< Key Hightlight >

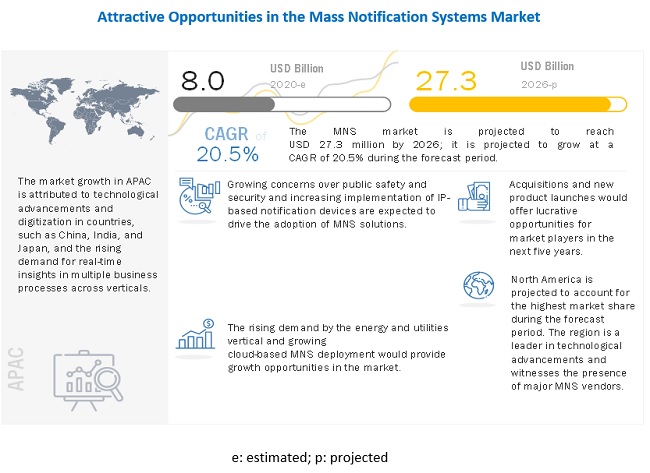

The global Mass Notification Systems market size is expected to grow from USD 8.0 billion in 2020 to USD 27.3 billion by 2026, at a Compound Annual Growth Rate (CAGR) of 20.5% during the forecast period. High Adoption of MNS across hospitals and medical facilities, and increasing implementation of IP-based notification devices is also expected to drive the market growth. However, inadequate rules and regulations across vertical is one of the factors hindering the industry growth.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on the global MNS market

MNS solutions offer the ability to designate different groups so companies can reach the right people with the right message quickly. Organizations can create a group for different shifts so if someone tests positive for COVID-19, they can alert people who may have been working the same shift. This helps alert people about potential exposure, without causing panic with those who were not working at the time. This functionality can also extend to creating groups and zones for particular areas. If only one building or floor was exposed, it might only be necessary to alert people who were in the same area.

Moreover, being able to reach people via on-premises and mobile devices with health and safety information and new procedures due to the pandemic, helps minimize confusion and disruptions. Therefore, many organizations are utilizing MNS to share critical information with people in a timely manner. As local regulations change, the versatility of mass notifications can expand beyond simple alerting to help notify about events that impact their wellbeing. In this blog post, we’ll outline three practical use cases for mass notification during the COVID-19 pandemic.

Market Dynamics

Driver: Increasing implementation of IP-based notification devices

Digitalization has encouraged MNS providers to offer safety and security solutions through IP-enabled devices. There has been a rapid implementation and integration of mass notification solutions through IP-based notification appliances among diverse businesses, such as education and healthcare. IP-based notification devices utilize the existing IP network to deliver targeted and personalized alerts to personnel or masses via Personal Computers (PCs), mobile devices, telephones, giant voice, and public address systems, or any IP-enabled devices. These IP-based notification devices are managed through a single web-based unified console, which enables the operator to effectively trigger, manage, track, and control notification processes across various communication channels. Moreover, personnel accountability can be seamlessly ensured through IP-based notification devices since IP-based end-user devices can pinpoint the exact location of the personnel, thereby enabling faster relief and rescue operations.

Restraint: Stringent privacy regulations pertaining to access to individual data

Post the Virginia Tech Shootout in 2007, there has been a spike in varsity campus authorities adopting MNS for alerts in the event of emergency situations. Most of the mass notification vendors track personnel, students, or employees through their IP-based devices, and disclosure of the same to government officials or enterprise bosses might become a matter of concern for end users. To maintain privacy and reduce the amount of spam messages, various campus students are unwilling to share their cell numbers in their respective colleges. Moreover, sharing of details of students with campus law enforcement agencies is a typically observed problem. Privacy infringement is one of the major reasons hindering end users from using IP-based mass notification solutions, especially in the US and European countries, where privacy regulations pertaining to access individual data are significantly strict.

Opportunity: Extensive demand in the energy and utilities vertical

Natural disasters can result in significant losses in terms of life and monetary value in businesses, specifically in the energy and utilities vertical. Natural calamities, such as earthquakes, tsunamis, tornados, and industrial accidents, including rig fires, can result in enormous losses, both in terms of lives and money. Thus, the demand for the deployment of MNS in the energy and utilities vertical is significantly high, attributing to factors such as the need for safety of physical installations and personnel along with ease in backup management and disaster recovery. As MNS plays an essential role in protecting power plants, dams, reservoirs, refineries, and other physical assets from acts of vandalism, terrorism, or sabotage, their safety and security are extremely necessary as the investment incurred is high. The demand for MNS in the energy and utilities vertical is increasing because of the rising need for propagating alerts for emergency events, power outages, or other business operations, such as payment reminders or customer complaints, about which the consumers or personnel must be notified on a priority basis. The use of MNS is increasing for power outage notifications, such as storm warnings, planned outages, rolling blackouts, or restoration updates.

Challenge: Addressing a rise in the number of cyberattacks through mass notification messages

Cyberattacks have become complex and are expected to rise even further in the coming years. In recent years, the financial impact of cybercrimes has increased by nearly 78%, and the time taken to fix these cyberattacks has more than doubled. Furthermore, with the rapid spread of the COVID-19 virus across the world, the frequency of cyberattacks has increased with greater risk to enterprises’ business-critical data and financial assets. Business Email Compromise (BEC) scams are becoming more frequent wherein the threat actors hack the MNS and circulate fraudulent emails to the masses, and trick them into transferring sensitive data or funds. With the presence of a global pandemic, many threat actors seek the opportunity to send phishing and BEC emails that are disguised as government emails or emails with logos of Center for Disease Control (CDC) and World Health Organization (WHO) with links to malicious sites designed to steal email credentials. Some malicious attackers also target text messages asking the end-users to click on fraudulent links, by doing so, the actors are able to steal credentials to infiltrate an organization’s network and gain access to critical information, clone smartphones, and compromise payment systems. Although, MNS is an effective tool to address communication challenges during emergencies, it can easily become a carrier of false advice and cures for life-threatening diseases such as the COVID-19 pandemic. Cyberattacks targeted toward healthcare operational functions asking recipients to respond with personal data could result in theft of such personal data of patients and paramedic staff. Growing digitization, decentralization of security systems, connected networks, and interconnected devices have opened new attack vectors for hackers to steal real-time data. Addressing these rising number of cyberattacks through mass notification channels is expected to remain a challenge in the coming years.

The business continuity and management application area is expected to grow at the fastest CAGR rate during the forecast period

Businesses across the world experience unexpected events that can hamper normal business operations and these events can occur at any given time. Business continuity and management teams of SMEs or large enterprises depend on an efficient MNS solution that is implemented on-premises or in the enterprise cloud to help conduct business operations as usual. MNS solutions help incident response teams within an organization to report to, in case of any potential crisis and communicate and notify employees and higher management with necessary guidelines that need to be followed to address the crisis. Real-time notifications help businesses to continue their business operations until the disruptions are eliminated. Sending alerts with the help of MNS in the initial stage of any business interruption becomes critical for the business to prevent loss of life and business-critical resources. Various internal departments within an enterprises such as IT, facility management, HR teams, payroll teams as well as security teams utilize MNS solutions to broadcast messages to the right recipients at the right time, further helping the business and its management to continue its operations.

By component type, the solution segment is expected to hold the largest share during the forecast period

MNS solutions for industrial avenues and manufacturing plants are usually deployed on-premises. The on-premises deployment mode is generally used for alerting individual employees, updating contact information, and securing personal data and devices, such as computers, laptops, and smartphones. The on-premises deployment mode refers to the installation of systems in the premises of an organization. The organization is responsible for maintaining the solution and all its related processes. These solutions are delivered on a one-time license fee and an annual service agreement, which includes free upgradation and installation of new functionalities. On-premises deployment is the most trustworthy deployment mode for MNS applications, owing to the security offered by the deployment mode for critical data and operations. Moreover, operations management on-premises infrastructure reduces the turnaround and response time significantly, in case of emergencies.

The on-premises segment is estimated to account for a larger market size during the forecast period

MNS solutions for industrial avenues and manufacturing plants are usually deployed on-premises. The on-premises deployment mode is generally used for alerting individual employees, updating contact information, and securing personal data and devices, such as computers, laptops, and smartphones. The on-premises deployment mode refers to the installation of systems in the premises of an organization. The organization is responsible for maintaining the solution and all its related processes. These solutions are delivered on a one-time license fee and an annual service agreement, which includes free upgradation and installation of new functionalities. On-premises deployment is the most trustworthy deployment mode for MNS applications, owing to the security offered by the deployment mode for critical data and operations. Moreover, operations management on-premises infrastructure reduces the turnaround and response time significantly, in case of emergencies.

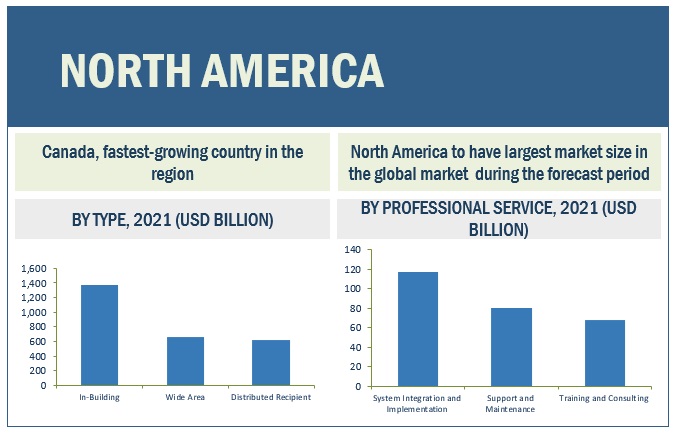

North America is expected to account for the largest market size during the forecast period

North America is expected to hold the largest market size and dominate the MNS market from 2020 to 2026. MNS can ensure optimum resource utilization during emergency situations. They minimize the loss of life and property. In April 2006, the Virginia Tech shooting had critical legal aftermath, and the jury found the university guilty of negligence for delaying campus warning about shootouts. Prior information about the shootout could have saved many lives. The Clery Act outlines a clear need for MNS in schools and varsities to reduce shootouts and violence rates. The major growth drivers of North America are an increase in the use of smartphones, tablets, notebooks, and PCs at work. North America, especially the US, has the highest percentage of employees using mobile devices at work. This has led to significant penetration of MNS services in the region.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The MNS platform vendors have implemented various types of organic as well as inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions, to strengthen their offerings in the market. The major vendors offering MNS solutions are IBM (US), Google (US), Motorola Solutions (US), BlackBerry (US), Eaton (Ireland), Honeywell (US), Siemens (Germany), Everbridge (US), Blackboard (US), Desktop Alert (US), OnSolve (US), Singlewire Software (US), xMatters (US), Regroup Mass Notification (US), Alertus (US), Johnson Controls (US), Federal Signal Corporation (US), Rave Mobile Safety (US), and AlertFind (US), ATI Systems (US), CrisisGo (US), Omnilert (US), Catalyst Technologies (Australia), Omnigo (US), and Klaxon (UK).

Scope of the report

Report Metric | Details |

Market Size Available for years | 2016-2026 |

Base year considered | 2019 |

Forecast Period | 2020-2026 |

Forecast units | Value (USD Billion) |

Segments covered | Application, Component, Organization Size, Deployment Mode, Vertical, and Region |

Geographies covered | North America, APAC, Europe, MEA and Latin America |

Companies covered | The major market players include IBM (US), Google (US), Motorola Solutions (US), BlackBerry (US), Eaton (Ireland), Honeywell (US), Siemens (Germany), Everbridge (US), Blackboard (US), Desktop Alert (US), OnSolve (US), Singlewire Software (US), xMatters (US), Regroup Mass Notification (US), Alertus (US), Johnson Controls (US), Federal Signal Corporation (US), Rave Mobile Safety (US), and AlertFind (US), ATI Systems (US), CrisisGo (US), Omnilert (US), Catalyst Technologies (Australia), Omnigo (US), and Klaxon (UK) (Total 25 companies) |

The study categorizes the MNS market based on application, component, organization size, deployment mode, vertical, at the regional and global level.

On the basis of component, the MNS market has been segmented as follows:

- Solutions

- In-building solutions

- wide area solutions

- distributed recipient solutions

- Services

- Professional Services

- Managed Services

On the basis of application, the MNS market has been segmented as follows:

- Emergency Response

- Business Continuity And Management

- Public Warnings And Alerting

On the basis of organization size, the MNS market has been segmented as follows:

- Large Enterprises

- Small and Medium-Sized Enterprises

On the basis of deployment modes, the MNS market has been segmented as follows:

On the basis of verticals, the MNS market has been segmented as follows:

- Education

- Energy and Utilities

- Government

- Healthcare and Life Sciences

- It And Telecom

- Media and Entertainment

- Transportation and Logistics

- Other Verticals

On the basis of regions, the MNS market has been segmented as follows:

- North America

- Europe

- Germany

- UK

- France

- Rest of Europe

- APAC

- Japan

- South Korea

- China

- India

- Rest of APAC

- MEA

- Middle East

- Africa

- Rest of MEA

- Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In June 2020, IBM launched Watson Works to address the challenges of returning to the workplace. Watson Works is a curated set of products that embed Watson AI models and applications to help companies navigate many aspects of the return-to-workplace challenge following lockdowns put in place to slow the spread of COVID-19.

- In January 2019, Motorola Solutions acquired VaaS International Holdings, a Video analysis-as-a-Service (VaaS) company, which is a provider of data and image analytics for vehicle location for a purchase price of USD 445 million.

- In May 2019, Eaton introduced Trellix, an advanced connected lighting platform designed to drive efficient, effective decision making for building operations.

- In July 2019, Honeywell launched a new software, Honeywell Forge Inspection Rounds, to help field workers of the oil and gas, mining, and aerospace industries to digitize equipment inspection programs..

- In December 2019, Siemens introduced the updated Desigo CC platform to manage all building sizes. With the product portfolio extension, Desigo CC Compact, provides precise scalability and flexibility in usage also for small and medium-sized buildings.