< Key Hightlight >

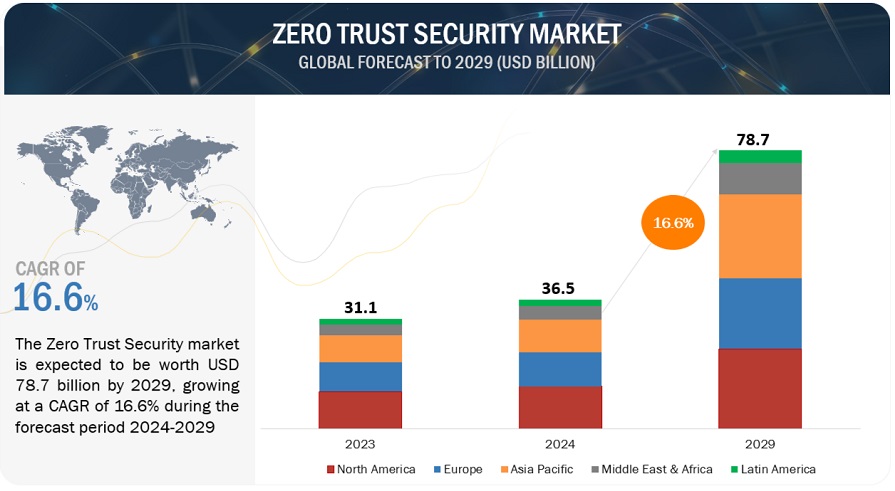

In the post-COVID-19 scenario, the global zero trust security market size is projected to grow from USD 19.6 billion in 2020 to USD 51.6 billion by 2026, recording a compound annual growth rate (CAGR) of 17.4% from 2020 to 2026. The major factors driving the market include the growing frequency of target-based cyberattacks and increasing regulations for data protection and information security.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Zero Trust Security Market

Amidst the COVID-19 pandemic crisis, various governments and regulatory authorities mandate both public and private organizations to embrace new practices for working remotely and maintaining social distancing. Since then, the digital ways of doing business became the new business continuity plan (BCP) for various organizations.

With the widespread use of BYOD device, WFH trend, and internet penetration across the corners of the globe, individuals are progressively inclined towards the use of digital technologies such as cloud solutions, driving the need for Zero trust security measures for protection against cyber-attacks. There is growth in the need for endpoint and Virtual Private Network (VPN) security measures and rising demand for cyber hygiene practices to ensure robust security policies and practices amid Covid-19 pandemic.

Zero Trust Security Market Dynamics

Driver: Growing frequency of target-based cyber-attacks

Targeted attacks have witnessed a rise in recent years, infiltrating the target’s network infrastructure and simultaneously maintaining anonymity. Attackers that have a specific target in mind mostly attack endpoints, networks, on-premises devices, cloud-based applications, data, and various other IT infrastructure. The primary motive behind a targeted attack is to intrude on the targeted company or organization’s network and steal critical information. As a result of these targeted attacks, business-critical operations in organizations are negatively impacted in terms of business disruptions, intellectual property loss, financial loss, and loss of critical and sensitive customer information.

Restraints: Budgetary constraints among small and emerging start-ups in developing countries

Cybersecurity requirements grow at a higher rate than the budgets planned to address them. Most of the small firms lack the budget and IT security expertise to adopt enhanced cybersecurity solutions to safeguard their network and IT infrastructure from various cyberattacks. The limited capital funding can be a major restraining factor for some small and medium-sized companies, embracing a zero trust security model.

Opportunity: High demand for improved visibility due to the rise in IoT traffic among enterprises

As the enterprises across verticals adopt IoT devices to improve operational efficiency and enhance communications, the IoT traffic is projected to rise in the coming years. The growing adoption of these IoT devices has widened the scope of attacks for cybercriminals. A zero trust security model approach is projected to be adopted by organizations dealing with critical business and personal information in the coming years, as it offers security professionals with improved visibility in terms of users accessing the network from various locations, accessed applications, and the exact time of access.

Challenge: Design and implementation challenges to deploy zero trust security solutions

Deploying a zero trust security model to a new or existing infrastructure has various design and implementation challenges. The model enforces IT teams in enterprises to assess their network security and transform from a network perimeter-based approach into a user-based and application-based security model. Redesigning and redeploying web- and mobile-based applications can become exhaustive and time-consuming. Most networks are not designed keeping zero trust security in mind and upgrading to a zero trust model requires in-depth network analysis of network hardware, services, and traffic.

To know about the assumptions considered for the study, download the pdf brochure

By deployment, the cloud segment is expected to grow at a higher CAGR than the on-premises segment during the forecast period.

Zero trust security solutions can be deployed on-premises, as well as offered as a cloud offering as per the business requirements. The on-premises deployment mode enables organizations to have a more control over all the zero trust security solutions such as next-generation firewalls and next-generation intrusion prevention system. The cloud deployment mode of zero trust security solutions benefits enterprises with cloud-based solutions offering speed, scalability, and enhanced IT security. As more applications get deployed over the cloud, there is a growing demand for cloud-based zero trust security solutions among SMEs and large enterprises.

By organization size, the large enterprises segment is expected to hold a larger market

Large enterprises accounts for a higher market share in terms of revenue in the global zero trust security market. Large enterprises are reshaping their security policies and architecture to incorporate zero trust to protect critical assets from various cyber-attacks. Large organizations majorly adopt zero trust security to safeguard network, end-points, data centers, devices, users and applications from unauthorized usage and malicious ransomware attacks. Increasing penetration of MFA among large organizations to facilitate privileged access to servers and web applications is also promoting the market growth.

By region, North America is expected to account for the largest market share during the forecast period.

The North American region has presence of several prominent market players delivering advanced solutions to all the industry verticals in the regions. Apart from geographical presence, strategic investments, partnerships, and significant R&D activities are thereby contributing to the hefty deployments of zero trust security solutions. Key players such as Palo Alto Networks, Inc., Symantec Corporation, Okta, Inc., Cisco Systems Inc., Akamai Technologies, Inc., Centrify Corporation, and Cyxtera Technologies, along with several start-ups in the region are offering enhanced Zero Trust Security solutions & services to cater the needs of customers. Such factors are expected to fuel the growth of the market in North America.

Scope of the Report

Report Metric | Details |

Market size available for years | 2014-2026 |

Base year considered | 2019 |

Forecast period | 2020–2026 |

Forecast units | Value (USD) |

Segments covered | Solution Type, Deployment Type, Authentication Type, Organization Size, Vertical, And Region |

Geographies covered | North America, Europe, Asia Pacific, Middle East and Africa, Latin America |

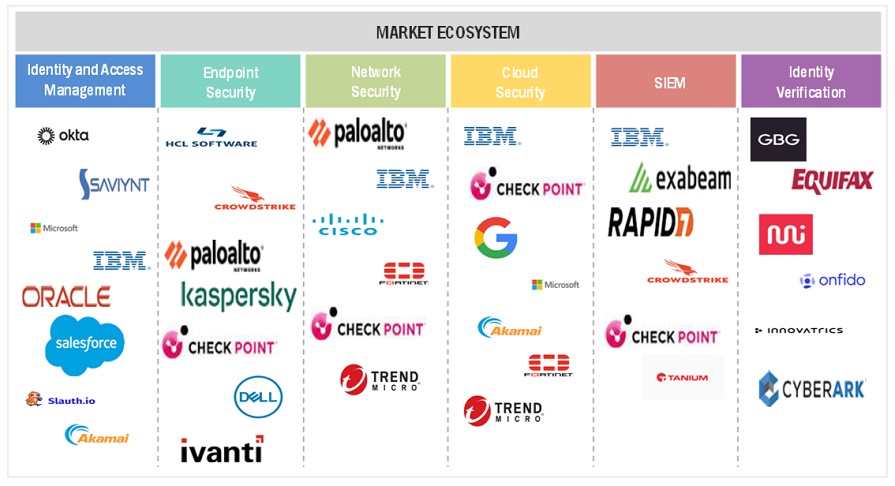

Companies covered | Major vendors, namely, include Cisco Systems Inc. (US), Akamai Technologies (US), Palo Alto Networks (US), Okta Inc. (US), Check Point Software Technologies (US), Trend Micro Inc. (Japan), IBM Corporation (US), Symantec Corporation (US), FireEye Inc. (US), McAfee Corporation (US), Forcepoint (US), RSA Security (US), Centrify (US), Cyxtera Technologies (US), , Illumio (US), Sophos Group PLC (US), QNext Corporation (US), Google LLC (US), Microsoft Corporation (US), VMWare Inc. (US), Fortinet (US), Cloudflare Inc. (US), SonicWall (US), Varonis Systems (US), Pulse Secure (US) and ON2IT (Netherland). |

This research report categorizes the Zero Trust Security Market to forecast revenues and analyze trends in each of the following submarkets:

On the basis of solution type, the Zero Trust Security Market has been segmented as follows:

- Network Security

- Data Security

- Endpoint Security

- Security Orchestration Automation and Response

- API Security

- Security Analytics

- Security Policy Management

- Others

On the basis of deployment type, the Market has been segmented as follows:

On the basis of authentication type, the Zero Trust Security Market has been segmented as follows:

- Single-factor Authentication

- Multi-factor Authentication

On the basis of organization size, the Market has been segmented as follows:

On the basis of verticals, the Zero Trust Security Market has been segmented as follows:

- IT and ITES

- Financial and Insurance

- Healthcare and Social Assistance

- Retail Trade

- Utilities

- Others

On the basis of region, the Market has been segmented as follows:

- North America

- Europe

- UK

- Germany

- France

- Rest of Europe

- Asia Pacific

- China

- Japan

- Australia

- Singapore

- Rest of APAC

- Middle East and Africa

- Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In June 2019, Palo Alto Networks acquired PureSec to improve Prisma offering. PureSec is one of the players in serverless architecture security and supports all the serverless vendors, including AWS Lambda, Google Cloud Functions, Azure Functions, and IBM BlueMix.

- In May 2019, Okta opened its first office in Germany. This would enable the company to expand its footprint in the Europe region to generate more revenues by increasing its customer base in Europe.

- In April 2019, Cyxtera Technologies announced the launch of Risk Orchestrator to enhance the power, scale and reach of its Total Fraud Protection platform.

- In March 2019, Centrify announced the launch of a new cloud-based solution, Centrify Zero Trust Privilege. The platform will enable organizations grant least privilege access based on verifying who is requesting access, the context of the request, and the risk of the access environment.

- In February 2019, Symantec acquired Luminate Security, Software Defined Perimeter and Zero Trust innovator. The acquisition enabled Symantec to extend their portfolio in Integrated Cyber defense.