< Key Hightlight >

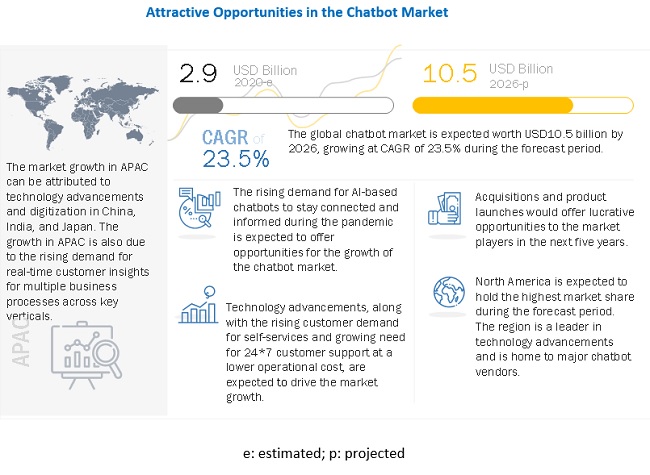

The global Chatbot market size to grow from USD 2.9 billion in 2020 to USD 10.5 billion by 2026, at a Compound Annual Growth Rate (CAGR) of 23.5% during the forecast period. The factors contributing to the growth of the chatbot market includes growth in need for 24/7 customer support at a lower operational cost, increase in focus on customer engagement through various channels and advancements in technology coupled with rising customer demand for self-service operations, thus offering a competitive advantage to businesses.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on Global Chatbot Market

The chatbot market is estimated to witness a trivial slowdown in 2020 due to the global lockdown. The COVID-19 pandemic has increased the churn rate and shuddered almost every industry. The lockdown is impacting global manufacturing, and supply chains and logistics as the continuity of operations for various sectors is badly impacted. The sectors facing the greatest drawbacks are manufacturing, transportation and logistics, and retail and consumer goods. The availability of essential items is impacted due to the lack of manpower to work on production lines, supply chains, and transportation, although the essential items are exempted from the lockdown. The condition is expected to come under control by early 2021, while the demand for chatbot solutions and services is expected to increase due to the increasing demand for enhancing customer experience and building a personalized relationship with prospects. Several verticals would deploy a diverse array of chatbot solutions and services to enable digital transformation initiatives, which address mission-critical processes, improve operations, and differentiate customer viewing experiences. The reduction in operational costs, better customer experiences, resolution of customer queries, enhanced visibility into processes and operations, and improved real-time decision-making are key business and operational priorities that are expected to drive the adoption of chatbots.

Market Dynamics

Driver: Growth in need for 24×7 customer support at a lower operational cost

Chatbots are becoming critical in delivering 24×7 support to customers, thereby helping various industries streamline and optimize the customer experience they offer at every stage in the process. Various industries, such as finance, retail and eCommerce, government, telecom, and travel and hospitality, have shifted their focus toward resolving customer queries in minimal time. The provision of quick responses to customer queries has become a key factor for the success of organizations. Hence, enterprises look at the chatbot as a powerful conversational interface for engaging customers effectively and providing them with a dynamic and rich user experience environment. Starbucks, KLM Dutch Airlines, Spotify, and the Bank of America are some of the prominent brands that have deployed chatbots with the intent to deliver seamless customer experiences. For instance, the Bank of America deployed a chatbot by leveraging AI and predictive analytics capabilities, which enable users to communicate through voice and text options. The chatbot assists users in making payments, saving money, transferring funds, and checking balances, thereby improving the quality of services delivered to the customers. KLM Dutch Airline is another company that has deployed a chatbot for its customer service channel. After deploying the chatbot, the company could enhance its customer interaction with Facebook Messenger by 40%.

Restraint: Dearth of accuracy in user’s voice authentication

Due to the evolution of voice-based authentication, 2 different approaches have emerged. The first approach of authentication is to have individuals repeat the same sentence multiple times and create a very general template made up of a wide range of voiceprints. When users speak in the future, the new voice prints generated can be matched with their old voice prints for authenticating them. However, the disadvantage of this approach is that voiceprints are more generic, and thus, cannot be authenticated at the same level of accuracy used for authenticating the voiceprints generated with a single passphrase. The second approach is to create a voiceprint using a single phrase or word and store it for the individual voiceprint. However, using this approach, third parties can record authentication attempts and replay them to gain access. These are 2 available voice authentication techniques that need more capabilities to be a good standalone method for authenticating users.

Opportunity: Initiatives toward the development of self-learning chatbots to deliver a more human-like conversational experience

Self-learning chatbots can adapt to changing conditions in the environment they operate in and can learn from their actions, experiences, and decisions. These chatbots can be considered intelligent enough to analyze data in minimal time and help the customer find the exact information they are looking for conveniently by offering support in multiple languages. Self-learning bots, with data-driven behavior, are powered by the NLP technology and self-learning capability (supervised ML) and can enable the delivery of more human-like and natural communication; they also learn from their own mistakes. Various initiatives are being undertaken for the development of self-learning chatbots. For instance, data scientists from Facebook and researchers from Stanford University formed a partnership to develop self-learning chatbots and are focusing on the integration of reinforcement learning technology instead of general intelligence, with the intent to avoid scenarios where technology can go wrong. These initiatives are still in the research phase, along with other plans toward creating advanced chatbots that can intelligently answer questions raised by users. Moreover, CogitAI, in February 2019, introduced a commercial availability of its Continua platform, which is a self-learning bot and would be helpful in application areas such as web marketing, building management, and video games. These initiatives, coupled with the growing need to deliver customized experiences, are expected to create the demand for self-learning chatbots in the coming years.

Challenge: Lack of awareness about the effect of chatbot technology on various applications

Lack of awareness and challenges related to change in the management may impact the growth of the market to a certain extent. Though the adoption of chatbots solutions is increasing among various industries, challenges pertaining to the effective utilization and limited awareness about the benefits offered by AI-powered chatbot solutions may limit the adoption of chatbot solutions among developing regions such as Latin America and Africa. Moreover, large organizations are at the forefront of adopting chatbot solutions; however, Small and Medium-sized Enterprises (SMEs) have limited adoption of the same, owing to the cost associated with their maintenance and lack of skilled resources. However, the adoption of chatbot solutions is expected to grow in the coming years among SMEs with the growing awareness of chatbot solutions.

Among verticals, retail and eCommerce vertical segment is expected to hold largest market size during the forecast period

The chatbot market is segmented into the various verticals, particularly BFSI, IT and telecom, retail and eCommerce, healthcare and life sciences, transportation and logistics, government, travel and hospitality, media and entertainment, and others (education, energy and utilities, and manufacturing). Key factors favoring the growth of chatbots across these verticals include the rising technology advancements and growing availability of industry-specific chatbots. The retail and eCommerce segment is expected to hold largest market share in the market. The increased adoption of chatbots among the retail and eCommerce vertical can be attributed to several chatbot benefits, such as consistent customer services and lower marketing costs, which increase business returns. Chatbots for retail businesses are perfect for offering customized product recommendations. They enable retail businesses to provide superior customer service by driving customer engagement 24/7, without requiring human intervention. According to Chatbots Magazine, businesses can reduce customer service costs by up to 30% by implementing conversational solutions such as virtual agents and chatbots. Chatbots for eCommerce companies are typically designed to complete buyers’ purchases, offer buyers product recommendations, and provide customer support.

APAC to grow at a higher CAGR during the forecast period

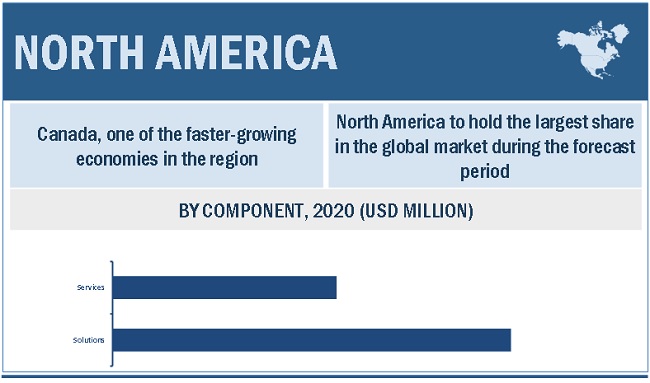

The chatbot market has been segmented into five regions: North America, Europe, APAC, MEA, and Latin America. Among these regions, North America is projected to hold the largest market size during the forecast period. APAC is expected to grow at the highest CAGR during the forecast period. Countries in APAC are technology-driven and present major opportunities in terms of investments and revenue. These countries include China, Singapore, Japan, and India. Factors such as flexible economic conditions, industrialization- and globalization-motivated policies of governments, and digitalization are expected to support the growth of the chatbot market in APAC.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The chatbot vendors have implemented various types of organic as well as inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. Some of the key players operating in the chatbot market include IBM (US), Microsoft (US), Google (US), AWS (US), Nuance (US), Oracle (US), Creative Virtual (UK), Artificial Solutions (Spain), Kore.ai (US), Inbenta (US), [24]7.AI (US), Aivo (Argentina) ServiceNow (US), Conversica (US), Personetics (US), LiveChat (Poland), MindMeld (US), CogniCor (US), Gupshup (US), Contus (India), Chatfuel (US), KeyReply (Singapore), SmartBots (US), Yellow Messenger (India), Kevit (India), Yekaliva (India), and Pypestream (US). The study includes an in-depth competitive analysis of these key players in the chatbot market with their company profiles, recent developments, and key market strategies.

Scope of the Report

Report Metric | Details |

Market size available for years | 2015–2026 |

Base year considered | 2019 |

Forecast period | 2020–2026 |

Forecast units | USD Million |

Segments covered | Component, Type, Channel Integration, Business Function, Vertical, and Region |

Geographies covered | North America, Europe, APAC, Latin America, and MEA |

Companies covered | IBM (US), Microsoft (US), Google (US), AWS (US), Nuance (US), Oracle (US), Creative Virtual (UK), Artificial Solutions (Spain), Kore.ai (US), Inbenta (US), [24]7.AI (US), Aivo (Argentina) ServiceNow (US), Conversica (US), Personetics (US), LiveChat (Poland), MindMeld (US), CogniCor (US), Gupshup (US), Contus (India), Chatfuel (US), KeyReply (Singapore), SmartBots (US), Yellow Messenger (India), Kevit (India), Yekaliva (India), and Pypestream (US). |

This research report categorizes the chatbot market based on component, type, application, deployment mode, organization size, vertical, and region.

By component:

- Solutions

- Services

- Managed Services

- Professional Services

- Consulting

- System Integration and Implementation

- Support and Maintenance

By type:

By deployment mode:

By channel integration:

- Websites

- Contact Centers

- Social Media

- Mobile Applications

By organization size:

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

By business function:

- Information Technology Service Management

- Human Resources

- Sales and Marketing

- Finance

By application:

- Customer Service

- Personal Assistant

- Branding and Advertisement

- Customer Engagement and Retention

- Data Privacy and Compliance

- Employee Engagement and On Boarding

- Payment Processing

- Others (Churn Analysis, Campaign Management, News Delivery, and Data Aggregation).

By vertical:

- BFSI

- IT and Telecom

- Retail and Ecommerce

- Healthcare and Life Sciences

- Transportation and Logistics

- Government

- Travel and Hospitality

- Media and Entertainment

- Others (Education, Energy and Utilities, and Manufacturing)

By region:

- North America

- Europe

- UK

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- Japan

- Rest of APAC

- MEA

- Israel

- UAE

- South Africa

- Rest of MEA

- Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In February 2021, Kore.ai launched a Virtual Assistant Platform in Japanese. To better serve Japan region’s needs and accelerate the adoption of virtual assistants’ company released the Kore virtual assistant platform in Japanese. This will help enterprise customers improve time-to-market and enhance the customer experience in their native language.

- In February 2021, Nuance announced the acquisition of Saykara, Inc., a like-minded startup focused on developing a mobile AI assistant to automate clinical documentation for physicians. The acquisition underscores Nuance's ongoing expansion of the market and technical leadership in conversational AI and ambient clinical intelligence (ACI) solutions that reduce clinician burnout, enhance patient experiences, and improve overall health system financial integrity.

- In January 2021, Nuance launched the Omnichannel Patient Engagement Virtual Assistant Platform to power healthcare's 'Digital Front Door.' Nuance's omnichannel patient engagement platform represents a new integrated philosophy for enabling healthcare's digital front door and a well-thought-out, well-implemented, and highly-practical solution for delivering an enhanced level of digital services to patients.

- In December 2020, Artificial Solutions announced several new updates to Teneo Languages that allow organizations to create high-quality conversations in less time and with less effort than ever before.

- In November 2020, Nuance announced the acquisition of Saykara, Inc., a like-minded startup focused on developing a mobile AI assistant to automate clinical documentation for physicians. The acquisition underscores Nuance's ongoing expansion of the market and technical leadership in conversational AI and ambient clinical intelligence (ACI) solutions that reduce clinician burnout, enhance patient experiences, and improve overall health system financial integrity.

- In September 2020, Google launched a new Dialogflow Customer Experience in Beta. The new Dialogflow Customer Experience (CX) platform is aimed at building artificial intelligence agents for enterprise-level projects at a larger and more complex scale than the standard variety.

- In April 2020, Google and Apple collaborated to enable the use of Bluetooth technology for helping the government and healthcare agencies reduce the spread of COVID-19. This enabled a broader Bluetooth-based contact tracing platform.

- In June 2019, Artificial Solutions partnered with Capgemini to leverage Conversational AI for Digital Transformation. The partnership enabled Capgemini to utilize Artificial Solutions’ conversational AI development platform, Teneo, as part of its services within its digital transformation projects for clients.

- In January 2019, IBM formed a partnership with the Ingenico Group to build a payment-enabled chatbot with the intent to deliver personalized experiences to its customers. Ingenico Group is a European company engaged in delivering the technology required for conducting secure electronic transactions.