< Key Hightlight >

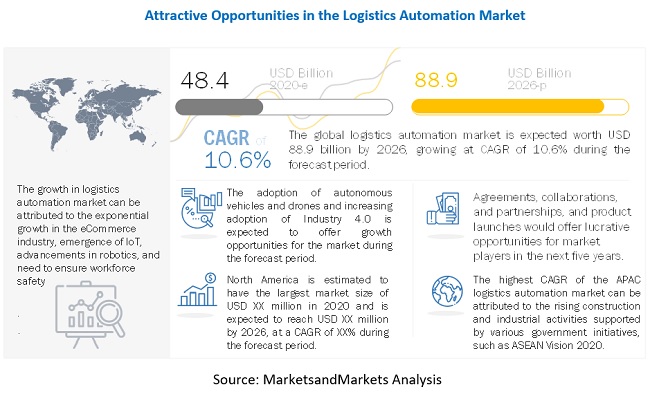

The global logistics automation market size is projected to grow from USD 48.4 billion in 2020 to USD 88.9 billion by 2026, at a Compound Annual Growth Rate (CAGR) of 10.6% during the forecast period. The logistics automation market is gaining traction due digital transformation in the logistics industry, emergence of IoT, exponential growth in the eCommerce industry, advancements in robotics, and growing need to ensure workforce safety.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on the global logistics automation market

As the COVID-19 pandemic continues to spread in the US, logistics and supply chain operations are affected severely, especially in the North American region. Retail, industrial goods, and consumer goods are some of the major industries that are hugely affected by the COVID-19 outbreak in North America. Supply chain disruptions will have both long-term and short-term effects on businesses. Changing government policies and lockdown measures could make it difficult for freight service providers to keep their services running smoothly throughout the country for the coming weeks. This has necessitated companies in the logistics industry to understand the specific demand effects of their business, create a short-term demand synchronization strategy, and prepare for possible channel shifts.

According to a survey by the Supply Chain Media, among 143 supply chain decision-makers in Europe, the COVID-19 pandemic is having a clear impact on the supply chains of virtually all European manufacturers, wholesalers, and retailers. Although 78% of them are experiencing a negative short-term impact, 17% are noticing positive effects, and only 5% say they are not affected in any way.

APAC has suffered significantly due to the COVID-19 pandemic as it has some of the world’s biggest developing economies. The electronics industry in the APAC region accounts for ~70% of the total worldwide electronics industry. China, being the hub of electronics manufacturing, has witnessed heavy losses in this sector due to COVID-19. The production of electronic devices was suspended because of logistics slowdown and the unavailability of a workforce. Further, several e-commerce companies around the region have stopped supplying non-essentials. Due to the imposition of lockdowns, a trend of reverse migration is observed across the region.

According to a report by the Economist Intelligence Unit (EIU), over-reliance on Asian, and especially Chinese suppliers and clients was already a major concern for MEA before the COVID- 19 disruption in 2020, and after the outbreak, MEA businesses are planning to diversify supply chains as well as refocus on local produce where possible.

SMEs account for 80-90% of Latin America businesses. Due to COVID-19, there is a high impact of local/national lockdowns and the economic slowdown on SMEs. For instance, in Chile, an estimated 70% of SMEs are closed. As a result, the Chilean government has launched an initiative “Apóyame 2020” (Support Me Here). In this initiative, SMEs are invited to sell their products in the online marketplace, hosted by major retailers.

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

Driver: Advancements in Robotics

Robots are used to transfer products from one location to another in an efficient and timely manner. They automate tedious, dull, and unsafe tasks involved in various processes, such as warehousing and material handling, without manual intervention. The increasing labor cost is one of the key concerns of companies in the manufacturing sector. Organizations are adopting robotic technologies to automate logistic processes, thereby minimizing manual labor and resulting in lower operational costs.

Advances in robotics technologies have contributed to the development of automated vehicles that are used in warehouses. An AI-based system can instruct robots to carry out a certain task in a real-time scenario and enhance autonomous decision-making functionalities. The workload of personnel involved in logistics operations can be minimized using advanced robots that are programmed to perform repetitive and physically-demanding tasks. The increasing adoption of robots by various end-use industries to improve logistics operations is one of the most significant factors projected to drive the growth of the logistics automation market.

Restraints: High Capital Investment

The automation of logistics operations requires high capital investment. The setting up of large-scale automated warehouse facilities involves the installation of automation equipment, software, and solutions, which incur heavy expenses. It is not viable for several companies to replace their existing logistics processes due to the high cost of new and advanced systems. Automation systems used in industries require maintenance and upgrades occasionally, involving high capital re-investments. Thus, companies with limited financial resources are unable to opt for automation systems, thereby acting as a restraint to the growth of the logistics automation market.

Opportunity: Adoption of Autonomous vehicles and drones

Autonomous vehicles and drones play a vital role in automated logistics processes. Companies such as Google and Tesla have made significant advances in driverless vehicle technologies. The future of logistics will include large autonomous trucks that assist in the delivery of goods to distribution centers. Autonomous forklifts will be responsible for the unloading of packages using a network of conveyor belts and robot arms. Tesla, a leading manufacturer of electric vehicles, is undertaking measures to introduce fully autonomous heavy-duty freight vehicles. Similarly, companies such as Amazon and UPS are investing in the development of flying drones to automate delivery processes.

Challenge: Lack of skill and expertise in operating advanced systems

Industrial automation devices and systems need to be operated by skilled personnel, owing to the complexity of these systems. The operating procedure of digital systems may be misinterpreted by an unskilled person, which might lead to errors and faults in the logistics process. And for this purpose, employees need to undergo training in the areas of the technology to ensure that they understand and are capable of using physical and software robotics in logistics. This industry requires highly specialized personnel skills in AI and big data, as the logistics industry generates a voluminous amount of data, which needs to be properly modeled, integrated, wrangled, and then analyzed to gain specific insights. There is a shortage of skilled personnel in the logistics industry, and as a result, companies are conducting in-house training programs in collaboration with vendors of logistics automation solutions. Training concepts and development plans are adapted to suit individual needs and capabilities.

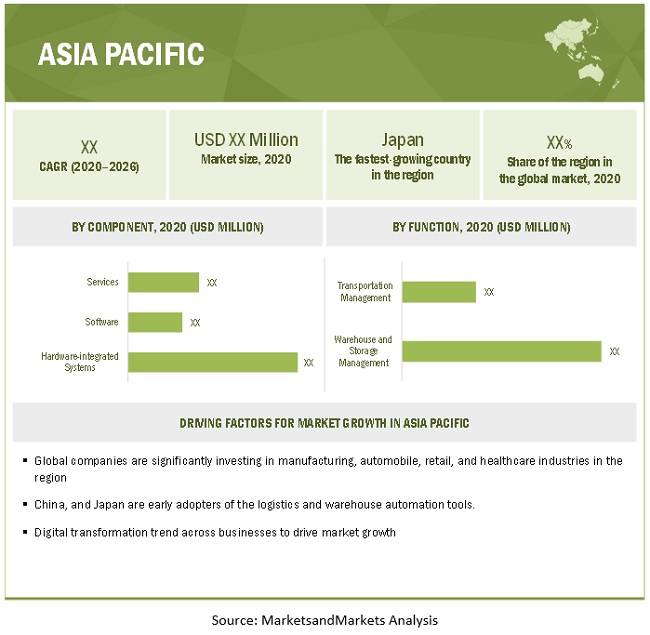

APAC to grow at the highest CAGR during the forecast period

APAC is expected to grow at the highest CAGR during the forecast period. The region is transforming dynamically with respect to the adoption of new technologies across various sectors, especially in China, Japan, India, and ANZ. These countries have always supported and promoted industrial and technological growth. Also, they possess a developed technological infrastructure, which is promoting the adoption of logistics automation solutions across all industry verticals. Moreover, the eCommerce companies in the region are investing in improving their supply chain network and logistics processes through the adoption of logistics automation solutions. Global companies are significantly investing in manufacturing, automobile, retail, and healthcare industries in the region. Further, the expansion of the transportation and logistics industry and the increase in trade agreements are key factors projected to drive the growth of the logistics automation market in APAC.

Key Market Players

This research study outlines the market potential, market dynamics, and major vendors operating in the logistics automation market. Key and innovative vendors in the market include 6 River Systems (US), ABB (Switzerland), BEUMER Group (Germany), Blue Yonder (US), Daifuku (Japan), Dematic (US), E&K Automation (Germany), Eyesee (Hardis Group) (France), Falcon Autotech (India), GreyOrange (US), HighJump (Korber) (US), Honeywell Intelligrated (US), Jungheinrich (Germany), Knapp (Austria), Locus Robotics (US), Manhattan Associates (US), Murata Machinery (Japan), Oracle (US), SAP (Germany), SBS Toshiba Logistics (Japan), Seegrid (US), SSI Schaefer (Germany), Swisslog (Switzerland), System Logistics (Italy), TGW Logistics Group (Austria), and Zebra Technologies (US).The study includes an in-depth competitive analysis of these key players in the logistics automation market with their company profiles, recent developments, and key market strategies.

Scope of Report

Report Metric | Details |

Market size available for years | 2020-2026 |

Base year considered | 2019 |

Forecast period | 2020-2026 |

Forecast units | Value (USD Million) |

Segments covered | Component (hardware-integrated systems, software, and services), function, organization size, vertical, and region. |

Regions covered | North America, Europe, APAC, MEA, and Latin America |

Companies covered | 6 River Systems (US), ABB (Switzerland), BEUMER Group (Germany), Blue Yonder (US), Daifuku (Japan), Dematic (US), E&K Automation (Germany), Eyesee (Hardis Group) (France), Falcon Autotech (India), GreyOrange (US), HighJump (Korber) (US), Honeywell Intelligrated (US), Jungheinrich (Germany), Knapp (Austria), Locus Robotics (US), Manhattan Associates (US), Murata Machinery (Japan), Oracle (US), SAP (Germany), SBS Toshiba Logistics (Japan), Seegrid (US), SSI Schaefer (Germany), Swisslog (Switzerland), System Logistics (Italy), TGW Logistics Group (Austria), and Zebra Technologies (US). |

This research report categorizes the logistics automation market to forecast revenue and analyze trends in each of the following submarkets:

Based on Components

- Hardware-integrated Systems

- Software

- Warehouse Management System (WMS) software

- Transportation Management System (TMS) software

- Services

- Consulting

- Implementation

- Support and Maintenance

Based on Function

- Warehouse and Storage Management

- Transportation Management

Based on Organization size:

Based on Vertical:

- Manufacturing

- Healthcare and Pharmaceuticals

- Fast-Moving Consumer Goods (FMCG)

- Retail and eCommerce

- 3PL

- Aerospace and Defense

- Oil, Gas, and Energy

- Chemicals

- Others (paper and printing, and textiles and clothing)

Based on regions:

- North America

- Europe

- APAC

- MEA

- Latin America

Recent Developments:

- In February 2021, Honeywell Intelligrated partnered with Fetch Robotics, a company that provides cloud-driven robotic solutions. Fetch Robotics will launch an autonomous mobile robot called PalletTransport1500 for contactless pallet transportation across distribution centers. It will utilize Honeywell Intelligrated’s Momentum warehouse execution system software to move pallets and other large payloads up to 1136 kg safely and efficiently.

- In May 2020, Manhattan Associates launched the Manhattan Active Warehouse Management solution. It is the world’s first cloud-native enterprise-class Warehouse Management System (WMS) that unifies every aspect of distribution and never needs upgrading. Manhattan Active WM ushers in a new level of speed, adaptability, and ease of use within distribution management.

- In March 2020, Dematic launched the Dematic Multishuttle (DMS) 2 E, which is the latest version of the company’s warehouse automation solution.

- In March 2020, Kion Group acquired Digital Applications International Limited (DAI) on behalf of Dematic. The acquisition of the UK-based software company that specializes in logistics automation solution will enhance the capabilities of the Dematic IQ Software and broaden the intralogistics software offerings.

- In September 2020, Jungheinrich acquired a stake in the robotics startup Magazino, based in Munich, and signed a contract, for strategic collaboration to develop the automation software and expand joint solutions for automated intralogistics.