< Key Hightlight >

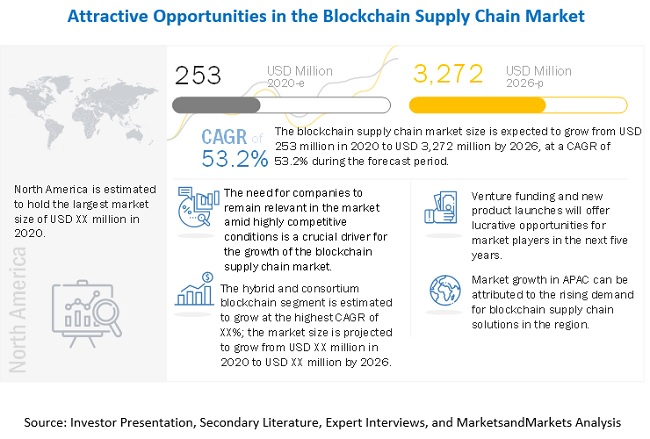

The post-COVID 19 global blockchain supply chain market size is expected to grow from USD 253 million in 2020 to USD 3,272 million by 2026, at a Compound Annual Growth Rate (CAGR) of 53.2% during the forecast period.

The major factors fueling the blockchain supply chain market include Increasing popularity of blockchain technology in retail and SCM, growing need for supply chain transparency and rising demand for enhanced security of supply chain transactions. Moreover, Growing need for automating supply chain activities and eliminating middlemen and rising government initiatives would provide lucrative opportunities for blockchain supply chain vendors.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID 19 IMPACT

The lockdowns imposed as a result of the COVID-19 outbreak has shut down economies and is impacting every aspect of the supply chain in North America. This has also caused various industries to move their normal manufacturing processes to manufacture essential medical supplies, PPE kits, etc. According to a survey by the Supply Chain Media among 143 supply chain decision-makers in Europe, the COVID-19 pandemic is having a clear impact on the supply chains of virtually all European manufacturers, wholesalers, and retailers. Although 78% of them are experiencing a negative short-term impact, 17% are noticing positive effects, and only 5% say they are not affected in any way. COVID-19 finally forced many companies and entire industries to rethink and transform their global supply chain model. For example, according to a report by the Economist Intelligence Unit (EIU), over-reliance on Asian, and especially Chinese suppliers and clients was already a major concern for MEA before the COVID-19 disruption in 2020, and after the outbreak, MEA businesses are planning to diversify supply chains as well as refocus on local production where possible. The COVID-19 pandemic has resulted in an increased demand for eCommerce. To successfully operate in pandemic technologies, such as AI and Machine Learning (ML), are beginning to drive innovation strategies of the business which has further fueled the increase in the adoption of blockchain supply chain solutions across SMEs. Blockchain is being used for proper distribution of COVID-19 vaccine to keep a proper track of maintenance as well as storage of vaccine for distribution.

MARKET DYNAMICS

Driver: Increasing popularity of blockchain technology in retail and SCM

The retail and SCM industry witnesses several transactions each day, along with the exchange of information on a daily basis. The information may include authentication process information, procurement data, sales, fees, certifications, approvals, and disbursements. The major challenges faced by companies operating in the supply chain industry include reduced costs, enhanced speed, and continuous tracking of products’ movement and quality. Various stakeholders in the SCM industry have started adopting blockchain technology to improve the transparency and efficiency in business operations and enhance the overall experience of the final delivery phase. The integration of blockchain technology with an SCM system prevents data manipulation, which is expected to be one of the biggest driving factors for the overall growth of the blockchain market. This technology further enables the recording of transactions on distributed ledgers, thus offering increased transparency, fraud prevention, and improved efficiency to various agencies.

Restraint:Uncertain regulatory status and standards

With technological advancements, regulatory bodies need to understand what the current regulations lack and how these regulations can impact the overall technology-enabled applications. Uncertainties in regulations remain a concern in the blockchain supply chain market. At present, the lack of regulations is expected to be one of the biggest restraining factors for the adoption of blockchain technology, especially for SCM in many industry verticals. Healthcare institutions across the globe are working closely to find a common set of standards for blockchain technology, however, the regulatory acceptance by healthcare institutions is one of the biggest challenges in transforming supply chain systems. The distributed ledger technology is still at a nascent stage, which raises a number of questions related to the wide range of applications, security, and authenticity for regulators and policymakers both at the national and international levels. Owing to issues such as standardization and interoperability, the regulatory status of blockchain technology remains uncertain.

Opportunity: Growing need for automating supply chain activities and eliminating middlemen

The supply chain ecosystem includes various services, such as legal, insurance, settlement, transport management, route planning, normative compliance, fleet management, delivery schedules, and connectivity with stakeholders. These processes require middlemen. Blockchain technology equips supply chains with an automated process for storing the data in the digital format, which is extremely difficult to tamper with. By applying blockchain technology in supply chain activities, the need to appoint middlemen for transaction validations or negotiations would be eliminated. Moreover, the blockchain technology synchronizes all the transaction data across networks, so that each participant validates the work of other participants. It ultimately automates supply chain transactions and encourages a direct relationship between stakeholders, thereby eliminating the need for any middlemen. The added advantage of the blockchain technology is that, even with so many transactions and their data to handle, each transaction can be accurately backtracked to its point of origin.

Challenge: Managing the increasing data volume

A huge amount of energy and computing power is required for validating blocks and storing ledgers in the blockchain technology. In the case of Bitcoin technology, networks are large and public, which can process around 450 trillion transactions per second. These numbers of transactions per second are small when compared with the required transactions workload projected for supply chains. Furthermore, supply chains mainly rely on permissioned blockchain, due to confidentiality issues. The capabilities of the permissioned blockchain are still few than those of centralized databases that are being used by supply chain organizations at present. This raises significant hesitations about the scope of the data elements that the permissioned blockchain can capture. It would be challenging to increase the capacity of the permissioned blockchain for keeping up with the increasing pace of big data.

SMEs segment to grow at a higher CAGR during the forecast period

Rather than investing in on-premises networking solutions, SMEs prefer cloud-based solutions, which are more flexible and fall within the budget. The adoption of the pay-as-you-go model by SMEs to flexibly manage the IT infrastructure as per their requirements is projected to drive the adoption of blockchain supply chain. Also, the need for efficient customer data protection and cost-cutting, as well as attaining a competitive advantage, enables quick response and timely decisions that are projected to drive the growth of the blockchain supply chain market in SMEs.

FMCG vertical to hold the largest market size during the forecast period

In the FMGC segment, delivering the right product at the right time and quantity is very critical. Also, quick delivery of perishable goods is a major task for any food and beverage distributor. Hence, real-time supply chain visibility becomes absolutely essential for successful FMCG supply chain execution and unplanned cost avoidance. Blockchain supply chain platform and services provide FMCG companies with real-time supply chain visibility, BI, and reduced operating cost. The uses of blockchain in the supply chain for FMCG include anti-counterfeiting, advertising, and consumer data management. Anti-counterfeiting blockchain solutions track and trace products through barcodes assigned to products in the supply chain process, ensuring customers receive authentic products.

To know about the assumptions considered for the study, download the pdf brochure

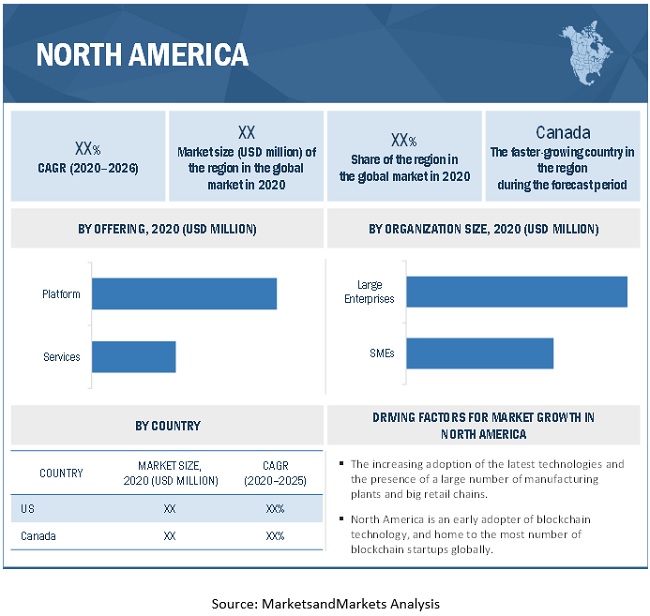

North America to hold the largest market size during the forecast period

With the technological advancement and the rising focus on making supply chain functions, such as logistics, warehousing, fulfillment, production, and transportation management more efficient, the need for a blockchain supply chain is being fueled in the region. The increasing adoption of the latest technologies and the presence of a large number of manufacturing plants and big retail chains are expected to drive the adoption of blockchain supply chain in the region. The presence of stringent regulations and trade agreements related to the supply chain across the region is also a driver of the blockchain supply chain here.

Asia Pacific is expected to contribute to the fastest-growing region with the highest CAGR during the forecast period as it is getting technologically equipped with the early adoption of new technologies. The latest trends of widespread adoption of trucking, containerization, and computerization resulting in scaled shipping and delivery of raw materials, Work In Progress (WIP), and finished goods around the world and effectively improving cost, quality, and delivery of supply chain are also a driver for blockchain supply chain software and services. The increased shift of APAC enterprises toward leaner and agile supply chains with end-to-end visibility by the adoption of the latest technologies is also one of the biggest drivers of blockchain supply chain software and services in the region.

Key Market Players

Major vendors in the global blockchain supply chain market include IBM (US), SAP SE (Germany), Oracle (US), Guardtime (Estonia), and Interbit (Canada)

Oracle is one of the leading providers of a wide array of technologies. The company operates in three business areas: cloud and license, hardware, and services. It offers middleware software, Oracle databases, cloud infrastructure, application software, and hardware systems, including networking products, computer servers, and storage-related services. It has a broad portfolio of SCM applications that enable organizations to improve outcomes for operational efficiency, while ensuring cost savings. Oracle offers a comprehensive and broad portfolio of cloud solutions for business functions, such as enterprise resource planning, human capital management, customer experience, and SCM. The Oracle SCM offerings enable organizations to efficiently organize and improve their supply chains. These offerings include Oracle product lifecycle management cloud, Oracle supply chain planning cloud, Oracle inventory management cloud, Oracle order management cloud, Oracle order manufacturing cloud, and Oracle logistics cloud. Oracle’s geographic operations are spread across Europe, the MEA, APAC, North America, and South America. Some of its notable subsidiaries include Oracle International Corporation (US), Oracle Global Holdings, Inc. (US), Oracle America, Inc. (US), Oracle Technology Company (Ireland), Oracle Systems Corporation (US), and OCAPAC Holding Company (Ireland).

Scope of the Report

Report Metric | Details |

Market size available for years | 2014–2026 |

Base year considered | 2019 |

Forecast period | 2020–2026 |

Forecast units | Value (USD) |

Segments covered | Offering (platform and Services), type, providers, application, organization size, end user, and Region |

Geographies covered | North America, Europe, APAC, MEA, and Latin America |

Companies covered | IBM (US), Microsoft (US), SAP (Germany), AWS (US), Oracle (US), Huawei (China), Guardtime (Estonia), TIBCO Software (US), Bitfury (The Netherlands), Interbit (Canada), Auxesis Group (India), VeChain (China), Chainvine (UK), Digital Treasury Corporation (China), Datex Corporation (US), OpenXcell (US), Algorythmix (India), BlockVerify (UK), and Applied Blockchain (UK). |

This research report categorizes the blockchain supply chain market to forecast revenues and analyze trends in each of the following subsegments:

Based on Offering:

- Platform

- Services

- Technology Advisory and Consulting

- Deployment and Integration

- Support and Maintenance

Based on Type:

- Public

- Private

- Hybrid and Consortium

Based on Providers:

- Application Providers

- Middleware Providers

- Infrastructure Providers

Based on Application:

- Asset Tracking

- Counterfeit Detection

- Payment and Settlement

- Smart contracts

- Risk and Compliance Management

- Others (Inventory Control and Reward Management)

Based on Organization Size:

Based on Verticals:

- FMCG

- Retail and eCommerce

- Healthcare

- Manufacturing

- Transportation and Logistics

- Oil, Mining, and Gas

- Others (Construction, Agriculture, and Automobile)

Based on Region:

- North America

- Europe

- United Kingdom (UK)

- Germany

- Rest of Europe

- APAC

- China

- Japan

- India

- Rest of APAC

- MEA

- Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In June 2019, MIMOS collaborated with Oracle to leverage blockchain technology for greater transparency and trust.

- In October 2018, Oracle Blockchain Applications Cloud was launched to help customers increase trust and provide agility in transactions across their business networks.

- In September 2018, in order to fight the growing problem of counterfeit drugs in India, NITI Aayog and Oracle signed a Statement of Intent (SoI) to pilot a real drug supply-chain using blockchain distributed ledger and IoT software.