< Key Hightlight >

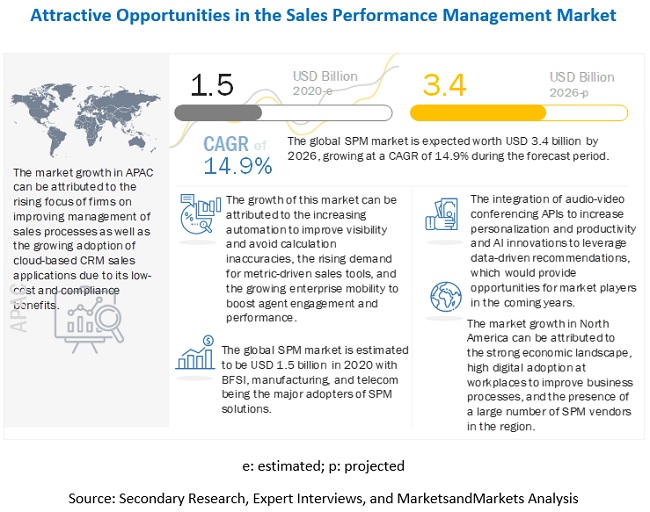

The global Sales Performance Management (SPM) market size is projected to grow from USD 1.5 billion in 2020 to USD 3.4 billion by 2026, at a Compound Annual Growth Rate (CAGR) of 14.9% during the forecast period. The demand for SPM is driven by growing automation to improve visibility and avoid incentive compensation calculation inaccuracies, rising demand for metric-driven sales tools, and increasing enterprise mobility to increase agent engagement and performance.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID -19 Impact on Sales Performance Management Market

With the ongoing work from home scenario, global lockdowns, and economic uncertainties caused by COVID-19, the transition to the cloud has increased and companies have started transitioning to cloud environments for optimizing planning and management of incentives, quotas, and territories as well for enhancing the performance of sales representatives due to cloud technology’s cost-effectiveness and flexibility advantages , which has further bolstered the growth of the market. Although declined usage by Small and Medium-sized Enterprises (SMEs) due to their increased investments in other collaboration technologies, falling profits, and less allocation of Information Technology (IT) budgets has somewhat hindered the growth of the SPM market.

Market Dynamics

Driver: Growing automation to improve visibility and avoid calculation inaccuracies

Sales departments are under constant pressure for automating compensation and reward plans, performance appraisals, sale quotas, and territory mapping with the ongoing digitalization and automation across workplaces. According to the 2019 Sales Compensation Administration Best Practices Study by Xactly, 83% surveyed companies were still facing payment inaccuracies at an average rate of higher than five percent. In such cases, the deployment of SPM solutions provides quick and accurate view of the entire SPM processes to both representatives and supervisors as well as helps them proactively eliminate variable pay anomalies and increase productivity. For instance, Cox Automotive achieved 99% commission pay-out accuracy rate through the adoption of a renowned ICM solution.

The need to gain holistic visibility into performance has further driven companies and sales departments to adopt SPM solutions. According to State of Sales Performance Survey Report 2019 by Ambition, 31.6% surveyed respondents feel gaining visibility into numbers drives them the most to sell. These advantages thereby compel organizations to deploy SPM solutions for increased productivity and improved processes.

Restraint: Skepticism among small and medium-sized enterprises to avoid additional costs or altering of organizational structure

As it requires a lot of administrative work, time, and patience. The deployment of SPM solutions also involves conducting extensive training, retraining, and career development workshops for different employee levels, which turns out to be a time consuming and costly process. Furthermore, the time taken for the implementation and training of users, which consumes over a year is a big deal for SMEs who want a quick deployment and faster results at a cost-effective price. Owing to such hassles and upfront costs, several SMEs refrain from deploying SPM solutions that may require them to change the way they work.

As per Wisdom of Crowds SPM Study 2020, two-thirds of surveyed respondents considered SPM solutions minimally important. Moreover, 27.5% of respondents did not have any plan to deploy SPM solutions in 2020, which means despite numerous advantages, the presence of substitutes for SPM solutions and hassles involved in deployment are expected to restrain the market growth.

Opportunity: Integration of audio-video conferencing application programming interfaces to increase personalization and productivity

SPM has evolved a lot since its inception. With such ongoing advancements in the SPM market, several SPM providers have also increased their investments in audio-video conferencing tools or Application Programming Interfaces (APIs) to enable customer-agent engagements and collect live interactions for identifying opportunities and driving decisions. For instance, in September 2020, Oracle integrated Zoom with its Oracle Fusion Cloud Customer Experience (CX) offering to enable sales and other teams to include video into its existing processes. Similarly, in April 2020, NICE, another renowned SPM solution provider, integrated its platform with Zoom as well as RingCentral to provide integrated solutions for enabling remote employee collaboration and distributed virtual contact centers.

The integration of audio-video conferencing APIs help SPM providers offers SPM solutions that do more than just basic SPM while providing a high level of personalization and increased productivity with one-click video or audio meetings. Such growing inclination of renowned SPM solution providers toward integrating audio-video conferencing APIs in their solutions opens green-field opportunities to other SPM providers aiming to strengthen their foothold in the SPM market.

Challenge: Prevailing apprehensions related to levels of intrusion

Although SPM solutions provide a high level of autonomy for the management of key sales processes, the hindrance from employees in terms of the adoption of new technologies is somewhat a challenge for organizations planning to deploy SPM solutions. This is mainly because employees think that continuous monitoring would cause a high level of intrusion and that their privacy will be invaded. Such prevailing apprehensions not only cause high attrition but also decline the sales productivity in terms of employee effectiveness. With the growing availability of SPM Return on Investment (RoI) reports and the increasing awareness related to the benefits of SPM solutions, companies are training and educating their employees related to the benefits of SPM solutions that involve improved visibility into reward, commission, and compensation plans; gamification features; and faster pay-out processes. By introducing such support strategies for deploying SPM solutions and helping employees understand their benefit, the hindrance in the adoption of SPM solutions by employees is ephemeral.

On-premises segment to hold the largest market size during the forecast period

The growth of on-premises segment is mainly attributed to high demand for customizing solutions as per business requirements, especially among large enterprises and companies having data security and privacy concerns. On-premises deployment model is mostly preferred by large organizations with diverse data and design requirements and sufficient sales personnel.

Banking, Financial Services, and Insurance (BFSI) to hold the largest market share among verticals during the forecast period

As BFSI companies deal with diverse insurance and banking products, such as debit cards, credit cards, loans, and insurance policies that involve employment of large number of sales representatives, the demand to manage complex incentive compensation calculations and offer representatives with holistic visibility into entire SPM processes has compelled BFSI companies to aggressively adopt SPM solutions.

To know about the assumptions considered for the study, download the pdf brochure

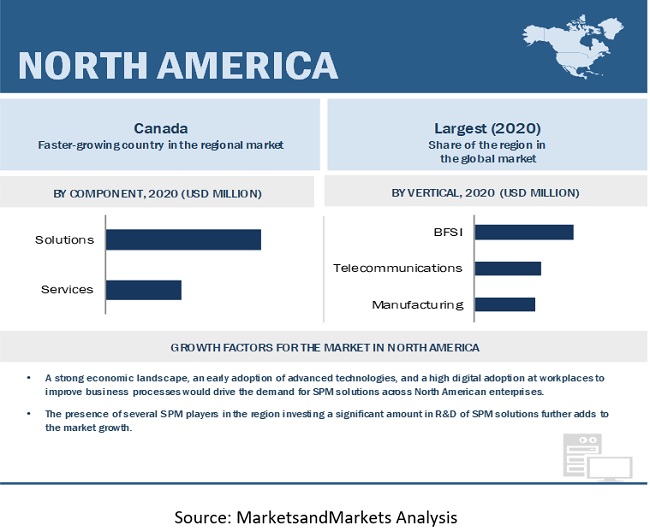

North America to hold the largest market size during the forecast period

The North American SPM market is already mature for SPM solutions, owing to North America’s strong economic landscape, early adoption of advanced technologies, high digital adoption at workplaces to improve business processes, and high technology awareness. Furthermore, the region constitutes developed economies, such as the US and Canada, which have fairly adopted SPM solutions, besides incorporating advanced technologies. The region is also home to several small as well as well-established SPM solution providers, such as SAP, Anaplan, Oracle, Xactly, and Varicent, which are among the key driving factors for the growth of the SPM market in the region.

Market Players:

Market players profiled in this report include SAP (Germany), Oracle (US), Xactly (US), Anaplan (US), NICE (Israel), Varicent (Canada), beqom (Switzerland), Performio (US), Incentives Solutions (Israel), Optymyze (UK), Salesforce (US), Iconixx (US), Axtria (US), Gryphon Networks (US), CellarStone (US), ZS (US), Board (Switzerland), Zoho (India), InnoVyne (Canada), and XANT (US) among others. These players offer various SPM solutions to cater to the demands and needs of the market. Major growth strategies adopted by the players include product enhancements and partnerships.

Scope of the Report

Report Metric | Details |

Market size available for years | 2016–2026 |

Base year considered | 2019 |

Forecast period | 2020–2026 |

Forecast units | USD Million |

Segments covered | Component, Organization Size, Deployment Type, Vertical, and Region |

Geographies covered | North America, Europe, APAC, MEA, and Latin America |

Companies covered | SAP (Germany), Oracle (US), Xactly (US), Anaplan (US), NICE (Israel), Varicent (Canada), beqom (Switzerland), Performio (US), Incentives Solutions (Israel), Optymyze (UK), Salesforce (US), Iconixx (US), Axtria (US), Gryphon Networks (US), CellarStone (US), ZS (US), Board (Switzerland), Zoho (India), SalesScreen (Norway), Ascent Cloud (US), Adventace (US), Plecto (Denmark), Spotio (US), Ambition (US), Spinify (Canada), Apttus (US), Centrical (US), Reflektive (US), InnoVyne (Canada), and XANT (US) |

The research report categorizes the SPM market to forecast revenues and analyze trends in each of the following submarkets:

By component:

- Solutions

- Incentive Compensation Management (ICM)

- Territory Management

- Sales Planning and Monitoring

- Sales Performance Analytics and Reporting

- Other Solutions (Sales Coaching and Gamification)

- Services

- Consulting

- Integration and Implementation

- Training and Education

- Support and Maintenance

By organization size:

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

By deployment type:

By vertical:

- BFSI

- Telecommunications

- Manufacturing

- IT and ITeS

- Consumer Goods and Retail

- Healthcare and Pharmaceuticals

- Energy and Utilities

- Travel and Hospitality

- Others (Education, Real Estate and Construction, and Media and Entertainment)

By region:

- North America

- Europe

- APAC

- MEA

- Kingdom of Saudi Arabia (KSA)

- Rest of MEA

- Latin America

- Brazil

- Rest of Latin America

Recent Developments

- In December 2020, Oracle enhanced the Territory Management and Incentive Compensation components of its Oracle Sales Performance Management Cloud with new and improved features in its 21 A update. The enhancement was a part of Oracle’s quarterly SPM update strategy.

- In November 2020, Xactly launched a new offering, Operational Sales Management (OSM), to expand its SPM portfolio. The new solution connects and integrates processes related to salespeople, territories, quotas, and credits. The launch is set to strengthen Xactly’s foothold in the SPM market.

- In November 2020, Varicent launched mobile apps to provide reporting options similar to the reporting capabilities in the Varicent platform. Accessible via Apple’s App Store and Android marketplaces, the mobile apps provide sellers with advanced analytics and motivational tools on the go. The launch has helped Varicent further strengthen its foothold in the SPM market.

- In October 2020, NICE inContact, a NICE business, announced the fall release of NICE inContact CXone with features, including new auto-discovery of trends across digital and voice interactions, new Business Intelligence (BI) for deeper operational visibility, enhanced remote workforce agility and agent engagement, and new real-time customer authentication for better customer and agent interactions.

- In October 2020, beqom released a new version of its mobile app and Individual Pay Estimator that now gives employees the ability to see their performance and variable compensation pay-outs with better and flexible KPIs.