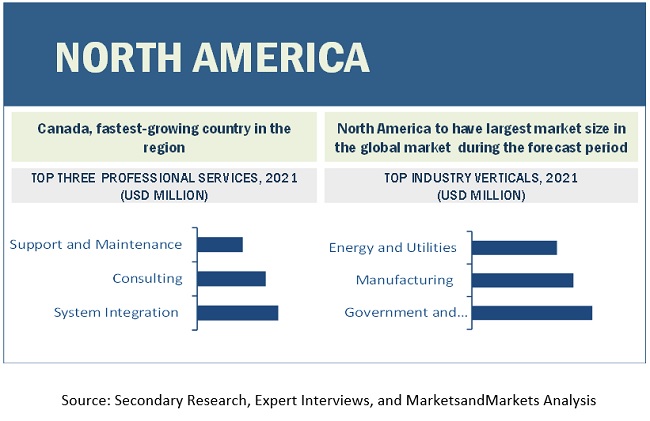

Among verticals, the energy and utilities segment to grow at the highest CAGR during the forecast period

Predictive maintenance market is segmented based on verticals. The verticals include government and defense, manufacturing, transportation and logistics, energy and utilities, healthcare and life sciences, and others (agriculture, telecom, media, and retail). The energy and utilities segment is the fastest-growing segment in the predictive maintenance market due to the growing demand for power-usage analytics applications. The ability of standalone solutions to identify asset monitoring problems in advance and perform repairs that minimizes disruption to energy production would drive the growth of predictive maintenance market.

Deployment via the cloud to grow at a rapid pace during the forecast period

Most of the vendors in the predictive maintenance market offer cloud-based maintenance solutions to gain maximum profits and effectively automate the equipment maintenance process. The adoption of cloud-based predictive maintenance solutions is expected to grow, mainly due to their benefits, such as easy maintenance of generated data, cost-effectiveness, scalability, and effective management.

North America to hold the largest market size during the forecast period

North America is expected to hold the largest market size in the global predictive maintenance market, while Asia Pacific (APAC) is expected to grow at the highest CAGR during the forecast period. In APAC, the highest growth rate can be attributed to the massive investments made by private and public sectors for enhancing their maintenance solutions, resulting in an increased demand for predictive maintenance solutions used for automating the maintenance and plant safety process. North America is expected to be the leading region in terms of adopting and developing predictive maintenance. The rising investments in emerging technologies such as IoT, AI, ML, the increasing presence of predictive maintenance vendors, and growing government support for regulatory compliance are the major factors expected to contribute to the market growth during the forecast period.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The predictive maintenance solution and service vendors have implemented various types of organic as well as inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions, to strengthen their offerings in the market. The major vendors in the global predictive maintenance market include IBM (US), Microsoft (US), SAP (Germany), Hitachi (Japan), PTC (US), GE (US), Schneider Electric (France), Software AG (Germany), SAS (US), TIBCO (US), C3 IoT (US), Uptake (US), Softweb Solutions (US), Asystom (France), Ecolibrium Energy (India), Fiix Software (Canada), OPEX Group (UK), Dingo (Australia), Sigma Industrial Precision (Spain), Google (US), Oracle(US), HPE (US), AWS (US), Micro Focus (UK), Splunk (US), Altair (US), RapidMiner (US), ReliaSol (Netherlands), and Seebo (Israel).

The study includes an in-depth competitive analysis of these key players in the predictive maintenance market with their company profiles, recent developments, and key market strategies.

Scope of the Report

Report Metric | Details |

Market size available for years | 2014–2025 |

Base year considered | 2019 |

Forecast period | 2020–2025 |

Forecast units | USD Million |

Segments covered | Component, deployment mode, organization size, industry vertical, and region |

Geographies covered | North America, Europe, APAC, Latin America, and MEA |

Companies covered | IBM (US), Microsoft (US), SAP (Germany), Hitachi (Japan), PTC (US), GE (US), Schneider Electric (France), Software AG (Germany), SAS (US), TIBCO (US), C3 IoT (US), Uptake (US), Softweb Solutions (US), Asystom (France), Ecolibrium Energy (India), Fiix Software (Canada), OPEX Group (UK), Dingo (Australia), Sigma Industrial Precision (Spain), Google (US), Oracle(US), HPE (US), AWS (US), Micro Focus (UK), Splunk (US), Altair (US), RapidMiner (US), ReliaSol (Netherlands), and Seebo (Israel) |

This research report categorizes the predictive maintenance market based on components, deployment modes, organization size, verticals, and regions.

By component:

- Software

- Services

- Managed Services

- Professional Services

- System Integration

- Support and Maintenance

- Consulting

By deployment mode:

- Cloud

- Public Cloud

- Private Cloud

- Hybrid Cloud

- On-premise

By organization size:

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

By vertical:

- Government and Defense

- Manufacturing

- Energy and Utilities

- Transportation and Logistics

- Healthcare and Life Sciences

- Others (Agriculture, Telecom, Media, and Retail)

By region:

- North America

- Europe

- UK

- Germany

- France

- Italy

- Rest of Europe

- APAC

- China

- Japan

- India

- Rest of APAC

- MEA

- Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In June 2020, PTC enhanced ThingWorx Industrial IoT platform to accelerate Industrial IoT deployments across the enterprise value chain. ThingWorx 9.0 would deliver new and expanded features to help industrial companies create, implement, customize, and scale their solutions.

- In September 2019, GE Digital enhanced its software portfolio that made it possible for companies to more easily and effectively operate their plants, analyze industrial data, and optimize their operations. The product updates include the Predix Essentials solution, which would make it easier for industrial companies to connect, visualize, and analyze their data and reduce waste, lower costs, and increase performance.

- In May 2019, Microsoft collaborated with NXP Semiconductors to bring AI and ML capabilities for anomaly detection to Azure IoT users. The two companies jointly launched a new Anomaly Detection Solution for Azure IoT. The solution included predictive maintenance features for rotating components, presence detection, and intrusion detection for preventing failures and reducing downtime to enhance productivity and system safety.

- In March 2019, TIBCO Software announced that it acquired SnappyData, a high-performance in-memory data platform for mixed workload applications. This acquisition will complement the TIBCO Connected Intelligence platform with a unified analytics data fabric that enhances analytics, data science, streaming, and data management for various use cases requiring speed, volume, and agility.

- In February 2019, IBM launched a new portfolio of IoT solutions that team AI and advanced analytics to help asset-intensive organizations, such as the Metropolitan Atlanta Rapid Transit Authority (MARTA), to improve maintenance strategies. The solution was designed to help organizations to lower costs and reduce the risk of failure from physical assets such as vehicles, manufacturing robots, turbines, mining equipment, elevators, and electrical transformers. The solution named IBM Maximo Asset Performance Management (APM) solutions were designed to collect data from physical assets in near real-time and provide insights on current operating conditions, predict potential issues, identify problems and offer repair recommendations.

- In February 2019, PTC announced the availability of a new version of its award-winning ThingWorx Industrial Internet of Things (IIoT) solution platform. The company enhanced its ThingWorx platform by introducing new capabilities, including Operator Advisor, designed to increase the productivity of factory workers by simplifying the way critical operational data is collected, synthesized, and delivered.