< Key Hightlight >

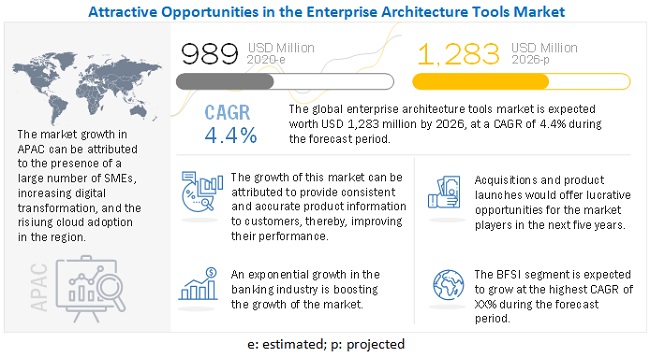

The global Enterprise architecture tools market size is expected to grow from USD 989 million in 2020 to USD 1,283 million by 2026, at a Compound Annual Growth Rate (CAGR) of 4.4% during the forecast period. Key factors that are expected to drive the growth of the market are the increasing adoption of the business-driven enterprise architecture approach for strategic business transformation and an increasing need to align enterprise information technology architecture with business strategy. However, increasing data thief activities and data security concerns are expected to limit the market growth. Apart from drivers and restraints, there are a few lucrative opportunities for enterprise architecture tools providers. Adding big data capabilities to enterprise architecture tools and an increasing need to adopt application rationalization practices are some of the opportunities for vendors in the enterprise architecture tools market. These opportunities are expected to present new market growth prospects for enterprise architecture tools vendors.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact analysis on the global enterprise architecture tools market

The impact of the COVID-19 pandemic on the market is covered throughout the report. The pandemic has had a negative impact on the enterprise architecture tools market. The major reason for the negative impact on the market is reduced IT spending across organizations, which led to low spending on new software and solutions. Further, the high cost associated with the enterprise architecture tools is another reason, which led to reduced demand for the solutions and services during a pandemic. However, in the coming years, the demand for enterprise architecture tools can increase owing to organizations’ usage of such solutions to enhance agility between their business functions.

Market Dynamics

Driver: Increasing adoption of business-driven enterprise architecture approach for strategic business transformation

Enterprise architecture provides an overall picture of an entire IT strategy. It helps in optimizing long-term decision-making and also guides in selecting the best deployment option out of multiple existing routes. A business-driven enterprise architecture approach can help address completely different actions that are important for an organization; indicating which one is the best to follow. To stay competitive in a new business and economic environment, organizations require new strategies and practices.

A business-driven enterprise architecture approach also results in saving time and work on pipeline projects more quickly. Enterprises are focusing on their business needs to align the business needs with the IT department as a whole and efficiently manage the application portfolio to progress the organization as a whole. Hence, the increasing adoption of a business-driven enterprise architecture approach for strategic business transformation is expected to act as a driver for the global enterprise architecture tools market.

Restraint: Increasing data thief activities and data security concerns

Enterprise architecture tools have access to enterprise data, which is stored in databases. This data contains decade-old information of an enterprise and also helps in modeling business architecture. Given the importance of data, attackers will target access to the data. For instance, the Equifax data breach in 2017 in which the personal details of 143 million customers were leaked, along with credit card data of 209,000 customers.

It is a top priority of an enterprise architecture tool to secure the data. It needs to be focused on the way the data is stored, accessed, and used. Regulations, such as General Data Protection Regulation (GDPR) and Electronic Communications Privacy Act (ECPA), also hold the enterprise architecture tools market accountable for data privacy. Enterprises are sensitive when it comes to data sharing and accessibility. Therefore, enterprise architecture tools providers need to maintain the highest level of privacy and security. Cybersecurity is one of the most important factors for smooth business operations. In recent times, there has been a huge rise in the number of data breaches and cyberattacks. Cyberattacks increased by 600% from 2016 to 2017. Hence, increasing data thief activities and data security concerns are expected to restrain the growth of the global enterprise architecture tools market.

Opportunity: Adding big data capabilities to enterprise architecture tools

Big data is impacting the way organizations understand and make use of the growing volume, velocity, variety, and value of enterprise data. Companies are taking steps to analyze and make use of the disparate information it has to speed up and increase focus on initiatives that help drive and grow the company. The enterprise architecture tools using the big data capabilities would help the business target the right market activities and fine-tune marketing, sales, and business operations, resulting in business transformation and maximum return on investment. Big data can help architects follow ideas where the outcome is not clear. Enterprise architecture tools placed by organizations are expected to enable the organization to react and respond where needed to capitalize on opportunities when they arise. Hence adding big data capabilities to enterprise architecture tools will offer an ample amount of opportunities for enterprise architecture tools providers.

Challenge: High cost and lack of technical expertise

The cost of enterprise architecture tools’ license is dependent on modules/features selected and the bands of the user. The users are generally categorized into power users, content contributors, and content consumers. It is a complex pricing mechanism that results in higher license fees. Due to the high cost of enterprise architecture tools, SMEs cannot afford these tools. Therefore, many users are limiting the usage of enterprise architecture tools. Furthermore, the technical expertise will result in underutilization of all the features and applications of the tools for business planning and implantation of strategies. Hence, high costs and lack of technical expertise are expected to challenge the enterprise architecture tools providers.

Solutions segment to hold a larger market size during the forecast period

The solution enables the creation of a systematic reporting functionality model, which helps in improving the coherence or alignment of the entities on it. This again will result in complexity reduction, standardization, vendor independence, and cost reduction. Due to such benefits offered by enterprise architecture tools solutions, their demand across verticals is expected to increase during the forecast period. Application architecture solution enables organizations to understand the mapping and collation of organization's software applications as part of its overall enterprise architecture. The solution also offers the effectiveness of the applications’ interaction with each other to meet business or user requirements. An application architecture helps ensure that applications are scalable and reliable, and assists enterprises in identifying gaps in functionality.

On-premises deployment type to hold a larger market size in 2020

In the on-premises type of delivery model, software or solutions are installed and operated from customers’ in-house server and computing infrastructure. The cost of installing on-premises solutions is included in the Capital Expenditure (CAPEX) of companies. This approach is mostly adopted for applications that involve the processing of sensitive and confidential data. Nowadays, every organization generates vast amounts of data due to the use of machine learning, IT devices, sensors, clickstreams, and many other devices. The on-premises deployment type enables organizations to ingest data into their own databases, thereby maintaining data security.

Large enterprises to hold a majority of the market share during the forecast period

Large enterprises have a large corporate network and many revenue streams. Large enterprises are keen to invest in new and latest technologies to effectively run their business. The enterprise architecture tools market has a stronghold in large enterprises, as the IT infrastructure becomes more complex in large enterprises as compared to SMEs. The existing system integration with advanced enterprise architecture tools is a challenge faced by large enterprises, which now can be easily resolved due to the robust integration, training, and support services provided by enterprise architecture tools providers.

Telecommunications industry vertical to hold a significant market share during the forecast period

Digital transformation is a must to survive in a globally connected and competitive environment. Telecommunications companies are investing in new technologies, such as smart computing products, IoT, cloud computing, mobility, and analytics, to gain efficiency and innovation, and attract consumers. The introduction of 5G technology in the near future is expected to further pressure players in handling their businesses efficiently. This vertical faces challenges in maintaining IP copyrights, and it deals with cross-border data privacy and security challenges by regulators and anti-trust inquiries. Over the few years, leading telecommunication companies have been adopting new strategies for effective management of their IT architecture to attain maximum value and have proper maintenance of their architecture through integrations, to enhance their business performance. To deliver maximum value, the transformation of the enterprise architecture of telecommunication companies is essential, but it is a difficult task and takes multi-year efforts.

To know about the assumptions considered for the study, download the pdf brochure

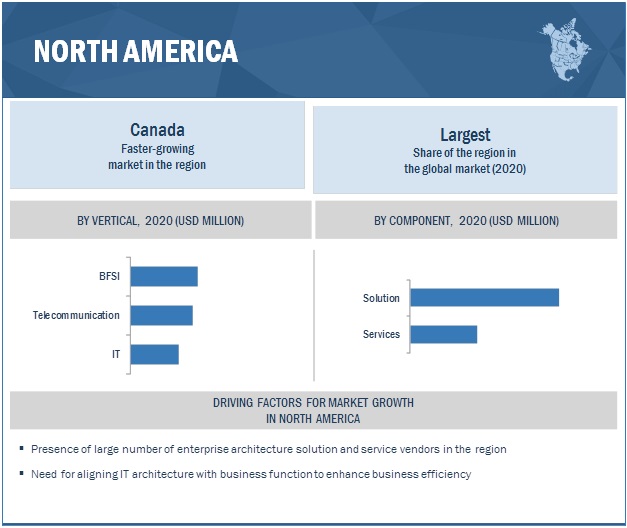

North America to account for the largest market size during the forecast period

The global enterprise architecture tools market by region covers five major geographic regions, namely, North America, Asia Pacific (APAC), Europe, Middle East & Africa (MEA), and Latin America. North America is expected to be the most promising region for major verticals, such as IT, BFSI, and telecommunications. The enterprise architecture tools market size in North America is expected to grow steadily during the forecast period. North America is further segmented into the US and Canada. The US is expected to be one of the major revenue contributors toward the growth of the enterprise architecture tools market in North America. Canada is also expected to present major growth opportunities for enterprise architecture solution and service providers.

Key Market Players

The enterprise architecture tools vendors have implemented various types of organic as well as inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions, to strengthen their offerings in the market. The major vendors offering enterprise architecture tools solutions and services globally are Software AG (Germany), Avolution (Australia), BiZZdesign (Netherlands), MEGA International (France), BOC Group (US), Orbus Software (UK), QualiWare (Denmark), Leanix (Germany), erwin (US), Sparx Systems (Australia), ValueBlue (Netherlands), UNICOM Global (US), Clausmark (Germany), Enterprise Architecture Solutions (UK), Planview (US), MonoFor (US), Valispace (Portugal), FIOS Insight (US), Aplas (Australia), NinjaRMM (US), CodeLogic (US), BetterCloud (US), Ardoq (Norway), Facility Planning Arts (US), and Keboola (US).

The study includes an in-depth competitive analysis of key players in the enterprise architecture tools market with their company profiles, recent developments, COVID-19 developments, and key market strategies.

Scope of the report

Report Metric | Details |

Market size available for years | 2016–2026 |

Base year considered | 2019 |

Forecast period | 2020–2026 |

Forecast units | Million (USD) |

Segments covered | Component (Solutions & Services), Deployment Type, Organization Size, Vertical, and Region |

Geographies covered | North America, APAC, Europe, MEA, and Latin America |

Companies covered | Software AG (Germany), Avolution (Australia), BiZZdesign (Netherlands), MEGA International (France), BOC Group (US), Orbus Software (UK), QualiWare (Denmark), Leanix (Germany), erwin (US), Sparx Systems (Australia), ValueBlue (Netherlands), UNICOM Global (US), Clausmark (Germany), Enterprise Architecture Solutions (UK), Planview (US), MonoFor (US), Valispace (Portugal), FIOS Insight (US), Aplas (Australia), NinjaRMM (US), CodeLogic (US), BetterCloud (US), Ardoq (Norway), Facility Planning Arts (US), and Keboola (US) |

This research report categorizes the enterprise architecture tools market based on component, deployment type, organization size, vertical, and region.

Based on the component:

- Solutions

- Infrastructure Architecture

- Application Architecture

- Data Architecture

- Security Architecture

- Others

- Services

- Managed Services

- Professional

Based on the deployment type:

Based on the organization size:

Based on the vertical

- BFSI

- Consumer Goods and Retail

- Telecommunication

- IT

- Manufacturing

- Healthcare and Life Sciences

- Others

Based on the region:

- North America

- Europe

- APAC

- MEA

- Latin America

- Brazil

- Rest of Latin America

Recent Developments

- In January 2021, erwin acquired Quest Software, the aim of this acquisition is to add new capabilities to Quest Software, which may help drive significant data initiatives and the deployment of modern applications while ensuring regulatory compliance.

- In November 2020, BOC Group formed a partnership with ATD Solution, an APAC-based digital enterprise architecture consulting firm. The aim of the partnership is to expand BOC Group’s presence in the APAC and offer better enterprise architecture solutions in the region.

- In January 2020, Avolution added Multi-Factor Authentication (MFA) feature in its ABACUS solution. After MFA is enabled on ABACUS, the cloud account, a user can enroll an authentication application on a smartphone or by using the QR code presented during login.