< Key Hightlight >

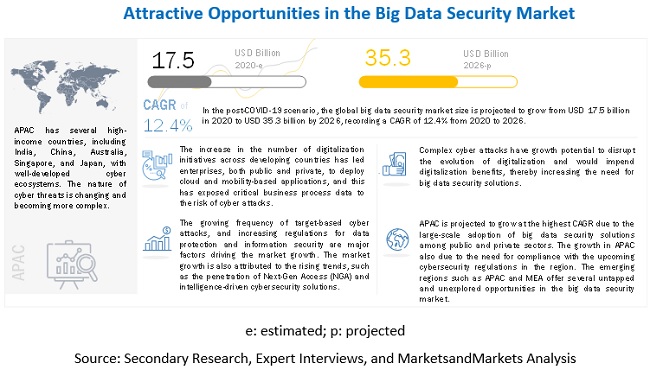

In the post-COVID-19 scenario, the global big data security market size is projected to grow from USD 17.5 billion in 2020 to USD 35.3 billion by 2026, recording a Compound Annual Growth Rate (CAGR) of 12.4% from 2020 to 2026. The market’s growth can be attributed to the increasing awareness and rising investments in big data security solutions across global organizations operating across verticals.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Big data Security Market

Amidst the COVID-19 pandemic crisis, various governments and regulatory authorities mandate both public and private organizations to embrace new practices for working remotely and maintaining social distancing. Since then, the digital ways of doing business became the new Business Continuity Plan (BCP) for various organizations. With the widespread use of BYOD device, WFH trend, and internet penetration across the corners of the globe, individuals are progressively inclined towards the use of digital technologies such as cloud solutions, driving the need for Big data security measures for protection against cyber-attacks. There is growth in the need for endpoint and Virtual Private Network (VPN) security measures and rising demand for cyber hygiene practices to ensure robust security policies and practices amid Covid-19 pandemic.

Big data Security Market Dynamics

Driver: Rising cyber-attacks demand for scalable big data security solutions

Targeted attacks have witnessed a rise in recent years, infiltrating targets’ network infrastructure and simultaneously maintaining anonymity. Attackers who have a specific target in mind mostly attack endpoints, networks, on-premises devices, cloud-based applications, data, and various other IT infrastructure. The primary motive behind targeted attacks is to intrude on targeted companies’ or organizations’ network and steal critical information. As a result of these targeted attacks, business-critical operations in organizations are negatively impacted in terms of business disruption, intellectual property loss, financial loss, and loss of critical and sensitive customer information. The impact of targeted cyber-attacks affects targeted organizations, and their domestic and global customers. Personally, Identifiable Information (PII) such as names, telephone numbers, addresses, driver license numbers, and social security numbers is stolen by attackers, resulting into security breaches and identity thefts.

Restraints: Low big data security budget and high installation cost

The budget for cybersecurity in emerging startups is insufficient to implement Next-Generation Firewalls (NGFWs) and Advanced Threat Protection (ATP) solutions. The lack of investments and limited funding are key factors that are projected to restrict the adoption of big data security solutions among small firms in developing economies. Lesser financial capabilities lead to a dearth of proper IT security infrastructure in these firms, resulting in the slow adoption of new technologies and enterprise security solutions. Small enterprises are burdened with the proper management of planned budget funds for various operational challenges and business continuity planning.

Opportunity: Adoption of AI- and ML- based applications to increase demand for big data security solutions

AI is a technology that focuses on making intelligent machines that can assist and automate processes. ML is a subset of AI, which enables machines to accurately predict outcomes without algorithms and learn from their users how they expect them to function. The primary mission of ML is to work on algorithms that make machines capable of receiving information and statistically analyzing data, providing acceptable outputs.

As enterprises today are accumulating data from numerous sources, securing information is of utmost importance for companies. AI and ML in data security can assist security analysts in reducing the time taken by authorities to prevent data thefts. As AI and ML focus on securing information by working with algorithms provided to them, they can also learn about how specific threats are classified. With such techniques, these technologies can quickly scan through the abnormal behavior of the system and determine if abnormalities classify as potential threats.

Challenge: Discovering sensitive data at scale during data ingestion

Unlike structured data that resides in well-protected IT perimeters, sensitive content exists in unstructured formats such as office documents, files, or images, and is distributed and published through file sharing, social media, and email. Most enterprises across industries realize the growing importance of collecting their data and gaining meaningful analysis for improving business growth and building competitive advantages. A huge volume of data is generated each day in various forms and from different sources. Sensitive data discovery is integral to creating and maintaining an effective big data security plan. With the rapid adoption of cloud and the rise of remote workers, organizations are no longer only concerned with the sensitive data accumulated mainly on-premises. Currently, there are multiple paths that data can travel through and a large number of locations where sensitive data can stay. The growing concern of identifying and analyzing sensitive data from structured and unstructured data collected via multiple sources has become a challenge.

By deployment, the cloud segment is expected to grow at a higher CAGR than the on-premises segment during the forecast period.

Big data security solutions can be deployed on-premises, as well as offered as a cloud offering as per the business requirements. The on-premises deployment mode enables organizations to have a more control over all the big data security solutions such as next-generation firewalls and next-generation intrusion prevention system. The cloud deployment mode of big data security solutions benefits enterprises with cloud-based solutions offering speed, scalability, and enhanced IT security. As more applications get deployed over the cloud, there is a growing demand for cloud-based big data security solutions among SMEs and large enterprises.

By organization size, the large enterprises segment is expected to hold a larger market

Large enterprises accounts for a higher market share in terms of revenue in the global big data security market. Large enterprises are reshaping their security policies and architecture to incorporate big data to protect critical assets from various cyber-attacks. Large organizations majorly adopt big data security to safeguard network, end-points, data centers, devices, users and applications from unauthorized usage and malicious ransomware attacks.

To know about the assumptions considered for the study, download the pdf brochure

By region, North America is expected to account for the largest market share during the forecast period.

The North American region has presence of several prominent market players delivering advanced solutions to all the industry verticals in the regions. Apart from geographical presence, strategic investments, partnerships, and significant R&D activities are thereby contributing to the hefty deployments of Big data security solutions. Key players such as IBM, Oracle, HPE, Microsoft, and Thales, along with several start-ups in the region are offering enhanced Big Data Security software solutions & services to cater the needs of customers. Such factors are expected to fuel the growth of the market in North America.

Scope of the Report

Report Metric | Details |

Market size available for years | 2014-2026 |

Base year considered | 2019 |

Forecast period | 2020–2026 |

Forecast units | Value (USD) |

Segments covered | Component, Software, Deployment Type, Organization Size, Vertical, And Region |

Geographies covered | North America, Europe, Asia Pacific, Middle East and Africa, Latin America |

Companies covered | Major vendors, namely, include IBM (US), Oracle (US), Microsoft (US), Google (US), Amazon Web Services (US), Hewlett Packard Enterprise (US), Talend (US), Micro Focus (UK), Check Point (Israel), FireEye (US), Rapid7 (US), Thales (France), Informatica (US), McAfee (US), Centrify (US), Sisense (US), Imperva (US), Proofpoint (US), Varonis (US), Cloudera (US), Fortinet (US), Digital Guardian (US), SentinelOne (US), DataVisor (US), and Zettaset (US). |

This research report categorizes the Big Data Security Market to forecast revenues and analyze trends in each of the following submarkets:

On the basis of component, the Big Data Security Market has been segmented as follows:

On the basis of software, the Market has been segmented as follows:

- Data Discovery and Classification

- Data Authorization and Access

- Data Encryption, Tokenization and Masking

- Data Auditing and Monitoring

- Data Governance and Compliance

- Data Security Analytics

- Data Backup and Recovery

On the basis of deployment type, the Big Data Security Market has been segmented as follows:

On the basis of organization size, the Market has been segmented as follows:

On the basis of verticals, the Big Data Security Market has been segmented as follows:

- IT and ITES

- Telecommunications

- Healthcare and Social Assistance

- Financial and Insurance

- Retail Trade

- Utilities

- Other Verticals

On the basis of region, the Market has been segmented as follows:

- North America

- Europe

- UK

- Germany

- France

- Rest of Europe

- Asia Pacific

- China

- Singapore

- Japan

- Australia

- Rest of APAC

- Middle East and Africa

- Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In October 2020, IBM Security announced new and upcoming capabilities for Cloud Pak for Security, that includes a data security solution that enables companies to detect, respond, and protect from threats to their most sensitive data across hybrid cloud environments.

- In February 2020, Oracle and Microsoft expanded their cloud collaboration with a new cloud interconnect location in Amsterdam, Netherlands. The new interconnect location would enable these businesses to share data across applications running in Microsoft Azure and Oracle Cloud.

- In June 2020, Microsoft partnered with SAS to bring cloud-based SAS industry solutions to its customers.

- In July 2020, Google Cloud announced two new security offerings, Confidential VMs and Assured Workloads, for governments to provide customers with advanced security tools to support compliance and data confidentiality.

- In August 2019, HPE acquired MapR Technologies to advance its Intelligent Data Platform.