< Key Hightlight >

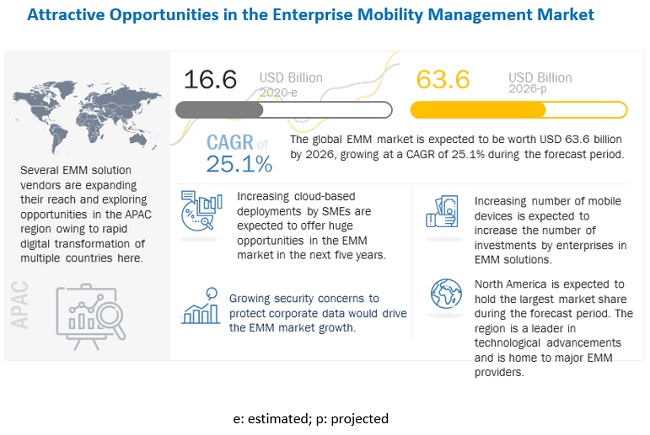

The global Enterprise Mobility Management (EMM) market size is expected to grow from USD 16.6 billion in 2020 to USD 63.6 billion by 2026, at a Compound Annual Growth Rate (CAGR) of 25.1% during the forecast period. The increasing mobile workforce and adoption of BYOD programs within enterprises to improve their workforce productivity, thus allowing employees to work from anywhere, at any time, and using any device to access corporate data on the go has boost the demand for EMM solutions. In addition to this, proliferation of new mobile devices in the market drives the implementation of mobile device management solutions in regions.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on the global EMM market

In response to the widespread transmission of the COVID-19, employers are compelled to provide their employees with remote access options, enabling them to work outside of the corporate infrastructure. Providing a work-from-home option for employees is a prudent measure to prevent the spread of viruses throughout the workplace. In this pandemic crisis, many organizations have also implemented a BYOD program that allows employees to use their personal devices for work to ensure business continuity. With a remote workforce, organizations are ensuring that employees can access corporate resources while working from home and have the right tools to stay productive. These factors lead to large enterprises deploying EMM solutions. These solutions also provide remote security and management capabilities to enable BYOD, as well as manage corporate devices. Countries have come up with unique mobile solutions with secured systems to reduce the spread of COVID-19 virus. For instance, Oman has launched Tarassud Plus, a powerful secured system that combines a mobile application using AI with enhanced features that help find COVID-19 statistics, guidelines, and the best practices to prevent the spread of the infection.

Market Dynamics

Driver: Increasing trend of work from home due to the COVID-19 pandemic drives the adoption of EMM solutions

With the COVID-19 pandemic, more companies are adopting remote work practices. The demand for mobility in the current workforce is on the rise, particularly due to the impact of the COVID-19 pandemic that is driving the shift to remote working. Adoption of EMM solutions is on the rise as these solutions give companies the option to control, update, and even wipe data off of devices from a distance. Remote workforces and MDM are more important than ever in 2020’s pandemic reality. Unmanaged remote endpoints are one of the biggest risks to an organization’s cybersecurity posture today. Enterprises have spent large amounts of money over the past several months rolling out more robust VPN solutions and mobile devices (laptops and tablets) for users to be able to perform their jobs remotely, while security has seemingly taken a backseat to these larger efforts to keep workforces employed and productive. For instance, the demand for mobile device management solutions in the Apple space is surging, as the pandemic drives forward the transition even as an increasing number of enterprises move to adopt Macs, iPhones, and iPads in their business. EMM solutions also offer remote wiping that can irretrievably erase any content in the device with the help of a trigger if loss or theft of the device is identified, further preventing loss of critical data. The need for EMM and the ability to detect and remediate vulnerabilities on remote endpoints is now a necessity rather than a convenience.

Restraint: EMM solutions to cater to every business need for a consistent end-user experience

Vendors that offer EMM solutions are unable to customize the solution as per specific business requirements. Enterprises often complain about the inability of the EMM solution to address flexibility and agility with multi-user connections. Every business has different security needs for mobile devices that gain access to the corporate network. Vendors also face several challenges while integrating EMM into an organization’s existing security and management controls and workflows. However, the right EMM solution can enhance both security and efficiency, allowing an IT admin to control and monitor systems from a single access point. Every company is different with varying business needs and gaining an accurate awareness of what a company requires is extremely challenging. Since the needs of every company would differ, the implementation of EMM solutions should also be different for a consistent end-user experience.

Opportunity: Rising number of cyberattacks on personal devices and business-critical data drives the adoption of EMM solutions

According to Lookout’s report, enterprise mobile phishing attacks have increased over time. Since Q4 2019, enterprise mobile phishing attack rates have grown about 37% globally. The US has seen some of the worst of it, with a 66% increase since the end of 2019. As more mobile devices are deployed in the workplace, phishing attacks that target those devices are becoming more common, creating a need to train employees on proper mobile security protocols.

Skilled cybersecurity professionals who could collaborate with developers are necessary to ensure the effectiveness of security. For new companies, encrypting all data with a cryptographic hash should be done. The digital signature of each file would be verified by the system to ensure data integrity. If an intruder gains unauthorized file access, the file’s digital signature would be altered, and the system notifies the concerned parties of any malicious activity. There should also be an authentication mechanism to restrict data access. Businesses could implement a multi-factor authentication of all network users. Block-chain-based cybersecurity solutions, such as a digital identification system, could simplify the authentication process. Another thing to take into consideration is to adopt an authentication mechanism that’s AI-powered. It will change access privileges based on the network and location of an employee.

Challenge: Poor enterprise system integrators

Every organization should have multiple systems for workflow automation to run in synchronization. To share critical data, various systems should be interconnected. In the same way, mobile devices, such as smartphones and laptops, should integrate with complex business systems in a seamless way. Failure to integrate mobile devices with complex systems could lead to information silos, which are made when critical information is only available on one device and not shared with the network of the company. An employee who works from home from time to time, for example, and fails to share important files after moving to another company would generate an information silo. Thus, advanced apps are needed, which could interact with several complex business systems to simplify the processing of data and workflows across.

By component type, the solution segment is expected to hold the largest share during the forecast period

Organizations are relying on EMM solutions to enhance customer acquisitions, retain existing customers, and enhance the customer experience and profitability. Organizations need to manage their data efficiently and effectively to enhance their productivity and maintain business continuity. The proliferation of data amounting to big data has forced vendors to adopt EMM solutions and help IT teams simplify and manage their decision-making process. EMM solutions enable the analysis of vast amounts of social media and sensor-based data to uncover new insights about relationships between customers, products, and operations, and represent them in an easy-to-understand manner. EMM solutions and services are already being accepted and implemented by large enterprises and SMEs.

The cloud segment is estimated to account for a faster CAGR rate during the forecast period

Under the deployment segment, the cloud is expected to grow at a higher growth rate during the forecast period. Cloud-based solutions involve the Software-as-a-Service (SaaS) model, wherein users can access EMM solutions virtually through the internet. In this deployment type, EMM solutions are delivered via the cloud. The advantages of deploying cloud-based EMM solutions include flexibility, scalability, affordability, operational efficiency, and low costs. However, cloud-deployed EMM solutions have certain shortcomings, such as lack of control over applications, strict government regulations, and private content. The overall adoption of cloud-based EMM solutions is projected to be on the rise and would be high during the forecast period, due to the associated functionalities and core features.

The BFSI vertical area is expected to grow at the larger market size during the forecast period

Under the vertical segment, the BFSI vertical is expected to hold a larger market size during the forecast period. The rising trend of the BYOD trend in the BFSI sector has led to the adoption of EMM solutions. Several companies in the BFSI sector are increasingly focusing on enhancing workplace mobility, thereby improving employee productivity and satisfaction. For instance, ABANCA, one of the largest banks based in Galicia (Spain), required a flexible, extensible platform that enables its IT department to manage COPE devices

North America is expected to account for the largest market size during the forecast period

North America is expected to hold the largest market size and dominate the EMM market from 2020 to 2026. North America is home to multiple EMM vendors, such as IBM, Microsoft, ManageEngine, and Citrix, who offer EMM solutions and services. These companies target higher revenues and business expansions due to the strong competition across the North American region. Organizations in North America focus on innovations to keep up with the latest technologies in the market. In this region, verticals such as BFSI, retail, and healthcare and life sciences adopt EMM solutions due to various benefits, such as efficient management of day-to-day transactions in the BFSI vertical, improved supply chain management process, and enhanced ability of healthcare machines to track patient health.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The EMM platform vendors have implemented various types of organic as well as inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions, to strengthen their offerings in the market. The major vendors offering EMM solutions are IBM (US), Microsoft(US), Cisco (US), BlackBerry (Canada), VMware(US), SAP (Germany), Citrix (US), Matrix42(Germany), MobileIron (US), Nationsky (China), Snow Software(Sweden), Sophos (UK), SOTI (Canada), Codeproof (US), Netplus Mobility (US), Hexnode (US), ManageEngine(US), Miradore (Finland), Quest Software (US), Ivanti(US), Scalefusion (India), 42Gears Mobility Systems(India), Social Mobile (US), AppTech (Switzerland), and Jamf (US).

Scope of the report

Report Metric | Details |

Market Size Available for years | 2016-2026 |

Base year considered | 2019 |

Forecast Period | 2020-2026 |

Forecast units | Value (USD Billion) |

Segments covered | Component, Organization Size, Deployment Mode, Vertical, and Region |

Geographies covered | North America, APAC, Europe, MEA and Latin America |

Companies covered | The major market players include IBM (US), Microsoft(US), Cisco (US), BlackBerry (Canada), VMware(US), SAP (Germany), Citrix (US), Matrix42(Germany), MobileIron (US), Nationsky (China), Snow Software(Sweden), Sophos (UK), SOTI (Canada), Codeproof (US), Netplus Mobility (US), Hexnode (US), ManageEngine(US), Miradore (Finland), Quest Software (US), Ivanti(US), Scalefusion (India), 42Gears Mobility Systems(India), Social Mobile (US), AppTech (Switzerland), and Jamf (US) (Total 25 companies) |

The study categorizes the EMM market based on component, organization size, deployment mode, vertical, at the regional and global level.

On the basis of component, the EMM market has been segmented as follows:

- Solutions

- MDM

- MAM

- MCM

- Identity and Access Management

- Mobile Expense Management

- Services

- Professional Services

- Consulting

- Support and Maintenance

- Deployment and Integration

- Managed Services

On the basis of organization size, the market has been segmented as follows:

- Large Enterprises

- Small and Medium-Sized Enterprises

On the basis of deployment modes, the EMM market has been segmented as follows:

On the basis of verticals, the market has been segmented as follows:

- BFSI

- Retail and eCommerce

- Healthcare and Life Sciences

- IT and Telecom

- Manufacturing

- Government

- Transportation and Logistics

- Travel and Hospitality

- Others Verticals

On the basis of regions, the EMM market has been segmented as follows:

- North America

- Europe

- Germany

- UK

- France

- Rest of Europe

- APAC

- Japan

- China

- India

- Rest of APAC

- MEA

- Israel

- UAE

- South Africa

- Rest of MEA

- Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In June 2020, IBM launched Watson Works to address the challenges of returning to the workplace. Watson Works is a curated set of products that embed Watson AI models and applications to help companies navigate many aspects of the return-to-workplace challenge following lockdowns put in place to slow the spread of COVID-19.

- In July 2020, Citrix and Microsoft joined hands to reimagine new flexible workplaces during the COVID-19 pandemic situation. Under the partnership, Microsoft will select Citrix Workspace as a preferred digital workspace solution, and Citrix will select Microsoft Azure as a preferred cloud platform, moving Citrix’s existing on-premises customers to Microsoft Azure to enable them to work anywhere across devices.

- In May 2020, BlackBerry launched BlackBerry Spark Suites, which include the BlackBerry Spark UEM Express Suite, BlackBerry Spark UEM Suite, BlackBerry Spark UES Suite, and BlackBerry Spark Suite.

- In December 2020, Cisco announced an agreement to acquire IMImobile. Both companies have reached an agreement on the terms of a recommended cash offer pursuant to which Cisco will pay 595 pence per share in exchange for each share of IMImobile, or an aggregate purchase price of approximately USD 730 million assuming fully diluted shares, net of cash, and including debt.

- In August 2019, VMware unveiled innovations across its industry-leading Workspace ONE Platform. The new modern management, security, and multi-cloud VDI innovations enable the IT staff to leverage the power of automation to intelligently manage and secure access to any app, on any cloud, and delivered to any device.a