< Key Hightlight >

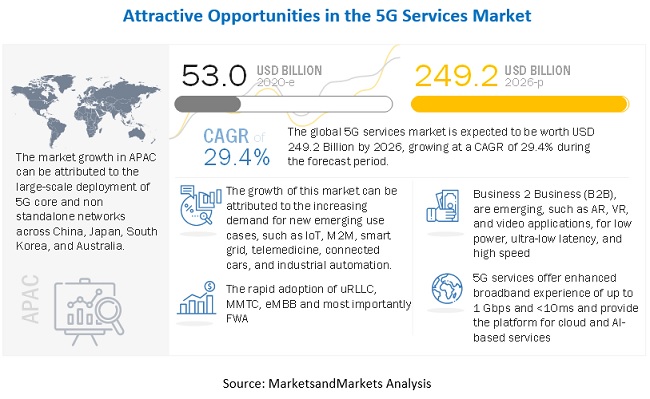

The global 5G Services Market size is expected to grow from USD 53.0 billion in 2020 to USD 249.2 billion by 2026, at a Compound Annual Growth Rate (CAGR) of 29.4% during the forecast period. The transformation to the 5G ecosystem is expected to witness 3–4 times faster growth rate than other connectivity transformations. This is primarily due to the rapid innovation in virtualization in the networking domain, coupled with the growing numbers of applications, which require a latent-free connection. The above factors have resulted to expect rapid adoption of 5G services, followed by a quick roll out of 5G services by other developing economies. Countries expected to launch 5G services at the earliest include the US, China, South Korea, Japan, the UK, and Germany. Countries with a strong 4G infrastructure are expected to be the early deployers Countries with agile connectivity platforms in IoT are also expected to quickly transform their services into 5G, probably by 2020 Q1.

To know about the assumptions considered for the study, Request for Free Sample Report

The COVID-19 pandemic has affected every segment of society, including individuals and businesses. During the COVID-19 pandemic, the telecom sector is playing a vital role across the globe to support the digital infrastructure of countries. Every individual and government, irrespective of federal, state, central, local, and provinces, has been in constant touch with one other in the society to provide and get real-time information on COVID-19. Currently, healthcare, telecommunication, media and entertainment, utilities, and government institutes are functioning day and night to stabilize the condition and facilitate prerequisite services to every individual.

COVID-19 cases are growing day-by-day, as several infected cases have been on the rise. In line with individuals, COVID-19 has a massive impact on large enterprises and SMEs. Core industries, such as manufacturing, automotive, textile, transportation and logistics, travel and hospitality, and consumer goods, have been closed due to country-level lockdown across the globe. This would have a substantial impact on the global economy in terms of the decline in GDP. Since ages, SMEs are acting as the backbone of the economy. In the current situation, SMEs are the most affected due to the COVID-19 pandemic.

Market Dynamics

Driver: The need to transform the mobile broadband experience

5G networks deliver an enhanced broadband experience of up to 1 Gbps and <10ms and provide the platform for cloud and AI-based services. Various data-intensive applications, both individual as well as Business 2 Business (B2B), are emerging, such as AR, VR, and video applications. Industries, such as IT and telecom, retail, healthcare, automotive, media and entertainment, BFSI, and agriculture, have different types of service requirements, including high bandwidth, low power, ultra-low latency, and high speed. To cope with the increasing demand for mobile broadband services, the network capacity needs to be increased by using a new spectrum, which would lead to the wide adoption of the 5G core to deploy 5G technology for enhanced mobile broadband services.

Restraint: High costs required for deployment of 5G network

The transition from 4G to 5G technology would result in huge investments. The costs of the 5G infrastructure depends heavily on the required throughput density, periodic interest rate, and base station price. The reduction of these costs is important for effective and ultra-dense small cell deployments. The challenge for CSPs in transitioning to 5G is to justify the multibillion dollars of investments in new network equipment required to transform their network to a virtualized infrastructure; move services from 3G and 4G to 5G; all while protecting their business against the ever-increasing risks of disruptions and cyber threats. The transition to a standalone model is essential for Telcos to capitalize on the full range of benefits that 5G offers. Their ability to successfully capture enterprise customers with low latency applications will require a distributed, standalone network with an edge compute platform, network slicing, and control/user plane separation. The current standalone deployments have helped Telcos get off the ground quickly with their 5G rollouts that are focused on delivering fixed and mobile broadband services to consumers.

Opportunity: Unleashing massive IoT ecosystem and critical communication services

The growing popularity of IoT use cases in various sectors relying on connectivity spanning large areas, and need to handle a huge number of connections, has driven up the demand for massive IoT technologies. Today massive IoT is emerging as a new focal point for IoT connectivity technologies. Massive IoT is an attractive opportunity for 5G, but Telco still rely on current cellular IoT standards, such as NB-IoT in the early 5G era. 5G networks is expected to support the massive rollout of intelligent IoT nodes for a multitude of scenarios. It will also provide a competent platform to support the widespread adoption of critical communications services. mMTC has already been developed as part of 3GPP Release 13/14 Low Power Wide Area Network (LPWAN) technologies, which includes NB-IoT. These are expected to meet most 5G mMTC requirements. The widespread adoption of IoT and continuous advancements in Machine-to- Machine (M2M) communication networks are transforming various verticals by connecting all types of devices, appliances, systems, and services.

Challenge: Delay in spectrum harmonization across geographies

Harmonizing the use of spectrum bands across geographies is important in achieving improved market conditions that enable cost-efficient and competitive industrial devices. Hardware devices designed for 5G services in different regions can be reused, resulting in reusability and mass production of devices. This, in turn, would reduce the cost of devices and make it easier for consumers to adopt them. Various countries have already begun to assign a spectrum for 5G wide-area cellular networks and quick regulatory actions. Some countries have also begun to consider licensed spectrum as part of industrial digitalization and industrial applications. For instance, Germany allocated local licensed spectrum in 3700–3800 MHz band range to industries for their applications in 2019, while Japan announced the allocation of the 28 GHz band. These diverse allocations lead to challenges for building a device ecosystem for industrial applications. Device chipsets need to be supported not only by an ecosystem of traditional Mobile Broadband (MBB) devices but also by an ecosystem that includes industrial devices of varying complexity on different spectrum bands. However, these ecosystems are still under formation and thus pose a challenge for the 5G services market.

Among end users, enterprises segment to grow at the highest CAGR during the forecast period

Under the end users segment, enterprises segment is expected to grow at the highest growth rate during the forecast period. The most significant value of 5G will not come from connecting people, but from its ability to provide seamless connectivity to infrastructures, machines, and things. 5G is set to become the foundation platform for several new applications in verticals, such as manufacturing, transportation, and healthcare. However, capabilities and standards required to unlock a new world of enterprise services are still under development. Consequently, commercial 5G enterprise applications, such as Industry 4.0 factories, autonomous driving cars, and robotic surgeries, are already in the execution phase. Latency-dependent and time-sensitive applications, such as automated vehicle driving and telerobotics, will especially benefit from edge computing in combination with 5G network slicing.

Among enterprise, the manufacturing segment is expected to dominate the market during the forecast period

Based on enterprises, the manufacturing segment of the 5G services market is projected to hold a larger market size during the forecast period. Industry 4.0 is expected to be fueled by cyberphysical systems and IoT, which will require the support of 5G networks. This will enable the efficient, connected, flexible factories of the future. Inside factories, 5G will facilitate manufacturing procedures, including more efficient production lines (with machine vision, and high definition video for managing processes), AGVs in factories (autonomous transportation) and machine control, with latency of less than 5ms using URLLC.

To know about the assumptions considered for the study, download the pdf brochure

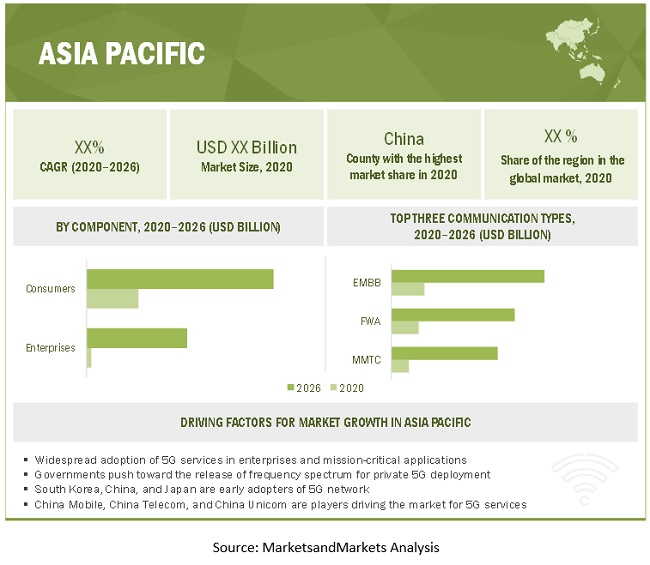

APAC to account for the largest market size during the forecast period

APAC is estimated to hold the largest market share in 2020. The region is transforming dynamically with respect to the adoption of new technologies across various sectors. The infrastructural growth in APAC, especially in Japan, South Korea, Australia, Singapore, China, and India, and the increasing deployment of 4G and 5G networks present huge opportunities for the implementation of the 5G services. Due to a massive mobile subscriber base, enterprises in this region are becoming more competitive and focusing on offering better customer service. The region is set to dominate 5G, edge computing, blockchain, and 5G core technology, due to its size, diversity, and the strategic lead taken by countries, including Singapore, South Korea, China, Australia, and Japan.

Market Players

The report includes the study of key players offering 5G services. It profiles major vendors in the global 5G services market. The major vendors include AT&T (US), China Mobile (China), SK Telecom (South Korea), Verizon (US), BT Group (UK), Deutsche Telekom (Germany), T-Mobile (US), China Telecom (China), Orange S.A (France), Vodafone (UK), China Unicom (China), Telstra (Australia), Telefonica (Spain), KT (South Korea), Rogers (Canada), Bell Canada(Canada), Etisalat( UAE), STC (KSA), LG U+( South Korea), NTT Docomo (Japan), KDDI (Japan), Telus (Canada), Swisscom (Switzerland), DISH (US), Reliance Jio(India), Rakuten (Japan), MTN ( South Africa), Airtel (India), and Telenor Group (Norway).These players have adopted various strategies to grow in the global 5G services market.

The study includes an in-depth competitive analysis of these key players in the 5G services market with their company profiles, recent developments, and key market strategies.

Scope of Report

Report Metric | Details |

Market size available for years | 2020-2026 |

Base year considered | 2019 |

Forecast period | 2020-2026 |

Forecast units | Value (USD Billion) |

Segments covered | Communication type, end user, enterprise, application, and region. |

Regions covered | North America, Europe, APAC, Middle East and Latin America |

Companies covered | AT&T (US), China Mobile (China), SK Telecom (South Korea), Verizon (US), BT Group (UK), Deutsche Telekom (Germany), T-Mobile (US), China Telecom (China), Orange S.A (France), Vodafone (UK), China Unicom (China), Telstra (Australia), Telefonica (Spain), KT (South Korea), Rogers (Canada), Bell Canada(Canada), Etisalat( UAE), STC (KSA), LG U+( South Korea), NTT Docomo (Japan), KDDI (Japan), Telus (Canada), Swisscom (Switzerland), DISH (US), Reliance Jio(India), Rakuten (Japan), MTN ( South Africa), Airtel (India),and Telenor Group (Norway). |

This research report categorizes the 5G services to forecast revenue and analyze trends in each of the following submarkets:

Based on communication types

Based on end Users

Based on Enterprises:

- Manufacturing

- Energy and Utilities

- Media and Entertainment

- Government

- Transportation and Logistics

- Healthcare

- Others

Based on regions:

- North America

- Europe

- APAC

- Middle East and Africa

- Latin America

Recent Developments:

- In January 2021, AT&T launched its 5G+ services in some popular areas and venues across Tampa, such as Channel District, Raymond James stadium, and Tampa International Airport in the US.

- In January 2021, Nokia partnered with China Mobile for the successful trialing of AI-powered RANs to predict bandwidth traffic and detect network anomalies to advance the 5G-RAN architecture.

- In January 2021, T-Mobile together with Ericsson and Nokia signed a five-year, multi-billion-dollar agreements to continue advancing and expanding the country’s largest 5G network.

- In February 2021, Verizon Business and Deloitte unveiled a 5G and MEC retail industry digital platform, which is designed to give retailers the ability to store data with near real-time analytics to improve customer engagement, inventory efficiency, and associate productivity.

- In November 2020,Orange S.A. launched 3.5 GHz 5G network in 15 French municipalities and announced to cover than 160 municipalities by the end of 2020. This new service allowed individuals and businesses to benefit from unprecedented quality of service and helped them develop new use.

- In September 2020,T-Mobile and American Tower have signed a new long-term agreement, which enhances T-Mobile’s access to American Tower’s US sites. This new agreement ensured T-Mobile can serve Americans’ wireless needs for years to come, enabling T-Mobile to increase momentum on its rapid 5G deployment.

Key Benefits of Buying the Report

The report would provide the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall 5G services market and its subsegments. It would help stakeholders understand the competitive landscape and gain more insights better to position their business and plan suitable go-to-market strategies. It also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.