< Key Hightlight >

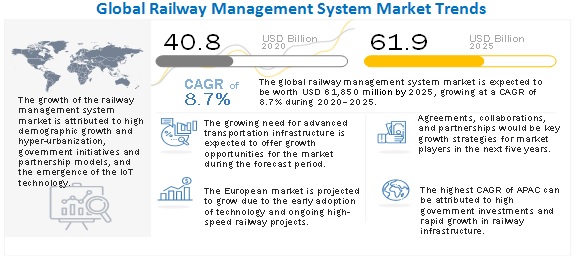

[249 Pages Report] The global railway management system market size is expected to grow from USD 40.8 billion in 2020 to USD 61.9 billion by 2025, at a Compound Annual Growth Rate (CAGR) of 8.7% during the forecast period. High demographic growth and hyper-urbanization, increase in government initiatives and public-private partnerships, adoption of IoT and other automation technologies, and rise in congestion due to aging railway infrastructure are expected to be the major factors driving the growth of the railway management system market.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Railway Management System Market

The COVID-19 pandemic significantly impacted rail operations in 2020, wherein rail services have been stalled for a quarter in many countries, and several other countries have resumed the rail operations with limited trains on track. While some of the countries have incurred severe losses, there are countries that have engaged in the total revamp of rail infrastructure and construction of new tracks and freight corridors during the imposed lockdown. The impact of COVID-19 has been severe on the market for 2020; however, the market is expected to bounce back in 2021. Remote-based monitoring and predictive maintenance technologies would be required as out-of-operations rolling stock would need proper maintenance.

Railway Management System Market Dynamics

Driver: Rise in congestion due to aging railway infrastructure

Aging railway systems limit the efficiency of resources and compromise reliability in established rail markets. New markets adopt newer, more flexible technology infrastructures, leaping over the current practices. Several current IT systems are old and complex, making data sharing difficult. They are also unable to cope with the scale of growth predicted over the next few years. Frequent network failures and system outages can have a domino effect, significantly affecting customer satisfaction.

The increasing demand for rail services is straining the existing systems and requiring the optimization of the existing passenger and freight schedules to achieve increased throughput on the current rail infrastructure. Rail freight companies are experiencing growth in trade, especially in energy and commodities areas. Harbors are experiencing serious bottlenecks, resulting in issues for connected railroads. Rail companies are increasing asset utilization and making significant investments in infrastructure to meet capacity challenges. They are also investing heavily in proper asset management, automation, and traffic control technologies.

Restraint: High initial cost of deployment

The initial cost involved in the installation of railway management solutions is high. Expenses involved in financing a railway management system project may be a major factor that can restrain the market growth. Huge Capital Expenditure (CAPEX), coupled with mounting upfront installation costs, is certainly a hurdle to the adoption of railway management system technologies across regions. The limited existing budgets for railways are a restraining factor in the deployment of advanced railway technologies and solutions by governments and private companies.

The railway management system requires a huge initial investment to set up field-level devices, replace aging infrastructure, arrange transmission networks between end users, and manage the integration of new and existing systems within railway premises. High operational and maintenance costs are also a huge concern for railway authorities.

Opportunity: Increase in globalization and need for advanced transportation infrastructure

The impact of globalization has a direct effect on the traffic of all types of railway transportation. There is a demand for increased speed, security, and reliability. Hence, the future railway transportation ecosystem must deliver solutions to satisfy the demand, from source to destination, with a high level of service, regardless of the distance traveled or the number of steps required to reach the destination. The demand from people is changing daily, and therefore, there is a need for more convenient travel solutions.

All public and private sector participants have recognized the need for better transportation infrastructure. Organizations see the potential of smarter railway transportation to address this need. Regions such as Europe, North America, and APAC are increasing their focus on building smarter rail infrastructure.

Challenge:Integration complexities with legacy infrastructure

Railway technology systems are integrated using different technology elements, such as hardware, software, and network, which can be complex to configure. The integration of different hardware devices, along with railway management system software, with legacy system infrastructure may become complex. Without strong pre-existing IT and skilled personnel, the implementation of digital infrastructure is difficult. Railway operators can do a complete overhaul of the IT system; however, costs incurred in such an overhaul would take a significant amount of time to realize. Several current IT systems are old and complex, which makes data sharing a difficult task. They are also unable to cope with the scale of growth predicted over the next few years. Frequent network failures and system outages can have a domino effect, negatively impacting customer satisfaction.

Legacy systems are often unable to integrate with new generation smart devices due to protocol issues. These systems are not capable enough to communicate efficiently with technologically advanced systems. As most of the developing countries are still relying on their legacy infrastructure, these integration complexities are expected to hinder the market growth in developing regions in the coming years. IT and network security restrictions to reduce privacy intrusion and data breaches are projected to be some of the major challenges to the growth of the railway management system market.

The services segment to have a higher growth during the forecast period

The services segment of the railway management system market is expected to have a higher growth rate during the forecast period. The railway management services have gained more traction due to higher adoption of IoT and smart technologies and increasing deployment of railway management solutions for streamlining superior rail operations and their associated activities.

By services, System Integration and Deployment segment to dominate the market during the forecast period

Under the services segment, the system integration and deployment segment is expected to dominate the market during the forecast period. System integration and deployment services help identify the need for adaptation or upgradation to support smart railways software in the existing infrastructures and avoid the restriction of such software. These services help in speed deployment, save time and costs, enable efficient working, and minimize deployment-related disruptions.

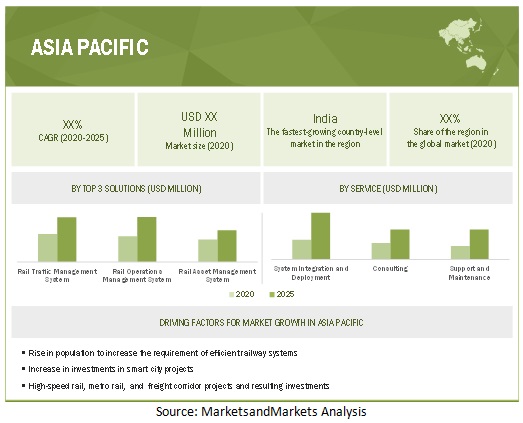

By region, Asia Pacific to record the highest growth during the forecast period

The APAC railway management system market is estimated to have strong growth in the future. The APAC region is witnessing high growth due to the increasing adoption of new technologies, rising investments for digital transformation, and the growing rail spending in APAC countries. A majority of potential economies in the region include Australia, Singapore, China, Korea, Hong Kong, and India, which are said to be rapidly investing in the rail technological transformation.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The report includes the study of key players offering railway management system solutions and services. It profiles major vendors in the global rail asset Management market. The major vendors in the rail asset management market include Siemens (Germany), Cisco (US), Alstom (France), Hitachi (Japan), Wabtec (US), Trimble (US), Atkins (UK), Uptake (US), Amadeus (Spain), and Advantech (Taiwan). These players have adopted various strategies to grow in the global railway management system market.

Scope of the Report

Report Metrics | Details |

Market size available for years | 2016-2025 |

Base year considered | 2019 |

Forecast period | 2020-2025 |

Forecast units | Value (USD Million) |

Segments covered | By Offering, Solutions, Services, Regions |

Regions covered | North America, Europe, APAC, MEA, Latin America |

Companies covered | Siemens (Germany), Cisco (US), Alstom (France), Hitachi (Japan), Wabtec (US), ABB (Switzerland), IBM (US), Huawei (China), Indra Sistemas (Spain), Honeywell (US), Fujitsu (Japan), Toshiba (Japan), Tech Mahindra (India), DXC Technology (US), Trimble (US), Atkins (UK), Uptake (US), Accenture (Ireland), Capgemini (France), Amadeus (Spain), Advantech (Waiwan), Thales Group (France), Eurotech (Italy), Frequentis (Austria), and Nokia Networks (Finland). |

This research report categorizes the C-RAN market to forecast revenues and analyze trends in each of the following subsegments:

By Offerings:

By Solutions:

- Rail Operations Management System

- Facility Management

- Revenue Management

- Workforce Management

- Rail Automation Management

- Rail Traffic Management System

- Intelligent Signalling Solution

- Real-Time Train Planning and Route Scheduling/Optimizing Solution

- Centralized Traffic Control Solution

- Rail Asset Management System

- Train Information

- Track Monitoring

- Maintenance Management

- Rail Control System

- Positive Train Control Solution

- Communication-Based Train Control Solution

- Integrated Control Solution

- Rail Communication and Networking System

- Ground-To-Train Communication Solution

- Train-To-Train Communication Solution

- Rail Security

- Rail Analytics

- Passenger Information System

- Freight Information System

By Services:

- Consulting

- System Integration and Deployment

- Support and Maintenance

By Region:

- North America

- Europe

- UK

- Germany

- France

- Rest of Europe

- APAC

- China

- Japan

- India

- Rest of APAC

- MEA

- Nigeria

- South Africa

- Rest of MEA

- Latin America

- Brazil

- Mexico

- Rest of Latin America

The study includes an in-depth competitive analysis of these key players in the railway management system market with their company profiles, recent developments, and key market strategies.

Recent Developments:

- In October 2020, Hitachi announced a partnership with BART (Bay Area Rapid Transit) to design and install the latest technology for digitally controlled trains in San Francisco, US. The company hopes to increase capacity and improve services.

- In February 2020, Alstom acquired Bombardier Transportation. The acquisition would expand Alstom’s rolling stock portfolio and add significant assets to its services business, including access to a large network of maintenance facilities and a large number of trains in service.

- In January 2020, Siemens announced a partnership with ARM, a leading provider of automotive IP and software. The company hopes to achieve active-safety, advanced driver assistance, in-vehicle infotainment, and self-driving vehicles.

- In December 2019, Alstom entered into a contract with the Public Transport Authority of Western Australia (PTA) to manufacture and maintain the next-generation of C-series trains for Perth’s growing rail network.