< Key Hightlight >

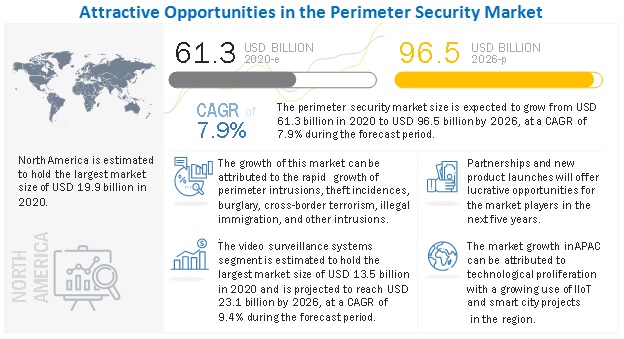

The perimeter security market is projected to grow from 61.3 billion in 2020 to USD 96.5 billion by 2026, at a Compound Annual Growth Rate (CAGR) of 7.9% during the forecast period. The rise in perimeter intrusions, theft incidences, burglary, cross-border terrorism, illegal immigration, and other intrusions to drive the market growth.

To know about the assumptions considered for the study, Request for Free Sample Report

The COVID-19 pandemic has affected every segment of society including individuals and businesses. The internet ecosystem has been playing a pivotal role all over the globe. Due to the COVID-19 pandemic, the dependency on homeland security and law enforcement agencies has increased significantly. Critical infrastructure security, emergency services, and others are leveraging the perimeter security solutions to provide necessary services to consumers.

Stringent government regulations and industry standards to curb terrorism, cross border intrusions, and protection of critical infrastructures to grow at the highest CAGR during the forecast Period

Perimeter security systems are not only being used to prevent and detect intrusions in critical infrastructures, military sites, and other high-risk sites, but are now being used at commercial and residential sites, urban and remote areas, retail spaces, and transportation sites. The rising issues surrounding illegal immigration and rising terrorist threats have urged governments to devise regulations and industry standards for perimeter security. For example, PAS 68, which the UK government developed in collaboration with perimeter security manufacturers, is a publicly available specification for vehicle security barriers. It has become the UK’s standard security benchmark for Hostile Vehicle Mitigation (HVM) equipment. The US federal government has established both safety and security requirements at airports to protect the airfield perimeter fences. In November 2019, the Italian Government passed Law 133, which establishes the 'National Cyber Security Perimeter' to ensure high-level security for hybrid IT networks of critical governmental agencies, state-owned bodies, and private companies. Governments are implementing regulations and highly emphasizing the need to secure critical infrastructural sites, such as oil and gas fields, nuclear power, and defense sites. Hence, the global perimeter security systems market is expected to ascend in the coming years.

To know about the assumptions considered for the study, download the pdf brochure

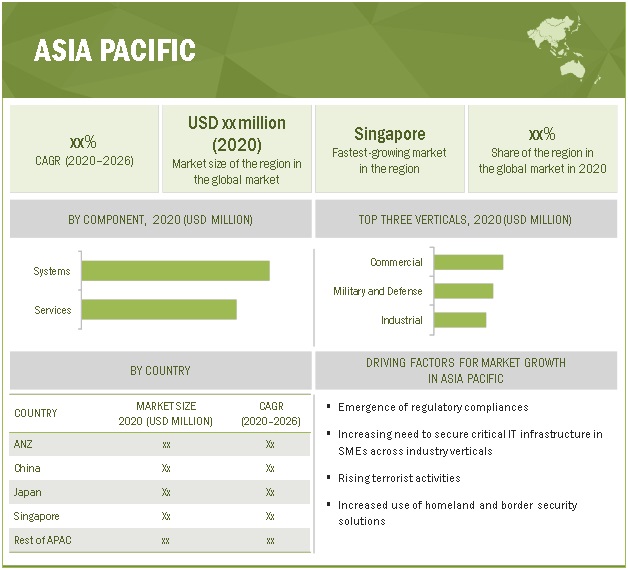

APAC to account for the highest CAGR during the forecast period

Asia Pacific (APAC) has witnessed an advanced and dynamic adoption of new technologies and is expected to record the highest CAGR in the global perimeter security market during the forecast period. APAC constitutes major economies, such as China, Japan, Singapore, and Australia and New Zealand, which are expected to register high growth rates in the perimeter security market. In recent years, the APAC region has undergone tremendous economic growth, political transformations, and social changes. India, Japan, and Singapore have updated or launched new national security policies to deal with the increasingly sophisticated threats. Companies operating in APAC would benefit from the flexible economic conditions, industrialization-motivated policies of the governments, as well as from the growing digitalization, which is expected to have a significant impact on the business community.

Market Dynamics

Driver: Adoption of latest techniques, including IP-based video surveillance cameras for remote monitoring, wireless technology, motion sensors, and aerial dronesAdoption of latest techniques, including IP-based video surveillance cameras for remote monitoring, wireless technology, motion sensors, and aerial drones

The demand for multi-layered perimeter protection has increased with growing perimeter threats. Rapid technological advancements, such as the use of next-generation sensors, integrated fibre-optic Perimeter Intrusion Detection System (PIDS), thermal cameras, and video analytics, are experiencing high growth. Video surveillance cameras are being deployed for perimeter security at a high rate. One of the best ways to prevent crimes, such as thefts and vandalism in residential and commercial areas, is by utilizing advanced perimeter security techniques, such as video surveillance, perimeter detection systems, and access control systems. Earlier, CCTV cameras were being used to monitor various business assets. With technological advancements in internet and camera hardware, IP cameras and IP network systems are rapidly replacing CCTV cameras. IP cameras offer flexibility, remote access, and better scalability as compared to traditional analog camera-based monitoring systems. IP-based cameras provide a more efficient and flexible physical security system because of controllable bandwidth, which gives a high resolution. Wireless IP-based surveillance solutions are cost-effective to deploy as installation and also, cabling is not required. However, the processing of large amounts of video data at each wireless node for video surveillance applications is still challenging. With the rise in the number of intrusions across the world, the need for multi-layered perimeter protection has increased. Technologies such as next-generation fence-mounted sensors, infrared sensors, integrated fiber-optic perimeter intrusion detection system, and perimeter fence detection system, combined with CCTV, offer huge growth opportunities for the perimeter security market. Thermal imaging and video analytics complement each other well and effectively address the potential needs of the market. Various countries, such as Russia and the UK, are deploying CCTV cameras with facial recognition features for citizen identification as well as border control. Other innovations, such as aerial security and surveillance with Unmanned Aerial Vehicles (UAVs) powered with AI and computer vision, are also expected to boost the perimeter security market globally.

Restraint: Lack of technical expertise, and the need for security training and awareness

Lack of awareness about security risks and the subsequent potential losses are restricting the growth of the perimeter security market. System integrators and security technologists, with minimal knowledge and understanding about perimeter security, try integrating the existing IT systems with advanced perimeter security, which could damage the existing IT system running on critical infrastructure. The biggest challenge organizations are facing today is the lack of technical expertise and security skills, which is hampering the organizations’ ability to meet their evolving perimeter security needs. Many organizations hire security professionals who lack the right skill to analyze the complexities of the perimeter security systems. Furthermore, the companies with pressing perimeter security needs are lacking qualified professionals to fill their positions, which makes them vulnerable to various types of intrusions. Training is one of the critical services provided by security vendors. They educate and train the personnel at the customer’s premises on how to use the solution that has been deployed. This training helps the personnel become more skilled, which ultimately helps in increased safety and security. The growth rate of the security training and consulting segment is expected to remain high in the coming two to five years due to the evolution in security technology and rapid developments in mobile devices and applications.

Opportunity: Emergence of AI, facial recognition, ALPR, computer vision, and big data analytics in perimeter security systems

As the nature of terror strikes is continuously changing, verticals, such as government, military and defense, correctional facilities, transportation, critical infrastructure, commercial, and industrial, are deploying advanced perimeter security solutions to secure their perimeters from advanced intrusions. The traditional perimeter security platforms have been replaced by advanced perimeter security platforms with the use of advanced technologies, such as AI, ML, computer vision, and facial recognition. This next-generation technology-integrated systems have not only augmented the efficiency, but also compel manufacturers to come up with new advanced perimeter security systems. Intelligent perimeter security systems powered by AI, ML, and computer vision have become critical for national border and facility protection. Video analytics solutions combined with facial recognition, advanced object tracking, Advanced License Plate Recognition (ALPR), AI, ML, and other innovative technologies help detect threat events in real time, thereby, enhancing the perimeter security of industrial sites, commercial buildings, airports, and other critical facilities. Combining AI with surveillance offers a wave of unrealized opportunities ranging from predictive crime to real-time identification of an ongoing crime or attack.

Challenge: Integration of logical and physical components of security systems

Security system integration refers to the merging of physical security applications, such as access control, with logical security applications, such as biometric identification programs, into a single, comprehensive system. Organizations can significantly enhance the efficiency and comprehensiveness of their security infrastructure by this convergence. For instance, if the access control and intrusion alarm systems are linked, the access control system can be programmed to lock down a facility based on the type of alarm that sounds once the system determines an intruder. Integration between video and access control is the most sought-after combination. This leads to integration issues as most manufacturers offer integrations with a variety of video and other security components but not with their fellow access control competitors. Additionally, vendors use their own unique application program interfaces and their own databases with reporting methods that make the integration process challenging.

Key Market Players

This research study outlines the market potential, market dynamics, and major vendors operating in the Perimeter security market. Key and innovative vendors in the Perimeter security market Honeywell (US), Dahua Technology (China), Bosch Security Systems (Germany), Hikvision (China), Axis Communications (Sweden), Pelco (US), Thales Group (France), Johnson Controls (US), Fiber Sensys (US), Panasonic Corporation (Japan), United Technologies Corporation (US), Gallagher (New Zealand), Avigilon (Canada), Flir Systems (US), Senstar (Canada), Ingersoll Rand (US), Infinova (US), Southwest Microwave (US), Rbtec Perimeter Security Systems (US), Sorhea (France), Puretech Systems (US), Advanced Perimeter Systems (UK), Cias Elettronica (Italy), Sightlogix (US), and Nortek Security & Control (US).

The study includes an in-depth competitive analysis of these key players in the perimeter security market with their company profiles, recent developments, and key market strategies.

Scope of the Report

Report Metrics | Details |

Market size available for years | 2014–2026 |

Base year considered | 2020 |

Forecast period | 2021–2026 |

Forecast units | Value (USD) |

Segments covered | component, systems, services, solution, service, vertical, and region |

Geographies covered | North America, Europe, APAC, MEA and Latin America. |

Major companies covered | Honeywell (US), Dahua Technology (China), Bosch Security Systems (Germany), Hikvision (China), Axis Communications (Sweden), Pelco (US), Thales Group (France), Johnson Controls (US), Fiber Sensys (US), Panasonic Corporation (Japan), United Technologies Corporation (US), Gallagher (New Zealand), Avigilon (Canada), Flir Systems (US), Senstar (Canada), Ingersoll Rand (US), Infinova (US), Southwest Microwave (US), Rbtec Perimeter Security Systems (US), Sorhea (France), Puretech Systems (US), Advanced Perimeter Systems (UK), Cias Elettronica (Italy), Sightlogix (US), and Nortek Security & Control (US) |

This research report categorizes the Perimeter security market to forecast revenues and analyze trends in each of the following submarkets:

Based on Component:

Based on System:

- PERIMETER INTRUSION DETECTION SYSTEMS

- VIDEO SURVEILLANCE SYSTEMS

- ACCESS CONTROL SYSTEMS

- ALARMS AND NOTIFICATION SYSTEMS

- OTHER SYSTEMS

Based on Service:

- Professional Services

- Managed Services

Based on Industry Vertical:

- Commercial

- Industrial

- Infrastructure

- Government

- Military and Defense

- Residential, Educational and Religious Buildings

Based on the Region:

- North America

- Europe

- United Kingdom (UK)

- Germany

- France

- Rest of Europe (other EU and non-EU countries)

- APAC

- China

- Japan

- Australia and New Zealand

- Singapore

- Rest of APAC (Philippines, Vietnam, Indonesia, Taiwan, and South Korea,)

- Middle East and Africa

- Latin America

- Brazil

- Mexico

- Rest of Latin America (Colombia, Chile, Argentina, and Peru)

Recent Developments:

- In March 2020, Dahua Technology launched Retail Epidemic Safety Protection Solution that would help retailers with daily operations and improve business efficiency. With the government and other organizations continuously opting for different measures to keep the staff as safe as possible, the Retail Epidemic Safety Protection Solution would slow the spread of the virus and create a safe in-store shopping experience for customers..

- In October 2019 Honeywell announced the creation of Honeywell Robotics. It is an advanced technology center of excellence focused on innovating and developing artificial intelligence, machine learning, computer vision, and advanced robotics for use across supply chains.

- In June 2020, Honeywell announced the launch of Honeywell Forge Cybersecurity Suite. The Honeywell Forge Cybersecurity Suite offers improved industrial-grade remote access, increased asset discovery capabilities with active and passive functionality, and better cybersecurity risk monitoring to help industrial organizations embrace remote operations.

- In July 2019, Hikvision launched a thermal Bi-spectrum Deep Learning Turret Camera that brings the enhanced capabilities of indoor fire detection, along with an advanced temperature anomaly alarm and visual warning.

Key Benefits of Buying the Report

The report would provide the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall perimeter security market and its subsegments. It would help stakeholders understand the competitive landscape and gain more insights to better position their business and plan suitable go-to-market strategies. It also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.