< Key Hightlight >

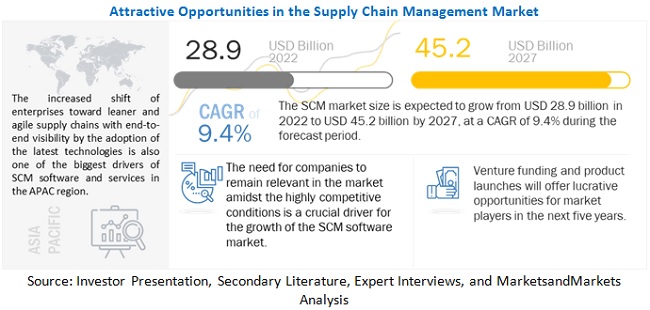

The post-COVID 19 global SCM market size is expected to grow from USD 23.2 billion in 2020 to USD 41.7 billion by 2026, at a Compound Annual Growth Rate (CAGR) of 10.3% during the forecast period.

The major factors fueling the SCM market include demand for greater visibility and transparency in supply chain data and processes, high growth in eCommerce, increasing adoption of cloud supply chain management among SMEs and enhancing business continuity by minimizing potential failures. Moreover, advances in technologies are making evolution to the supply chain industry and integration of AI capabilities with SCM offerings would provide lucrative opportunities for SCM vendors.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID 19 IMPACT

The lockdowns imposed as a result of the COVID-19 outbreak has shut down economies and is impacting every aspect of the supply chain in North America. This has also caused various industries to move their normal manufacturing processes to manufacture essential medical supplies, PPE kits, etc. According to a survey by the Supply Chain Media among 143 supply chain decision-makers in Europe, the COVID-19 pandemic is having a clear impact on the supply chains of virtually all European manufacturers, wholesalers, and retailers. Although 78% of them are experiencing a negative short-term impact, 17% are noticing positive effects, and only 5% say they are not affected in any way. COVID-19 finally forced many companies and entire industries to rethink and transform their global supply chain model. For example, according to a report by the Economist Intelligence Unit (EIU), over-reliance on Asian, and especially Chinese suppliers and clients was already a major concern for MEA before the COVID-19 disruption in 2020, and after the outbreak, MEA businesses are planning to diversify supply chains as well as refocus on local production where possible. The COVID-19 pandemic has resulted in an increased demand for eCommerce. To successfully operate in pandemic technologies, such as AI and Machine Learning (ML), are beginning to drive innovation strategies of the business which has further fueled the increase in the adoption of cloud-based SCM solutions across SMEs.

MARKET DYNAMICS

Driver: Demand for greater visibility and transparency in supply chain data and processes

Traditionally, the lack of visibility and transparency is the greatest hurdle in achieving the supply chain’s objectives. Most organizations lack transparency in supply chain processes and the visibility needed to predict better and prevent disruptions and inventory imbalance. This largely stems from an inability to hold overwhelming amount of data scattered across different processes, sources, and systems. Supply chain organizations struggle to keep pace with both technological advances and changes that the digital age is bringing to industries and markets. Under these circumstances, they lag in elevating their personnel and empowering them with the knowledge, data, and capabilities needed to succeed. These days, leaders in the supply chain, sourcing, and procurement should prepare their processes and infrastructure to embrace new technology and their ability to harness more data than ever before. By using technologies, such as machine learning, AI, and IoT to improve supply chain transparency, leaders in back offices can drive product excellence, accelerate time-to-market, and develop new products and services.

Restraint: Growing security and privacy concerns among enterprises

The enterprises adopting cloud-based SCM face security and privacy issues. The enterprises possess confidential data that needs to be protected to avoid data breaches and theft as it may affect the reputation of enterprises on the whole. The enterprises’ data may leak over the Internet and can be accessed by unauthorized users, which is a growing concern among the enterprises. For example, the cloud-based transportation management system needs multitenant architecture, in which a single version of the software runs on a server that is shared by multiple customers. Hence, there is a possibility that subscribers of an enterprise can view the data of competitors. These security issues relating to the data access by unauthorized users will likely threaten the enterprise data security and competitive business position, as well. Hence, these issues relating to security and privacy increase the growing concern among the enterprises and are restraining the growth of the cloud SCM market during the forecast period.

Opportunity: Advances in technologies are making evolution to the supply chain industry

According to a recent report from mobile and IoT management solutions provider, SOTI, 41% of British transport and logistics companies, and 49% of global T&L companies, identified that their businesses use legacy technology. Of all transport and logistics companies globally with outdated technology, over one third (37%) admitted that they have been unable to upscale operations adequately during the pandemic due to their legacy technology. Advances in information and communications technology are making the evolution of the supply chain more possible. Technologies such as IoT, cloud computing, 5G, blockchain, AI, 3D printing, and robotics are all critical to enabling the digital supply network of the future. For instance, transparency and accountability are key areas of a functional supply chain, and real-time tracking enables. GPS monitors, can now track everything from a shipment’s location to its current temperature, providing up-to-the-minute facts that enable logistics professionals to fully understand how their supply chains operate. During the ongoing COVID-19 pandemic, real-time tracking is useful for high-value items and goods. All stages of a shipment’s chain of custody can be mapped and verified through the use of IoT data and device check-ins. As just one example, IoT devices can automatically flag shipments that have left a safe temperature zone and help protect customers from spoiled goods.

Challenge: Limited awareness of supply chain management tools

Awareness regarding supply chain management solutions and their benefits is low among healthcare providers. While various supportive initiatives, such as Just-In-Time (JIT) approaches and stockless inventory systems, have been introduced in the market over the years, unlocking the full potential of SCM tools will require increased training on SCM principles, such as improved information and communication within internal departments, information and measurement systems, and enhanced executive support.

SMEs segment to grow at a higher CAGR during the forecast period

Rather than investing in on-premises networking solutions, SMEs prefer cloud-based solutions, which are more flexible and fall within the budget. The adoption of the pay-as-you-go model by SMEs to flexibly manage the IT infrastructure as per their requirements is projected to drive the adoption of SCM. Also, the need for efficient customer data protection and cost-cutting, as well as attaining a competitive advantage, enables quick response and timely decisions that are projected to drive the growth of the SCM market in SMEs.

FMCG vertical to hold the largest market size during the forecast period

The real-time supply chain visibility becomes absolutely essential for successful FMCG supply chain execution and unplanned cost avoidance. Additionally, this industry significantly needs inventory management solutions that would help end-users to keep inventory controlled and shipments moving in a timely manner. Without careful warehouse management and inventory control, FMCG distributors risk spoilage, contamination, or damaged products that can put consumers at risk and open their business to liability and violation of stringent food safety laws. SCM solutions and services provide FMCG companies with real-time supply chain visibility, business intelligence, and reduced operating cost. These features empower them to immediately execute and optimize orders for efficient transportation spend management, shipment routing, and on-demand delivery of products. Hence te adoption is expected to be greater in FMCG vertical.

To know about the assumptions considered for the study, download the pdf brochure

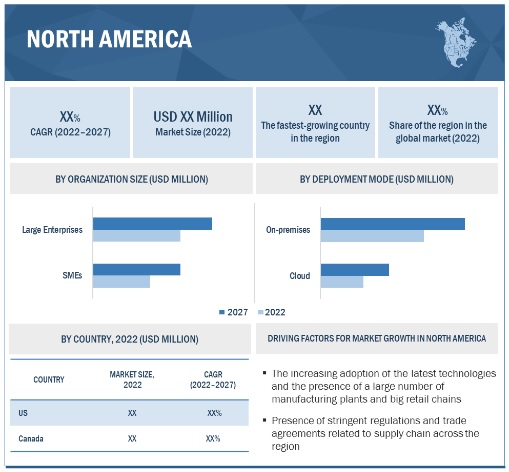

North America to hold the largest market size during the forecast period

North America is expected to contribute the highest market share in terms of revenues during the forecast period as it is a technologically advanced region with a high number of early adopters and the presence of major market players. With the technological advancement and focus toward making supply chain functions, such as logistics, warehousing, fulfillment, production, and transportation management more efficient, the need for SCM is being fueled in the region. Also, the presence of stringent regulations and trade agreements related to the supply chain across the region is also a driver of SCM.

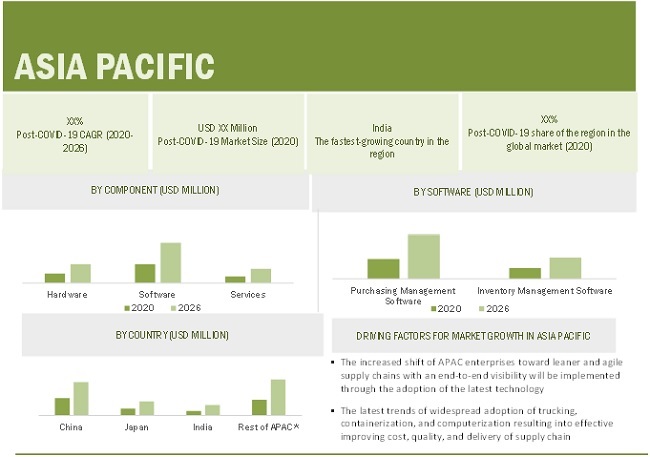

Asia Pacific is expected to contribute to the fastest-growing region with the highest CAGR during the forecast period as it is getting technologically equipped with the early adoption of new technologies. Huge investments in infrastructure by the government and private enterprises, especially in India and Indonesia, with the motive of easing the movement and improvement in infrastructure, are expected to drive the demand for SCM in the region. The increased shift of APAC enterprises toward leaner and agile supply chains with end-to-end visibility by the adoption of the latest technologies is also one of the biggest drivers of SCM software and services in the region.

Key Market Players

Major vendors in the global SCM market include SAP SE (Germany), Oracle (US), The Descartes Systems Group (Canada), Infor (US), IBM (US), Manhattan Associates (US), and Logility (US).

Infor (Infor) was founded in 2002 and is headquartered in New York, US. The company is a leading provider of enterprise software and services. It innovates and develops varied cloud-based software solutions tailored to the needs of specific industries, such as aerospace and defense, automotive, public sector, and retail, in addition to horizontal software products, which are industry agnostic. The company also provides consulting services as well as maintenance and support services for its clients. The software offerings include software for enterprise human capital management, financial management, business intelligence, asset management, enterprise performance management, SCM, service management, manufacturing operations, business project management, and property management for hospitality companies. The supply chain offerings of Infor are designed to manage the entire supply chain of its customers, including planning, designing, execution, and forecasting. The major products are Infor Network Design, Infor Demand Planning, Infor Scheduling, Infor Sales and Operations Planning, Infor Transportation Planning, Infor Advanced Planning, Infor Advanced Scheduling, Infor Warehouse Management, and Infor Supply Chain Execution. Infor also offers the GT Nexus, Inc. (GT Nexus) supply chain network platform in a cloud ecosystem to interconnect suppliers, distributors, and other value chain actors of the supply chain. The company manages its business through the three segments of license, maintenance, and consulting. It caters to a diverse client base ranging from SMEs to large enterprises, with a presence in more than 43 countries across the regions of North America, APAC, Latin America, MEA, and Europe. The global reach of Infor empowers the company with economies of scale as well as a competitive advantage.

Scope of the Report

Report Metric | Details |

Market size available for years | 2014–2026 |

Base year considered | 2019 |

Forecast period | 2020–2026 |

Forecast units | Value (USD) |

Segments covered | Component (Hardware, Software, and Services), Deployment Mode, Organization Size, Vertical, and Region |

Geographies covered | North America, Europe, APAC, MEA, and Latin America |

Companies covered | SAP SE (Germany), Oracle (US), The Descartes Systems Group (Canada), Infor (US), IBM (US), Manhattan Associates (US), Logility (US), Kinaxis (Canada), Blue Yonder (US), Korber (US), Coupa Software (US), Epicor (US), BluJay Solutions (US), Llamasoft (US), E2open (US), JAGGAER (US), Zycus (US), GEP (US), Tive (US), Calista (Singapore), Most (Sweden), FreightBro (India), 4TiGo (India), Trukky (India), Lobb (India). |

This research report categorizes the SCM market to forecast revenues and analyze trends in each of the following subsegments:

Based on Component:

Based on Deployment Mode:

Based on Organization Size:

Based on Verticals:

- FMCG

- Retail and eCommerce

- Healthcare

- Manufacturing

- Automotive

- Transportation and Logistics

- Others (Construction, Oil and Gas, Aerospace and Defense, and Agriculture)

Based on Region:

- North America

- Europe

- United Kingdom (UK)

- Germany

- France

- Rest of Europe

- APAC

- China

- Japan

- India

- Rest of APAC

- MEA

- Kingdom of Saudi Arabia

- United Arab Emirates

- Rest of MEA

- Latin America

- Brazil

- Rest of Latin America

Recent Developments

- In December 2020, Infor partnered with MphRx and developed a global solution to help healthcare organizations manage COVID-19 vaccine inoculation with real-world clinical data.

- In July 2020, Infor and DBS Bank partnered to integrate digital trade financing into global supply chains.

- In September 2018, Infor CloudSuite Federal Financials & Supply Chain Management, a next-generation application, set to deliver a change in financial management for the public sector. This solution helped federal agencies reduce the risk, cost, and complexity of financial management modernization process.