< Key Hightlight >

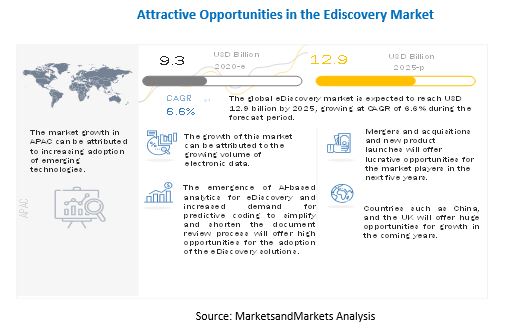

[241 Pages Report] MarketsandMarkets estimates the global eDiscovery market size to grow from USD 9.3 billion in 2020 to USD 12.9 billion by 2025, at a Compound Annual Growth Rate (CAGR) of 6.6% during the forecast period. The key factors that are expected to drive the growth of the market are focus on proactive governance with data analytics and the emergence of new content sources, increase in the number of litigations across the globe, increase in ESI and social media penetration, and varying structure of regulatory policies. However, increasing chances of cyberattacks and data theft activities during the COVID-19 pandemic and the lack of a skilled professional workforce are expected to limit the market growth. Apart from the drivers and restraints, there are a few lucrative opportunities for eDiscovery solution providers. The emergence of AI-based analytics for eDiscovery and increased demand for predictive coding to simplify and shorten the document review process are some of the opportunities for the vendors in the eDiscovery market. These opportunities are expected to present new market growth prospects for eDiscovery vendors.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact analysis on the global eDiscovery market

Business and economic conditions have changed due to COVID-19 outbreak, which has started in early 2020. Since then eDiscovery professionals are considering business revisions and making decisions to support the collection, processing, and review of ESI. The most discussed topic among business, legal, and IT professionals in the eDiscovery ecosystem is how to plan and execute the core eDiscovery task of collection during the pandemic. IT infrastructure and skilled workforce are the major challenges for remote collection. Furthermore, the UK announced a new strain of COVID-19 in November 2020 that has forced a change in the working norms of the country. According to WHO, this new strain has been detected in eight European countries. As a result, countries across the globe have banned travel from/to European and middle east countries. The impact of COVID-19 is believed to be short-term; however, it may have a significant effect on the businesses, forecast to a significant extent for a minimum of 8 to 12 months. With the introduction of new practices, such as the work from home and social distancing, virtual private network connectivity has led to the requirement and adoption of cloud-based eDiscovery solutions.

The impact of the COVID-19 on the market is covered within report. The pandemic has had a negative impact on the eDiscovery market. Due to the COVID-19 outbreak, courts were shut down, and litigation processes were on hold. This led to organizations investing more in eDiscovery solutions and services to continue operations. Governments are announcing packages to help businesses during this pandemic, with a special focus on Small and Medium-sized Enterprises (SMEs).

Market Dynamics

Driver: Focus on Proactive Governance with Data Analytics and The emergence of new content sources

There has been an increase in the adoption of digital technologies across all verticals. Enterprises across all domains have been swept by a sudden surplus of exponential growth in data over the last decade. Data is growing faster than ever. Almost 90% of the world’s existing data has been created in the last few years, and by the end of 2020, it is estimated that data would grow to 44 zettabytes approximately. Furthermore, smartphones are nearly accounting for 40% of the global eCommerce transactions and thus generate voluminous content. The increase in internet usage driven by the social network phenomenon has redefined the scope and scale of content created and distributed. There is an increased need for firms to manage this commercial and private data for enhancing their business competitiveness.

These factors have made it essential for enterprises to explore efficient database applications and implement scalable content management solutions. eDiscovery solutions and services capture, store, manage, and deliver unstructured data into a structured format, without any errors or data losses within seconds. To work more efficiently, traditional eDiscovery solutions have evolved with new components, such as intelligent information platform, to capture and manage new data. There are various factors, such as increasing business productivity and working efficiency, improving staff engagement, improving data control management, and minimizing the overall cost of data management, which enables enterprises to adopt eDiscovery solutions.

Restraint: Increasing chances of cyberattacks and data theft activities during the COVID-19

Cybersecurity is one of the most important factors for carrying on smooth business operations. In recent times, there has been a huge rise in the number of data breaches and cyberattacks—the instances of cyberattacks increased by 600% from 2016 to 2017. Most enterprises are unaware of this issue and have unprotected data and poor cybersecurity practices in place, making them vulnerable to data losses. As per data from Cybint Solutions, a cyberattack takes place every 39 seconds and, in the year 2018, 62% of businesses experienced phishing and social engineering attacks. As per a report by Norton, the US is expected to account for half of the data breach activities by 2023. As per the study by Iomart, there has been a 273% increase in the first quarter of 2020, during the pandemic as most of the data is being exchanged through web. The Federal Bureau of Investigation (FBI) reported that it had reported 12,377 COVID-19 related scams till mid-June.

eDiscovery solutions process crucial business data an enterprise. This type of data is very important for every enterprise, and this data being compromised might mean an impact on brand image, market position, and business strategy. Hence, increasing cyberattacks and data thefts are expected to restrict the growth of the global eDiscovery market.

Opportunity: Emergence of AI-based analytics and predictive coding for eDiscovery

Artificial Intelligence (AI) is slowly changing the legal profession, and advancements in AI-based analytics is expected to increase the speed and improve the quality of the eDiscovery processes. Analytics is used to discover, interpret meaningful patterns in data. Analytics helps in managing exploding data volumes, handling new types of data, such as multi-media, social, BYOD, managing eDiscovery costs, and complying with new regulations. Predictive coding is essentially an ML process that uses computer algorithms and software to determine which documents are relevant to litigations by self-learning. The self-learning of the logic required for eDiscovery is based upon a review of test documents by lawyers and attorneys. eDiscovery solutions then apply the same algorithm to a larger document group, thus making the document review process less difficult and less complex. The predictive coding makes eDiscovery reviews more efficient, thereby resulting in cost savings and skillfully countering the explosive growth in digital data. Furthermore, AI helps in image classification, text classification, audio search signature detection, translation, among other tasks. Hence, embedding AI and analytics with eDiscovery will offer opportunities for vendors operating in the market.

Challenge: High initial costs of investment, installation, and maintenance

There are many advantages of eDiscovery solutions; however, these come with costs and overheads associated with them. The licenses of these solutions are priced per user or project, and in many cases, users order fewer licenses than required in order to control their costs. The eDiscovery solution may work best under strong IT infrastructure and stable connections; however, enterprises in developing countries face continuous issues with their connectivity and IT infrastructure. Furthermore, there is a necessity for regular maintenance of the system to ensure high reliability, as these solutions process crucial enterprise data. There is a high cost associated with the collection, amalgamation, processing, review, and preservation of documents, which may deter many probable customers from implementing eDiscovery solutions and services. Hence, the high cost of installation, maintenance, and related activities is expected to act as a challenge for vendors operating in the global eDiscovery market.

Solutions segment to hold a larger market size during the forecast period

The GDPR and the US privacy laws and along with the increasing amount of data generation has have resulted in increased pressure on organizations to adopt eDiscovery solutions. Also, the threat of lawsuits for eDiscovery flaws is encouraging organizations to adopt eDiscovery solutions. Advanced analytical capabilities in eDiscovery solutions are offering customers with improved and relevant insights from data, especially during the early case assessment phase. Furthermore, to cope with the existing systems, eDiscovery vendors are offering solutions with the capability to integrate with a variety of systems and fit any IT environment, thus making it easier, faster, and cost-effective to install and use eDiscovery solutions. eDiscovery solutions enable easy and efficient implementation of the Electronic Discovery Reference Model (EDRM) model that includes identification, preservation, collection, processing, review, production, and presentation of the relevant data during legal cases leading to reduced time, costs, and manual intervention.

On-premises deployment type to hold a larger market size in 2020

The on-premises segment is expected to hold a higher share in the eDiscovery market, although companies have been focusing more on the cloud deployment type in recent times as it provides them with several benefits, such as flexibility, scalability, speed, interoperability, and reduced infrastructure costs. In the on-premises type of delivery model, software or solutions are installed and operated from customers’ in-house server and computing infrastructure. The cost of installing on-premises solutions is included in the CAPEX of companies. This approach is mostly adopted for applications that involve the processing of sensitive and confidential data. Nowadays, every organization generates vast amounts of data due to the use of ML, IT devices, sensors, clickstreams, and many other devices. The on-premises deployment type enables organizations to ingest data into their own databases and discover using eDiscovery solutions, thereby maintaining data security.

Large enterprises to hold a majority of the market share during the forecast period

Large enterprises have a large corporate network and many revenue streams. Hence, there is a huge amount of data generated by them. Large enterprises are keen to invest in new and latest technologies to effectively run their business. The eDiscovery market has a stronghold in large enterprises, as the process of litigations becomes more complex in large enterprises as compared to SMEs. The existing system integration with advanced eDiscovery solutions is a challenge faced by large enterprises, which now can be easily resolved due to the robust integration, training, and support services provided by eDiscovery vendors. These enterprises prefer to implement solutions and their associated services on-premises. This deployment type can assist them in increasing their profits and maintaining data confidentiality.

BFSI vertical to hold a majority of the market share during the forecast period

The advent of advanced technologies will play a crucial role in the growth of the BFSI vertical. Digital technologies have enabled banking customers to access real-time banking and financial information services on any device. The BFSI vertical has a plethora of data gathered from various sources, including capital markets, insurance, asset management, Automated Teller Machines (ATMs), and online transactions. Litigations in banks are a complex procedure, as a significant amount of data is to be reviewed, and the complexities faced while reviewing manual or documented entries. The usage of eDiscovery has provided more transparency and clarity in records for litigation. Furthermore, maintaining regulatory compliance and following standard procedures is an important aspect in the BFSI vertical to deal with legal cases and find relevant documents to be presented, which can be met using the eDiscovery solutions.

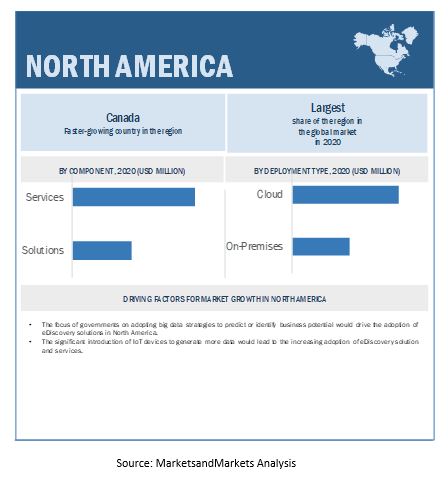

North America to account for the largest market size during the forecast period

The global eDiscovery market by region covers five major geographic regions, namely, North America, Asia Pacific (APAC), Europe, Middle East & Africa (MEA), and Latin America. North America is expected to account for the largest market size during the forecast period. North America is expected to be the most promising region for major verticals, such as government and public sector, legal, BFSI, healthcare and life sciences and IT and telecommunications. North America is heavily impacted by COVID-19. According to the Bureau of Economic Analysis (which is maintained by the US Department of Commerce), 11.6% of the US economic output comes from the manufacturing vertical. Owing to the lockdown, various manufacturing firms have halted their operations and are hence using fewer cloud services. During the COVID-19 pandemic, technologies such as AI and robotics are expected to boost the growth of several verticals by creating opportunities for innovation, but the pandemic situation has reduced manpower efforts, which may affect the working culture in the region. In this report, North America is further segmented into the US and Canada. The US is expected to be one of the major revenue contributors towards the growth of the eDiscovery market in North America. The US is one of the most developed countries, which is inclined toward innovation. The country has the infrastructure, innovation, and initiatives necessary for the evolution of the eDiscovery market. According to a recent report by CompTIA, the US holds the highest tech market share in the world, representing 32% of the total share, or approximately USD 1.7 trillion in 2020. Owing to the rapid growth in technological innovations and the increased use of the internet, the US eDiscovery market is expected to dominate the overall North American region.

Key Market Players

The eDiscovery vendors have implemented various types of organic as well as inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions, to strengthen their offerings in the market. The major vendors offering eDiscovery solutions and services globally are Microsoft (US), IBM (US),OpenText (Canada), Deloitte (US),Micro Focus (UK), ZyLAB(The Netherlands), Relativity(US), Nuix(Australia), Logikcull(US), KLDiscovery(US), Exterro(US), Thomson Reuters(Canada), Knovos(US), Casepoint(US), Nextpoint(US), DISCO(US), Veritas(US), One Discovery(US), Congruity360(US), Onna(US), Everlaw(US), Texifter(US), Allegory(US), Evichat(Canada), and Reductech(UK).

The study includes an in-depth competitive analysis of key players in the eDiscovery market with their company profiles, recent developments, COVID-19 developments, and key market strategies.

Scope of the report

Report Metric | Details |

Market size available for years | 2016–2025 |

Base year considered | 2019 |

Forecast period | 2020–2025 |

Forecast units | Billion (USD) |

Segments covered | Component (Solutions & Services), Deployment Type, Organization Size, Vertical, and Region |

Geographies covered | North America, APAC, Europe, MEA, and Latin America |

Companies covered | Microsoft(US), IBM(US), OpenText(Canada), Deloitte(US), Micro Focus(UK), ZyLAB(The Netherlands), Relativity(US), Nuix(Australia), Logikcull(US), KLDiscovery(US), Exterro(US), Thomson Reuters(Canada), Knovos(US), Casepoint(US), Nextpoint(US), DISCO(US), Veritas(US), One Discovery(US), Congruity360(US), Onna(US), Everlaw(US), Texifter(US), Allegory(US), Evichat(Canada), and Reductech(UK) |

This research report categorizes the eDiscovery market based on component, deployment type, organization size, vertical, and region.

Based on the component:

- Solutions

- Processing, Review, and Analysis

- Identification, Preservation, and Collection

- Production and Presentation

- Services

- Managed Services

- Maintenance and Support

- Training, Consulting, and Integration

Based on the deployment type:

Based on the organization size:

Based on the vertical:

- Government and Public Sector

- Legal

- BFSI

- Energy and Utilities

- Healthcare and Life Sciences

- Retail and Consumer Goods

- Manufacturing

- IT and Telecommunications

- Others

Based on the region:

- North America

- Europe

- UK

- Germany

- France

- Rest of Europe

- APAC

- China

- Japan

- ANZ

- Rest of APAC

- MEA

- KSA

- UAE

- South Africa

- Rest of MEA

- Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In May 2021, Relativity partnered with Proofpoint to integrate Proofpoint's enterprise archiving and compliance solution with Relativity's AI enabled communication surveillance platform Relativity Trace.

- In September 2020, ZyLAB announced the availability of ZyLAB Insight in its eDiscovery platform. ZyLAB Insights is an AI-based functionality that can automatically extract entity information from unstructured datasets. ZyLAB Insights will be available to all ZyLAB ONE SaaS customers across the North America and Europe regions.

- In September 2020, Relativity announced enhancements in the Relativity One solution. Relativity introduced the Aero User Interface (UI) in its eDiscovery solution, Relativity One. Aero UI helps in simplifying the complex processes of managing large volumes of data.

- In October 2020, Nuix announced its partnership with noticia. noticia is a Canada-based eDiscovery services company and is an approved Nuix migration partner to offer a low-risk migration path for Canadian government agencies, corporations, and law firms.

- In March 2020, OpenText acquired XMedius (Canada) for USD 75 million. XMedius offers solutions for secure information exchange and unified communication, enabling organizations to move their workloads to the cloud. This acquisition strengthens OpenText’s position in secure information exchange, unified communications, and digital fax.