< Key Hightlight >

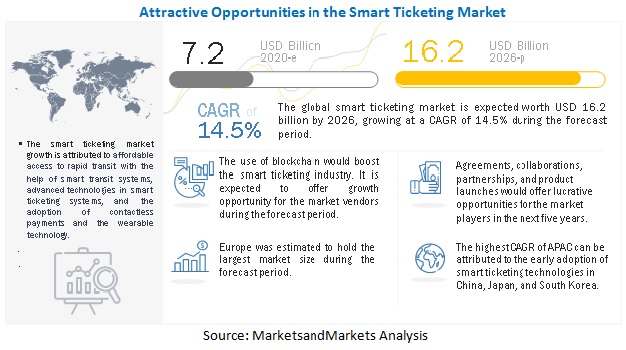

The global smart ticketing market size is projected to grow from USD 7.2 billion in 2020 to USD 16.2 billion by 2026, at a Compound Annual Growth Rate (CAGR) of 14.5% during the forecast period. The smart ticketing market is gaining traction due to affordable access to rapid transit with the help of smart transit systems, huge demand for smart ticketing from sports, entertainment, and tourism industries, advanced technologies in the smart ticketing systems, rising adoption of contactless payments, upsurge in the intelligent transportation market, and growing adoption of wearable technologies.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on the smart ticketing market

The COVID-19 pandemic has dramatically changed the availability and use of transportation system in North America. Since March 2020, there has been a significant decrease in transportation activities in the US and Canada due to travel and public health restrictions. The steep decline in ridership during the crisis has caused public transit systems across the US tremendous financial distress. Even with the infusion of USD 25 billion provided by Congress in April 2020 through the CARES Act, transit agencies were still facing a shortfall. The focus of governments has shifted toward the adoption of measures for safeguarding citizens and infrastructure, and therefore, innovation projects have taken a hit. After the outbreak of the pandemic in the US, mobile payments in the country have increased. It is the preferred method of payment as it requires minimal physical interaction, helping in preventing the spread of the virus.

Europe is the most affected region across the globe. As Italy struggled to deal with the rising number of deaths in the country, countries across Europe adopted increasingly strict measures to ensure that their citizens stay at home. The imposition of several restrictions has severely affected the transportation industry, resulting in tremendous revenue losses. After the lockdown restrictions were eased and businesses reopened, the public transport riders started operating for people from essential industries such as healthcare and the food supply chain. They had to practice strict physical distancing; as a result, there was less occupancy in buses and rails. Even after more restrictions were relaxed, limited transport services were provided in many countries.

The COVID-19 pandemic has had a deep impact on transport connectivity in APAC. It has posed a huge challenge for government agencies, raising unknowns, and imposing wrenching trade-offs. The COVID-19 outbreak has slowed down most of the economies, such as China, India, Japan, and Australia. The number of countries imposing travel restrictions more than doubled in March 2020, leading to a sharp fall in passenger demand in the transportation sector. To overcome these challenges, governments have started taking several initiatives in the region to control the spread of the pandemic. In China, all sorts of toll and fare collection have stopped. It has put in place a no-stop, no-check, and toll-free policy for vehicles transporting emergency supplies and essential personnel.

As of 30th March 2020, the top five countries affected due to the COVID-19 pandemic in Latin America were Brazil, Chile, Ecuador, Mexico, and Panama. These countries have reported the highest number of COVID-19 infected cases in the region. In the Middle East, due to mass gatherings and high tourism, countries such as the UAE, Iran, Bahrain, and Kuwait have had a high number of positive cases. In Africa, positive cases are minimum due to less international travel and tourism as compared to developed countries. The pandemic has a negative impact on tourism and overall productivity in countries due to travel and safety restrictions. It is expected that these countries would witness social and economic impacts in the long term and affect the market growth in the region.

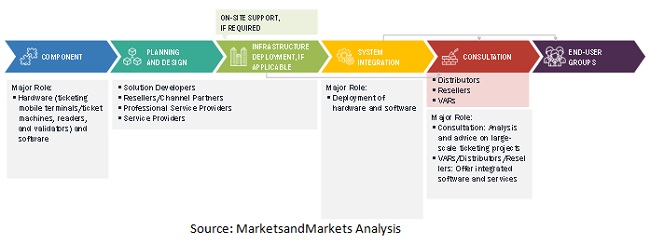

Market Value Chain

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

Driver: Huge demand for smart ticketing from sports, entertainment, and tourism industries

Smart ticketing is emerging as an innovation in the ticketing system in the sports, transportation, and entertainment industries. Smart tickets offer a cost-effective and efficient way for passengers to manage their travels in public transport. Passengers can also load credit amounts in their tickets in advance for their travel. If the smart ticket is stolen or lost, then users can recover and transfer the amount to another smart card, thereby making it a convenient and secured ticketing application for travelers.

The integration of smart technologies, including virtual reality, smartphones, contactless smart cards, maps, wearables, and Artificial Intelligence (AI) in the travel and tourism industry benefitted the countries such as China, India, Singapore, and the UAE in a noticeable economic growth. Smart technologies help this industry to offer a diversified range of services that attract visitors across the world. Transportation authorities in various regions, such as Europe and APAC, support the growth of the travel and tourism industry by regulating ambitious projects to strengthen the adoption of smart ticketing systems.

Restraints: High setup costs for smart tickeing systems

Smart ticketing systems are widely used in the public transportation network. The deployment of these smart transit systems across the network requires joint efforts from entities, such as infrastructure providers, component manufacturers, service providers, the public sector, and user groups. The involvement of various entities for the successful implementation of ticketing systems entails a sophisticated framework, which results in a huge amount of investments.

Opportunity: Use of blockchain to boost smart ticketing industry

Smart ticketing systems are largely used in stadiums, concerts, and similar events. The smart ticketing industry faces various problems, such as fraud, scalpers, fake tickets, incomplete sales of tickets, tickets bought in the secondary market, and the lack of a uniform refund system. Sometimes, tickets are bought in mass by bot networks and sold at a very high price in the secondary market. In addition, the identity of visitors is unknown to the event organizers, which may lead to security issues. There is no uniformity among different players. With the help of blockchain technology, uniformity among different players can be created, and transparency can be attained in ticket booking processes. Smart ticketing enables event organizers to set terms for crypto-tickets, such as pricing, exchange, refunds, and resales. At the same time, customers can have the assurance that their tickets are not fake and are not used by other people.

Challenge: Data safety and security issues

Data safety and security issues associated with the use of smart ticketing systems are estimated to be one of the major challenges affecting the growth of the market. User data stored in smart cards or mobile devices can be misused. While using smart ticketing systems for transportation, a few credentials are needed. These include secret cryptographic keys for authentication with the point-of-service terminal to avail travel tickets. The conventional smart card stores user credentials for a longer time in tamper-resistant hardware. Security professionals require certain levels of certification for tamper-resistant hardware used in standard solutions to keep valuable information assets safe. Users with mobile devices that lack secure hardware have the option of storing and retrieving their credentials from the cloud for appropriate authentication. However, for transport ticketing, transaction speed is often vital to provide convenience for users while approaching a gated station or boarding a bus. Hence, the credentials stored on insecure mobile devices raise the risk of security breaches. The impact of this challenge can be subsided with the emergence of blockchain technology in the smart ticketing ecosystem in the near future.

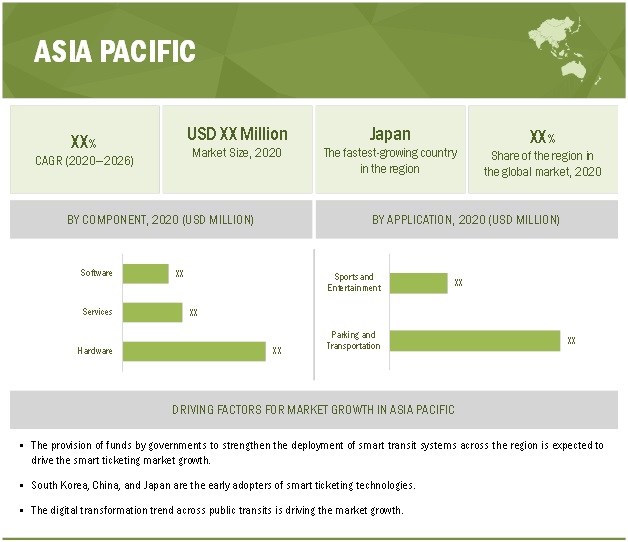

APAC to grow at the highest CAGR during the forecast period

APAC is expected to grow at the highest CAGR during the forecast period owing to the presence of emerging economies such as China, India, Indonesia, Malaysia, and Thailand. These countries are focusing on building smart cities due to strong economic growth, the rise in population, and rapid urbanization. APAC countries are also attracting investments, promoting new technologies, and developing innovative solutions to improve the quality of life. These developments are fueling the growth of the smart ticketing market in the region. There is an emphasis on the development of advanced and interoperable automated fare collection systems, such as smart cards and NFC-enabled devices, to increase both the efficiency of transport systems and ridership by giving commuters a smooth travel experience. Developed countries such as Japan and Singapore are focusing on technology-enabled transport systems by making heavy technology investments.

Key Market Players

This research study outlines the market potential, market dynamics, and major vendors operating in the smart ticketing market. Key and innovative vendors in the smart ticketing market include ACT (England), Atsuke (France), Cammax (England), Conduent (US), Confidex (Finland), Corethree (England), Cubic (US), Flowbird Group (France), Giesecke+Devrient (Germany), HID Global (US), Hitachi Rail (Italy), IDEMIA (France), Indra (Spain), Infineon Technologies (Germany), INIT (Germany), LIT Transit (Slovenia), Masabi (England), NXP Semiconductors (Netherland), PayiQ (Finland), Scheidt & Bachmann (Germany), SecuTix (Switzerland), Siemens (Germany), Thales (France), Ticketer (England), and Xerox (US). The study includes an in-depth competitive analysis of these key players in the smart ticketing market with their company profiles, recent developments, and key market strategies.

Scope of Report

Report Metrics | Details |

Market size available for years | 2020-2026 |

Base year considered | 2019 |

Forecast period | 2020-2026 |

Forecast units | Value (USD Million) |

Segments covered | Component (hardware, software, and services), application, organization size, and region. |

Regions covered | North America, Europe, APAC, and RoW |

Companies covered | ACT (England), Atsuke (France), Cammax (England), Conduent (US), Confidex (Finland), Corethree (England), Cubic (US), Flowbird Group (France), Giesecke+Devrient (Germany), HID Global (US), Hitachi Rail (Italy), IDEMIA (France), Indra (Spain), Infineon Technologies (Germany), INIT (Germany), LIT Transit (Slovenia), Masabi (England), NXP Semiconductors (Netherland), PayiQ (Finland), Scheidt & Bachmann (Germany), SecuTix (Switzerland), Siemens (Germany), Thales (France), Ticketer (England), and Xerox (US). |

This research report categorizes the smart ticketing market to forecast revenue and analyze trends in each of the following submarkets:

Based on Components:- Hardware

- Software

- Services

- Consulting

- Implementation

- Support and Maintenance

Based on Application:

- Parking and Transportation

- Sports and Entertainment

Based on Organization size:

Based on regions:

- North America

- Europe

- APAC

- RoW

Recent Developments:

- In February 2021, Infineon Technologies launched 40 nm SLC36/SLC37 security controller platforms with high-performance 32-bit ARM SecurCore SC300 dual interface security chips. These crypto controller platforms provide better performance and flexibility for contactless payments, ticketing, and access applications.

- In February 2021, Cubic’s CTS business division signed a contract with New York Metropolitan Transportation Authority to upgrade the fare payment system for Metro-North Railroad and Long Island Rail Road to a new account-based contactless fare payment system.

- In February 2021, Scheidt & Bachmann partnered with Pyramid Computer, a leading developer and manufacturer of IT solutions for retail and hospitality markets, to promote self-checkout solutions at fuel retail sites. Scheidt & Bachmann developed the SIQMA Smoove smart checkout solution by deploying Pyramid Computer’s hardware solution for self-checkout. The partnership enabled the company to develop intuitive SIQMA applications.

- In February 2021, Conduent and Flowbird, a French company specializing in urban mobility payment methods, signed a 10-year contract with Comutitres and the transport authority Ile-de-France Mobilités to replace all Ile-de-France Mobilites’s bus and tram onboard ticketing platforms with next-generation technologies.

- In February 2021, HID Global acquired TSL UK Ltd, a global provider of RFID handheld readers. The expansion of the RFID component business with TSL readers provides HID Global a one-stop-place for offering RFID hardware and integration tools.

Key Benefits of Buying the Report

The report would provide the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall smart ticketing market and its subsegments. It would help stakeholders understand the competitive landscape and gain more insights better to position their business and plan suitable go-to-market strategies. It also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.