< Key Hightlight >

The global VaaS market size is expected to grow from USD 3.8 billion in 2020 to USD 6.2 billion by 2026, at a Compound Annual Growth Rate (CAGR) of 8.7% during the forecast period. Growing demand for real-time and remote access video services, adoption of cloud-based services by enterprises, increasing number of internet users around, and lower total cost of ownership are expected to be the major factors driving the growth of the VaaS market.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Video as a Service Market

Owing to the outbreak of COVID-19, various countries follow strict lockdowns, shutdowns, and mobility restrictions to avoid the spread of the virus. The VaaS market has been witnessing a positive impact as the use of video conferencing for collaboration and communication has increased by more than 100%. The pandemic also has disrupted business efficiency and employee productivity across the globe. Hence, the adoption of VaaS solutions and services has spurred significantly in the pandemic, which has positively impacted market growth. It is expected that the adoption of VaaS solutions for collaboration, training, client engagement, and marketing will continue to grow in the post-pandemic scenarios.

Video as a Service Market Dynamics

Driver: Lower total cost of ownership

Business cloud service platforms are complicated to install and require a higher cost of ownership. Earlier, organizations had to appoint infrastructure teams for managing their cloud infrastructure on their own servers. VaaS enables organizations to reduce investments in building the infrastructure as it is taken care of by managed Services Providers (MSPs). Cloud vendors have their service platforms deployed on their own servers. Organizations get their data onto their platforms and have to pay only for the resources they require to use the video conferencing services. By using shared VaaS infrastructure, organizations can reduce the Total Cost of Ownership (TCO) and can save money on infrastructure, licensing, and support costs.

Restraint: Data security and privacy concerns

The security and privacy of the video content shared across various platforms can pose major concerns for enterprises. Moreover, organizations are also concerned about copyright and Digital Rights Management (DRM) due to the possibilities of misuse, information leakages, and data breaches. The healthcare, finance, manufacturing, information, and public sectors witnessed the highest number of data breach incidents in 2019. To counter such challenges, enterprises need to restructure their strategies in employing video conferencing offerings before deploying these solutions. In the absence of policies and procedures for the proper management of video content, video conferencing solutions may witness a sluggish adoption rate. Furthermore, vendors need to offer interoperable and easy-to-use enterprise-grade video communication solutions that have in-built security features.

Opportunity: Rise of 5G to boost adoption of cloud services

5G technology will bring major improvements to the cloud computing world. This is because most technology innovations can be more efficient when cloud-dependent. 5G, in turn, improves that integration with its low to zero latency, making for smoother communications. Enhanced mobile broadband will deliver a seamless, high-quality experience for cloud video services such as conferencing, recording, and storage. Lower cost per bit will bring affordable and truly unlimited mobile data packages, better adapted to heavy media usage. Furthermore, newer technologies such as facial recognition and live transcripts using AI and ML will spur the adoption of video conferencing over 5G. The evolution of 5G is yet to realize its full transformational potential and provides a great growth opportunity for the VaaS market.

Challenge: Poor internet speed can reduce the quality of service

The lack of strong communication tools significantly limits employee productivity. Noise during video or low-quality video can create misunderstandings or consume more time of employees. Low quality of video streaming and disturbances during video conferences can significantly limit effective communication among workers, especially in the COVID-19 situation. Many people are frustrated due to the bad quality of video and other disturbances that occur during video conferences. According to a Cisco global survey focused on the future of work, 98% of workers stated that they experienced frustration from distractions during video meetings when working from home. Two of the top five frustrations called out were related to background noise—either from other participants or their own side of the call. Many video conferencing solutions providers are developing advanced noise cancellation technologies. The need to improve operational efficien

By Applications, the Marketing and Client Engagement segment to have a higher growth during the forecast period

The marketing and client engagement application of the VaaS market is expected to have a higher growth rate during the forecast period. With the help of video conferencing for marketing purposes, organizations can easily engage audiences, communicate with them more efficiently, and expand their reach. VaaS solutions help enhance customer engagement by enabling more communication with the clients, thus allowing them to have a better relationship with the enterprise.

By Verticals, the BFSI segment to dominate the market during the forecast period

VaaS solutions enable Banking, Financial Services and Insurance (BFSI) enterprises to transform branches into sales and service channels without employing additional onsite staff. These solutions facilitate enhanceed internal communication, knowledge sharing, and investor relations. Live or on-demand videos enable these enterprises to carry out announcements regarding executive messaging and policies, investor relations, external communication, and collaborations among their geographically dispersed teams.

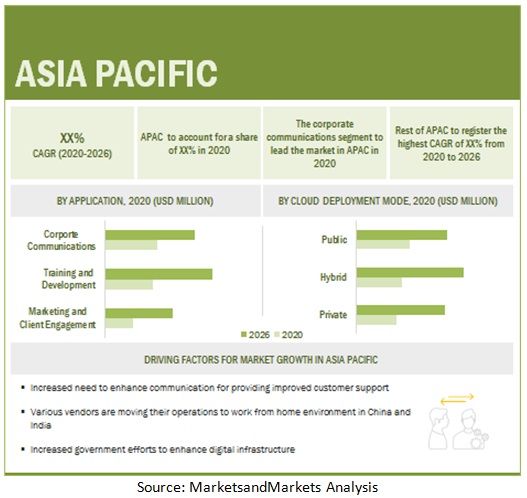

By region, Asia Pacific to record the highest growth during the forecast period

The APAC VaaS market is estimated to have strong growth in the future. Government initiatives to promote the digital infrastructure are responsible for driving the adoption of VaaS solutions in the region. Several technological service providers in this region are partnering with solution providers to enhance and provide customized offerings as per the business requirements of local clients. There is a huge untapped market for VaaS vendors in the developing countries of APAC. The major contributors to the APAC VaaS market are China, Japan, ANZ, and the rest of APAC.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The report includes the study of key players offering VaaS solutions and services. It profiles major vendors in the global VaaS market. The major vendors in the VaaS market include Microsoft (US), Zoom Video Communications (US), Cisco (US), Adobe (US), Avaya (US), Google (US), AWS (US), Poly (US), LogMeIn (US), and RingCentral (US). These players have adopted various strategies to grow in the global VaaS market.

The study includes an in-depth competitive analysis of these key players in the VaaS market with their company profiles, recent developments, and key market strategies.

Scope of the Report

Report Metrics | Details |

Market size available for years | 2017-2026 |

Base year considered | 2020 |

Forecast period | 2020-2026 |

Forecast units | Value (USD Million) |

Segments covered | By Application, Cloud Deployment mode, Vertical, Region |

Regions covered | North America, Europe, APAC, MEA, Latin America |

Companies covered | Microsoft (US), Zoom Video Communications (US), Cisco (US), Adobe (US), Avaya (US), Google (US), AWS (US), Poly (US), LogMeIn (US), RingCentral (US), Zoho Corporation (India), PGi (US), Wickr (US), Pexip (Norway), Starleaf (UK), BlueJeans Network (US), Enghouse Systems (Canada), Qumu (US), Sonic Foundry (US), ON24 (US), Lifesize (US), Kaltura (US), Kollective (US), VIDIZMO (US), and VBrick (US). |

This research report categorizes the VaaS market to forecast revenues and analyze trends in each of the following subsegments:

By Application:

- Corporate communications

- Training and development

- Marketing and client engagement

By Cloude Deployment mode:

- Public cloud

- Private cloud

- Hybrid cloud

By Vertical:

- Banking, Financial services and Insurance

- It and ITeS

- Healthcare and life sciences

- Education

- Media and entertainment

- Government and Public sector

- Retail and consumer goods

- Other verticals

By Region:

- North America

- Europe

- UK

- Germany

- France

- Rest of Europe

- APAC

- China

- Japan

- ANZ

- Rest of APAC

- MEA

- Kingdom of Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of MEA

- Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In September 2020, Zoom Video Communications partnered with Lumen to allow Lumen to offer Zoom as part of its Unified Communications and Collaboration Suite. This will enhance the user experience for the Unified Communications and Collaboration Suite and will provide enhanced customer reach for Zoom.

- In May 2020, Sony Semiconductor Solutions and Microsoft partnered to make AI-powered smart cameras and video analytics solutions more accessible for customers. With this partnership, both companies will embed Microsoft Azure’s AI capabilities on Sony’s intelligent vision sensor IMX500, which extracts useful information out of images in smart cameras and other devices.

- In January 2020, Avaya and VExpress, an Australian ICT distributor, signed a Master Agent agreement to enable channel partners to fastrack the operational recovery efforts of Australia’s midmarket organizations and SMEs with the help of cloud communications and collaboration solutions from Avaya.

- In August 2019, Cisco acquired Voicea, a meeting and voice specialist, for Webex ‘game-changer’. With Voicea’s technology, Cisco would enhance its Webex portfolio of products with a powerful transcription service to boost collaboration in meetings and calls. Voicea's technology would be a game-changer for Cisco Webex customers to experience more productive and actionable meetings.