< Key Hightlight >

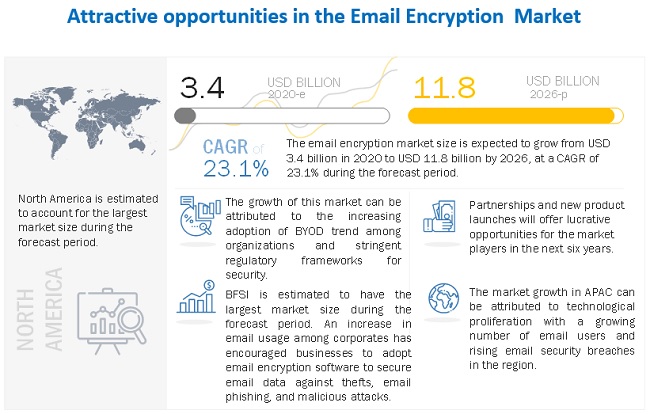

The global email encryption market size is projected to grow from USD 3.4 billion in 2020 to USD 11.8 billion by 2026, at a Compound Annual Growth Rate (CAGR) of 23.1% during the forecast period. Major driving factors for the market include rise in BEC scams and spear phishing, growing number of email users globally, high demand for cloud-based email encryption services, and mandate to comply with data protection directives.

Email encryption helps in encrypting data with the use of encryption key so that the information that needs to be communicated through emails can be secured. With a steep increase in email usage for corporate as well as personal communication among individuals, sensitive information can be accessed by unidentified sources. This has encouraged businesses to adopt email encryption software to secure their data against thefts and losses. Moreover, these solutions help organizations prevent cyber-threats and attacks such as spams, malware, viruses, Business Email Compromise (BEC) attacks, zero-hour malware, and other intrusions that may expose critical enterprise information and infrastructure to risk.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact Analysis on Email Encryption Market

The COVID-19 pandemic has affected every segment of society, including individuals and businesses. The internet ecosystem has been playing a pivotal role all over the globe. Due to the COVID-19 pandemic, the dependency on online businesses has increased significantly. BFSI, healthcare and life sciences, manufacturing, automotive, retail, transport and logistics, among others, are leveraging the internet to provide necessary services to consumers. Vendors have experienced decreased demand for a email encryption system. Amidst the COVID-19 pandemic crisis, various governments and regulatory authorities have mandated both public and private enterprises to embrace new practices of teleworking and maintaining social distance. Since then, digital ways of doing business and usage of emails with home servers became the new business continuity plan (BCP) for various organizations. With the widespread use of mobile devices and internet penetration across the globe, individuals are progressively inclined towards the use of digital technologies such as email encryption, email security, and Data Loss Prevention (DLP). The rate of phishing and email scams has spiked up in the pandemic, and organizations have become more cautious when it comes to protecting confidential data stored on email servers. Email encryption solutions enable organizations to encrypt email data to protect its resources from malicious cyber-attacks.

Market Dynamics

Driver: Rise in BEC scams and spear-phishing

Over the years, organizations have been massively getting hit by these sophisticated cyber-attacks, such as email-based phishing and BEC scams, leading to huge financial losses. In BEC, adversaries target corporate email accounts, spoofing customers and employees or partners for financial gains such as approving payment transfers to cybercriminals’ account. Fraudulent practices such as spear phishing to steal data for malicious purposes are on the rise. The use of email encryption solution and services are an effective measure to protect email data. Spear-phishing activities to steal sensitive information for malicious purposes and installation of malware on a targeted user’s device are on the rise. Hackers all over the world are exploiting the fears around the COVID-19 pandemic; there is an increase in COVID-19-related attacks, including BECs and spear-phishing.

Restraint: High cost of email-encryption solutions

The major challenge faced by companies while adopting email encryption solutions is the high cost involved in deploying these solutions. Email encryption solutions help organizations and users in reducing the risk of data loss on email platforms. The adoption of the email encryption solutions significantly increases businesses’ overall overhead costs, as the solutions require expansion of IT resources for securing and encrypting emails. The price of the solution scales up as per the size of the file to be encrypted. Free platforms available on the internet do not possess prime capabilities to safeguard sensitive data efficiently. The email encryption solutions prove to be a costly solution for SMEs due to budget restrictions. Moreover, the maintenance and timely upgradation costs add to the overall increase in an organization’s expenses. The software licensing costs charged per user (email account) and maintenance cost of the email encryption software and technical support for users, are an expensive solution for low-budget enterprises to deploy. Moreover, these encryption solutions need to be compatible with existing IT systems. Thus, all these factors hinder the adoption of email encryption solutions.

Opportunity: Higher demand for cloud-based email encryption services

Enterprises are seeking cloud deployment security solutions to enable cost-effectiveness, rapid deployment, and on-demand access to expertise to mitigate advanced emails threats. The rapid growth in IT infrastructure has given rise to new and sophisticated threats, such as spear phishing, trojans, ransomware, BEC scams, social engineering, and malware and spams, which have put organizations’ critical data at risk. Cloud-based email protection helps businesses to safeguard from phishing attacks, ransomware, spam, spoofing, and malicious threats over email in real-time. There are many vendors in the email encryption market that offer cloud-based email encryption services to their clients. For example, Virtru, offers a cloud-based and secure email encryption platform which ensures that all emails are end-to-end encrypted. As more applications become virtual, the need for cloud-based email encryption solutions are gaining traction.

Challenge: Requirement of key management and verification solutions for encrypting keys

The requirement of key management and verification solutions for encrypting keys is one of the major challenges in the email encryption market. Encryption solutions are used for securing confidential data, files, folders, and emails. Encryption key management solutions secure cryptographic keys from losses. These cryptographic keys are the combination of alphabets and numerals acting as passwords. If encryption keys get corrupted, the existing and past content becomes vulnerable and gets exposed to hackers. So, these encryption keys need to be secured and maintained privately with the help of experts so that they cannot be hacked by unidentified users. Moreover, email encryption keys become useful only when both parties have installed the encryption key software. In this process, recipients need to install an email encryption solution and create a pair of encryption keys and provide their public portion to senders. The senders can open emails only after entering the encryption keys. This continual creation, provisioning, and management of encryption keys are time-consuming and restrict email encryption usage.

Based on vertical, the Banking, Financial Services, and Insurance (BFSI) industry vertical accounts for the largest market size in the email encryption market

The BFSI industry vertical is expected to hold the highest market share in the email encryption market. BFSI is the most targeted industry vertical as it deals with large volumes of sensitive and private financial data. The enterprises in this industry vertical are demanding for the email encryption solution to ensure irreversible encryption. Moreover, the BFSI industry vertical is the most regulated as it has to comply with many security requirements. There are strong data security requirements for BFSI industries due to the sensitive and private data they deal with. Various government mandates, such as Personal Information Protection and Electronic Documents Act (PIPEDA), Gramm-Leach-Bliley Act (GLBA), Federal Financial Institutions Examination Council (FFIEC), along with standards, including PCI DSS and SOX, require financial institutions to ensure protection from APTs, phishing, malware, and other advanced email attacks.

To know about the assumptions considered for the study, download the pdf brochure

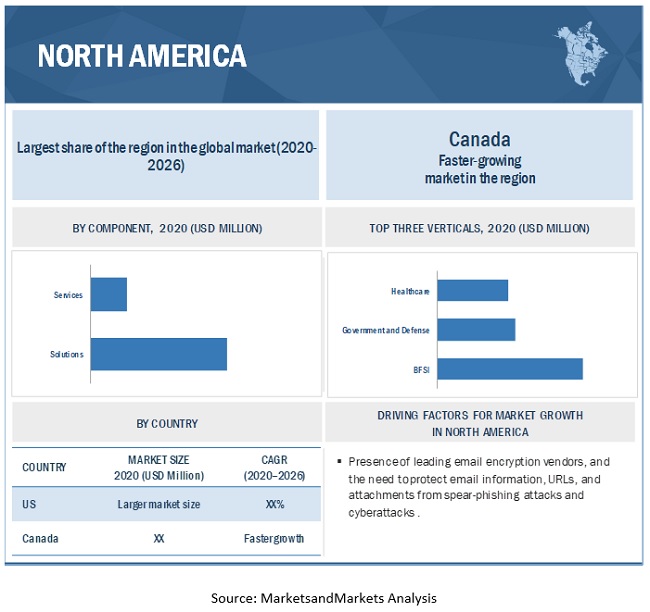

North America is expected to hold the largest market size during the forecast period

North America is estimated to account for the highest market share in the email encryption market. Early adoption of email encryption and the presence of several vendors that provide email encryption solutions are expected to drive the email encryption market growth in the region. Businesses in this region are increaisngly implementing email encryption solution for enabling data security, preventing cyber-attacks and commercial espionage, and ensuring security and privacy of data to facilitate business continuity.

Key Market Players

This research study outlines the market potential, market dynamics, and key and innovative vendors in the email encryption market include Micro Focus (UK), Broadcom (US), Cisco (US), Trend Micro (Japan), Sophos (UK), Proofpoint (US), BAE Systems (UK), Zix (US), Entrust Datacard (US), Mimecast (UK), Egress Software (UK), ProtonMail (Switzerland), Trustifi (US), Barracuda Networks (US), Intemedia (US), Clearswift (UK), Virtru (US), Echoworx (Canada), NeoCertified (US), Deltagon (Finland), DeliverySlip (US), Hornetsecurity (Germany), Datamotion (US), Virtru (US), Smarsh (US), Retarus (Germany), Lux Sci (US), Cryptzone (US), SecureAge Technology (Singapore), Paubox (US), Sendinc (US), and Frama (Denmark).

The study includes an in-depth competitive analysis of these key players in the email encryption market with their company profiles, recent developments, and key market strategies.

Scope of the Report

Report Metric | Details |

Market size available for years | 2014–2026 |

Base year considered | 2019 |

Forecast period | 2020–2026 |

Forecast units | Value (USD) |

Segments covered | Component, Deployment Mode, Organization Size, Vertical, and Regions. |

Geographies covered | North America, Europe, APAC, Middle East and Africa (MEA), and Latin America. |

Major companies covered | Micro Focus (UK), Broadcom (US), Cisco (US), Trend Micro (Japan), Sophos (UK), Proofpoint (US), BAE Systems (UK), Zix (US), Entrust Datacard (US), Mimecast (UK), Egress Software (UK), ProtonMail (Switzerland), Trustifi (US), Barracuda Networks (US), Intemedia (US), Clearswift (UK), Virtru (US), Echoworx (Canada), NeoCertified (US), Deltagon (Finland), DeliverySlip (US), Hornetsecurity (Germany), Datamotion (US), Virtru (US), Smarsh (US), Retarus (Germany), Lux Sci (US), Cryptzone (US), SecureAge Technology (Singapore), Paubox (US), Sendinc (US), and Frama (Denmark). |

This research report categorizes the Email encryption to forecast revenues and analyze trends in each of the following submarkets:

Based on type:

- End-to-end email encryption

- Gateway email encryption

- Boundary email encryption

- Hybrid email encryption

- Client plugins

Based on component:

- Solutions

- Services

- Training and Education

- Support and Maintenance

Based on deployment mode:

Based on organization size:

Based on the vertical:

- BFSI

- Government and Defense

- IT and ITeS

- Telecommunication

- Energy and Utilities

- Manufacturing

- Retail and eCommerce

- Healthcare

- Other verticals (media and entertainment, education, and travel and transportation)

Based on the region:

- North America

- Europe

- United Kingdom (UK)

- Germany

- France

- Rest of Europe (EU and Non-EU countries)

- APAC

- China

- Japan

- Singapore

- Rest of APAC (India, Indonesia, Taiwan, and South Korea)

- Middle East and Africa (MEA)

- Latin America

- Brazil

- Mexico

- Rest of Latin America (Argentina, Columbia, Chile, and Peru)

Recent Developments:

- As of May 2021, Sophos Email Advanced Portal Encryption will be available to customers and partners as an add-on product to Sophos Email Advanced. Portal Encryption enables senders of emails to securely deliver an encrypted email onto a web portal.

- In February 2021, Mimecast entered into a strategic partnership with Netskope, a cloud security vendor. The strategic integrations will enable businesses to secure cloud services and emails using enterprise-grade DLP solutions.

- In January 2021, MicrosoftTrend Micro is a Microsoft Gold Certified Partner. Trend Micro has a long history of delivering security for the Microsoft environment. For example, Trend Micro Cloud App Security integrates directly with Microsoft Office 365 to protect incoming and internal Office 365 emails from advanced malware and other threats.

- In August 2020, Proofpoint launched the Proofpoint Essentials Security Awareness solution. This solution provides training to SMEs to help them identify high risks via threat simulations. This reduces the impact of phishing and malware infections.

- In January 2020, Micro Focus introduced Voltage SmartCipher. This offering ensures secure file encryption across collaboration platforms, such as email/cloud-hosted environments. The solution provides improved privacy compliance with persistent unstructured file encryption.

- In May 2019, Trend Micro enhanced its email security capabilities to combat BEC attacks, machine learning-based detection of suspicious email content, sandbox malware analysis, document exploit detection, and email reputation technologies.

- In February 2019, Symantec introduced Email Fraud Protection, an automated solution that helps organizations block fraudulent emails and combat BEC attacks. The Email Fraud Protection solution integrates with Symantec Email Security and Symantec Email Threat Isolation to support email authentication standards and minimize threats, such as spam, spear phishing, malware, credential thefts, and malware attacks on-premises or in the cloud.

Key Benefits of Buying the Report

The report would provide the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall email encryption market and its sub-segments. It would help stakeholders understand the competitive landscape and gain more insights to position their business and plan suitable go-to-market strategies. It also helps stakeholders understand the market's pulse and provides them with information on key market drivers, restraints, challenges, and opportunities.