< Key Hightlight >

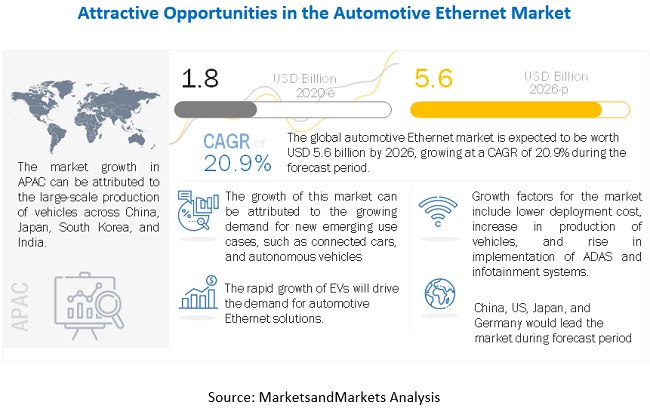

MarketsandMarkets expects the automotive Ethernet market to grow from USD 1.8 billion in 2020 to USD 5.6 billion by 2026, at a Compound Annual Growth Rate (CAGR) of 20.9% during the forecast period. The next-generation automotive application increase complexities in the in-vehicle infrastructure. Modern cars are heavily flooded with a network module, Electronic Control Units (ECUs), sensors, actuators, connectivity modules, and cables that led to complexities within the vehicle. Automotive Original Equipment Manufacturers (OEMs) are adopting next-generation technologies to sustain stability in the vehicle infrastructure and minimize network workload.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 has compelled businesses to rewire the business strategy. The pandemic has adversely impacted the automotive sector all over the globe. The nationwide lockdown and social distancing norms have extended automotive ecosystem vendors to shut down business operations in the first six months of 2020. Advancements in the COVID-19 vaccination, governments’ stimulus packages and the recovery in the global economy have initiated a growth trend in the automotive sector. Vehicle sales have been increased in Q3 and Q4 of 2020 in North America, APAC, and Europe. This increasing trend is driven by strong customer demand in passenger cars and commercial vehicle segments. Electric Vehicles (EVs) can garner a maximum market share in the future due to development in EV infrastructures, government initiatives, and cost-effectiveness.

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

Driver: Prevalence of electric vehicles

Over the last few years, the growth of EVs has been promising all over the globe. Automotive OEMs have invested notable capital in the designing of EVs. The government authorities have taken several initiatives to accelerate the production of EVs for the consumer and commercial segment. The technology evolution and the development of the entire ecosystem, including advancements in chipsets and modules, the availability of lithium-ion batteries, and the modernization of charging infrastructure, have propelled the growth of EVs all over the globe. In a nutshell, technology advancements, government policies, growth in the consumer economy, and OEM’s investments are the key drivers boosting EV production.

Restraints: Intricacy in-migration from traditional in-vehicle connectivity technologies to Ethernet

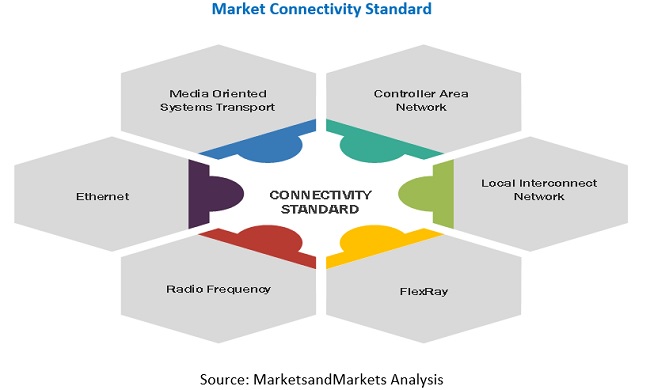

Connectivity plays an important role in the in-car infrastructure. Over the last few decades, CAN, LIN, FlexRay, and Radio Frequency (RF) dominate the in-vehicle connectivity industry. Automotive OEMs and Tier 1 suppliers are prevalent in using traditional technologies for the in-car network. These are low profile protocols and offer end-to-end connectivity for ECUs in the car. Some technologies, such as MOST and FlexRay, were designed to support new application areas: infotainment and ADAS. However, technologies are insufficient to provide high bandwidth and low latency for infotainment applications

Opportunities: Emergence of connected cars

Standardization of the high bandwidth Ethernet allows connected cars and IoT application developers to develop advanced applications that require high bandwidth. The proliferation of such applications is expected to further increase the demand for high bandwidth connectivity for computer systems within the vehicle. In 2015, the Institute of Electrical and Electronics Engineers (IEEE) set 100BASE-T1 Physical Layer (PHY) standard for high speed 100Mbps Ethernet. The high-speed Ethernet creates a significant opportunity for application developers. It also affects the vehicle's functional design and can also support real-time connectivity with the outside world. Connection to the outside world in a connected car gives more flexibility to the user in terms of choosing applications from third-party application providers or OEMs or partners.

Challenge: Interoperability among components and application computability

Interoperability among components provided by different vendors is one of the key challenges of the automotive Ethernet market. There have been significant efforts from automotive manufacturers and Ethernet providers to establish standards that can provide interoperability for components used in the automotive Ethernet. Interoperability among various components is a very important factor as it provides more flexibility for automotive companies and customers to install different products from different suppliers into the vehicle. As high-end, medium-range, and low-end vehicles have different safety features, application developers and automotive manufactures need to consider that applications developed or available are compatible with the safety system installed into the vehicle.

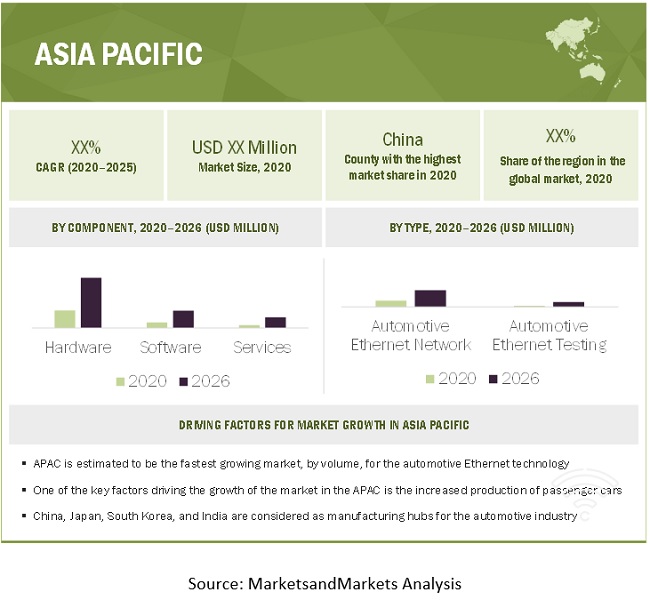

APAC region to account for the largest market size during the forecast period.

Over the last few years, the automotive sector in APAC has categorically transformed due to technology development, positive economic growth, and stable socio-political conditions. Globally, the region is contributing a major share in terms of production of vehicles and sales of vehicles. Mass consumer base across emerging markets, such as China, India, and Malaysia, have been driving the automotive sector. The income per capita has shown growth in China and India. Hence, automotive OEMs have huge opportunities in APAC to drive business revenue. Automotive OEMs are focusing more on safety and security features to improve customer experience.

Key Market Players

Key and emerging market players include Broadcom (US), NXP Semiconductors N.V. (Netherlands), Marvell (Bermuda), Microchip Technology Inc. (US), Vector Informatik GmbH (Germany), System-on-Chip Engineering S.L. (Spain), Molex, LLC (US), Texas Instruments (US), Cadence Design Systems, Inc. (US), TTTech Auto AG (Austria), Excelfore (US), DASAN Networks, Inc. (South Korea), ACTIA Group (France), NEXCOM International Co., Ltd. (Taiwan), AllGo Embedded Systems Pvt. Ltd. (India), Spirent Communications (UK), Keysight Technologies (US), Aukua Systems Inc (US), Intrepid Control Systems (US), RUETZ SYSTEM SOLUTIONS GMBH (Germany), TSN Systems GmbH (Germany), Xena Networks (Denmark), TEKTRONIX, INC (US), Rohde & Schwarz (Germany), and Realtek Semiconductor Corp. (Taiwan). These players have adopted various strategies to grow in the automotive Ethernet market.

Scope of the Report

Report Metric | Details |

Market size available for years | 2018–2026 |

Base year considered | 2019 |

Forecast period | 2020–2026 |

Forecast units | Million (USD) |

Segments covered | Component (hardware, software, and services), type, bandwidth, application, vehicle type, |

Geographies covered | North America, Europe, APAC, MEA, and Latin America |

Companies covered | Broadcom (US), NXP Semiconductors N.V. (Netherlands), Marvell (Bermuda), Microchip Technology Inc. (US), Vector Informatik GmbH (Germany), System-on-Chip Engineering S.L. (Spain), Molex, LLC (US), Texas Instruments (US), Cadence Design Systems, Inc. (US), TTTech Auto AG (Austria), Excelfore (US), DASAN Networks, Inc. (South Korea), ACTIA Group (France), NEXCOM International Co., Ltd. (Taiwan), AllGo Embedded Systems Pvt. Ltd. (India), Spirent Communications (UK), Keysight Technologies (US), Aukua Systems Inc (US), Intrepid Control Systems (US), RUETZ SYSTEM SOLUTIONS GMBH (Germany), TSN Systems GmbH (Germany), Xena Networks (Denmark), TEKTRONIX, INC (US), Rohde & Schwarz (Germany), and Realtek Semiconductor Corp. (Taiwan). |

Scope of the Report

The research report categorizes the automotive Ethernet market to forecast the revenues and analyze trends in each of the following subsegments:

By Type

- Automotive Ethernet Network

- Automotive Ethernet Testing

By Component

- Hardware

- Software

- Services

- Consulting

- Implementation

- Training and Support

By Bandwidth

- 10Mbps

- 100Mbps

- 1Gbps

- 2.5/5/10Gbps

By Application

- Advanced Driver Assistance Systems (ADAS)

- Infotainment

- Powertrain

- Body and Comfort

- Chassis

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Farming and Off-highway Vehicles

By Region

- North America

- Europe

- APAC

- MEA

- Latin America

Recent Developments

- In March 2019, Broadcom launched BCM8956X, a family of automotive multilayer Ethernet switches. This product will help the company address the growing need for bandwidth, security, and Time-Sensitive Networking (TSN). The product is IEEE compliant for 100 BASE-T1 PHY. Broadcom would help automotive OEMs and Tier1 suppliers advance into Gigabit Ethernet Systems.

- In September 2018, NXP acquired OmniPHY, an automotive Ethernet sub-solution provider. Following this acquisition, the company would accelerate its growth in in-vehicle networks. OmniPHY was one of the innovative vendors in the automotive Ethernet market.

- In May 2019, Marvell acquired Aquantia, a leader in Multi-Gig Ethernet connectivity, to extend its position in the Multi-Gig 2.5G/5G/10G Ethernet segments. This acquisition will speed up Marvell's leadership in the transformation of the in-car network to high-speed Ethernet over the next decade.

- In November 2018, Microchip announced an in-vehicle networking solution dubbed as “Intelligent Network Interface Controller networking (INICnet)” that simplifies infotainment system which works over Ethernet. This technology would be instrumental for automotive OEMs to design customer-oriented in-vehicle entertainment solutions.

- In January 2019, Molex collaborated with AllGo, one of the leading automotive software providers for media and connectivity solutions. This collaboration will help Molex deliver versatile infotainment and connectivity solution for automotive OEMs.