< Key Hightlight >

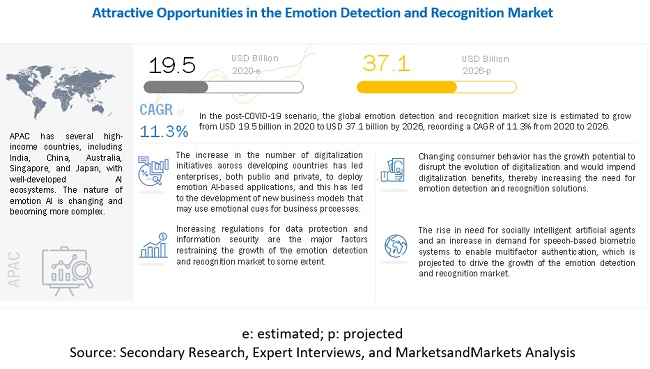

In the post COVID-19 scenario, the global emotion detection and recognition market size is projected to grow from USD 19.5 billion in 2020 to USD 37.1 billion by 2026, at a Compound Annual Growth Rate (CAGR) of 11.3% during the forecast period. The major factors driving the market growth include the rising need for accretion of speech-based emotion detection systems to analyze emotional states, Adoption of IoT, AI, ML, and deep learning technologies across the globe, growing demand in the Automotive AI industry, growing need for high operational excellence, and rising need for socially intelligent artificial agents.

To know about the assumptions considered for the study, download the pdf brochure

COVID-19 Impact on the Emotion Detection and Recognition Market

Amidst the COVID-19 pandemic crisis, various governments and regulatory authorities mandate both public and private organizations to embrace new practices for working remotely and maintaining social distancing. Since then, the digital ways of doing business became the new Business Continuity Plan (BCP) for various organizations.

- Rise in government initiatives on technology advancements in AI for security and public safety during COVID-19.

- Increase in demand in telehealth systems to drive the demand for affective computing technology adoption

- Emerging touchless identity verification systems to increase the demand for affective computing systems

Emotion Detection and Recognition Market Dynamics

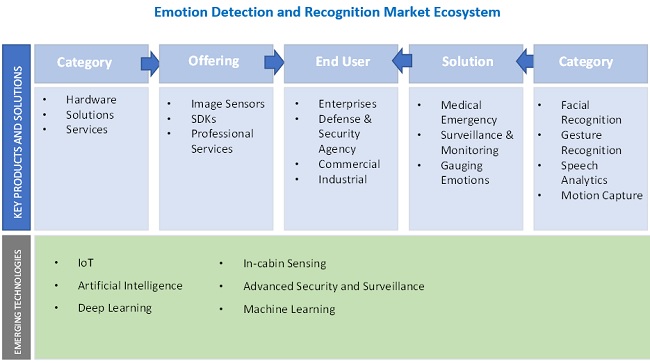

Drivers: The market for speech and voice recognition technology for consumers and enterprises has witnessed rapid development due to recent advancements in the accuracy of voice recognition systems. Speech recognition is used in various application areas, such as call centers, to classify calls according to the voice tone and analyze the emotions of customer-based on the pitch of their tone. Beyond Verbal, a leading player in voice and speech recognition, transforms voice intonations to vocal biomarkers with features such as passive, continuous, non-invasive, and cost-effective. With the help of the speech spectrum, children diagnosed with autism and emotional abnormalities are being treated.

Restraints: The cost incurred in manufacturing emotion detection and recognition systems is higher, and the tangible return on investment (RoI) is low. This factor acts as a major barrier to the growth of the emotion detection and recognition market, as most enabling technologies, such as wearable computing and gesture recognition, witness high development costs. Thus, companies that lack financial resources do not opt for the platform, despite their interest in increasing the overall productivity using these solutions.

Opportunity: Automotive is another industry where emotion detection and recognition technologies witness high demand. Not only do these technologies detect how tired or distracted the driver is, but they also create a comfortable, wholesome driving experience. In the long run, with the advancement of emotion detection and recognition technologies, these software solution will be widely used on the Internet of Things (IoT) and Smart Home/City. This is also relevant to the gaming industry.

Challenges: Classifying complex categorical emotions has been a relatively unexplored area of the emotion detection and recognition market. An important consideration in automated emotion classification is the choice of features to extract. Facial expressions and head motions are important modalities used by people to communicate their mental states to others. The differences between dynamic facial expressions are impossible to communicate back to the user without additional processing.

To know about the assumptions considered for the study, download the pdf brochure

By technology, natural language processing technology to hold the highest market share in 2020

Natural Language Processing (NLP) is a subfield of Artificial Intelligence (AI) that enables computers to understand human languages, including slangs, accents, and contractions, to produce human-like speech and text. It executes a lexical analysis that evaluates languages and sets of data, based on human languages. NLP empowers computers to perform tasks, such as translation, question answering, content classification, part-of-speech tagging, language detection, parsing, lemmatization/stemming, and semantic reasoning. NLP-powered applications are gaining traction in different applications, such as speech and voice recognition, gesture recognition, computer-assisted coding, and data mining.

By software, the facial expression recognition segment to grow at the highest CAGR during the forecast period

Facial expressions are a mixture of an individual’s cognitive state, intention, personality, and psychology and are quite often used to communicate messages in interpersonal relationships. Facial expressions are also gestures that are extremely helpful in responding to a particular speech. Facial recognition software is an integral part of the emotion detection and recognition system as it enables the identification of emotions or responses from facial expressions and generates real-time results.

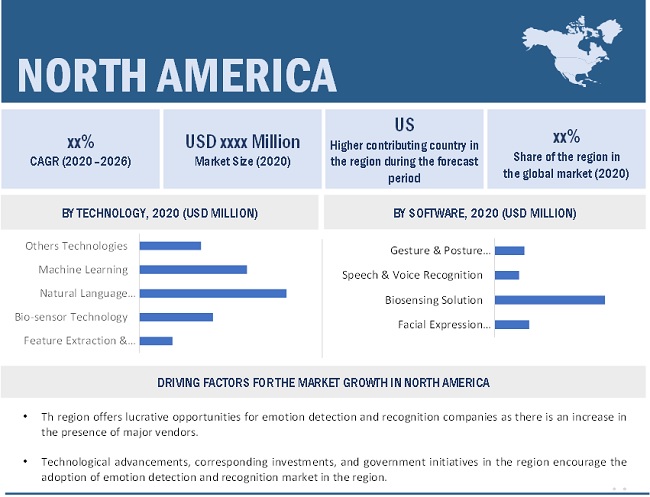

By region, North America to account for the highest market share during the forecast period

North American has the presence of several prominent market players delivering advanced software solutions to all the verticals in the regions. Owing to their strong economies, the US and Canada are expected to be major contributors to the growth of the emotion detection and recognition market. Apart from this factor, the geographical presence, strategic investments, partnerships, and significant Research and Development (R&D) activities are contributing to the hefty deployments of emotion detection and recognition software solutions. Key pure play vendors, such as Affectiva, Kairos, and Eyeris, along with several startups in the region, offer enhanced emotion detection and recognition software to cater to the needs of customers. Such factors are expected to fuel the growth of the global emotion detection and recognition market in North America.

Market Players:

The vendors covered in the market report include NEC Global (Japan), IBM (US), Intel (US), Microsoft (US), Apple (US), Gesturetek (Canada), Noldus Technology (Netherlands), Google (US), Tobii (Sweden), Cognitec Systems (Germany), Cipia Vision Ltd (Formerly Eyesight Technologies) (Israel), iMotions (Denmark), Numenta (US), Elliptic Labs (Norway), Kairos (US), PointGrab (US), Affectiva (US), nViso (Switzerland), Beyond Verbal (Israel), Sightcorp (Holland), Crowd Emotion (UK), Eyeris (US), Sentiance (Belgium), Sony Depthsense (Belgium), Ayonix (Japan), and Pyreos (UK). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches and product enhancements, and acquisitions to expand their presence in the global emotion detection and recognition market.

Scope of the Report

Report Metric | Details |

Market size available for years | 2014-2026 |

Base year considered | 2020 |

Forecast period | 2021–2026 |

Forecast units | Value (USD) |

Segments covered | Technology, Component, Software, Application Area, Vertical And Region |

Geographies covered | North America, Europe, APAC, and RoW |

Companies covered | The major companies covered include NEC Global (Japan), IBM (US), Intel (US), Microsoft (US), Apple (US), Gesturetek (Canada), Noldus Technology (Netherlands), Google (US), Tobii (Sweden), Cognitec Systems (Germany), Cipia Vision Ltd (Formerly Eyesight Technologies) (Israel), iMotions (Denmark), Numenta (US), Elliptic Labs (Norway), Kairos (US), PointGrab (US), Affectiva (US), nViso (Switzerland), Beyond Verbal (Israel), Sightcorp (Holland), Crowd Emotion (UK), Eyeris (US), Sentiance (Belgium), Sony Depthsense (Belgium), Ayonix (Japan), and Pyreos (UK). |

This research report categorizes the emotion detection and recognition market to forecast revenues and analyze trends in each of the following submarkets:

Based on Technology:

- Feature Extraction and 3D Modelling

- Biosensors Technology

- Natural Learning Processing (NLP)

- Machine Learning (ML)

- Other Technologies (records management technology, big data analytics, and other middleware tech)

Based on Component:

Based on Software:

- Facial Expression Recognition

- Biosensing Solution

- Speech and Voice Recognition

- Gesture and Posture Recognition

Based on Application areas:

- Medical Emergency

- Marketing and Advertising

- Law Enforcement, Surveillance, and Monitoring

- Entertainment and Consumer Electronics

- Other Application areas (robotics and eLearning)

Based on Verticals:

- Academia and Research

- Media and Entertainment

- IT and ITES

- Healthcare and Social Assistance

- Telecommunications

- Retail and eCommerce

- Automotive

- BFSI

- Other Verticals

Based on the region:

- North America

- Europe

- United Kingdom (UK)

- Germany

- The Netherlands

- Rest of Europe (France, Russia, and Switzerland)

- APAC

- China

- Japan

- Australia

- Rest of APAC (India, New Zealand, and Singapore)

- RoW (Middle East and Africa [MEA] and Latin America)

Recent Developments

- In July 2019, EyeSight technologies partnered with leading tier 1 automobile company in China to help bring DriverSense, Eyesight Technology’s Driver Monitoring System (DMS), to automakers in the Chinese market.

- In June 2019, Microsoft launched four free “Eyes First” games for people with speech and mobility disabilities. They can play games, such as tile slide, match two, double up, and maze using the eye gaze input.

- In January 2019, Affectiva partnered with Aptiv PLC to enable next-generation vehicle experience. The partnership will deliver innovative and scalable software derived from deep learning architectures - to enhance perception capabilities in advanced safety solutions and reimagine the future of the in-cabin experience.

- In September 2018, Affectiva unveiled Mobile Lab with automotive AI technology. The mobile lab car features, which are a part of the first multi-modal in-cabin sensing solution, called Affectiva Automotive AI, demonstrate how AI can make driving safer in semi and fully autonomous vehicles.

- In May 2018, Microsoft signed an agreement to acquire XOXCO, a company with conversational AI and bot development capabilities.