< Key Hightlight >

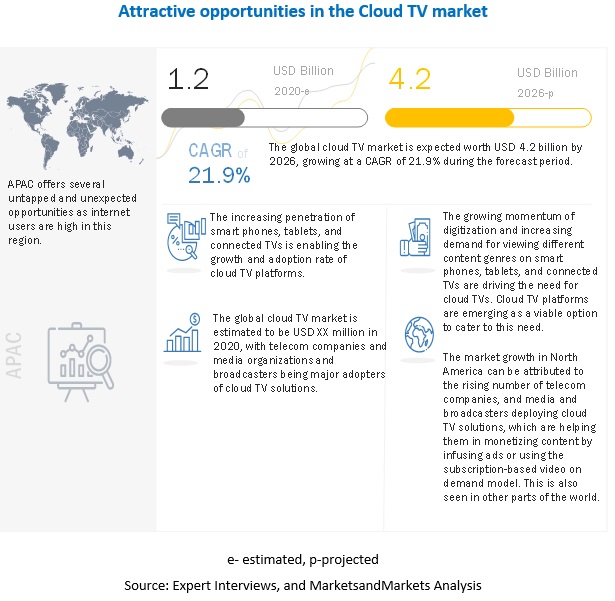

The Cloud TV market size is expected to grow from USD 1.2 billion in 2020 to USD 4.2 billion by 2026, at a Compound Annual Growth Rate (CAGR) of 21.9% during the forecast period. The cloud TV platform is used to deliver audio, video, rich media, and other media content over the internet. Cloud TV is delivered over end users’ handheld devices, such as smartphones, tablets, and connected TVs, through a wireless connection over the internet. It offers features such as live TV, video-on- demand, and web surfing.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on global Cloud TV market

The COVID-19 health crisis has fundamentally impacted lifestyles and routines of all consumers. Work-from-home mandates and social distancing have driven in-home video consumption to unprecedented levels. Consumers are also learning new skills and keeping themselves entertained through a plethora of internet-based content. Be it OTT platforms, video hosting websites such as YouTube, or video conferencing tools and software for hosting webinars and internal meetings, the COVID-19 pandemic has transformed the way people function. This current era, marked by the COVID-19 pandemic, has accelerated in-home video consumption to levels never seen before. While devices such as smartphones, connected TVs, and tablets enhance the entertainment experience, technological advancements, the continued proliferation of video apps, and improved interoperability and connectivity with other devices have pushed cloud TVs to even greater heights during the COVID-19 pandemic. Many users opted for SVODs during this pandemic. For instance, Netflix reached a whopping 15.8 million paid subscribers in the first three months of 2020 amid the coronavirus pandemic as people were forced to stay at home. Netflix had expected 7.2 million subscribers but witnessed more than a double rise in paid subscribers. As per Limelight Networks, online videos continue to rapidly grow in popularity at the expense of traditional broadcast viewing. On average, viewers spend nearly 7 hours 55 minutes per week watching various types of content.

Cloud TV Market Dynamics

Driver: Demand for higher user experience for on-demand or interactive viewing

Advances in technology and consumer behaviour are changing the way video content is being delivered to consumers. These advances involve migration from traditional broadcasting models and platforms to digital distribution over the internet to a wide range of connected devices. This fundamental shift is triggering three major disruptions for broadcasters and telecom providers, each calling for the scalability, cost flexibility, and agility of cloud TV platforms. Online video consumption has increased enormously in the last decade. Customers are accustomed to using OTT videos and internet services; therefore, they are valuing a more tailored and interactive viewing experience. As a result, they are demanding more choice, convenience, and control over their viewing, choosing to watch a network’s scheduled line-up, enjoy a live event, or record favorite content and watch it whenever and on whatever device they want. This requires far more computing power and resources than traditional broadcasting. Thus, many telecom providers and broadcasters are leveraging the cloud TV platform for providing customers a range of viewing options, along with personalized content suggestions. Customers are also expecting to view content as per their choice. Hence, this is expected to fuel the demand for cloud TVs.

Restraint: Lack of high-speed network infrastructure and internet access in rural areas

One of the main restraints in adopting cloud TV is the lack of high-speed network infrastructure. Internet and mobile phone connectivity is an integral part of cloud TV. There is an ongoing mobile network connectivity problem in rural areas. These areas are remote and backward because of a lack of facilities and poor connectivity. This issue has made it extremely difficult for cloud TV providers to enter the rural areas. Although the last couple of years have seen significant improvements in access to decent broadband and 3G,4G, and mobile services in rural areas, rural networks are struggling due to the increasing demand for digital services, widening the digital divide between urban and rural areas. While all urban areas in the world are covered by mobile-broadband networks, there are gaps in connectivity and internet access in rural areas, according to International Telecommunication Union (ITU), a subsidiary of the United Nations. Connectivity gaps in the rural areas are high in Least developed countries (LDCs), where 17% of the rural population live in areas with no mobile coverage at all, and 19% of the rural population is covered by 2G. According to 2019 data, about 72% of households in urban areas have internet access internet at home, while 37% of the population in rural areas uses the internet. These factors hamper the adoption of cloud TV solutions.

Opportunities: Adoption of 5G to increase the demand for cloud TV

The rising adoption of 5G technology and growing advancements in wireless communication are expected to boost the market growth. Many telecom vendors invest in the progress of 5G technology to strengthen the cloud TV experience. For instance, Nokia and AT&T collaborate to advance the 5G technology in the 39 GHz band by finishing fixed wireless 5G tests with AT&T's internet TV streaming service, DIRECTV NOW. Speed and low latency are essential to make the experience of cloud TV seamless. Developed countries such as the US, and certain European and APAC countries have high-speed network infrastructure, i.e., 5G in place, and adopt new-age technologies much faster and easier. Carriers in North America, Europe, and Australia have set up 5G. As the demand for high-quality content and seamless streaming would rise, 5G would drive cloud TV viewer experience to new heights videos account for the majority of mobile internet bandwidth used today.

Challenge: Concerns over digital piracy

As cloud TV providers are offering more TV channels in cloud, the importance of content protection in cloud TV is becoming a concern for them. The problem of piracy is still a big concern, and any operator looking to launch a cloud TV service needs to be aware of its potential challenges. Robust content protection in cloud TV needs to be implemented using a form of multiple DRM that acknowledges increased fragmentation in the marketplace. To tackle such challenges, in 2017, 30 leading content creators and on-demand entertainment companies from around the world launched the Alliance for Creativity and Entertainment (ACE), a new global coalition dedicated to protecting the dynamic legal market for creative content and reduce online piracy. The worldwide members of ACE are Amazon, AMC Networks, BBC Worldwide, Bell Canada and Bell Media, Canal+ Group, CBS Corporation, Constantin Film, Foxtel, Grupo Globo, HBO, Hulu, Lionsgate, Metro-Goldwyn-Mayer (MGM), Millennium Media, NBCUniversal, Netflix, Paramount Pictures, SF Studios, Sky, Sony Pictures Entertainment, Star India, Studio Babelsberg, STX Entertainment, Telemundo, Televisa, Twentieth Century Fox, Univision Communications Inc., Village Roadshow, The Walt Disney Company, and Warner Bros. Entertainment Inc. Cloud TV platforms are now relying on multi-DRM solutions so that their premium content remains secure across devices. Therefore, the support for multi-DRM is required in cloud TV platforms to tackle the digital piracy challenge.

Media companies and broadcasters vertical to grow at the highest CAGR during the forecast period

Media and broadcasting is a huge and diverse vertical. It encompasses video and audio content distribution, publishing, film, music, and social media, among others. However, a common trend across all the segments of media and broadcasting is the rising importance of video content delivered over the internet. Advances in technology and consumer behaviour are driving a transformation in the way video content is delivered to consumers. The change involves a migration from traditional broadcasting models and media platforms toward digital distribution over the internet to a wide array of connected devices. This fundamental shift is triggering three major disruptions for broadcasters and media companies. These disruptions are scalability, cost flexibility, and agility of cloud computing. With the digitalization of media and broadcasting mediums, the consumer appetite for gaining access to the right information or preferred channels is growing increasingly. The media and broadcasting vertical seeks to interact with its consumers to achieve deeper customer engagement. Various companies use cloud TV platforms to do live broadcasting of sports, which includes live voting for viewers. This ensures consumer engagement and retention. Using AI and analytics, the media and broadcasting companies show preferred content to their consumers, which, in turn, increases the viewing time and ad revenue. These factors help the cloud TV platforms to be consumed by media and broadcasting companies.

Large enterprises to hold a larger market size during the forecast period

Cloud TVs help enterprises with easy and quick deployments, thus helping them in expanding their existing markets. They save a lot of time and reduce building and maintenance costs. Integrated solutions can leverage the power of cloud computing platforms, such as AWS, Google Cloud, and Microsoft Azure, to provide a streamlined cloud TV platform from planning to delivery of personalized content, deployment and implementation of online video services, and incorporate the growth for customers launching large-scale cloud TV services. Many global operators are looking to migrate from legacy solutions to more agile and flexible cloud infrastructure powered solutions by proven technologies and delivered by providers with unique expertise in deploying cloud TV services. These benefits and features of cloud TVs have favored their adoption among large enterprises.

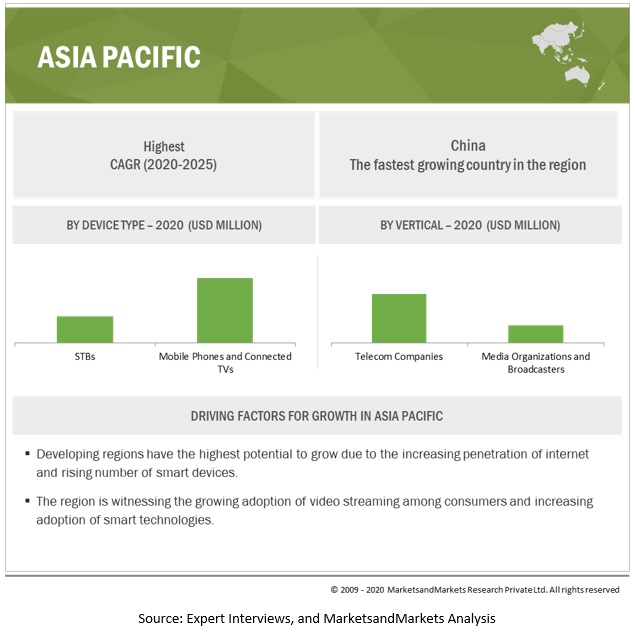

Asia Pacific to grow the highest during the forecast period

The global Cloud TV market by region covers 5 major geographic regions, namely, North America, Asia Pacific (APAC), Europe, Middle East and Africa (MEA), and Latin America. Asia Pacific is expected to grow the highest owing to the rising internet and smart phone penetration.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The Cloud TV market comprises major solution providers, such as Kaltura (US), Brightcove (US), Amino Technologies (UK), Muvi (US), IntelliMedia Networks (US), Pontis Technologies (Argentina), Mware Solutions (Netherlands), MatrixStream Technologies (US), CSG Systems International Inc (US), Viaccess-Orca (France), Simplestream (UK), MediaKind (US), Comcast Technology Solutions (US), ActiveVideo (US), Synamedia (UK), Entertainment And Interactivity For Digital Tv (Brazil), Egla Communications (US), Minerva Networks (US), SeaChange International (US), Icareus (Finland), video.space (US), AVITENG (Turkey), Amagi Corporation (US), Metrological (Netherlands), and Streemfire (Austria). These players adopt new product developments as their key growth strategy.

The study includes an in-depth competitive analysis of these key players in the Cloud TV market with their company profiles, recent developments, and key market strategies.

Scope of the report

Report Metric | Details |

Market size available for years | 2016–2026 |

Base year considered | 2019 |

Forecast period | 2020–2026 |

Forecast units | Million (USD) |

Segments covered | Deployment type, device type, organization size, vertical and regions. |

Geographies covered | North America, APAC, Europe, Latin America, and MEA |

Companies covered | Kaltura (US), Brightcove (US), Amino Technologies (UK), Muvi (US), IntelliMedia Networks (US), Pontis Technologies (Argentina), Mware Solutions (Netherlands), MatrixStream Technologies (US), CSG Systems International Inc (US), Viaccess-Orca (France), Simplestream (UK), MediaKind (US), Comcast Technology Solutions (US), ActiveVideo (US), Synamedia (UK), Entertainment And Interactivity For Digital Tv (Brazil), Egla Communications (US), Minerva Networks (US), SeaChange International (US), Icareus (Finland), video.space (US), AVITENG (Turkey), Amagi Corporation (US), Metrological (Netherlands), and Streemfire (Austria). |

This research report categorizes the Cloud TV market based on deployment type, device type, organization size, vertical, and region.

Based on deployment type, the Cloud TV market has been segmented as follows:

- Public cloud

- Private cloud

Based on organization size, the Cloud TV market has been segmented as follows:

- Small and Medium-sized Enterprises

- Large Enterprises

Based on verticals, the Cloud TV market has been segmented as follows:

- Telecom companies

- Media organizations and broadcasters

Based on regions, the Cloud TV market has been segmented as follows:

- North America

- Europe

- UK

- Germany

- France

- Rest of Europe

- APAC

- China

- Japan

- Australia and New Zealand

- Rest of APAC

- MEA

- KSA (Kingdom of Saudi Arabia)

- United Arab Emirates (UAE)

- South Africa

- Rest of MEA

- Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In November 2020, CommScope and Kaltura partnered to deliver cloud TV offerings to communication service providers and media companies worldwide. The integrated solutions would leverage the power of AWS to provide a streamlined cloud platform, from planning to delivery, deployment, and implementation, and ongoing growth for customers launching large-scale cloud TV services. AWS enables video providers to enhance operational flexibility and resilience, and take advantage of optimized resources and cost structures.

- In April 2019, Brightcove acquired the online video platform business of Ooyala, a provider of the cloud video technology, for USD 15 million in cash and stock. The strategic acquisition strengthens Brightcove’s position as a market leader in the online video industry. With this acquisition, Ooyala’s OVP customers joined the list of companies working with Brightcove.

- In July 2020, CSG Systems International and Bell Canada, Canada’s largest communication company that provides advanced wireless, Internet, TV, and business services, announced a seven-year extension to their long-standing partnership. CSG Systems International would continue to support the residential customer service and billing for Bell Canada’s Fibe and Alt TV services. Bell Canada’s Fibe TV is an IP-based television service. It enables users to stream live TV on the screen of their choice.