< Key Hightlight >

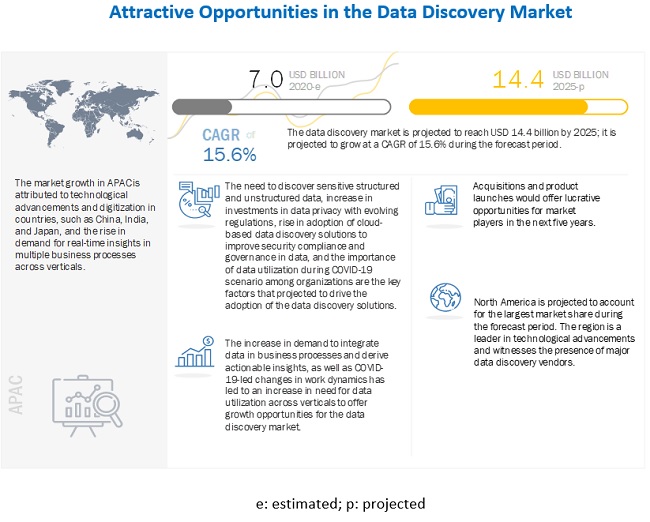

The global data discovery market size to grow from USD 7.0 billion in 2020 to USD 14.4 billion by 2025, at a Compound Annual Growth Rate (CAGR) of 15.6% during the forecast period. Various factors such as the growing need to discover sensitive structured and unstructured data, increasing investments in data privacy with evolving regulations, growing adoption of cloud-based data discovery solutions to improve security compliance and governance within data, and growing importance of data utilization during COVID-19 scenario among organizations are expected to drive the adoption of the data discovery market.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on Global Data Discovery Market

Businesses providing data discovery solutions and services are expected to witness a minor decline in their growth for a short span of time. However, the focus on vaccine development, adoption work from home initiatives, and eHealth are leading to explosion of structured and unstructured data, which needs to be discovered and managed efficiently to derive insights. The market would witness a minimal slowdown in 2020, followed by positive growth during the forecast period. The global spread of COVID-19 has led numerous privacy, data protection, security and compliance questions. These challenges are driving the need for companies and organizations to ensure their data discovery solutions not only secure, but also support data analysis for strategic business decisions.

Market Dynamics

Driver: Growing need to discover sensitive structured and unstructured data

Unlike structured data that resides in well protected IT perimeters, sensitive content exists in unstructured formats such as office documents, files, or images and are distributed and published via file sharing, social media and email. Most enterprises across industries are realizing the growing importance of harvesting their data and drawing meaningful analysis for driving business growth and building competitive advantage. Every organization is generating vast amounts of data due to the use of IoT devices, sensors, and geospatial devices. Generating insights from structured and unstructured data by unifying them into specific formats, so that the end-user can validate and understand it, is the need of the day. Sensitive data discovery is integral to creating and maintaining an effective data security plan. Especially with the rapid adoption of the cloud and the rise of remote workers, organizations are no longer only concerned with sensitive data living solely on-premise. Now, there are multiple paths that data can travel through and an even greater number of locations that sensitive data can land. While the thought may seem overwhelming at first, need to discover sensitive data comes into action and makes data security management easier for business.

Restraint Lack of skilled professional workforce

Significant technological advancements have taken place in the ICT domain. IoT, AI, ML, cloud, analytics, and data discovery are a few trends that have gained tremendous traction in the past few years. Data discovery is transforming businesses by providing actionable insights, but companies do face issues while extracting these insights. Data across the organizations grow constantly, and organizations often fail to capture the opportunities and extract actionable data. Organizations often fail to identify where they need to allocate their resources. This failure in allocating the resources results in not deriving the full potential of data discovery. Most organizations still cannot harness the complete benefits of the data discovery tools in the cloud due to the lack of awareness and professional expertise to utilize cloud-based data discovery solutions optimally.

Opportunity: Increasing demand to integrate data in business processes to derive actionable insights

In today’s digital and big data era, data can be structured or unstructured and most of it resides outside the enterprise. It has, thus, become crucial to have a platform that can be used to integrate all kind of information, perform a lot of discovery-based analysis (to separate noise from real signals), perform analytics on top of it and finally consume it through an intuitive visualization interface. This avenue is now being explored in the form of data discovery platform in many enterprises. Enormous volume of digital information is the storehouse of meaningful insights such as valuable business trends, shifting consumer behavior, onset of an epidemic, changing weather patterns and rising crime rate. When managed well, this data can provide business houses and governments an opportunity to unlock new business avenues and solutions for better governance. Today, enterprises need a comprehensive discovery platform that can process huge volumes of data in real time to provide meaningful insights. This discovery or decision-making platform is able to assimilate data, structure, refine, provide exploratory capability, identify and evaluate various patterns, and help make insight-based decisions faster.

Challenge: Data security and privacy concerns

Security threats are expected to grow even further in the future. In the past four years alone, the financial impact of cybercrimes has increased by nearly 78%, and the time it takes to resolve cyberattacks has more than doubled. The ever-growing data from various sources is becoming cumbersome for several IT teams. The inefficiency of managing exabytes and petabytes of data has raised the chances of security breaches and data loss. It may seem like data discovery is a threat to data privacy, but the actual threat is poorly managed data. Data discovery comes with three privacy risks: data breaches, data brokerage, and data discrimination. Data breaches occur when information is retrieved without consent. In most cases, data breaches are the result of out-of-date software, weak passwords, and targeted malware attacks. Such incidents can cost an organization a damaged reputation and a lot of money. Data breaches can be prevented by keeping software up-to-date, changing passwords often, and educating employees on best security practices.

Among verticals, the healthcare and life sciences segment to grow at a the highest CAGR during the forecast period

The data discovery market is segmented based on verticals into BFSI, government, healthcare and life sciences, retail, manufacturing, media and entertainment, telecommunications and IT, transportation and logistics, and other verticals (education, energy and utilities, and travel and hospitality). The BFSI vertical is expected to account for the largest market size during the forecast period. Moreover, the healthcare and life sciences vertical is expected to grow at the highest CAGR during the forecast period. During the COVID-19 pandemic, healthcare researchers and hospitals are dealing with enormous data, which has created a massive need for efficient data discovery and management. Data preparation and graphical user interface facilitates the users to utilize embedded intelligence with automated data prep tasks.

The on-premises segments is expected to hold the larger market size during the forecast period

The data discovery market by deployment mode has been segmented into on-premises and cloud. Cloud is further segmented by type in public cloud, private cloud, and hybrid cloud. The cloud segment is expected to grow at a rapid pace during the forecast period. The high CAGR of the cloud segment can be attributed to the availability of easy deployment options and minimal requirements of capital and time. These factors are supporting the current lockdown scenario of COVID-19 as social distancing and lack of workforce hit the industry, and are expected to drive the adoption of cloud-based data discovery solutions. Highly secure data encryption and complete data visibility and control feature are responsible for the higher adoption of on-premises-based data discovery solutions.

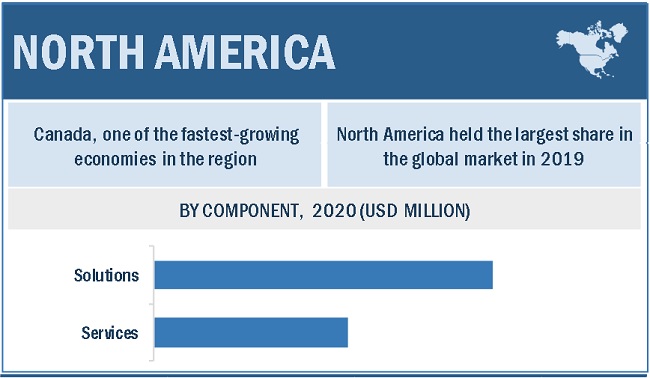

North America to hold the largest market size during the forecast period

North America is expected to hold the largest market size in the global data discovery market, while Asia Pacific (APAC) is expected to grow at the highest CAGR during the forecast period. The growing awareness for data security and privacy among organizations in key countries, such as China, India, and Japan, is expected to fuel the adoption of data discovery solutions and services. The commercialization of the AI and ML technology, giving rise to increased data generation, and the need for further advancements to leverage its benefits to the maximum are expected to drive the adoption of data discovery solutions in the region.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The data discovery vendors have implemented various types of organic as well as inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. The major vendors in the global data discovery market include IBM (US), Microsoft (US), Oracle (US), Salesforce (US), SAS Institute (US), Google (US), AWS (US), Micro Focus (UK), MicroStrategy (US), Cloudera (US), PKWARE (US), Alteryx (US), Thales (France), Spirion (US), Egnyte (US), Netwrix (US), Varonis (US), Digital Guardian (US), Nightfall (US), Securiti (US), DataGrail (US), Dathena (Singapore), BigID (US), Explorium (US), 1touch.io (US), Congruity360 (US), and Concentric (US). The study includes an in-depth competitive analysis of these key players in the data discovery market with their company profiles, recent developments, and key market strategies.

Scope of the Report

Report Metric | Details |

Market size available for years | 2014–2025 |

Base year considered | 2019 |

Forecast period | 2020–2025 |

Forecast units | USD Million |

Segments covered | Component, organization size, deployment mode, application, functionality, vertical, and region |

Geographies covered | North America, Europe, APAC, Latin America, and MEA |

Companies covered | IBM (US), Microsoft (US), Oracle (US), Salesforce (US), SAS Institute (US), Google (US), AWS (US), Micro Focus (UK), MicroStrategy (US), Cloudera (US), PKWARE (US), Alteryx (US), Thales (France), Spirion (US), Egnyte (US), Netwrix (US), Varonis (US), Digital Guardian (US), Nightfall (US), Securiti (US), DataGrail (US), Dathena (Singapore), BigID (US), Explorium (US), 1touch.io (US), Congruity360 (US), and Concentric (US) |

This research report categorizes the data discovery market based on components, deployment mode, organization size, application, vertical, and region.

By component:

- Solutions

- Services

- Managed Services

- Professional Services

- Support and Maintenance

- Deployment and Integration

- Consulting

By organization size:

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

By deployment mode:

- On-premises

- Cloud

- Public Cloud

- Private Cloud

- Hybrid Cloud

By application:

- Security and Risk Management

- Sales and Marketing Management

- Asset Management

- Supply Chain Management

- Others (Location Intelligence, Network Management, Social Network Analysis, and Workforce Management)

By functionality:

- Visual Data Discovery

- Augmented Data Discovery

- Search-based Data Discovery

- Self-service Data Preparation

By vertical:

- BFSI

- Government

- Healthcare and Life Sciences

- Retail

- Manufacturing

- Media and Entertainment

- Telecommunications and IT

- Transportation and Logistics

- Other Verticals (Education, Energy and Utilities, and Travel And Hospitality)

By region:

- North America

- Europe

- UK

- Germany

- France

- Rest of Europe

- APAC

- China

- Japan

- India

- Rest of APAC

- MEA

- KSA

- UAE

- South Africa

- Rest of MEA

- Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In November 2020, PKWARE acquired Dataguise, a company with innovative technology for businesses to discover and protect personal data stored across diverse IT systems and environments. The acquisition will expand PKWARE’s global footprint as it continues the operations of Dataguise’s existing offices in the US, India, Europe, and Canada.

- In October 2020, Micro Focus launched a new digital resource, CISO Resource to accelerate enterprise resilience during unprecedented global challenges. The launch of CyberResilient. Com, a digital resource designed to support CISOs and board members as they navigate the shifting demands of the digital economy, and attempt to continue to drive business growth during times of uncertainty.

- In September 2020, IBM launched a new risk-based service IBM Risk Analytics. The solution is designed to help organizations apply the same analytics used for traditional business decisions to cybersecurity spending priorities. The new service creates risk assessments to help clients identify, prioritize and quantify security risk as they weigh decisions such as deploying new technologies, making investments in their business and changing processes.

- In June 2020, SAS Institute released new enhancement for SAS Viya named SAS Viya 4. SAS Viya 4 is engineered to take advantage of the latest cloud technologies. The enhancement is designed to be delivered and updated continuously, the new architecture helps bring powerful analytics to everyone, everywhere.

- In May 2020, Google Cloud and Splunk partnered to help customers gain deeper insights from data. This partnership aimed to help organizations drive actionable insights from their data and enable better, faster decisions with real-time visibility across the enterprise.

- In February 2020, Google acquired Looker, a provider of a unified platform for business intelligence, data applications, and embedded analytics. This acquisition would enable Google to extend its analytics offering by defining two capabilities that would define business metrics and provide an analytical platform to make business decisions.

- In November 2019, Salesforce launched Customer 360 Truth, a new set of data and identity services that enable companies to build a single source of truth across all of its customer relationships. Customer 360 Truth connects data from sales, service, marketing, and commerce business functions to create a single, universal Salesforce ID for each customer. All of the customers’ previous interactions and shared preferences are brought together to create a view.

- In August 2019, Salesforce completed the acquisition of Tableau, a leading analytics platform provider. The acquisition would enable Salesforce to deliver powerful AI-driven insights across all types of data and use cases for people of every skill level.

- In June 2019, Oracle introduced a new feature in Oracle Analytics. The new feature would provide AI-powered self-service capabilities. Oracle Analytics with the features of data preparation, visualization, and Natural Language Processing (NLP) would help business analysts get data insights to make business decisions.