< Key Hightlight >

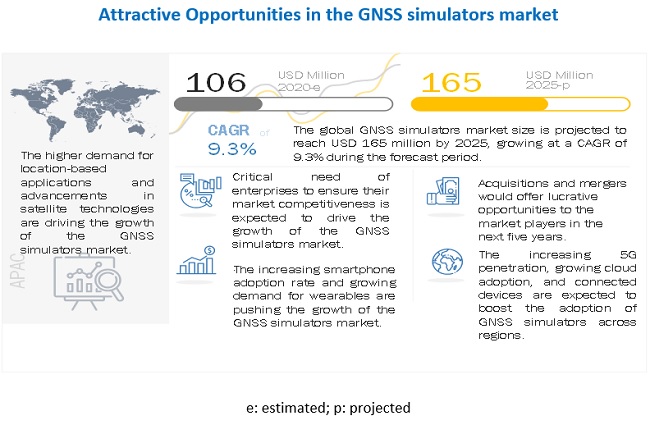

[232 Pages Report]The global GNSS simulators market size to grow from USD 106 million in 2020 to USD 165 million by 2025, at a Compound Annual Growth Rate (CAGR) of 9.3% during the forecast period. Various factors such as rapid penetration of consumer IoT, contribution of 5G in enabling ubiquitous connectivity, and increasing use of wearable devices utilizing location information are expected to drive the adoption of the GNSS simulators hardware, software, and services.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on global GNSS simulators market

COVID-19 has shocked the world and sent economies spinning. It was late-2019 when the virus first appeared in the Chinese city of Wuhan. Initially, it only affected China, but its effects started being felt around the globe, with many countries implementing lockdown. The volunteers from Slovakian company Sygic and other technology companies developed a mobile application, aiming to slow down the spread of COVID-19. The technology used GNSS and Bluetooth sensors to determine if the user came into contact with an infected person in the last 14 days. According to a study by Science Daily published in September 2020, the quality of GNSS reflectometry measurements may have improved significantly during the pandemic because of the lack of cars parked near the ground station. The researchers showed that parked cars significantly reduced the quality of the elevation data by scattering the GNSS signals, causing them to be reflected several times before they reached the antenna, like a cracked mirror.

In the year 2019, many Communications Service Providers (CSPs) started trials and rollouts of 5G networks. Many countries were getting ready for rollouts through spectrum auctions, infrastructure contracts, and other initiatives. But due to the advent of the COVID-19 pandemic there has been a huge impact on both rollouts and readiness for 5G. Countries have started witnessing delays in their spectrum auctions. Technologies deployed in 5G network contain a wide bandwidth for better time resolution, which makes 5G networks a convenient environment for accurate positioning. Hence, it also plays an important role in GNSS. So, the COVID-19 pandemic has indirectly impacted the GNSS as 5G/GNSS will be the core of future location engines for many applications in the Location-Based Services (LBS) and IoT domains.

Market Dynamics

Driver: Rapid penetration of consumer IoT

Consumer IoT refers to the interconnected environment of consumer electronics and devices. It is a key technology driver for the adoption of GNSS simulators. A rapid increase has been witnessed in the use of smart and connected consumer devices, such as self-driving cars, drones, smart sensors, connected homes, and wearable devices that are integrated with GNSS chip to enable real-time data communication. These devices are tested using GNSS simulators. IoT offers a variety of new devices and service options that have the potential to make the lives and jobs of consumers easier.

IoT plays a significant role in a broad range of applications, such as navigation, mapping, and location-based services. For example, in China, the Internet of Vehicles is catching momentum to provide a more convenient and seamless ride to consumers. IoT-enabled cars have GNSS chips integrated into them, which assist the drivers in driving the vehicles efficiently, and concerned agencies can track their locations for response in case of emergencies. GNSS chips are also being integrated into sensors and wearables to track data from human activities, such as walking, running, cycling, trekking, and swimming. Such IoT applications are leading to a rise in the need for precise GNSS simulators to test various consumer devices. Thus, the growing penetration of consumer IoT products would drive the growth of the GNSS simulators market.

Restraint: Lack of digital infrastructure

Lack of advanced digital infrastructures, such as internet connectivity and ICT infrastructure, is a key factor restraining the adoption of digital, location-based business models and services. Some countries have taken steps to build digital infrastructure, but many developing countries are still lagging in terms of digital advancements. Such a situation results in a digital divide, which refers to uneven access to, use of, or impact of ICT between different geographical, social, or geopolitical groups. A digital divide limits the ability to exploit many basic utilities of the GNSS industry. In addition, poor integration of business workflows of multiple industries with positioning infrastructure in some of the developing countries further limits the realization of the full potential of GNSS technology.

Opportunity: Growing demand for UAVs

Nations such as the US, the UK, and Australia are providing permits or licenses to operate UAVs commercially. The UAVs are integrated with GNSS chips for tracking, recording, and communicating real-time data. In 2012, the Federal Aviation Administration (FAA) enabled law enforcement agencies to fly UAVs that weigh less than 25 pounds below 400 feet. The agencies can use UAVs for training, but they need to prove their expertise before they are granted operational permits. Part 107 of FAA regulations cover a wide range of government and commercial uses for UAVs weighing less than 55 pounds. Companies are developing GNSS-integrated UAVs, customized for different applications to track their location continuously. The use of UAVs/Unmanned Ground Vehicles (UGVs) is not fully commercialized in all the geographical regions due to stringent government regulations. UGVs find applications in agricultural surveys, enabling agriculturists to achieve a high level of autonomy to enhance productivity and profitability. To achieve precise and real-time outputs from UAVs, they need to be tested under different conditions using GNSS simulators before they are exposed to live testing. Hence, the growing demand of UAVs would result in an increased need for GNSS simulators.

Challenge: Increase in jamming and spoofing attacks

Jamming and spoofing are the key challenges faced by GNSS users. Jamming refers to intentional interference, i.e., intended radiation of electromagnetic signals at GNSS frequencies to suppress weak GNSS signals such that they cannot be acquired and tracked by GNSS receivers. These jammers are used for military applications. Personal Protection Device (PPD) jammers are prohibited in the majority of the nations, but the use of these jammers is on the rise, as they are easily available on the internet. Apart from intentional interference, there exist cases of unintentional interference as well, wherein some GNSS bands are shared with certain radars and amateur radio. PPDs cause most of the jamming incidents due to their easy availability. For instance, a truck driver used a PPD and crossed the Newark airport regularly, triggering major problems for the receivers of the Ground-Based Augmentation System (GBAS) installed in the locality. Jamming is a problem faced by GNSS companies and needs to be addressed on priority.

Spoofing refers to the generation and transmission of fake GNSS signals aiming to lead a GNSS receiver off track. GNSS receivers are not aware of such attacks. Spoofing is more challenging when compared to jamming, as complex GNSS signal structures need to be replicated, usually for multiple GNSS signals parallel. For instance, in November 2017, an unintentional spoofing incident took place at the ION GNSS+ conference in Portland. A Radio Frequency Constellation Simulator (RFCS) manufacturer accidentally emitted spoofing signals within the exhibition hall. The emission caused multiple smartphones to transfer the lock to the spoofing signal. As the RFCS signal was set for a future time, it resulted in several Apple iPhones losing their security certificates and could not be unlocked anymore. The awareness regarding spoofing attacks is increasing slowly, and the efforts to achieve the required level of resilience from such attacks need to be doubled.

Vehicle assistance system application segment to have the highest CAGR during the forecast period

The GNSS simulators market by application has been segmented into navigation, mapping, surveying, Location-Based Services (LBSs), vehicle assistance systems, and others (timing and synchronization, gaming, weather forecasting, telematics). Advanced driver assistance systems use radar, video, or ultrasonic sensors to monitor the surrounding areas in relation to vehicle data, such as speed or acceleration. Driver assistance systems offer features that provide a driver with essential information and automate difficult or repetitive tasks to increase car safety on the road contributingto the growth of vehicle assistance system application.

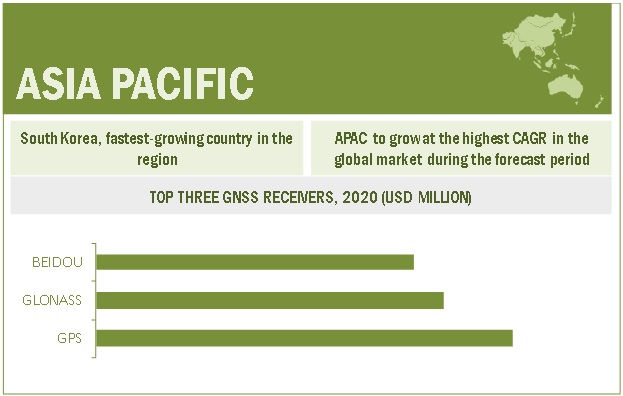

Asia Pacific to grow at the highest CAGR during the forecast period

North America is expected to hold the largest market size in the global GNSS simulators market. In contrast, Asia Pacific (APAC) is expected to grow at the highest CAGR during the forecast period. The major drivers for the growth of the market in APAC are the increasing rate of urbanization and the growing population. Due to the growth of IoT and portable consumer electronics devices in countries such as China, Japan, and South Korea, the APAC GNSS simulators market will continue to grow. The commercialization of IoT technology and the need for further advancements to leverage the technology to the maximum are expected to drive the adoption of GNSS solutions in the region.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The GNSS simulators vendors have implemented various types of organic and inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. The major vendors in the global GNSS simulators market include Spirent Communications (US), Rohde & Schwarz (Germany), Orolia (US), Hexagon (Sweden), Syntony GNSS (France), VIAVI Solutions (US), Keysight Technologies (US), u-blox (Switzerland), CAST Navigation (US), Accord Software and System (India), IFEN (Germany), Racelogic (UK), Teleorbit (Germany), iP-Solutions (Japan), Pendulum Instruments (Poland), Saluki Technology (Taiwan), Shanghai Huace Navigation Technology Ltd (China), Averna (Canada), GMV NSL (England), Brandywine Communications (US), Jackson Labs Technologies (US), Hunan Shuangln Electronic Technology (China), Work Microwave (Germany), Qascom (Italy), and M3 Systems (France). The study includes an in-depth competitive analysis of these key players in the GNSS simulators market with their company profiles, recent developments, and key market strategies.

Scope of the Report

Report Metric | Details |

Market size available for years | 2016–2025 |

Base year considered | 2019 |

Forecast period | 2020–2025 |

Forecast units | USD Million |

Segments covered | Component, type, application, GNSS receivers, vertical, and region |

Geographies covered | North America, Europe, APAC, Latin America, and MEA |

Companies covered | Spirent Communications (US), Rohde & Schwarz (Germany), VIAVI Solutions (US), Hexagon (Sweden), Keysight Technologies (US), u-blox (Switzerland), Orolia (US), CAST Navigation (US), Accord Software and System (India), IFEN (Germany), Racelogic (UK), Syntony GNSS (France), Teleorbit (Germany), iP-Solutions (Japan), Pendulum Instruments (Poland), Saluki Technology (Taiwan), Shanghai Huace Navigation Technology Ltd (China), Averna (Canada), GMV NSL (England), Brandywine Communications (US), Jackson Labs Technologies (US), Hunan Shuangln Electronic Technology (China), Work Microwave (Germany), Qascom (Italy), and M3 Systems (France) |

This research report categorizes the GNSS simulators market based on components, type, applications, GNSS receiver, vertical, and regions.

By Component:

- Hardware

- Software

- Services

- Professional Services

- Managed Services

By Type:

- Single Channel

- Multichannel

By GNSS Receiver:

- GPS

- GLONASS

- Galileo

- BeiDou

- Others (NavIC and QZSS receivers)

By Application:

- Navigation

- Mapping

- Surveying

- Location-Based Services (LBSs)

- Vehicle Assistance Systems

- Others (timing and synchronization, gaming, weather forecasting, telematics)

By Vertical:

- Military and Defense

- Automotive

- Consumer Electronics

- Aerospace

- Marine

- Other end users (agriculture, construction, and rail and road)

By Region:

- North America

- Europe

- UK

- Germany

- France

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- Rest of APAC

- MEA

- UAE

- South Africa

- Rest of MEA

- Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In December 2020, Hexagon|NovAtel introduced a new marine-certified GNSS receiver for nearshore applications named MarinePak7. It is a multi-constellation, multi-frequency receiver that has been specifically engineered to receive Oceanix Correction Service from NovAtel, providing horizontal accuracy up to three centimeters (95%) in a marine environment.

- In October 2020, VIAVI Solutions and EF Johnson Technologies announced new automated test capabilities for KENWOOD Viking VM6000 and VM7000 series radios, and high-power VM radio models VM5730H, VM7630H, and VM7730H, on the VIAVI 3920B Radio Test Platform and 8800SX Digital Radio Test Set.

- In August 2020, Spirent Communications introduced SimIQ for more efficient GNSS testing during product development.

- In September 2019, Spirent Communications announced the enhancement for the GSS9000 Series GNSS constellation simulator. The enhancement will provide improved capability, flexibility, and performance to meet the ever-more-demanding test needs of high-performance satellite navigation systems.

- In September 2018, Rohde & Schwarz updated its R&S SMW200A GNSS simulator by adding GPS L5 and Galileo E5 simulation capabilities.