< Key Hightlight >

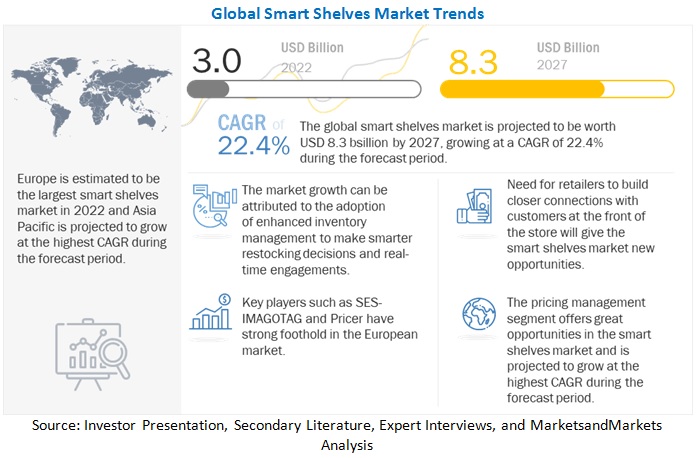

The global Smart Shelves market size is expected to grow from USD 1.8 billion in 2020 to USD 7.1 billion by 2026, at a Compound Annual Growth Rate (CAGR) of 25.1% during the forecast period. The major factors fueling the Smart Shelves market include adoption of enhanced inventory management by retail to make smarter restocking decisions and real-time engagements, and use of automation and intelligence solutions by retail to provide better shopping experience to customers. However, privacy concerns related to inbuild data tags is one of the restraining factor for the market growth in coming years.

To know about the assumptions considered for the study, Request for Free Sample Report

Altran, a global engineering firm, defined smart shelves as, “Smart shelves use RFID technology (e.g., RFID tags, RFID readers and antennas) to automatically track inventory in retail stores. Smart Shelves use weight sensors that are installed within shelves or underneath them. The sensors are used to track the amount of inventory sitting on the shelves”. Inventory management, planogram management, content management are some of the prime use cases of smart shelves.

Recently, most retailers have shifted their focus toward a customer-centric approach for offering better customer experiences. The adoption of a customer-centric approach has led to the huge requirement of customer data, which is being utilized to provide these personalized customer experiences. The rising integration of sensor technologies has further supported the large volume of data, which is also being analyzed to understand customer behavior. The smart shelves market is witnessing high growth due to the rapidly declining cost of sensors. This decline has led to an increase in the adoption of IoT technology across developing countries.

Market Dynamics

Driver: Adoption of enhanced inventory management to make smarter restocking decisions and real-time engagements

Enhanced inventory management and digital shelves provide retailers with new visibility and control. Smart shelves also help track in-store inventory levels, with the help of which retailers can enhance inventory management and make smarter restocking decisions. According to Wiseshelf, smart shelf technology minimizes the risk of lost sales which happens when customers do not find the desired item. The smart shelves technology enables automated tracking of stock availability and informs retail stores if the items are running low or have been misplaced from the original place and prevent theft and shrinkage. Smart shelves, when connected to the internet, offer helpful data about customer practices and relevant information about the optimization of the in-store experience.

Restraint: Privacy concerns related to inbuild data tags

One restraint in the adoption of smart-shelf technology has been concern about consumer privacy. In 2003, Walmart canceled testing for an RFID shelf inventory control system before it was installed. According to CNET, Walmart partnered with Gillette to test smart-shelf technology by tracking data implanted in that Gillette’s product packaging. Walmart’s aim was to alert store managers, by computer, of stock shortfalls and potential theft. Consumer privacy groups opposed the system due to privacy concerns. Consumers doubted that the product tagging tags can be abused and hacked and can provide information to follow people from stores to their homes. Furthermore, In January 2017, Walmart also failed with an app that let customers scan items as they removed them from shelves.

Opportunity: Need for retailers to build closer connections with customers at the front of the store

In a continuously evolving market, to be competitive, industries are using more automation, increasing efficiency, reducing costs, and helping to collect data. According to an article by Modern Retail, a technological survey provided insights where this use of technology is widely supported, with 75% of decision-makers implemented more technology and have developed smart warehouse systems in 2020. The use of IoT and AI in the implementation of smart shelves will help overcome warehouse challenges and track products throughout the supply chain. Smart shelving is one of the leading technologies that capture people’s attention in the world of retail and fulfillment. Furthermore, the growth of the RFID technology market is also going to boost and bring new opportunities for the smart shelves market. Along with RFID, the smart label market will also have a positive impact on the smart shelves market.

Software and solutions segment to grow with fastest growing CAGR during the forecast period

Software and solutions are essential tools and platforms, which are used to build connectivity between shelf components and the cloud servers and gateways. In-store execution, category analysis and planning, inventory optimization, price, promotion compliance, store monitoring and intelligence, and planogram monitoring are some of the prime instances of smart shelf software and solutions. COVID-19 has increased the demand for software and solutions in retail in order to connect the physical environment to the remote server. COVID-19 pandemic has revolutionized digital technology and remote working principles. In retail as well, it has become essential to monitor and keep track of inventory, planogram, pricing and offers, and content management of the products in real-time, thereby has impacted the adoption of smart shelves as well.

Pricing Management application to grow with the fastest growing CAGR during the forecast period

The need for price management is driven by several factors, such as the emergence of hyper-connected consumers and aggressive competition. Consumers are constantly looking for the fair price of a product rather than a low price and are connected to several channels of distribution at a single time. This has led the retailers to deploy a pricing strategy, which is similar across channels as the consumers always tend to compare prices. The increasing demand for goods has resulted in the establishment of always-on channels that can cater to the high demand and reduce opportunity loss. The aggressive competition in the retail industry has significantly affected the margins of retailers, and with more options for consumers coming in, these margins have reduced further. Thus, price management has become increasingly important for the retailers to check on the competitive pricing displayed on the shelf, thereby enabling the consumers to make an informed decision while comparing prices. Dynamic pricing is not new in the retail industry and has been used by gas stations and disruptive vendors, such as Amazon. The retailers can take advantage of the price optimization strategy by using automation to manage the pricing and demand efficiently.

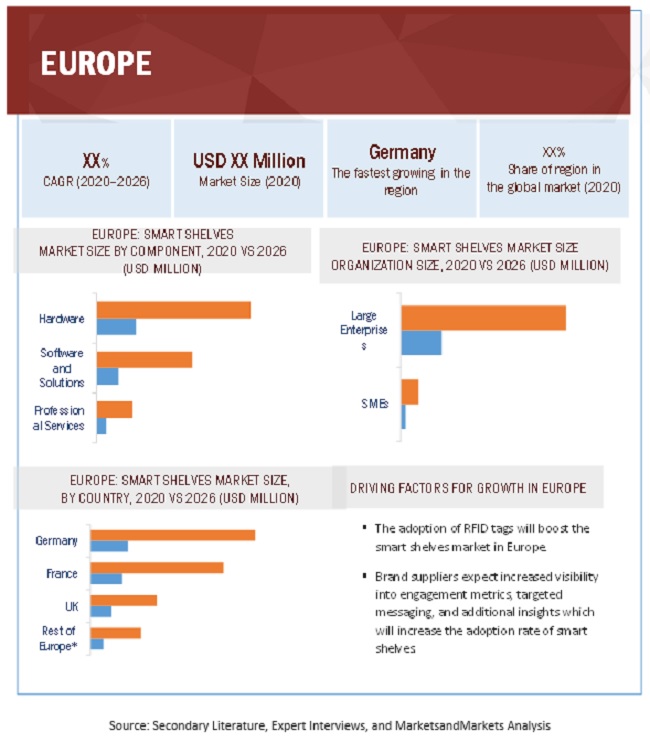

Europe to hold the largest market size during the forecast period

Europe accounted for the largest market share in terms of revenue in 2020 for the global smart shelves market and is expected to continue its dominance in the forecast period. The growth in this region is mainly due to the presence of key players such as SES Imagotag, Pricer, Cicor, and Opticon Sensors. High penetration of ESL in the regional retail business, especially in the countries such as France, Italy, Belgium, Germany, and other countries in Europe, is expected to garner the industry with largest market share over the forecast period. In terms of market size, Europe will be followed by Asia Pacific and North America, as the second- and third-largest smart shelves markets. Various factors such as the requirement for advanced and fast retail processes and a highly interactive retail environment in Europe contribute to the growth of the electronic market in the region.

Asia Pacific to grow with fastest growing CAGR during the forecast period

The economic reform programs of various countries in APAC are creating growth opportunities for the manufacturers of the smart shelves market. In addition, the expansion of large-scale retailers in this region is also responsible for the expected high growth rate of the market in APAC. The introduction of IoT to counter online retail and retailer’s problems and change in consumer preferences is expected to boost the smart shelves market.

Key Market Players

Major vendors in the global Smart Shelves market include Happiest minds (India), Intel (US), PCCW Solutions (Hong Kong), Avery Dennison (US), Honeywell (US), Huawei Technologies Co. Ltd (China), NXP Semiconductor (The Netherland), E-Ink Holdings (Taiwan), Samsung Electronics (South Korea), DIEBOLD NIXDORF, Incorporated (US), Software AG (Germany), SoluM (South Korea), MINEW (China), TraxRetail (Singapore), NEXCOM (Taiwan), Pricer (Sweden), Dreamztech Solutions Inc (US), Sennco Solutions, Inc (US), Tronitag (Germany), MAGO S.A. (Poland), SES-IMAGOTAG (France), AWM Smart Shelf (US), Wiseshelf (Israel), Caper (US), Zippin (US), and Focal Systems (UK).

Pricer:

Pricer is a leading player in the retail automation market. The company helps retailers to solve key-challenges, which arise in stores, such as meeting the new retail demands, improving store operations, and task management. It provides in-store digital shelf-edge solutions used for the electronic display of product information in retail stores. It offers a communication platform that supports both segment-based and pixel-based ESLs. The company also provides services for intelligently communicating, managing, and optimizing the price and product information on the retail floor. The company’s core offering is built around the smart shelves label technology using a unique and advanced optical wireless network system. Pricer’s customers include retailers operating in Europe, Latin America, Africa, and Japan. The solutions offered by the company improve its customers’ profitability by offering price optimization and margin control tools that help reduce personnel and printing costs. The primary sectors, which the company serves are DIY, electronics, groceries, and pharmacies. The company has an installed base of ~200 million smart shelves labels installed in almost 17,000 stores across the world in more than 50 countries.

Key development:

- In July 2020, Pricer announced that the Canadian Tire Dealer Association (CTDA), a dealer network of approximately 500 stores across Canada, signed a Master Framework Agreement with Pricer as its exclusive supplier for Electronic Shelves Label (ESL) systems.

- In February 2020, Pricer launched Pricer Plaza, a new and enhanced architecture for smart retail in-store services and business models. This product launch would bring more sophistication to the offerings of Pricer in terms of retail automation.