< Key Hightlight >

[198 Pages Report] MarketsandMarkets estimates the global Partner Relationship Management (PRM) market size to grow from USD 920 million in 2020 to USD 1,997 million by 2026, at a Compound Annual Growth Rate (CAGR) of 13.8% during the forecast period. Key factors that are expected to drive the growth of the market are the need to control the functional relationship between organizations and external partner channels, and focus on the enhancement of partner communication and reduction in channel management costs. However, data security and privacy aspects are expected to limit the market growth. Apart from drivers and restraints, there are a few lucrative opportunities for PRM solution providers. Business intelligence (BI) for better channel performance and the incorporation of AI into PRM to optimize partner engagement are some of the opportunities for vendors in the PRM market. These opportunities are expected to present new market growth prospects for PRM vendors.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact analysis on the global PRM market

The impact of the COVID-19 pandemic on the market is covered throughout the report. The pandemic has had a negative impact on the PRM market. Organizations use PRM solutions to enhance agility between their business functions and channel partners. The solutions primarily help companies in automating customer service functions and decreasing manual processing costs related to promotional funds management, order management, warranties, and returns processing. They can lower collateral distribution costs and promote self-service transactions through online inquiries (for example, order status, account status) and self-training programs. The deployment of PRM solutions, either in cloud or on-premises, helps organizations maintain consistency and authenticity across their partner management.

Market Dynamics

Driver: Need to control the functional relationship between organizations and external partner channels

In the current competitive market scenario, and companies are finding it difficult to differentiate their offerings. The dizzying rate of transformation is making it even challenging. The rate of producing, selling, and pivoting has increased over the years. To stay ahead of the curve, companies are rapidly reaching out to sales partners to facilitate rapid growth. Sales partnerships enable businesses to expand into new territories.

To improve channel loyalty and reach, channel managers are announcing new market opportunities and providing branded solution offerings to their partners. As per a recent report by Accenture, a majority of tech companies are dependent on indirect sales channels to promote their business. For instance, Cisco would generate one-third of its sales through indirect channels and 80% of revenue through channel partners. Hence, the need to control the functional relationship between organizations and external partner channels is expected to drive the PRM market growth.

Restraint: Data security and privacy aspects

PRM solutions hold a variety of data, including business-critical data and customer data. Privacy issues can make PRM unviable. Mobile operators are afraid of compromising the security of customer data because it would result in the loss of customers. Regulations such as General Data Protection Regulation (GDPR) also hold the PRM market accountable for data privacy. Enterprises are sensitive when it comes to data sharing and accessibility. Therefore, PRM solution and service providers need to maintain the highest level of privacy and security. Cybersecurity is one of the most important factors for smooth business operations. In recent times, there has been a huge rise in the number of data breaches and cyber attacks. Cyberattacks increased by 600% from 2016 to 2017.

The PRM solutions include sales, services and customer support, call centers, sales force automation systems, and order management. One of the problems with PRM is the trade-off between security and convenience. For user convenience, PCs, laptops, tablets, and mobile phones can be interface devices for accessing PRM systems. All these devices need to be connected to the internet, which can invite attacks such as Denial Of Service (DOS), malware, and identity thefts. Companies are finding it difficult to comply with GDPR. It is estimated that about 80% of companies are failing to comply with GDPR, which can result in fines and long-term problems. To provide seamless experiences and growth to customers, PRM providers need to provide a fully secure system to achieve business growth for customers while easily complying with regulations.

Opportunity: Business intelligence for better channel performance

Companies adopt channel partner techniques to market their products/services. However, these techniques can be a challenging task to effectively manage partners. The market is getting complex due to its evolving nature. Now-a-days, new partner types and partner programs are emerging to attract and retain partners. Utilizing the latest technologies such as AI and analytics for providing BI can further boost the adoption of PRM solutions. BI turns data into actionable insights that help organizations in strategic and tactical business decision-making. BI quickly provides channel visibility, tracks partner performance, and helps partners uncover opportunities to grow their business. It can help companies in making data-driven sales and marketing decisions. Therefore, the PRM solutions embedded with BI for better channel performance are an opportunity for players in the global PRM market.

Challenge: Complex data and system integration issues

Channel management is a complex process because it manages various business aspects. The channel management process varies from company to company; there would be different structures for SME, large enterprise, and government organizations. The configuration of PRM solutions is dependent on organizational structures as it defines the direct relationship between managers and subordinates. In the case of resellers or partner networks, structures are different and offer challenges to implement a PRM solution. Employees need special skills to use PRM solutions, and in the case of new staff, special training needs to be provided. Large enterprises have old systems in place, which might be a challenge for PRM providers while integrating them with PRM solutions. Hence, complex process and system integration issues offer challenges to the PRM providers.

Solutions segment to hold a larger market size during the forecast period

PRM solutions assist companies in automating customer service functions and decreasing manual processing costs related to promotional funds management, order management, warranties, and returns processing. Due to such benefits offered by PRM solutions, their demand across industry verticals is expected to increase during the forecast period. Major reasons behind the decline of PRM solutions during COVID-19 pandemic across the globe are reduced profit margins and less allocation of IT budgets. These reasons lead to low investments in new subscriptions. The demand for consulting, integration, and implementation services has also decreased with low technology spending on new subscriptions. These trends are expected to decrease the demand for PRM solutions and services.

On-premises deployment type to hold a larger market size in 2020

In the on-premises type of delivery model, software or solutions are installed and operated from customers’ in-house server and computing infrastructure. The cost of installing on-premises solutions is included in the Capital Expenditure (CAPEX) of companies. This approach is mostly adopted for applications that involve the processing of sensitive and confidential data. Nowadays, every organization generates vast amounts of data due to the use of ML, IT devices, sensors, clickstreams, and many other devices. The on-premises deployment type enables organizations to ingest data into their own databases, thereby maintaining data security. In the on-premises deployment type, companies must install the required hardware as well as software. In addition, they must maintain hardware, implement cybersecurity applications, train staff, update new versions, and arrange backup for data or damaged parts. Due to such huge initial upfront costs and the need for manual intervention, the on-premises deployment type can be afforded by large enterprises.

Large enterprises to hold a majority of the market share during the forecast period

Large enterprises have a large corporate network and many revenue streams. They are keen to invest in new and latest technologies to effectively run their business. The PRM market has a strong hold in large enterprises, as the partner network of large enterprises is more complex than SMEs. The existing system integration with advanced PRM solutions is a challenge faced by large enterprises. This challenge can be easily resolved with robust integrations, and training and support services provided by PRM vendors. These enterprises prefer to implement solutions and their associated services on-premises. This deployment type can assist them in increasing their profits and maintaining data confidentiality. The market size of the large enterprises segment in the global PRM market is expected to hold a larger market size as compared to the SMEs segment during the forecast period.

IT and Telecommunications industry vertical to hold a majority of the market share during the forecast period

This industry vertical faces challenges to maintain IP copyrights, and it deals with cross-border data privacy and security challenges by regulators and anti-trust inquiries. The IT and telecommunicationindustry vertical requires to synchronize enterprise customers and their partners in terms of language, time, currency, and platform. Communication service providers and customers’ businesses operating globally need multi-currency support. The industry vertical is adopting PRM solutions for overcoming these challenges. Hence, the industry vertical is expected to hold the highest market share in the global PRM market.

To know about the assumptions considered for the study, download the pdf brochure

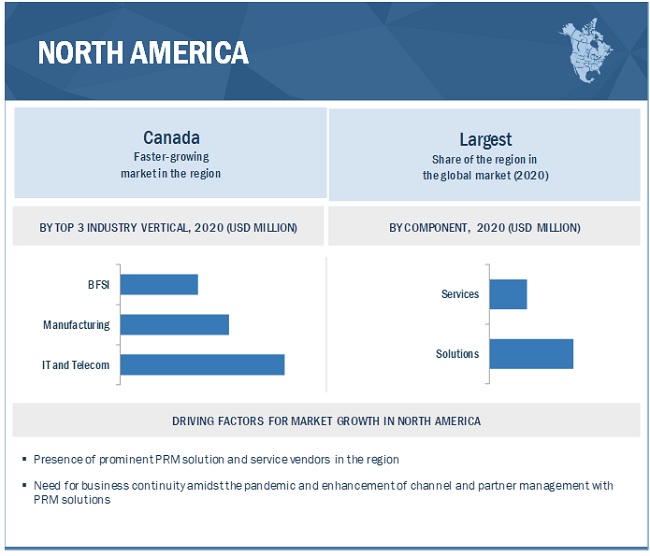

North America to account for the largest market size during the forecast period

The global PRM market by region covers five major geographic regions, namely, North America, Asia Pacific (APAC), Europe, Middle East & Africa (MEA), and Latin America. North America is expected to account for the largest market size during the forecast period. The market in this region is projected to be the most promising for major verticals, such as IT and telecom, and BFSI. The size of the PRM market in North America is projected to grow steadily during the forecast period. In this report, North America is further segmented into the US and Canada. The US is projected to be one of the major revenue contributors for the growth of the PRM market in North America. Canada is also projected to present major growth opportunities for PRM solutions & service providers. North America is increasingly impacted by the COVID-19 pandemic. According to the Bureau of Economic Analysis, which is maintained by the US Department of Commerce, 11.6% of the US economic output comes from the manufacturing vertical. Due to the lockdown, various manufacturing firms have halted their operations and are, hence using few cloud services.

Key Market Players

The PRM vendors have implemented various types of organic as well as inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions, to strengthen their offerings in the market. The major vendors offering PRM solutions and services globally are Allbound (US), Channeltivity (US), Oracle (US), Salesforce (US), Impartner (US), LogicBay (US), Magentrix (Canada), ZINFI Technologies (US), Zift Solutions (US), Mindmatrix (US), PartnerStack (Canada), ChannelXperts (Germany), Creatio (US), AppDirect (US), Webinfinity (US), PartnerPortal.io (Canada), Kiflo (France), Crossbeam (US), Everflow (US), Affise (Lithuania), WorkSpan (US), LeadMethod (US), Sharework (France), Agentcis(Australia), and CoSell (US).

The study includes an in-depth competitive analysis of key players in the PRM market with their company profiles, recent developments, COVID-19 developments, and key market strategies.

Scope of the report

Report Metric | Details |

Market size available for years | 2016–2026 |

Base year considered | 2019 |

Forecast period | 2020–2026 |

Forecast units | Billion (USD) |

Segments covered | Component (Solutions & Services), Deployment Type, Organization Size, Vertical, and Region |

Geographies covered | North America, APAC, Europe, MEA, and Latin America |

Companies covered | Allbound (US), Channeltivity (US), Oracle (US), Salesforce (US), Impartner (US), LogicBay (US), Magentrix (Canada), ZINFI Technologies (US), Zift Solutions (US), Mindmatrix (US), PartnerStack (Canada), ChannelXperts (Germany), Creatio (US), AppDirect (US), Webinfinity (US), PartnerPortal.io (Canada), Kiflo (France), Crossbeam (US), Everflow (US), Affise (Lithuania), WorkSpan (US), LeadMethod (US), Sharework (France), Agentcis(Australia), and CoSell (US) |

This research report categorizes the PRM market based on component, deployment type, organization size, vertical, and region.

Based on the component:

- Solutions

- Services

- Managed Services

- Training, Consulting, and Implementation

Based on the deployment type:

Based on the organization size:

Based on the vertical

- BFSI

- Retail and Franchising

- Healthcare and Life Sciences

- Manufacturing

- IT and Telecom

- Others

Based on the region:

- North America

- Europe

- APAC

- MEA

- Latin America

- Brazil

- Rest of Latin America

Recent Developments

- In March 2020, Allbound launched a new integration solution for HubSpot. The new integration solution can automatically integrate contacts and opportunities from partner referrals from Allbound and sync data inside of the HubSpot platform with an all-new Allbound workflow action.

- In September 2020, Alcatraz formed a partnership with Channelitivity. The aim of this partnership is to use Channeltivity’s PRM platform to develop a channel and training program to boost its biometric access control partners’ success.

- In June 2020, Impartner launched the Impartner Channel Ignite PRM Package. The company designed a new tailored solution in order to help companies stimulate the performance of their channel in a challenging business environment.

- In July 2019, Salesforce updated its PRM platform. The company added AI and self-reporting capabilities in its PRM platform to help channel managers to optimize partner engagement