< Key Hightlight >

[306 Pages Report] The global customer success platforms market size is expected to grow from USD 1.0 billion in 2020 to USD 2.5 billion by 2025, at a Compound Annual Growth Rate (CAGR) of 20.4% during the forecast period. Growing demand for advanced analytical-based solutions to monitor customer scores and reduce churn rates and advent of cloud computing in customer success to drive the growth of customer success platforms market. Data security and privacy concerns and difficulty in synchronizing CX data collected from different touchpoints within different domains are one of the major challenges in the customer success platforms market. Moreover, data aggregation and synchronization from multiple silos as one of the key restraining factor in the market.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on Global Customer Success Platforms Market

COVID-19 would have an impact on all the elements of the technology sector. The global ICT spending is estimated to decline by 4%–5% by the end of 2020. The hardware business is predicted to have the most impact on the IT industry. Due to the slowdown of hardware supply and reduced manufacturing capacity, IT infrastructure growth has slowed down. Businesses providing platforms and services are also expected to slow down for a short span of time. However, the adoption of collaborative applications, analytics, security solutions, and AI is set to increase in the remaining part of the year.

In a short time, the COVID-19 outbreak has affected markets and customers' behavior, and substantially impacted economies and societies. With offices, educational institutions, and manufacturing facilities shutting down for an indefinite period; major sports and events being postponed; and work-from-home and social distancing policies in effect, businesses are increasingly looking for technologies to assist them in these difficult times. Analytics professionals, business intelligence professionals, and professionals providing expertise in advanced analytics such as AI and ML are called for their expertise to help executives make business decisions on how to respond to new business challenges caused by the COVID-19 outbreak. From the silent generation to baby boomers using Zoom for the first time, to legacy-reliant organizations modernizing in cloud, there is a huge wave of ‘digital acceleration’ building toward a ‘new normal.’ The efficient remote working is being observed across verticals that previously thought it is impossible. The work-life balance may be strange, but employees are now being trusted more openly by their employers to work from home in an environment that suits their needs. In light of this monumental shift to remote working and cloud-based technologies, the long-term effects of COVID-19 as a catalyst for change in all aspects of life would be profound, and a strong instance of this can be found in the contact center industry.

Businesses are opting for customer success platforms for managing voluminous customer data and meeting customer expectations. Industries such as eCommerce, logistics, online learning, food delivery, and online business collaboration are witnessing a huge spike in their business, which is straining the limits of their customer-facing or internal applications. Businesses are facing the immediate need to speed up and scale out their applications, for which one of the fastest approaches is to deploy customer success platforms. The customer success platforms market is witnessing huge demand due to the increase in need to unified customer view and reduce churn rates during the COVID-19 crisis.

Market Dynamics

Driver: Advent of cloud computing in customer success

The demand for cloud-based solutions is increasing due to the reliable, scalable, flexible, and efficient IT management nature of these solutions. Small enterprises are keen on adopting advanced solutions to combine real-time self-service analytics with cloud-based solutions and enhance the market growth in the fastest possible time with minimal capital investments. Cloud-based customer success platforms provide highly scalable tools that offer easy data storage and access. The advent of cloud-based solutions is driving automation and improving the predictive accuracy of customer success. This, in turn, addresses various key challenges, including data collection and reporting, decision-making, and data optimization, thereby providing better insights to companies and Customer Success Managers (CSMs). The adoption of cloud-based customer success platforms has driven the adoption of customer success platforms among small enterprises and is expected to increase due to continuous Research and Development (R&D) investments by vendors. By deploying appropriate cloud-based solutions, organizations proactively address the concerns related to real-time optimization and make faster decisions, thereby improving the overall operational efficiency.

Restraint: Data aggregation and synchronization from multiple silos

The aggregation of data across channels, managed by different departments, may pose restraints to distributed companies. Businesses gather significant amounts of data related to customer behavior and expectations in order to enhance the customer feedback process. The contact between companies and customers generates data, and when the data is not synchronized with other technologies, organizations face problems in synchronizing a large amount of information in a structured format. According to stats published by Acxiom in 2017, 70% of marketers admit that they have suboptimal or no ability to integrate customer data between online and offline sources.

Data is collected from multiple silos, such as company websites, web, mobiles, social media, and emails, and businesses have to categorize it based on customer needs and expectations. This gathered data differs from one another, making it difficult for organizations to combine it, since it has to be structured in different forms. Customer success is not helpful when the organizational data is not synchronized. A large amount of structured and unstructured data requires significant resources, such as money, time, and expertise, to analyze. Hence, it is difficult to synchronize the customer data in a general format from each touch point.

Opportunity: Emergence of AI and ML to better monitor customer journey

With the rising competition, organizations are embracing advanced technologies, such as AI and ML, to stay ahead of their competitors. AI has numerous applications in the field of customer success, such as churn prediction, customer behavior analysis, and customer journey monitoring. AI can make CRMs and customer success applications smarter through the use of advanced algorithms. These systems are capable of generating automated insights about issues and behaviors for helping companies understand their customers. Furthermore, AI-embedded chatbots can improve customer experience and satisfaction, resulting in enhanced revenue and profits.

Without being explicitly programmed, ML-enabled customer success platforms utilize data to generate accurate insights. The systems sense customer preferences and suggest appropriate solutions to trigger their behavior. ML-enabled customer success systems can also improve workflow by initializing personalized customer interactions. With respect to customer success, these leading technologies can tap into numerous latent areas to intensify customer success.

Challenge: Difficulty in synchronizing CX data collected from different touchpoints within different domains

It is extremely important to exchange the data extracted out of multiple sources across different domains in organizations. If there is a certain change needed in the product by a customer and it is not well correlated with the manufacturing and research domain of the organization, it can create disinterest in the mind of the customer for the product. As a result of consistent growth and the complexity of touchpoints in the customer feedback process, businesses gather significant amounts of data related to customer behavior and expectations. Customers’ contacts with companies generate data, and when the data is not synchronized with other technologies, organizations face problems related to synchronizing this large amount of information in a structured format. Data is collected from different touchpoints, and businesses have to categorize it based on customer needs and expectations. Data collected from different touchpoints, such as company websites, web, mobiles, social media, and emails differ from one another, making it difficult for organizations to combine them together since they have to be structured in different forms. A large amount of structured and unstructured data requires significant resources, such as money, time, and expertise to analyze. Thus, it is difficult to synchronize the customer data in general format from each touchpoint.

By component, the services segment is expected to record the higher market growth rate during the forecast period

By component, the customer success platforms market is segmented into platforms and services. The services segment is expected to record higher growth rate during the forecast period. With customer data increasing day-by-day, it becomes essential for enterprises to adopt customer success services for addressing marketing requirements in the continuously evolving customer global demand landscape. The services segment is further categorized into two major types: professional services and managed services. These services help organizations streamline their marketing operations.

By application, the sales and marketing optimization segment to account for the highest market share during the forecast period

In the customer success platforms market by application, the sales and marketing segment is expected to have the largest market share during the forecast period. Customer success platforms have emerged as crucial elements in sales and marketing optimization, as they allow marketers and sales executives to directly engage with their target audience based on insights gathered from data. The platforms provide visibility around customer activities, including their onboarding status, adoption trends, and health scores. It allows them to have all the data, while interacting with customers, which enables them to provide a personalized experience.

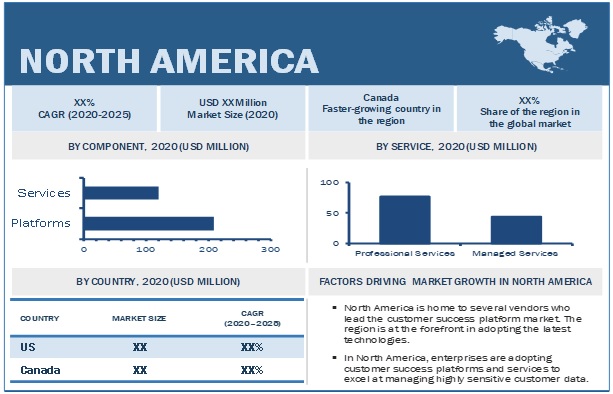

North America to account for the largest market size during the forecast period

North America is expected to hold the largest market size in the global customer success platforms market during the forecast period. The increasing demand for advance analytical-based solutions to monitor customer journey and reduce churn rates would fuel the demand for customer success platforms in North America. The advent of cloud computing in customer success, and increasing in data volume dur to growing digitalization are some of the factors driving the market growth in Europe. APAC is expected to record the fastest growth rate during the forecast period. The adoption of customer success technology by different verticals, such as BFSI and IT and telecom, is expected to contribute to the growth of the market in APAC region. The increasing number of players across different regions is further expected to drive the customer success platforms market.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Salesforce (US), Cisco (US), HubSpot (US), Gainsight (US), Freshworks (US), Totango (US), Amity (Canada), Strikedeck (US), ChurnZero (US), SmartKarrot (US), ClientSuccess (US), Bolstra (US), UserIQ (US), Planhat (Sweden), Salesmachine (US), Catalyst (US), AppsForOps (Australia), Armatic (US), CustomerSuccessBox (US), Clientshare (UK), Wootric (US), ZoomInfo (US), Akita (Ireland), Intercom (US), WalkMe (US), and Custify (Romania).

Scope of the Report

Report Metric | Details |

Market size available for years | 2014–2025 |

Base year considered | 2019 |

Forecast period | 2020–2025 |

Forecast units | Billion (USD) |

Segments covered | Component (Platforms & Services), Services, Application, Deployment Mode, Organization Size, Vertical, and Region |

Geographies covered | North America, Europe, APAC, MEA, and Latin America |

Companies covered | Salesforce (US), Cisco(US), HubSpot (US), Gainsight (US), Freshworks (US), Totango (US), Amity (Canada), Strikedeck (US), ChurnZero (US), SmartKarrot (US), ClientSuccess (US), Bolstra (US), UserIQ (US), Planhat (Sweden), Salesmachine (US), Catalyst (US), AppsForOps (Australia), Armatic (US), CustomerSuccessBox (US), Clientshare (UK), Wootric (US), ZoomInfo (US), Akita (Ireland), Intercom (US), WalkMe (US), and Custify (Romania) |

Scope of the Report

The research report categorizes the customer success platformsmarket to forecast the revenues and analyze trends in each of the following subsegments:

By Component

- Platforms

- Services

- Professional Services

- Consulting

- System Integration and Implementation

- Support and Maintenance

- Managed Services

By Application

- Sales and Marketing Optimization

- Reporting and Analytics

- Customer Segmentation

- Risk and Compliance Management

- Customer Service

- Customer Onboarding

- Others (revenue management, customer engagement, workflow management, and project administration)

By Deployment Mode

By Organization Size

By Vertical

- BFSI

- Retail and eCommerce

- Healthcare and Life Sciences

- Transportation and Logistics

- Government and Public Sector

- Energy and Utilities

- IT and Telecom

- Manufacturing

- Others (education, Media and Entertainment, and Travel and Hosptality)

By Region

- North America

- Europe

- APAC

- MEA

- Latin America

Recent Developments

- In May 2020, Gainsight, the Customer Success company announced the first complete customer success ecosystem—Gainsight Sightline, the only community-enhanced customer success technology exchange in the market.

- In April 2020, HubSpot, launched CMS Hub — a content management system that offers speed, security, and scalability to rapidly growing businesses. CMS Hub comprises two tiers, Enterprise and Professional, giving companies the freedom to choose a CMS offering best suited to their stage of growth.

- In February 2020, Salesforce acquired Evergage, a personalization and customer data platform provider that offers real-time, cross-channel personalization, and ML capabilities through its solutions. The acquisition would complement Salesforce Marketing Cloud’s robust customer data, audience segmentation, and engagement platform, enabling companies to deliver more relevant experiences during the moments of interactions across the entire customer journey.

- In July 2019, HubSpot announced that it offers free email creation, sending, and analytics as part of the free HubSpot CRM. HubSpot provides users the tools they need to see the full view of the customer journey and ultimately provide a more cohesive front end experience for their customers..

- In May 2019, Gainsight, the customer success company, announced today Pulse+, a digital subscription service for professional development, community, and career fellowship in the customer success market.