< Key Hightlight >

The global retail POS market size is projected to grow from USD 15.8 billion in 2020 to USD 34.4 billion by 2026, at a Compound Annual Growth Rate (CAGR) of 13.9% during the forecast period. The major growth drivers for the market include growing interest in non-cash transactions among consumers, increased data visibility through cloud POS systems and enhanced service delivery. However, data security concerns may restrain the market growth.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact Analysis on Retail POS Market

The COVID-19 pandemic has affected every segment of society, including individuals and businesses. The internet ecosystem has been playing a pivotal role all over the globe. Due to the COVID-19 pandemic, the dependency on online businesses has increased significantly. The retail sector is leveraging the internet to provide necessary services to consumers.

Market Dynamics

Driver: Growing interest in non-cash transactions among consumers

Some of the key benefits of going cashless that are attracting more consumers include safety, growth on saved funds in accounts, better money management, and flexibility. The ability to make different types of digital payments through banking cards is enabling consumers to opt for cashless payment modes. Users can store their card information in digital payment apps or mobile wallets to mark cashless payments. With the rising concerns over the safety of handling cash transactions due to the COVID-19 pandemic, merchants, as well as consumers, are relying on contact-less payment modes to avoid the risk of getting infected.

Restraint: Data security concerns

Retail POS systems are prone to security vulnerabilities, such as device faults, skimming, phishing, and software and network weakness. Owing to the unsecured networks, hackers can easily infiltrate the infrastructure and access valuable records, such as business account data and customer credit card details. Even if the network is well-protected, devices need to be secured too. Hence, selecting technology products with inherent security measures is critical when deploying POS devices. With more advanced technologies being deployed and the growing integrations between the enterprise system, there is a significant rise in threats, such as data thefts and cyberattacks.

Opportunity: Growing interest in POS solutions among small businesses

Small businesses are implementing POS systems to benefit from the host of benefits associated with them. Effective POS systems allow business owners to reduce time spent on business/store administration by offering relevant reports to help speed-up decision-making, in a timely fashion. The streamlined POS systems also aid in increasing store profitability through effective inventory management. Solutions also facilitate targeted and personalized marketing campaigns through customer data acquired during sales transactions. As small businesses struggle with managing capital expenses, reports produced from POS data can offer a bird’s eye view of the business operations to determine the efficiency of different departments.

Challenge: High maintenance cost of wireless POS systems

The maintenance cost associated with the wireless POS systems is very high. Fixing the hardware used in POS systems is a difficult task. Despite being able to contact the manufacturer to help the user troubleshoot the problem, it may still require a costly, time-consuming visit from a service provider to fix the problem. Unlike the web-based systems providing free upgrades that keep them updated, the software-based upgrades cost too high. As a part of business expansion, every time an upgrade is necessary, the user has to pay for new licenses and software. The monthly subscription charges associated with these systems may diminish the Return on Investment (RoI) in the long run.

Grocery stores segment to hold the largest market size during the forecast period

Grocery stores have some tough competition and large chain supermarkets use technology to make their jobs easier. A POS system helps manage the grocery stores and makes checkouts quicker. The grocery store software will help better organize the business and meet customer expectations. For instance, National Retail Solutions created the POS+ so that hard-working businesses can have the same opportunities as bigger grocery stores and it offers countless advantages. Independent stores, such as small shops, present at a single location are highly adopting retail POS terminals for providing customers with digital payment services.

To know about the assumptions considered for the study, download the pdf brochure

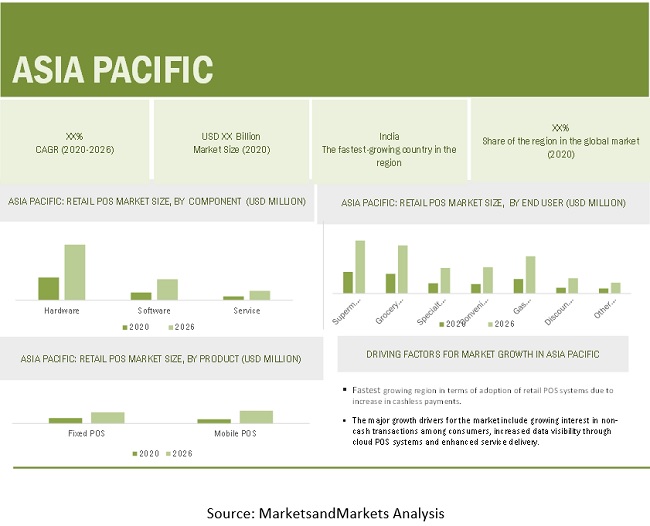

APAC to account for the highest CAGR during the forecast period

APAC countries are increasingly investing in retail POS projects. The retail POS market in APAC has been sub-segmented into China, Japan, India, and the rest of APAC. A rapidly growing customer base, due to the increasing prominence of SMEs, coupled with the reduction in TCO, is expected to drive the retail point of sale market growth in APAC. Benefits associated with retail POS systems, such as low queue time, high degree of security, paper-free receipt option, decrease in check-out space requirement, and increase in floor space, would help fuel the growth of the retail POS market in APAC. The booming retail sector and emerging infrastructures in the region would further facilitate the growth of the retail point of sale market in APAC. The major growth drivers for the market include growing interest in non-cash transactions among consumers, increased data visibility through cloud POS systems and enhanced service delivery. However, data security concerns may restrain the market growth.

This research study outlines the market potential, market dynamics, and key and innovative vendors in the retail POS market include Diebold Nixdorf (US), Ingenico (France), Intuit (US), NCR Corporation (US), SAP (Germany), Verifone (US), PAX Technology (Hong Kong), Square (US), Shopify (Canada), NEC Corporation (Japan), Toshiba Tec Corporation (Japan), Epicor (US), Lightspeed (Canada), Clover (US), Elavon (US), Castels Technology (Taiwan), Newland Payment Technology (China), New POS Technology (China), HP (US), Cegid Grou (France), Posiflex Technology (Taiwan), Centerm (China), Revel System (US), Vend (New Zealand), Zebra Technologies (US).

The study includes an in-depth competitive analysis of these key players in the retail POS market with their company profiles, recent developments, and key market strategies.

Scope of the Report

Report Metric | Details |

Market size available for years | 2014–2026 |

Base year considered | 2019 |

Forecast period | 2020–2026 |

Forecast units | Value (USD) |

Segments covered | Product (Fixed and Mobile), Component (Hardware, Software, and Services), End User (supermarkets/hypermarkets, grocery stores, specialty stores, convenience stores, gas stations, discount stores, and other end users), and Region |

Geographies covered | North America, Europe, APAC, MEA, and Latin America |

Companies covered | Diebold Nixdorf (US), Ingenico (France), Intuit (US), NCR Corporation (US), SAP (Germany), Verifone (US), PAX Technology (Hong Kong), Square (US), Shopify (Canada), NEC Corporation (Japan), Toshiba Tec Corporation (Japan), Epicor (US), Lightspeed (Canada), Clover (US), Elavon (US), Castels Technology (Taiwan), Newland Payment Technology (China), New POS Technology (China), HP (US), Cegid Grou (France), Posiflex Technology (Taiwan), Centerm (China), Revel System (US), Vend (New Zealand), Zebra Technologies (US). |

This research report categorizes the Retail POS market to forecast revenues and analyze trends in each of the following subsegments:

Based on Product:

Based on Component:

Based on End User:

- Supermarkets/Hypermarkets

- Grocery Stores

- Specialty Stores

- Convenience Stores

- Gas Stations

- Discount Stores

- Other End Users

- Others (Department Stores and Miscellaneous Retailers)

Based on Region:

- North America

- Europe

- United Kingdom (UK)

- Germany

- France

- Rest of Europe

- APAC

- China

- Japan

- India

- South Korea

- Rest of APAC

- MEA

- Kingdom of Saudi Arabia

- South Africa

- Rest of MEA

- Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In January 2021, NCR is looking to acquire Cardtronics. The acquisition of Cardtronics will accelerate and expand the NCR-as-a-service strategy.

- In December 2020, Intuit acquired Credit Karma, the consumer technology platform with more than 110 million members in the US, Canada, and the UK.

- In November 2020, SAP acquired Emarsys, one of the leading omnichannel customer engagement platform providers.

- In September 2020, Diebold Nixdorf partnered with Co-op Group to include managed services and remote monitoring of self-service and POS systems throughout the UK. This comprehensive offering optimizes members' shopping journeys by speeding up consumer checkout and enhances the company's operational efficiency.

- In November 2019, Ingenico partnered with FinTech Pundi X to enable crypto transactions around the world. Pundi X completed the integration of its XPOS software with the Point-Of-Sale (POS) APOS A8 devices of Ingenico.