< Key Hightlight >

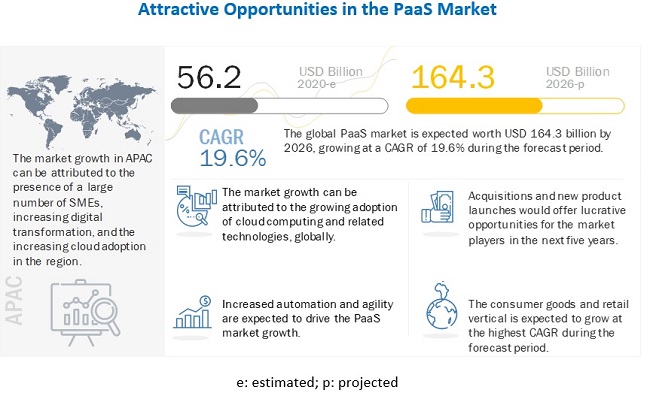

The global PaaS market size is expected to grow from USD 56.2 billion in 2020 to USD 164.3 billion by 2026, at a Compound Annual Growth Rate (CAGR) of 19.6% during the forecast period. Key factors that are expected to drive the growth of the market are the increasing need to reduce time to market and cost of application development and focus on streamlining application management. However, cloud washing hindering the growth of PaaS, and security concerns related to the adoption of public cloud are expected to limit the market growth.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact analysis on the global PaaS market

The impact of the COVID-19 pandemic on the market has been covered throughout the report. The pandemic has had a positive impact on the PaaS market growth. The major reason for the positive impact on the market is a rise in the demand for cloud-based business continuity tools and services, high dependency on public cloud services to meet their near-term business goals, and increased spending on cloud services by major industries due to COVID-19. However, reduced industry spending due to COVID-19 is expected to impact the adoption of PaaS solutions and services.

Market Dynamics

Driver: Increasing need to reduce TTM and cost of application development

The technological landscape in companies is changing at an alarming rate, including the way the infrastructure is built and maintained and software applications are being developed and deployed. Time to Market (TTM) is the time taken by an organization to introduce a product or a feature; it is a crucial factor to determine the success of an organization along with the development cost of its products. Better control over the development process makes it easier to introduce a product. Almost all companies give importance to TTM and aim to improve the same, but a majority of companies fail to attain the desired TTM due to inefficiencies in the overall digital landscape.

Digital transformation is the key to empower developers and enhance customer engagement and experiences. Companies aim at introducing the product as soon as possible because it is estimated that the first software product to enter the market can get up to 70% of the market share. Companies face financial losses if they fail to meet the TTM targets. It has been observed that there would be 33% less profit over five years if a product is introduced six months later to the market. On the other hand, if a product is launched on time, but it is 50% over budget, then the profit will be reduced by around 4%.

Less TTM and lower cost of application development would polish internal processes, fine-tune the approach to software product development, avoid development wastes, and ensure good cooperation. Hence, companies are focused on reducing the TTM and application development cost as it is important for them to introduce major version releases or small updates on time to be competitive in the market.

Restraint: Cloud washing hinders the PaaS market growth

/The term cloud washing is used when marketing teams label their software to make their software more appealing. Cloud-washed PaaS solutions differ from cloud-native offerings. Cloud-washed PaaS solutions deliver similar architecture and programming models. These solutions offer limited cloud characteristics and deliver only incremental improvement. However, cloud-native solutions that inject behavior into the application decouple application code from run-time infrastructure details, increase application density, and facilitate distributed interactions. There are many instances where end users are unable to determine whether a PaaS is cloud-washed or cloud-native. Cloud-washed solutions consume large amounts of machine resources (e.g. CPU, memory) and increased administration effort. Hence, the use of cloud-washed solutions is expected to hinder the market growth.

Opportunity: Rapid development of mobile app ecosystem

The mobile ecosystem is growing at a high pace, and app development emerges as a crucial component fueling its growth. Due to the growth of digital enterprises, the development of enterprise mobile apps is also becoming a top priority for organizations. As per the report by 451 Research, 50% of IT organizations plan to deploy a minimum of ten mobile apps over the next two years. Due to the COVID-19 pandemic, there has been a sudden spike in demand for some mobile applications. Technologies such as 5G and cloud computing have increased the development of these mobile applications. PaaS providers offer a certain set of tools for tablet, mobile, and web platforms, including a variety of functions right from data recovery, data backups, data security to licensing formalities, support, and maintenance, as well as server-based scalability. Developers can boost the application development, while PaaS providers take care of the rest.

Challenge: Vendor lock-in issues

In the case of vendor lock-in, the switching cost is high, so that the customer is stuck with the original vendor. Due to financial pressure and a limited workforce, customers are unable to switch to other vendors. Lack of standardization is also another major factor for the vendor lock-in process in the PaaS market. Furthermore, many customers are not aware of the standards that cause interoperability and portability of applications when taking services from vendors. To overcome this challenge, PaaS vendors maintain good business relationships with customers to ensure they continue to use their services.

application PaaS (aPaaS) segment to hold a larger market size during the forecast period

Various government organizations are adopting aPaaS as it provides modernization efforts while meeting all security requirements. For instance, in May 2019, Appian formed a partnership with Smartronix Inc., which is AWS’s premier partner, to deliver the speed and impact of low-code Appian platform to the Federal Government and the Department of Defense (DoD) through AWS or Microsoft Azure government cloud platform. The PaaS segment is gaining traction among enterprises, due to the various benefits it offers, such as reduced coding time, additional development capabilities without involving more staff, developing applications for multiple platforms, accessibility to support tools, support for geographically distributed teams, and efficient management of application development lifecycle.

Public cloud deployment to hold a larger market size in 2020

The public cloud segment is growing as various SMEs have embraced public PaaS. It offers a wide scope for data recovery and offers infrastructure, including hardware, OS, software, and middleware servers to run applications across different platforms. Moreover, enterprises are adopting public cloud services as they are easy to implement. Furthermore, with the adoption of public cloud solutions, it becomes easy to access platform solutions, such as big data, data analytics, and the Internet of Things (IoT). To cater to the growing demand for public cloud solutions, various organizations are shifting toward public cloud offerings. For instance, Red Hat OpenShift is an open-source enterprise PaaS. The company is providing its public PaaS version of OpenShift on its Red Hat Enterprise Linux (RHEL).

Large enterprises to hold a majority of the market share during the forecast period

The trend of digitalization has been increasing extensively among large enterprises. The growing connectivity of bandwidths and mobility trends can be seen more among large enterprises, due to the presence of a huge workforce. Large enterprises have a large corporate network and many revenue streams. These organizations are also keen to invest in new and latest technologies to effectively run their business. The PaaS market has a stronghold in large enterprises, as the IT infrastructure becomes more complex in large enterprises as compared to SMEs. The increasing demand for employees to access computing resources and applications from a mobile location and at any time has made it complex for enterprises to store their data properly, maintain and manage their data centers, and focus on their core business operations.

Manufacturing industry vertical to hold a significant market share during the forecast period

The demand for faster delivery and heightened production is rapidly increasing. Cloud technology assists manufacturing companies in meeting these increasing demands. It is mandatory for the manufacturing vertical to adapt to global changes in connectivity and computing. It is estimated that by 2023 about 50% of software used by manufacturers will be cloud-based. The cloud has made it easier to adopt emerging technologies, such as Machine-to-Machine (M2M) communication and IoT, which have led the manufacturing vertical to transform and digitalize processes on a large scale. These factors are accelerating the demand for cloud computing, leading to improved customer service and easier sustenance in the highly competitive market. Many manufacturers are using PaaS services for many of their mission-critical deployments. Along with software and web-based apps, PaaS provides third-party hardware as well as software for connection and data retrieval within the factory. PaaS services help the vertical in improving operational efficiencies within their factories.

To know about the assumptions considered for the study, download the pdf brochure

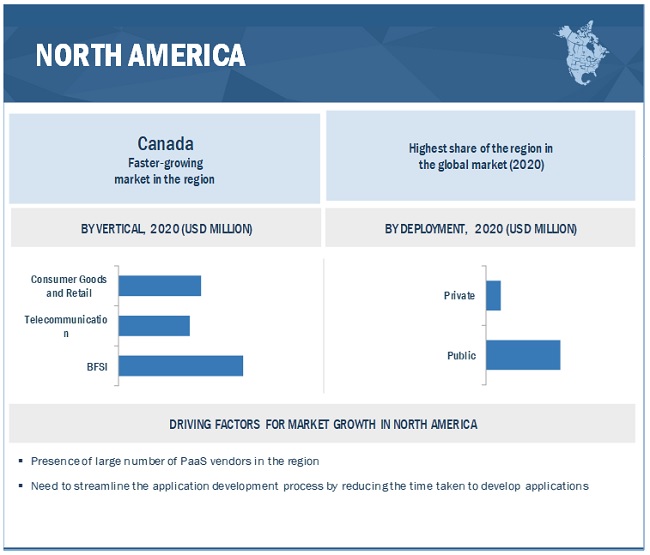

North America to account for the largest market size during the forecast period

The global PaaS market by region covers five major geographic regions, namely, North America, Asia Pacific (APAC), Europe, Middle East & Africa (MEA), and Latin America. North America is expected to be the most promising region for major verticals, such as IT, BFSI, and telecommunications. The increasing budget allocation for cloud services among enterprises is further expected to drive the market in North America. North America is expected to be the most promising region for major verticals, such as telecommunications, IT and ITeS, BFSI, and the government and public sector. The PaaS market size in North America is expected to grow steadily during the forecast period, as enterprises are adopting advanced application development technologies at various levels as a part of their strategy to sustain in the competitive market.

Key Market Players

The PaaS vendors have implemented various types of organic as well as inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions, to strengthen their offerings in the market. The major vendors offering PaaS solutions and services globally are AWS (US), Microsoft (US), Alibaba Cloud (China), IBM (US), Salesforce (US), Google (US), Oracle (US), SAP (Germany), Mendix (US), Zoho Corporation (India), Engine Yard (US), Apprenda (US), VMware (US), ServiceNow (US), Plesk (Switzerland), Render (US), CircleCI (US), Tray.io (US), Cloud 66 (UK), AppHarbor (US), Jelastic (US), Platform.sh (France), Scalingo (France), PythonAnywhere (US), and Blazedpath (US).

The study includes an in-depth competitive analysis of key players in the PaaS market with their company profiles, recent developments, COVID-19 developments, and key market strategies.

Scope of the report

Report Metric | Details |

Market size available for years | 2016–2026 |

Base year considered | 2019 |

Forecast period | 2021–2026 |

Forecast units | Billion (USD) |

Segments covered | Type, Deployment, Organization Size, Vertical, and Region |

Geographies covered | North America, APAC, Europe, MEA, and Latin America |

Companies covered | AWS (US), Microsoft (US), Alibaba Cloud (China), IBM (US), Salesforce (US), Google (US), Oracle (US), SAP (Germany), Mendix (US), Zoho Corporation (India), Engine Yard (US), Apprenda (US), VMware (US), ServiceNow (US), Plesk (Switzerland), Render (US), CircleCI (US), Tray.io (US), Cloud 66 (UK), AppHarbor (US), Jelastic (US), Platform.sh (France), Scalingo (France), PythonAnywhere (US), and Blazedpath (US). |

This research report categorizes the PaaS market based on component, deployment type, organization size, vertical, and region.

Based on the type:

- Application PaaS (aPaaS)

- Integration PaaS (iPaaS)

- Database PaaS (dbPaaS)

- Others

Based on the deployment:

Based on the organization size:

Based on the vertical

- BFSI

- Consumer goods and retail

- Telecommunication

- IT and ITeS

- Manufacturing

- Healthcare and life sciences

- Energy and utility

- Others

Based on the region:

- North America

- Europe

- UK

- Germany

- France

- Rest of Western Europe

- Central and Eastern Europe

- APAC

- MEA

- Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In January 2021, Microsoft introduced a new Wisely blockchain-enabled cPaaS offerings for enterprises, mobile carriers, OTT players, marketers, and industry regulators to improve their quality of service.

- In Septmber 2020, Oracle expanded its security portfolio with new cloud services designed to automatically help protect cloud workloads and data from risks posed by cyber threats. The three new cloud services, including Oracle data safe, Oracle cloud guard, and Oracle maximum security zones, provide centralized security configuration as well as automated enforcement of security practices.

- In June 2020, IBM collaborated with Wipro to accelerate the transformation to the cloud. Under this collaboration, Wipro will develop hybrid cloud offerings to help businesses migrate, manage, and transform across public or private clouds.

- In January 2019, AWS acquired CloudEndure, an Israeli-based company, which offers Disaster Recovery (DR) services. This acquisition would help AWS deliver enhanced and innovative migration, backup, and DR solutions to customers.