< Key Hightlight >

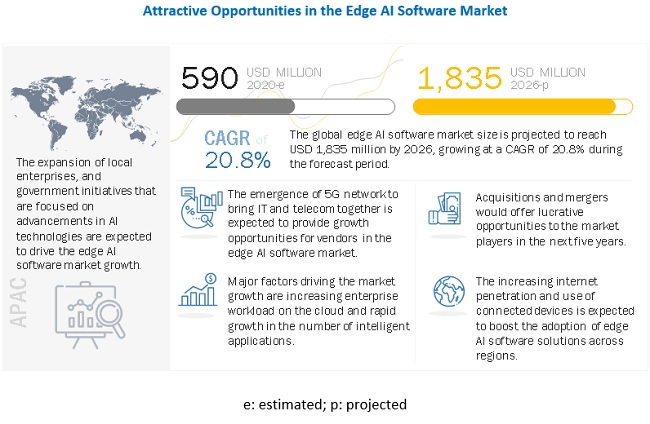

The global edge AI software market size to grow from USD 590 million in 2020 to USD 1,835 million by 2026, at a Compound Annual Growth Rate (CAGR) of 20.8% during the forecast period. Various factors such as increasing enterprise workloads on the cloud and rapid growth in the number of intelligent applications are expected to drive the adoption of the edge AI solutions and services.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on global edge AI software market

As the world braces for the continued impact of the COVID-19 pandemic, every industry has been affected. To mitigate pandemic risks, organizations around the world are taking adequate measures such as remote working capabilities, remote asset maintenance and monitoring, plant automation, and telehealth. A high positive impact has been witnessed in the healthcare vertical, as firms have started realizing the potential of edge AI software in combating the impact of COVID-19. This has led to increased funding and research to keep businesses safe and secure across the value chain. It is expected that the market will witness slow growth during the pandemic and bounce back with a higher adoption rate across verticals post-pandemic. Organizations worldwide have been using digital infrastructure to continue with their usual business activities as it serves as essential infrastructure. Healthcare, the public sector, and education verticals are adopting digitalization at an unprecedented rate. Several clouds and edge companies are offering their computational services for free to the frontline workers to reduce the impact of COVID-19.

Market Dynamics

Driver: Rapid growth in the number of intelligent applications

AI is witnessing significant growth with the emergence of numerous applications in different verticals. These applications require massive computing power for performing activities, such as capturing and processing data in real-time, to provide efficient and actionable results. AI applications, when running on the cloud technology, face latency issues and result in difficulties to offer quick responses. Edge AI software place the computing resources at the edge of the network, hence enabling applications to function with low latency and high bandwidth. Enterprises are increasingly adopting edge AI software, as they support critical AI applications, such as autonomous vehicles and robotics. Moreover, the considerable growth in the use of wearable devices is a potential factor, which is expected to drive the growth of edge AI software, as they need computing on-the-go and cannot depend on distant cloud services. With the proliferation of digital devices, edge AI software is expected to gain significant market traction in the coming years.

Restraint: Privacy and security concerns related to edge AI solutions

Security is a key concern related to edge AI solutions, as these edge nodes would interact with each other and share real-time data. The rise of security breaches, attacks, and Distributed Denial of Service (DDoS) on devices, such as routers, base stations, and switches, are restricting the adoption of edge AI solutions. The data is stored in microdata centers at the edge nodes in case of edge AI solutions, which is vulnerable to cyber-attacks. Edge AI solutions form a distributed network resulting in increased risks of malware and other security attacks. Considering these factors, solution vendors must ensure that data security and privacy are given prime importance..

Opportunity: Emergence of the 5G network to bring IT and telecom together

The dawn of the 5G network is bringing IT and telecommunications together and introducing new possibilities for high-end applications to further reduce the network latency. The 5G network enables to establish data centers at edge modules, as well as implement industry-specific networks aided by virtualization and software-defined networking principles in a single environment. Critical AI applications, such as autonomous vehicles, industry automation, surgery, and robotics, demand for ultra-low latency, i.e., less than a round trip delay of 1 millisecond. These low latency rates can be achieved by installing new hardware in air interfaces and deployment of edge nodes. The emergence of 5G networks across different applications is expected to increase the amount of data transferred to the data centers, thereby increasing the need for intermediary servers or edge networks.

Challenge: Optimization of edge AI standards

There are multiple standardizations and consortium activities related to edge AI. This leads to challenges related to the optimization of edge AI standards and pointing toward a need to build an efficient standardization ecosystem, which supports the needs of users, governments, and industries. Organizations and consortiums related to preparations of edge AI standards can support these standards with open-source testbeds and implementations, such as vertical, horizontal, and specialty standards. In August 2017, Edge Computing Consortium (ECC) signed a Memorandum of Understanding (MoU) with the Industrial Internet Consortium (IIC) to collaborate on standardizations, testbeds, and R&D projects supporting edge capabilities for technologies, such as AI, IoT, and ML.

The video surveillance segment to have largest market size during the forecast period

The edge AI software market by application has been segmented into autonomous vehicles, access management, video surveillance, remote monitoring and predictive maintenance, telemetry, energy management, and others (point of sales, field service support, precision agriculture, AR/VR, and smart wearables). Edge AI can significantly improve surveillance and monitoring while reducing the amount of raw data that’s transmitted to the cloud leading to the adoption of edge AI for video surveillance. With the advent of edge AI, ML intelligent camera systems can capture raw data, process, and analyze it using facial recognition to identify persons of interest and suspicious activities that may be occurring directly at the edge.

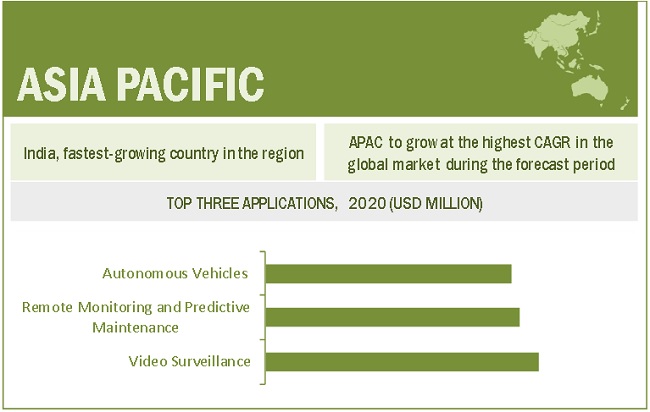

Asia Pacific to grow at the highest CAGR during the forecast period

North America is expected to hold the largest market size in the global edge AI software market. In contrast, Asia Pacific (APAC) is expected to grow at the highest CAGR during the forecast period. The APAC region shows rapid growth owing to various reasons such as the expansion of local enterprises and government initiatives that are focused on advancements in AI technology. The major countries in APAC are technology-driven and offer huge investment and revenue opportunities.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The edge AI software vendors have implemented various types of organic and inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. The major vendors in the global edge AI software market include Alphabet Inc. (US), Microsoft Corporation (US), IBM Corporation (US), Amazon Web Services, Inc. (US), Nutanix (US), Synaptics Incorporated (US), SWIM.AI Inc. (US), Imagimob AB (Sweden), Anagog Ltd. (Israel), TIBCO Software Inc. (US), Octonion SA. (Switzerland), FogHorn Systems (US), Bragi (Germany), Gorilla Technology Group (Taiwan), SixSq Sàrl (Switzerland), Azion Technologies LLC (US), ClearBlade Inc. (US), Alef Edge Inc. (US), Adapdix (US), byteLAKE (Poland), Reality Analytics Inc. (US), Deci (Israel), StrataHive (India), edgeworx (US), Invision AI Inc. (Canada), Veea Inc. (US), and Tact.ai Technologies, Inc. (US), Horizon Robotics (China), Kneron Inc. (US), and DeepBrainz AI (India). The study includes an in-depth competitive analysis of these key players in the Edge AI software market with their company profiles, recent developments, and key market strategies.

Scope of the Report

Report Metric | Details |

Market size available for years | 2014–2026 |

Base year considered | 2019 |

Forecast period | 2020–2026 |

Forecast units | USD Million |

Segments covered | Component, Data Source, Application, Vertical, And Region |

Geographies covered | North America, Europe, APAC, Latin America, and MEA |

Companies covered | Alphabet Inc. (US), Microsoft Corporation (US), IBM Corporation (US), Amazon Web Services, Inc. (US), Nutanix (US), Synaptics Incorporated (US), SWIM.AI Inc. (US), Imagimob AB (Sweden), Anagog Ltd. (Israel), TIBCO Software Inc. (US), Octonion SA. (Switzerland), FogHorn Systems (US), Bragi (Germany), Gorilla Technology Group (Taiwan), SixSq Sàrl (Switzerland), Azion Technologies LLC (US), ClearBlade Inc. (US), Alef Edge Inc. (US), Adapdix (US), byteLAKE (Poland), Reality Analytics Inc. (US), Deci (Israel), StrataHive (India), edgeworx (US), Invision AI Inc. (Canada), Veea Inc. (US), and Tact.ai Technologies, Inc. (US), Horizon Robotics (China), Kneron Inc. (US), and DeepBrainz AI (India) |

This research report categorizes the edge AI software market based on components, data source, applications, vertical, and regions.

By Component:

- Solution

- Services

- Training and Consulting

- System Integration and Testing

- Support and Maintenance

By Data Source:

- Video and Image Recognition

- Speech Recognition

- Biometric Data

- Sensor Data

- Mobile Data

By Application:

- Autonomous Vehicles

- Access Management

- Video Surveillance

- Remote Monitoring And Predictive Maintenance

- Telemetry

- Energy Management

- Others (Point of Sales, Field Service Support, Precision Agriculture, AR/VR, And Smart Wearables)

By Vertical:

- Government and Public

- Manufacturing

- Automotive

- Energy and Utilities

- Telecom

- Healthcare

- Others (Media and Entertainment, Retail and Ecommerce, and Banking, Financial Services and Insurance [BFSI]).

By Region:

- North America

- Europe

- UK

- Germany

- France

- Rest of Europe

- APAC

- China

- Japan

- India

- Rest of APAC

- MEA

- Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In December 2020, Synaptics partnered with Eta Compute and launched Katana Edge AI Platform that combines Synaptics’ proven low-power SoC architecture with energy-efficient AI software.

- In December 2020, Octonion released an expansion package dedicated to AI-based industrial condition monitoring on STMicroelectronics STM32 MCUs.

- In May 2020, IBM announced new services and solutions backed by a broad ecosystem of partners to help enterprises and telecommunications companies boost their transition to edge computing in the 5G era.

- In October 2019, FogHorn Systems announced new features for the Lightning Edge AI platform. The features include tools and enhancements for empowering operations technology (OT) professionals. The new drag-and-drop analytic programming capabilities and rich visualization dashboards enable OT staff to derive insights more quickly from real-time data without the need for assistance from data science teams.

- In September 2019, TIBCO Software announced an enhancement to the TIBCO Connected Intelligence Platform to accelerate TIBCO customers’ time-to-action, enabling them to innovate faster and more sustainably, ultimately turning ideas and investments into business value.

- In May 2019, Microsoft released Azure ML updates. The Azure ML platform enables intelligent applications, such as product recommendations in retail, load forecasting in energy production, image processing in healthcare, and predictive maintenance in manufacturing. The update released by Microsoft enables enterprise-grade model deployment, management, and monitoring to simplify and accelerate the ML life cycle.

- In February 2019, Bragi launched a technology suite for the next generation of the Hearable. The Suite consists of nanoSYSTEMS, nanoOS, and nanoAI. Based on this technology suite, Bragi offers both custom-designed product solutions and ready-to-produce reference designs for hearables.