< Key Hightlight >

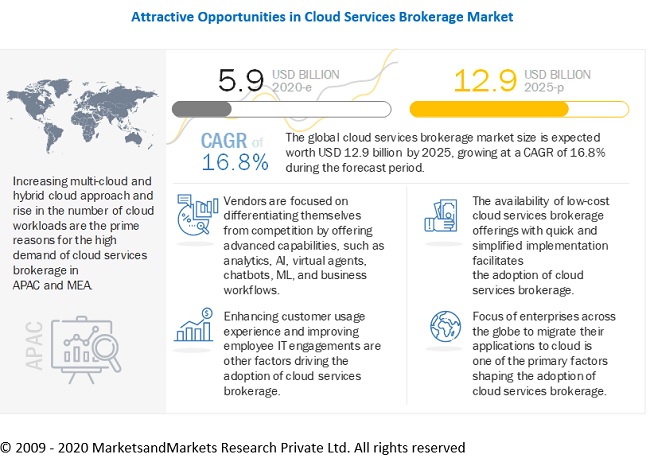

[222 Pages Report] The global cloud services brokerage market size is expected to grow from USD 5.9 billion in 2020 to USD 12.9 billion by 2025, at a Compound Annual Growth Rate (CAGR) of 16.8% during the forecast period. The CSB market will continue to grow post-COVID-19 as more enterprises across the globe plan to migrate its IT infrastrutcre to cloud, boost business continuity, and improvise IT operations. While technology spending in APAC has increased, the setback due to the recent COVID-19 pandemic is imminent.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact CSB Market

Many of the enterprises across verticals have adopted the work from home model to safeguard employee well-being and maintain operational efficiency, surging the demand for cloud based solutions. As more enterprises would turn to advance its IT infrastructure with the help of cloud based solutions, the demand for CSB solutions will continue to grow.

CSB Market Dynamics

Drivers: increased need to avoid venor lock-in

Deploying server infrastructure on the cloud comes with a possible risk of locking a customer with a particular service provider. The fear of vendor lock-ins is often cited as a major impediment to cloud service adoption. Moreover, the complexities of a cloud service migration mean that several customers stay with a provider to avoid the cumbersome process. With the emergence of multi-cloud system management, vendors can avoid lock-in with the help of a highly standardized cloud environment. To avoid vendor lock-in, end users must ensure that the architecture they have selected can run on heterogeneous clouds. In addition, the data available on the cloud can be easily migrated to another cloud. With the emergence of several cloud service providers, the market has become highly competitive, thereby offering end users numerous options to choose from. Enterprises need to ensure they have the flexibility to port applications between different providers. End users are opting for cloud offerings from different sources to avoid vendor lock-in. For instance, enterprises adopt public cloud services from vendors, such as Amazon, Microsoft, and Google, to store trivial data, while private cloud or on-premises systems are preferred for storing confidential data. Thus, CSB simplifies the management of a multi-cloud environment and hybrid environment without comprising control over critical resources, and tackles vendor lock-in.

Restraints: Regulatory compliance issues

Companies that deliver services on the cloud platform conduct businesses with a variety of industries, such as financial services, public sector, healthcare, and telecommunications. Industry-specific regulations, and other requirements and standards are evolving. However, the evolving unfavorable industry-specific laws, regulations, interpretive positions, or standards could harm businesses. The costs of compliance and other burdens imposed by industry-specific laws, regulations, and interpretive positions, may limit customers’ use and adoption of solutions and services, and reduce its overall demand. Compliance with these regulations may also require service providers to offer huge resources to support certain customers, which could increase the costs and lengthen the sale cycles. For example, financial service regulators have imposed guidelines for the use of cloud computing services that mandate specific regulations or require to obtain regulatory approval by financial service enterprises before outsourcing certain functions. However, if organizations are unable to comply with guidelines or regulations, or end-users are unable to obtain regulatory approvals to use services, the overall business may get hampered.

Challenges: Lack of awareness and security concerns

There is a certain lack of awareness about the benefits of cloud computing and storage services and solutions. The lack of awareness creates a significant gap between consumers and vendors. Cloud infrastructure services have grown over a period of time; however, security, scalability, and interoperability have always been major challenges. Professionals are also concerned about the resultant data loss in an aggregated cloud ecosystem. Owing to this, several small-scale industries are reluctant to move their data from on-premises to the cloud. Hence, cloud processes need to be monitored continuously to minimize risks and improve security features.

Opportunities: Growing demand among SMEs

Cloud adoption in SMEs is increasing day by day as the small scale companies are benefiting from cloud-based solutions. Cloud-based solutions address a series of problems in SMEs, such as enhanced IT operations and reduced IT costs. Public cloud has gained popularity among SMEs in recent times. According to Flexera’s State of the Cloud Report 2020, SMEs are adopting public cloud faster than large enterprises. The opportunity in the SMEs segment for cloud providers is gaining pace through the internal enablement model, while it also provides a good market for external cloud brokers, such as telecom providers and SIs. Greater cloud adoption in the SMEs segment with multi-source cloud services would guarantee a better future for the market.

To know about the assumptions considered for the study, download the pdf brochure

Based on service type, integration and support segment to be a larger contributor to the cloud services brokerage market growth during the forecast period

Cloud brokers help organizations integrate external cloud services with their core on-premises internal systems. Thus, cloud brokers help organizations manage their service life cycle and associated changes. Moreover, they manage the integration of services between various CSPs, thus forming a cloud service package for the customer. The broker forms a singular connection between the organization and various CSPs by providing a single pane of glass platform that buffers the organization from the technical complexity of interacting with multiple CSPs. The broker makes the migration to the cloud simple for its customers by integrating various interdependent business processes of the organization.

Based on deployment model, the public cloud segment to be a larger contributor to the CSB market growth during the forecast period

The public cloud is defined as computing services offered by third-party providers over the public internet, making them available to anyone who wants to use or purchase them. The public cloud refers to computing that shares resources, such as storage, compute, and networking, with external entities outside the organization depending on the demand. In the public deployment model, various resources, such as applications, storage, virtual servers, and hardware, are available to client enterprises over the internet. The services offered over the public deployment model are either free or offered under a subscription model. It helps organizations meet their demands for scalability, and provides pay per usage pricing strategy and ease of deployment. The public cloud is typically designed with built-in redundancies to prevent data loss. Service providers may store replicated files across several data centers to ensure that disaster recovery is smooth and fast. Data stored on a public cloud platform is generally regarded as safe from most hazards. However, enterprises can utilize public clouds to make their operations significantly more efficient. For instance, enterprises can store non-sensitive content, online document collaboration, and webmail in the public cloud. AWS, Microsoft, IBM, and Google are some of the largest providers of a public cloud.

Asia Pacific (APAC) to grow at the highest CAGR during the forecast period

APAC is projected to witness the fastest growth rate in the coming years due to the large-scale adoption of CSB in China, India, Singapore, Australia, and New Zealand. APAC consists of countries with a complex ecosystem of startups, government companies, SMEs, and large multinational companies using and developing an array of valuable Information and Communications Technology (ICT) solutions. Major factors for technological advancements in the region are the rising levels of urbanization, technological innovations, and government support for the digital economy. Rapid advancements in telecommunications, cloud computing, and IoT have led several organizations to adopt cloud-based strategies. The region is expected to experience huge growth during the forecast period.

Key Market Players

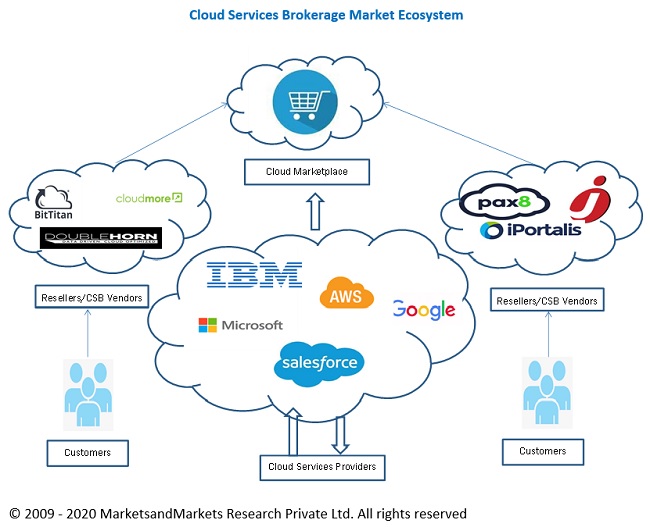

The cloud services brokerage market is dominated by companies such as Accenture (Ireland), IBM (US), VMware (US), Jamcracker (US), ActivePlatform (Belarus), Arrow Electronics (US), Cloudmore (Sweden), Wipro (India), DXC Technology (US), iPortalis (UK), Cognizant (US), InContinuum (Netherlands), Flexera (US), BitTitan (US), OpenText (Canada), CloudFX (Singapore), Proximitum (UK), Eshgro (Netherlands), NEC (Japan), AWS (US), CloudSME (Germany), Shivaami (India), NTT Data (US), Infosys (India), TCS (India), Pax8 (US), Oracle (US), Fujitsu (Japan), Microsoft (US), Capgemini (France), and Doublehorn (US). These vendors have a large customer base and strong geographic footprint along with organized distribution channels, which helps them to increase revenues.

Scope of Report

Report Metric | Details |

Market size available for years | 2016-2025 |

Base year considered | 2019 |

Forecast period | 2020-2025 |

Forecast units | Value (USD Million) |

Segments covered | Service Type, Platform Type, Deployment Model, Organization Size, Verticals, and Regions |

Regions covered | North America, Europe, APAC, MEA, and Latin America |

Companies covered | Accenture (Ireland), IBM (US), VMware (US), Jamcracker (US), ActivePlatform (Belarus), Arrow Electronics (US), Cloudmore (Sweden), Wipro (India), DXC Technology (US), iPortalis (UK), Cognizant (US), InContinuum (Netherlands), Flexera (US), BitTitan (US), OpenText (Canada), CloudFX (Singapore), Proximitum (UK), Eshgro (Netherlands), NEC (Japan), AWS (US), CloudSME (Germany), Shivaami (India), NTT Data (US), Infosys (India), TCS (India), Pax8 (US), Oracle (US), Fujitsu (Japan), Microsoft (US), Capgemini (France), and Doublehorn (US) |

This research report categorizes the CSB market to forecast revenue and analyze trends in each of the following submarkets:

Based on the service type:

- Integration And Support

- Automation And Orchestration

- Billing And Provisioning

- Migration And Customization

- Security And Compliance

- Other Services (catalog management, backup and DR, reporting and BI, and API)

Based on the platform type:

- Internal Brokerage Enablement

- External Brokerage Enablement

Based on the Deployment Model:

- Public Cloud

- Private Cloud

Based on organization size:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

Based on verticals:

- Banking, Financial Services, and Insurance (BFSI)

- Telecommunications

- IT and ITeS

- Government and Public Sector

- Retail and Consumer Goods

- Manufacturing

- Energy and Utilities

- Media and Entertainment

- Healthcare and Life Sciences

- Others (education, travel and hospitality, and transportation and logistics)

Based on regions:

- North America

- Europe

- UK

- Germany

- France

- Rest of Europe

- APAC

- China

- Japan

- Australia

- Rest of APAC

- MEA

- Saudi Arabia

- UAE

- South Africa

- Rest of MEA

- Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

In May 2020, Microsoft launched Back2Business Solution Boxes for SMBs in India. The new solution intends to enable Indian SMBs to maintain business continuity during COVID-19 and continue cloud adoption. It also aims at solving challenges faced by SMBs during work from home.