< Key Hightlight >

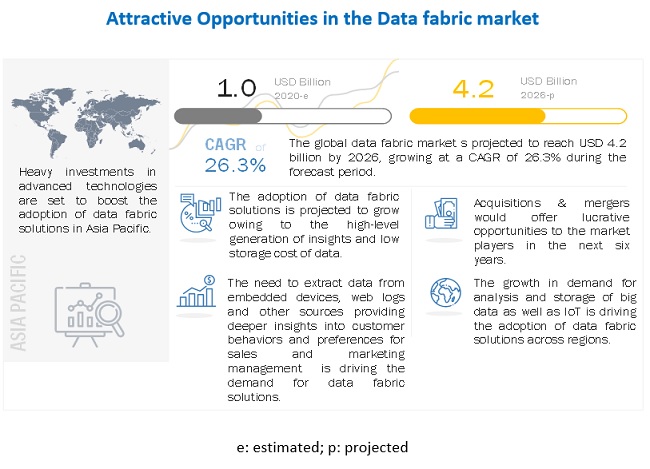

The global data fabric market size to grow from USD 1.0 billion in 2020 to USD 4.2 billion by 2026, at a Compound Annual Growth Rate (CAGR) of 26.3% during the forecast period. Various factors such as increasing volume and variety of business data, emerging need for business agility and accessibility, and growing demand for real-time streaming analytics are expected to drive the adoption of the data fabric software and services.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on global data fabric market

The COVID-19 pandemic has forced businesses to find new alternatives for speedy recovery and attention to the urgent need to access enough data in crisis times. Disparate data stores hamper the efforts of business leaders to make fully informed decisions. Using a modern data architecture approach called data fabric, Ernst & Young (EY) developed Business Resiliency Data Fabric that enables access to data wherever it lives. Data fabric supports rapid technological change while increasing data entropy. To help alleviate the consequences of COVID-19, Denodo launched the Coronavirus Data Portal (CDP), a collaborative initiative that leverages data virtualization to unify critical datasets originally exposed in different formats from multiple sources and countries and make the unified data open to everyone. Using the CDP and the data virtualization capabilities of the Denodo Platform, pmOne created detailed reports and AI analysis, seamlessly orchestrating all the information streams in the pmOne Share Cockpit. The collaboration of Denodo and pmOne provided the global community with trustworthy, up-to-date data about COVID-19 that can be used to develop new intelligence about COVID-19 and reduce its impact. Banks have transitioned to remote sales and service teams and launched digital outreach to customers to make flexible payment arrangements for loans and mortgages. Grocery stores have shifted to online ordering and delivery as their primary business. Schools in many locales have pivoted to 100% online learning and digital classrooms. Doctors have begun delivering telemedicine, aided by more flexible regulation. These approaches have resulted in the rise of volume and variety of business data, the rise in need for business agility and data accessibility, and increasing demand for real-time streaming analytics, contributing to the growth of the data fabric market.

Market Dynamics

Driver: Increasing volume and variety of business data

Data fabric solutions and services provide unmatched opportunities to integrate and analyze the structured, semi-structured, and unstructured data sets that otherwise might be disregarded. Not only the business data variety but also the volume of such data sets is increasing day by day due to the evolution of digital and smart technologies across varied business functions. Sensor data, geo-location data, machine data, data generated from social media and weblogs, and data from other sources are increasing tremendously on a daily basis. Storing and gaining knowledge from this data is a matter of concern for most organizations. According to Domo’s eighth-annual Data Never Sleeps graphic, every minute of every day, consumers spend USD 1 million online, make 1.4 million video and voice calls, share 150,000 messages on Facebook, and stream 404,000 hours of video on Netflix. The collective data that needs to be managed by the end of the decade would be huge. Data fabric helps integrate data from various sources, store large amounts of data, and analyze it seamlessly in one place.

Restraint: Lack of integration with legacy systems

The key factor limiting the adoption of data fabric is the organizational culture, which is built upon storing and analyzing business-related data using traditional techniques, such as data warehouse and data marts. Hence, the most significant challenge today is to make businesses more aware of how they can store and analyze real-time critical data coming from various business events for deriving a sustainable impact from data fabric adoption. The adoption of data fabric solutions and services for varied business applications could be exciting, but it is crucial to integrate such data management systems alongside well-established, legacy, and proven systems. Organizations are embedded with multiple levels of systems. There could be major flaws; while legacy systems do not have well-defined interfaces, documentation is scarce, and the IT teams do not possess the required skills. While it is true that data fabric can provide value to various business functions across organizations, the benefits and proposition of such data management technologies are yet to be realized by many organizations.

Opportunity: Increasing adoption of cloud

The adoption of data fabric across various applications is associated with the varying end-user requirements. However, technology advancement also plays a vital role in enhancing the adoption trend by companies and customers. Most of the leading analytics technology vendors are now focusing on developing a complete cloud-based suite that will have the ability to appraise and enhance its digital properties. This model helps organizations in saving time and costs for onsite deployment and management of software solutions. As per an article published by Hosting Tribunal in January 2021, 50% of enterprises spend more than USD 1.2 million on cloud services annually, and 94% of enterprises are already using a cloud service. Hence, the increasing adoption of cloud technologies across industry verticals would create immense potential opportunities for data fabric vendors.

Challenge: Disinclination toward investment in new technologies

The adoption of new technology or changes in the already existing ones requires considerable effort and costs to the company. Adoption of new technology in a company depends on several factors, such as the business value of the technology, compatibility with the existing infrastructure and technologies, complexity, budget constraints, organizational policies, and procedures. Various costs, such as initial set-up costs, including IT, spends and infrastructure requirements, hiring, training, maintenance, and support would further add up to the total cost of ownership of the new technology. Apart from the cost to the company, the interest of the stakeholders and their acceptance toward the change is one of the major factors influencing the probability of adoption of new technology. Further, traditional applications bring a complicated set of interfaces, which, at times, are not compatible with the third-party software, thus causing errors. The integration of data from various sources and analytics can be a daunting task for enterprises and further complicate system performance. The possibility of errors increases manifolds, as the legacy systems sometimes do not have well-defined interfaces to counter with the new Application Programming Interfaces (APIs). These complications make organizations reluctant to adopt data fabric.

Disk-based data fabric segment to have largest market size during the forecast period

Based on type of data fabric, the market has been segmented into disk-based data fabric and in-memory data fabric. Disk-based data fabric provides various features, such as secured, controlled, and governed data. Additionally, it gives access to data whenever it is required by applications; it also gives the flexibility to migrate data and applications, lessen the cost of ownership and data compliance.

Small and medium-sized enterprises to account for highest CAGR during the forecast period

The Data fabric market has been segmented by organization size into large enterprises and SMEs. The market share of large enterprises is higher; however, the market for SMEs is expected to register a higher CAGR during the forecast period. Good data and storage management are a greater concern for business continuity in SMEs. Data fabric solutions help SMEs to increase their productivity, efficiency, marketing, and many other business processes.

On-premises segment to have largest market size during the forecast period

Based on deployment mode, the market has been segmented into on-premises and cloud. The on-premises segment is expected to hold largest market size while the cloud segment is expected to account for higher CAGR during the forecast period. Industries susceptible to data losses, data privacy, and security breaches prefer on-premises deployment of data management solutions contributing to the higher adoption of on-premises deployment mode.

Business process management to account for highest CAGR during the forecast period

The data fabric market, by business application, comprises fraud detection and security management; governance, risk and compliance management; customer experience management; sales and marketing management; business process management; and other applications including supply chain management, asset management, and workforce management. BPM enables organizations to align business functions with customer needs and helps executives determine how to deploy, monitor, and measure company resources. When properly executed, BPM has the ability to enhance efficiency and productivity, reduce costs, and minimize errors and risk – thereby optimizing results.

APAC to account for highest CAGR during the forecast period

North America is expected to hold the largest market size in the global data fabric market. In contrast, APAC is expected to grow at the highest CAGR during the forecast period due to its growing technology adoption rate. The major countries in APAC that are technology-driven and present major opportunities in terms of investments and revenue include Australia, China, Japan, India, and South Korea. This is the major driving factor for the adoption of Data fabric software in APAC.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The Data fabric vendors have implemented various types of organic and inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. The major vendors in the global data fabric market include Oracle Corporation (US), IBM Corporation (US), Informatica (US), Talend (US), Denodo Technologies (US), Global IDs (US), NetApp (US), SAP SE (Germany), Software AG (Germany), Splunk (US), Dell Technologies (US), HP Enterprise (US), Teradata Corporation (US), TIBCO Software (US), Precisely (US), Idera (US), Nexla (US), Stardog (US), Gluent (US), Starburst Data (US), HEXstream (US), QOMPLX (US), CluedIn (Denmark), Iguazio (Israel), and Cinchy (Canada). The study includes an in-depth competitive analysis of these key players in the data fabric market with their company profiles, recent developments, and key market strategies.

Scope of the Report

Report Metric | Details |

Market size available for years | 2020–2026 |

Base year considered | 2020 |

Forecast period | 2021–2026 |

Forecast units | USD Billion |

Segments covered | Component, Data Fabric Type, Business Application, Deployment Mode, Organization Size, Vertical, and Region |

Geographies covered | North America, Europe, APAC, Latin America, and MEA |

Companies covered | Denodo Technologies (US), Global IDs (US), IBM Corporation (US), Informatica (US), NetApp (US), Oracle Corporation (US), SAP SE (Germany), Software AG (Germany), Splunk (US), Talend (US), Dell Technologies (US), HP Enterprise (US), Teradata Corporation (US), TIBCO Software (US), Precisely (US), Idera (US), Nexla (US), Stardog (US), Gluent (US), Starburst Data (US), HEXstream (US), QOMPLX (US), CluedIn (Denmark), Iguazio (Israel), and Cinchy (Canada) |

This research report categorizes the data fabric market based on components, data fabric type, business applications, deployment mode, organization size, vertical, and regions.

By Component:

- Software

- Services

- Managed services

- Professional services

- Consulting

- Integration

- Support and Maintenance

By Data Fabric Type:

- Disk-based data fabric

- In-Memory data fabric

By Business Applications:

- Fraud Detection and Security Management

- Governance, Risk and Compliance Management

- Customer Experience Management

- Sales and Marketing Management

- Business Process Management

- Other Applications (Supply Chain Management, Asset Management, and Workforce Management)

By Deployment Mode:

By Organization Size:

- Large enterprises

- Small and medium-sized enterprises (SMEs)

By Vertical:

- BFSI

- Telecommunications and IT

- Retail and E-Commerce

- Healthcare and Life Sciences

- Manufacturing

- Government

- Energy and Utilities

- Media and Entertainment

- Other Verticals (Transportation and Logistics, Travel and Hospitality, and Education).

By Region:

- North America

- Europe

- APAC

- MEA

- Latin America

Recent Developments:

- In December 2020, Teradata announced an update for Teradata QueryGrid. It extended the hybrid multi-cloud capability of Vantage and will enable Teradata customers to access data and analytics across heterogeneous technologies and public cloud providers with new cloud-native capabilities. It enables customers to access data and analytics across heterogeneous technologies and public cloud providers with new cloud-native capabilities..

- In December 2020, SAP announced SAP Data Intelligence 3.1. The update includes features such as connectivity and integration, metadata and governance, pipeline modeling, intelligent processing, and deployment and delivery. It is an on-premise edition of the SAP Data Intelligence platform..

- In November 2020, IBM announced new capabilities for IBM Cloud Pak for Data. The update will help companies drive innovation across their expanding environments and accelerate their digital transformations. The platform runs on Red Hat OpenShift. So, it can be deployed and managed in any cloud environment.

- In June 2020, HPE unveiled HPE Ezmeral. It is a new software portfolio and brand that would accelerate data-driven transformation across organizations. It provides a complete portfolio, including container orchestration and management, AI/ML and data analytics, cost control, IT automation, and AI-driven operations, and security. This solution enables organizations to increase agility and efficiency, unlock insights, and deliver business innovation..

- In October 2018, IBM launched AI OpenScale, a data governance platform, which would help organizations build AI-based applications that provide a fair and unbiased outcome.

- In June 2020, Informatica announced an update for the Intelligent Data Platform. The platform was designed to be powered by Informatica’s AI-powered CLAIRE engine. The update would allow businesses to master business-critical data to increase customer retention and loyalty, manage supply chain risk, drive digital commerce, and boost operational efficiency.

- In March 2020, Oracle released Oracle Coherence version 14.1.1. The solution is a part of Oracle's Enterprise Cloud Native Java portfolio and includes Oracle WebLogic Server 14.1.1. Coherence 14.1.1 brings significant new features to the market, representing many man-years of engineering effort. The platform is fully compatible with popular container and orchestration ecosystems such as Docker and Kubernetes.

- In February 2020, Talend released an update for Talend Data Fabric. The update introduced a Talend Cloud Data Inventory, which automatically calculates the Data Intelligence Score of all data across an organization and presents it in a self-service cloud app for every user. The update also includes capabilities such as AI features and cutting-edge cloud connectivity..