< Key Hightlight >

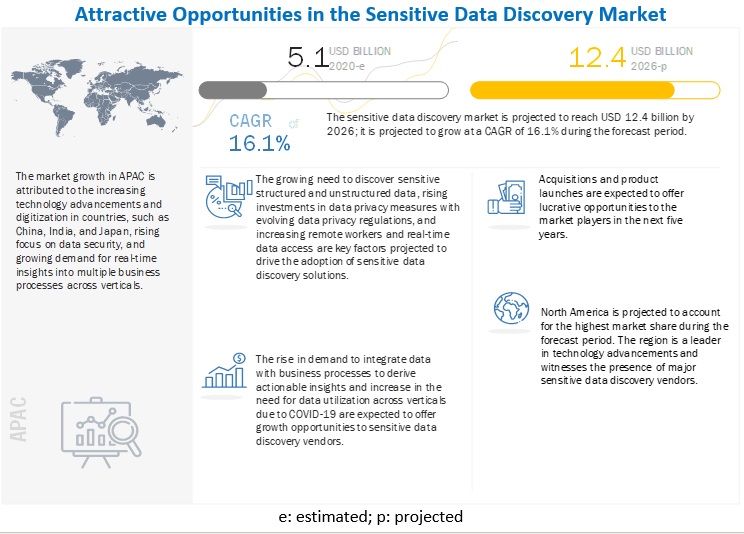

The global sensitive data discovery market size to grow from USD 5.1 billion in 2020 to USD 12.4 billion by 2026, at a Compound Annual Growth Rate (CAGR) of 16.1% during the forecast period. Various factors such as the growing need to discover sensitive structured and unstructured data, increasing investments in data privacy with evolving regulations such as General Data Protection Regulation (GDPR) and California Consumer Privacy Act (CCPA) to protect sensitive data, and rise in remote workers and real-time data access are expected to drive the adoption of the sensitive data discovery solutions and services.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on Global Sensitive Data Discovery Market

Businesses providing sensitive data discovery solutions and services are expected to witness a minor decline in their growth for a short span of time. However, the focus on vaccine development, adoption work from home initiatives, and eHealth are leading to explosion of structured and unstructured data, which needs to be discovered and managed efficiently to derive insights. The market would witness a minimal slowdown in 2020, followed by positive growth during the forecast period. The global spread of COVID-19 has led numerous privacy, data protection, security and compliance questions. These challenges are driving the need for companies and organizations to ensure their sensitive data discovery solutions not only secure, but also support data analysis for strategic business decisions.

Market Dynamics

Driver: Increasing investments in data privacy measures with the evolving data privacy regulations

With the implementation of General Data Protection Regulation (GDPR), the US has started implementing its privacy legislation. California was among the first, with California Consumer Privacy Act (CCPA) implemented on January 1, 2020. Texas has also implemented privacy legislation, known as Texas Identity Theft Enforcement and Protection Act, which was introduced in 2020, while Nevada's legislation, Senate Bill 220, was introduced before the CCPA on October 1, 2019. With new privacy laws implemented in the US and worldwide and changes being made to the existing legislation, businesses are facing an uphill battle when it comes to staying on the top of ever-changing data privacy. In North America, legislators are focusing on introducing regulations that align with advancements in data privacy (e.g., GDPR in the EU). The number of legislation introduced at both state and federal levels has increased. CCPA regulation raises the bar for companies to disclose personal information they collect, the information that is used. It also enables customers to not share their personal information. Other states in the US have drafted similar laws, and at the federal level, there is a significant activity with several new laws being proposed. Financial institutions collect and maintain large amounts of information related to their clients, prospects, and employees. Given numerous ways that financial institutions are using (and plan to use) personal information, and considering the evolution of regulations in this space. Industry experts believe that the ICT industry needs to be proactive and preemptive in managing data privacy risks.

Restraint Lack of skilled professional workforce

Significant technology advancements have taken place in the Information and Communications Technology (ICT) domain. Internet of Things (IoT), Artificial Intelligence (AI), Machine Learning (ML), cloud, analytics, and sensitive data discovery are a few trends that have gained tremendous traction in the past few years. Sensitive data discovery is transforming businesses by providing actionable insights. However, companies do face issues while extracting these insights. Data across organizations grows constantly, and organizations often fail to capitalize on opportunities and extract actionable data. Organizations also fail to identify where they need to allocate their resources, which results in not deriving the full potential of sensitive data discovery. Most organizations still cannot harness the complete benefits of sensitive data discovery tools in cloud due to the lack of awareness and professional expertise to optimally utilize cloud-based sensitive data discovery solutions.

Opportunity: Rise in demand to integrate data with business processes to derive actionable insights

In today’s digital and big data era, data can be structured or unstructured, and most of it resides outside enterprises. Thus, it has become crucial to have a platform that can be used to integrate various information, perform a lot of discovery-based analysis (to separate noise from real signals), perform analytics on top of it, and finally consume it through an intuitive visualization interface. This avenue is now being explored in the form of a sensitive data discovery platform in many enterprises. The increasing volume of digital information is providing meaningful insights for businesses such as customer trends, shifts in consumer behaviors, the outbreak of epidemics, changing weather patterns, and the rise in crime rate. These data, when managed well, can provide an opportunity to unlock new business avenues and solutions for better governance among business houses and governments. Currently, enterprises need a comprehensive sensitive data discovery platform that can process huge volumes of data in real time to provide meaningful insights. This sensitive data discovery or decision-making platform can assimilate data, structure, refine, provide the exploratory capability, identify and evaluate various patterns, and help make insight-based decisions faster.

Challenge: Data security and privacy concerns

Security threats are projected to grow even further in the future. In the past four years, the financial impact of cybercrimes has increased by nearly 78%, and the time it takes to resolve cyberattacks has doubled. The increase in data from various sources is cumbersome for several IT teams. The inefficiency of managing exabytes and petabytes of data has increased chances of security breaches and data losses. It may seem as if sensitive data discovery is a threat to data privacy. However, the actual threat is poorly managed data. The sensitive data discovery comes with three privacy risks: data breaches, data brokerage, and data discrimination. Data breaches occur when information is retrieved without consent. In most cases, data breaches are the result of out-of-date software, weak passwords, and targeted malware attacks. These incidents can lead to a damaged reputation and financial loss for organizations. The data breaches can be prevented by keeping software up-to-date, changing passwords, and educating employees on best security practices.

Among verticals, the healthcare and life sciences segment to grow at a the highest CAGR during the forecast period

The sensitive data discovery market is segmented based on verticals into BFSI, government, healthcare and life sciences, retail, manufacturing, telecommunications and IT, and other verticals (education, and travel and hospitality). The BFSI vertical is expected to account for the largest market size during the forecast period. Moreover, the healthcare and life sciences vertical is expected to grow at the highest CAGR during the forecast period. During the COVID-19 pandemic, healthcare researchers and hospitals are dealing with enormous data, which has created a massive need for efficient sensitive data discovery and management. Sensitive data discovery enables healthcare companies to locative sensitive data such as Protected Health Information (PHI) that were traditionally impossible to handle.

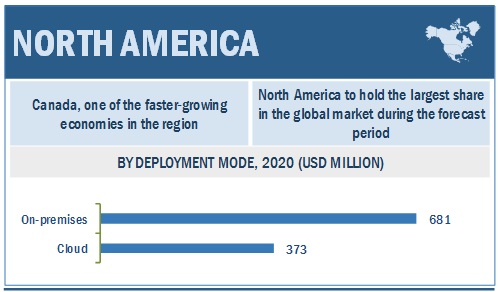

The on-premises segments is expected to hold the larger market size during the forecast period

The sensitive data discovery market by deployment mode has been segmented into on-premises and cloud. Cloud is further segmented by type in public cloud, private cloud, and hybrid cloud. The cloud segment is expected to grow at a rapid pace during the forecast period. The high CAGR of the cloud segment can be attributed to the availability of easy deployment options and minimal requirements of capital and time. These factors are supporting the current lockdown scenario of COVID-19 as social distancing and lack of workforce hit the industry, and are expected to drive the adoption of cloud-based sensitive data discovery solutions. Highly secure data encryption and complete data visibility and control feature are responsible for the higher adoption of on-premises-based sensitive data discovery solutions.

North America to hold the largest market size during the forecast period

North America is expected to hold the largest market size in the global sensitive data discovery market, while Asia Pacific (APAC) is expected to grow at the highest CAGR during the forecast period. The growing awareness for data security and privacy among organizations in key countries, such as China, India, and Japan, is expected to fuel the adoption of sensitive data discovery solutions and services. The commercialization of the Artificial Intelligence (AI) and Machine Learning (ML) technology, giving rise to increased data generation, and the need for further advancements to leverage its benefits to the maximum are expected to drive the adoption of sensitive data discovery solutions in the region.

Key Market Players

The sensitive data discovery vendors have implemented various types of organic as well as inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. The major vendors in the global sensitive data discovery market include IBM (US),Microsoft (US),Oracle (US), AWS (US), Proofpoint (US), Google (US), SolarWinds (US), Micro Focus (UK), PKWARE (US), Thales (France), Spirion (US), Egnyte (US), Netwrix (US), Varonis (US), Digital Guardian (US), Solix (US), Immuta (US), MENTIS (US), Ground Labs (US), Hitachi (Japan), Nightfall (US), Securiti (US), DataGrail (US), Dathena (Singapore), BigID (US), DataSunrise (US), and 1touch.io (US). The study includes an in-depth competitive analysis of these key players in the sensitive data discovery market with their company profiles, recent developments, and key market strategies.

Scope of the Report

Report Metric | Details |

Market size available for years | 2014–2026 |

Base year considered | 2019 |

Forecast period | 2020–2026 |

Forecast units | USD Million |

Segments covered | Component, organization size, deployment mode, application, vertical, and region |

Geographies covered | North America, Europe, APAC, Latin America, and MEA |

Companies covered | IBM (US),Microsoft (US),Oracle (US), AWS (US), Proofpoint (US), Google (US), Micro Focus (UK), SolarWinds (US), PKWARE (US), Thales (France), Spirion (US), Egnyte (US), Netwrix (US), Varonis (US), Digital Guardian (US), Solix (US), Immuta (US), MENTIS (US), Ground Labs (US), Hitachi (Japan), Nightfall (US), Securiti (US), DataGrail (US), Dathena (Singapore), BigID (US), 1touch.io (US), and DataSunrise (US) |

This research report categorizes the sensitive data discovery market based on components, deployment mode, organization size, application, vertical, and region.

By component:

- Solutions

- Services

- Managed Services

- Professional Services

- Support and Maintenance

- Deployment and Integration

- Consulting

By organization size:

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

By deployment mode:

- On-premises

- Cloud

- Public Cloud

- Private Cloud

- Hybrid Cloud

By application:

- Security and Risk Management

- Compliance Management

- Asset Management

- Other Applications (Network Management and Access Management)

By vertical:

- BFSI

- Government

- Healthcare and Life Sciences

- Retail

- Manufacturing

- Telecommunications and IT

- Other Verticals (Education, and Travel and Hospitality)

By region:

- North America

- Europe

- UK

- Germany

- France

- Rest of Europe

- APAC

- China

- Japan

- India

- Rest of APAC

- MEA

- KSA

- UAE

- South Africa

- Rest of MEA

- Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In January 2021, Netwrix and Stealthbits merged to address the increasing demand for sensitive data protection. Both companies merged to offer data security and privacy solutions to organizations of all size and in any region around the world.

- In November 2020, PKWARE acquired Dataguise, a company with innovative technology for businesses to discover and protect personal data stored across diverse IT systems and environments. The acquisition will expand PKWARE’s global footprint as it continues the operations of Dataguise’s existing offices in the US, India, Europe, and Canada.

- In October 2020, SolarWinds announced SolarWinds Endpoint Detection and Response (EDR). The solution would be fully integrated with SolarWinds Remote Monitoring and Management (RMM). The integration would allow users to efficiently configure and manage endpoint security while helping mitigate security risks for customers and their business.

- In October 2020, Micro Focus launched a new digital resource, CISO Resource to accelerate enterprise resilience during unprecedented global challenges. The launch of CyberResilient. Com, a digital resource designed to support CISOs and board members as they navigate the shifting demands of the digital economy, and attempt to continue to drive business growth during times of uncertainty.

- In September 2020, IBM launched a new risk-based service IBM Risk Analytics. The solution is designed to help organizations apply the same analytics used for traditional business decisions to cybersecurity spending priorities. The new service creates risk assessments to help clients identify, prioritize and quantify security risk as they weigh decisions such as deploying new technologies, making investments in their business and changing processes.

- In September 2020, Proofpoint launched two new products named Enterprise Data Loss Prevention (DLP) and Nexus People Risk Explorer. The Enterprise DLP solution helps organizations identify and quickly respond to data losses resulting from negligent, compromised, or malicious users. Nexus People Risk Explorer provides a unified view of vulnerable, attacked, and privileged users.

- In May 2020, Google Cloud and Splunk partnered to help customers gain deeper insights from data. This partnership aimed to help organizations drive actionable insights from their data and enable better, faster decisions with real-time visibility across the enterprise.

- In February 2020, Google acquired Looker, a provider of a unified platform for business intelligence, data applications, and embedded analytics. This acquisition would enable Google to extend its analytics offering by defining two capabilities that would define business metrics and provide an analytical platform to make business decisions.

- In June 2019, Oracle introduced a new feature in Oracle Analytics. The new feature would provide AI-powered self-service capabilities. Oracle Analytics with the features of data preparation, visualization, and Natural Language Processing (NLP) would help business analysts get data insights to make business decisions.