< Key Hightlight >

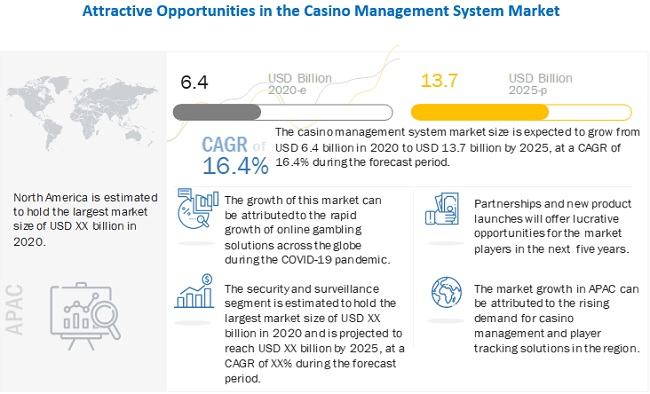

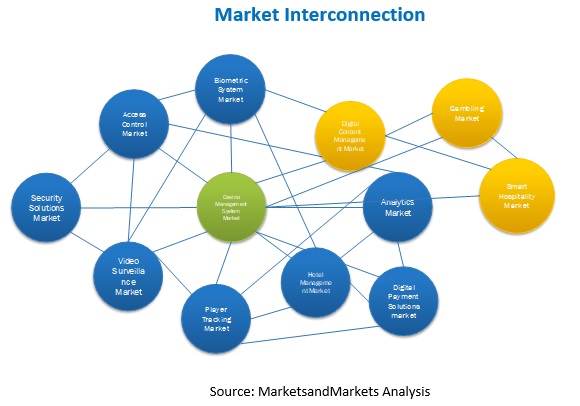

[260 Pages Report] The casino management systems market is projected to grow from USD 6.4 billion in 2020 to USD 13.7 billion by 2025, at a Compound Annual Growth Rate (CAGR) of 16.4% during the forecast period. The evolving lifestyle and societal concerns and increasing use of cashless slot machines and server-based gaming to drive the market growth.

To know about the assumptions considered for the study, Request for Free Sample Report

The COVID-19 pandemic has affected every segment of society including individuals and businesses. The internet ecosystem has been playing a pivotal role all over the globe. The casinos and gambling industry is one of the most severely hit industry during the COVID-19 pandemic. Due to the COVID-19 pandemic, the dependency on player tracking and security and surveillance systems has increased significantly. Casinos and resorts are leveraging the casino management solutions to provide necessary services to end users.

Security and surveillance application to grow at the highest CAGR during the forecast Period

Today’s demanding business environments require proficient handling of processes by implementing CMS solutions across casinos. Over the time, video surveillance has been proved to be an effective tool to create a secure and healthy environment in the gambling industry. Most of the casinos are deploying new generation of cameras and networking equipment, security and surveillance systems not only captures a player’s actions, but it also helps to store it for future references. CCTV cameras are now being replaced by IP cameras, since IP cameras require less hardware. Security and surveillance software would have more deployments in future. Therefore, the security and surveillance segment holds the highest growth rate during the forecast period.

To know about the assumptions considered for the study, download the pdf brochure

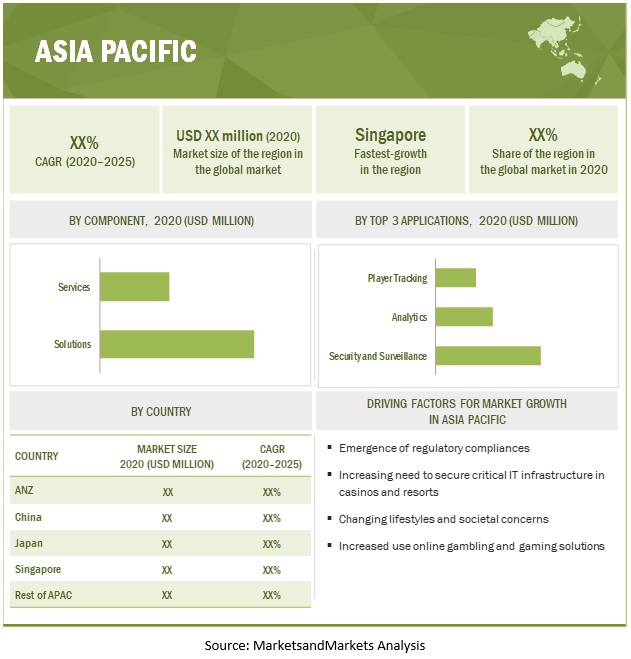

APAC to account for the highest CAGR during the forecast period

Asia Pacific (APAC) has witnessed an advanced and dynamic adoption of new technologies and is expected to record the highest CAGR in the global Casino management system market during the forecast period. APAC constitutes major economies, such as China, Japan, Singapore, and Australia and New Zealand, which are expected to register high growth rates in the casino management system market. In recent years, the APAC region has undergone tremendous economic growth, political transformations, and social changes. India, Japan, and Singapore, and Australia are the new casino heavens for gamblers and are attracting new casinos in the region. These new casinos are attracting installations of more deployment of IT solution and systems. Post-pandemic the APAC has become new revenue generating regional market and will lead in next couple of years in terms of revenues. China is the largest manufacturer and exporter of security components such as video surveillance cameras, biometric devices, and communication equipment. Companies operating in APAC would benefit from the flexible economic conditions, industrialization-motivated policies of the governments, as well as from the growing digitalization, which is expected to have a significant impact on the business community.

Market Dynamics

Driver: Demand for better management of security and surveillance operations in casinos

The risk landscape for modern-day casinos is evolving consistently due to growing concerns over thefts and frauds. Casinos witness large number of monetary transactions every day in wide-open environments that have multiple entry and exit points, making it challenging to secure them comprehensively. For the security personnel, it becomes difficult to monitor each person’s actions as large number of people walk through the entrances and exits on busy nights. In a recent case of casino theft fraud, in July 2020, a federal judge in Miami (U.S.) sentenced two workers at a Florida casino for stealing USD 5 million from the casino by tampering with the gambling machines to generate credit vouchers. Every year, such scams and thefts cost millions of dollars to the casino operators. In the light of growing security and surveillance concerns, the demand for advanced security solutions is growing rapidly in the casino industry.

Technological advancements such as facial recognition and automated number plate recognition have improved the utility of security solutions to facilitate securing large casinos handling heavy footfall. As casinos start to operate normally after the uplifting of restrictions on public gatherings due to the COVID-19 pandemic, casino operators are expected to increase their investment in procuring modern security solutions for their establishments.

Restraint: Growing popularity of online casinos/gambling

The growing interest among gamblers towards online casinos/gambling is expected to certainly impact the revenues of brick and mortar casinos over the forecast timeline. The availability of online platforms makes gambling extremely accessible to the customers who can login and play anytime they want from the comfort of their homes. These platforms offer all the games that are typically available at any casino from blackjack and poker to the slot machines. Another advantage of online gambling is the access to hundreds of online casinos that the customers can switch between for different games and bonuses. With a simple cellular device such as a smartphone or a tablet and an internet connection, one can avoid the hassle of travelling to a casino for gambling.

With growing penetration of smartphones, accessing online casinos from anywhere has become extremely convenient for the users. According to a recent study, smartphones account for nearly 75% of all the mobile handsets in use worldwide. The growing popularity of the app-based delivery models is likely to generate more interest in online casinos among the young adults who prefer better accessibility and user experience. As most of the casinos worldwide are still inoperable due to lockdowns and reluctance from people to visit public places, online gambling is expected to gain consistent popularity which will in turn, affect the brick and mortar casino revenues adversely.

Opportunity: Use of advanced analytics technologies for improving the solution capabilities

Casino operators have access to large volumes of data about their customers and their gaming behavior which can be leveraged for improving their operational procedures and their performance analysis/reporting using advanced AI-driven casino management solutions. By implementing advanced analytics, casinos can use statistical analysis and determine the most favorable rates for hotel rooms and segment customer profiles to target the right customer with the right marketing campaigns. These tools help casinos in gaining and analyzing demographic information about their customers and track their spending behavior, gaming patterns, visiting patters, and other such parameters to build comprehensive customer profiles.

High performance video analytics and storage solutions offer critical operational insights that assist the owners/operators in sustaining revenues and driving efficiency. The systems are equipped with high-resolution cameras, low-light technology, and wide coverage to improve visibility. Analytics solutions such as object recognition and heat mapping allow operators to identify which areas in the casinos are visited more by the customers. These insights can be used to maximize the revenues by targeting customers with offers and bonuses while they indulge in their favorite games. Considering the social distancing norms required and/or mandated during and post the COVID-19 pandemic, such technology can be used to effectively ensure social distancing and prohibit crowding on the casino floors.

Challenge: Steep decline in casino revenues and operations due to the COVID-19 pandemic

The COVID-19 pandemic has had a devastating impact on the land-based gambling/casino industry. The stay-at-home restrictions imposed by governments across many countries led to the closure of casinos, lottery outlets, and other gambling venues. Closures forced the casinos to go for weeks and months without revenues, and even when they started functioning, restrictions were put in place to limit the number of visitors preventing them from operating at full capacity. As they struggle to restart and maintain operations, the significant losses and revenues are expected to deter the largely affected casino owners from investing significantly in procuring new management systems.

This research study outlines the market potential, market dynamics, and major vendors operating in the Casino management system market. Key and innovative vendors in the Casino management system market Novomatic (Austria), Konami Gaming (Japan), Agilysys (US), Scientific Games (US), Oracle (US), Winsystems (Spain), Panasonic (Japan), Ensico Gaming (Slovenia), Apex Pro Gaming (Czechia), Amatic Industries (Austria), Honeywell (US), Dallmeier (Germany), HCL (India), Playtech (UK), Cyrun (US), IGT (UK), LGS (US), Wavestore (UK), Tangam Systems (US), Advansys (Slovenia), Avigilon (Canada), Casinfo Systems (US), RNGplay (India), FunFair (Ireland), Gaming Analytics (US), Delta Casino Systems (US), DAObet (Singapore), CasinoFlex Systems (Bulgaria), Omnigo (US), NtechLab (Russia), Nelysis (US), and Bateleur Systems (India). The study includes an in-depth competitive analysis of these key players in the Casino management system market with their company profiles, recent developments, and key market strategies.

Scope of the Report

Report Metric | Details |

Market size available for years | 2014–2025 |

Base year considered | 2019 |

Forecast period | 2020–2025 |

Forecast units | Value (USD) |

Segments covered | component, application, end user, and region |

Geographies covered | North America, Europe, APAC, MEA and Latin America. |

Major companies covered | Novomatic (Austria), Konami Gaming (Japan), Agilysys (US), Scientific Games (US), Oracle (US), Winsystems (Spain), Panasonic (Japan), Ensico Gaming (Slovenia), Apex Pro Gaming (Czechia), Amatic Industries (Austria), Honeywell (US), Dallmeier (Germany), HCL (India), Playtech (UK), Cyrun (US), IGT (UK), LGS (US), Wavestore (UK), Tangam Systems (US), Advansys (Slovenia), Avigilon (Canada), Casinfo Systems (US), RNGplay (India), FunFair (Ireland), Gaming Analytics (US), Delta Casino Systems (US), DAObet (Singapore), CasinoFlex Systems (Bulgaria), Omnigo (US), NtechLab (Russia), Nelysis (US), and Bateleur Systems (India). |

This research report categorizes the casinos management system market to forecast revenues and analyze trends in each of the following submarkets:

Based on component:

- Solution

- Service

- Consulting

- Deployment and Integration

- Support and Maintenance

Based on Application:

- Accounting

- Security and Surveillance

- Hotel and Hospitality Management

- Analytics

- Player Tracking

- Digital content Management

- Marketing and Promotions

Based on End User:

- Small and Medium Casinos

- Large Casinos

Based on the region:

- North America

- Europe

- United Kingdom (UK)

- Germany

- France

- Spain

- Rest of Europe (other EU and non-EU countries)

- APAC

- China

- Japan

- Australia and New Zealand

- Singapore

- Rest of APAC (India, Indonesia, Taiwan and South Korea)

- Middle East and Africa

- Latin America

- Brazil

- Mexico

- Rest of Latin America (Chile, Argentina, Colombia and Peru)

Recent Developments:

- In November 2020, Scientific Games and Menominee Casino Resort announced an agreement to install system solutions across 791 gaming machines. The solutions would include e iVIEW4 with Web Content Manager (WCM), Beverage Ordering Software System (BOSS), Business Intelligence, Elite Bonusing Suite (EBS), Promotional Kiosk, Servizio, and the Social Distancing and Automated Game Sanitization Modules.

- In October 2020, Novomatic extended its reach in Germany after receiving sports betting license by the Darmstadt Regional Council and has also become the first private providers to be granted a sports betting license.

- In October 2020, Agilysys and Shift4 Payments extended the partnership to offer seamless guest journey for hospitality operators. Shift4 Payments is a leading integrated payment processing provider. Agilysys can now offer an integrated payment experience which include online reservations, check in and checkout, on-premise dining, spa services and more to the hospitality operators.

- In September 2018, Novomatic and Monte-Carlo Société des Bains de Mer partnered to open the Novo Zone at Sun Casino. This is a live area on the casino floor where NOVOMATIC rolls out new releases and technology

- In September 2020, Konami launched slot cleaning systems which are linked to its Casino Management System Synkros. During COVID-19 Konami offered a new feature to its Synkros customer at no additional cost, where the slot machine is optimized and clear the machine between use. The new feature includes a mix of real time communications, alerts and report analytics.

- In August 2020, Konami and Gulfstream Park & Casino partnered to replace the previous casino management system. Gulfstream Park & Casino is the first land-based casino to launch Konami’s Synkros casino management system in Florida. Konami’s Synkros would help the casino with marketing and data analytics capabilities and assist teams to deliver greater entertainment to the players.

Key Benefits of Buying the Report

The report would provide the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall casino management system market and its subsegments. It would help stakeholders understand the competitive landscape and gain more insights to better position their business and plan suitable go-to-market strategies. It also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.